How to Exit the Market Successfully

Take Profit: Precise Explanation

A Take Profit order is a command sent to a broker via a trading platform to close an open position at a certain price level, presumably at a profit. The order is triggered automatically and filled only if the price hits the predetermined level.

A Take Profit order is a command sent to a broker via a trading platform to close an open position at a certain price level.

It's worth mentioning that some experts provide several Take Profit points when giving trading recommendations. It means that you can place more than one Take Profit level if the trade keeps moving in your favour.

Moreover, Take Profit orders are acceptable for any security, not only currencies but also stocks.

Should You Use It?

Some traders forget to set Take Profit orders. Let's consider an example.

Imagine you opened a long position for the EUR/USD pair on 1 August (1) and planned to hold it for several days. As you can see on the chart, since 5 August (2), the price started consolidating and later declined as you were trading on the swing in the downtrend.

If you placed the Take Profit order at 1.12, where the trendline lies, or at 1.1237, where the resistance could be set, according to two previous points where the pair rebounded, you would preserve your profit and exit the market before it bounced.

There are risks if you avoid a Take Profit order. If you just miss the reversal point, you could lose all of your gains.

If you don't place a Take Profit order, there is a high risk you'll lose everything you gained. To sum up, a Take Profit order can minimise the risks of losing money.

It seems that a Take Profit order is a perfect way to exit the market. But why don't some investors use them? Let's consider the benefits and limitations.

Take Profit orders: To use or not to use

Nothing is perfect, and Take Profit orders have disadvantages just like any other market tool. Let's consider the benefits and limitations that will help you decide whether or not to use Take Profit orders.

|

Benefits |

Limitations |

|

Prevent losses. As we showed in the example above, when you set a Take Profit order, you risk missing reversal point declines. |

Too wide. Not all traders know how to place Take Profit wisely. If it's too wide, the price may turn around before it reaches the Take Profit level. Thus, your trade won't be closed automatically, and you'll lose money. |

|

Save time. This advantage relates to the previous one. You don't have to monitor the market constantly to catch the moment when it turns against you. |

Too short. If you place an order too close to the entry level, the odds are your profit will be too small. |

|

No doubts. If you've ever traded, you know the feeling of greed. People are emotional. When you don't have a predetermined exit point, the constant willingness to increase your profit may work against you. |

Not for all. If you are a scalper or trade on high volatility, Take Profit orders won't work for you. Usually, such traders close their positions according to market conditions. Moreover, in such cases, it's almost impossible to predict the exit point in advance. |

|

Automatic. The order is executed at the conditions set in advance on the trading platform. |

Take Profit and Stop Loss Orders

Take Profit and Stop Loss orders serve the same object: exiting the market. Nevertheless, there is a significant difference that balances them out.

|

Similarities |

Differences |

|

Aim. Both orders are used to exit the market. |

When to exit. The main difference is that a Take Profit order is used when your trade is successful and your forecast is right. A Stop Loss is applied to limit your losses. It works when the price goes in the opposite direction to your expectation. |

|

Executed automatically. Both orders are triggered automatically as soon as the price touches the defined level. |

|

|

Same trade. Both orders can be placed for the same trade. |

A Take Profit order closes your opened position while you're on top. A Stop Loss order closes the failing position.

Look at examples of Stop Loss and Take Profit. Imagine we entered the market on 27 April (1). We decided to purchase the EUR/USD pair. We needed to place two orders – a Stop Loss and a Take Profit. You remember that a Take Profit provides an exit if the trade is profitable. We set a Take Profit order at the previous top of 1.0985 because there is a high chance the pair will rebound from the same level.

The Stop Loss is likely to help us avoid losing money. If we consider the buy position, then the Stop Loss will be below the point of the previous upward return. We placed a Stop Loss order at 1.0745. As you can see, our trade was profitable, and we closed the position at 1.0985.

Let's Calculate

We previously mentioned that one of the disadvantages of the Take Profit order is that traders don't know how to implement it correctly. So, you might be interested in how to set it. We will consider several methods.

Method 1

Use a specific formula:

(Target profit/point profit) x point size = price change in points

You need to divide target profit to point profit. The result should be multiplied by point size. As a result, you get the price change in points.

The next steps will depend on whether it's a purchase or sale. If it's a buy order, you need to add an opening price and price change in points. If it's a sell trade, you need to subtract price change in points from the opening price.

Let's specify. Assume that you believe the GBP/USD pair will rise, so you open a long position. The opening price is 1.2650. You would like to earn $100 and are ready to risk $50. You trade one standard lot. To get the point profit, you need to multiply the lot size by the contract size. The result should be multiplied by point size. Thus, we have 1 x 100,000 x 0.0001.

To count the price change in points, we will do the following: (100 / 10) x 0.0001= 0.001. Our Take Profit order equals 1.2660, which is 1.2650+0.001.

Method 2

We have explained one way, but we would like to focus on another one that is supposed to be more accurate. Here we won't use calculations.

Look for the previous reversal points to determine the possible Take Profit order.

To define the Take Profit level, you need to look at the previous price movements. The closest point where the price turned around will be possible Take Profit orders. To make it easier, you should know about support and resistance levels. These levels will become Take Profit points.

How to Find a Take Profit order on the MT4 Platform

It can place a profit order on the MT4 platform.

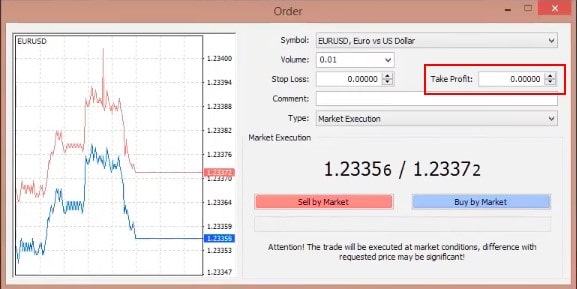

Step 1. Open the pair you want to trade. Click 'New Order'.

Step 2. Enter the Take Profit level.

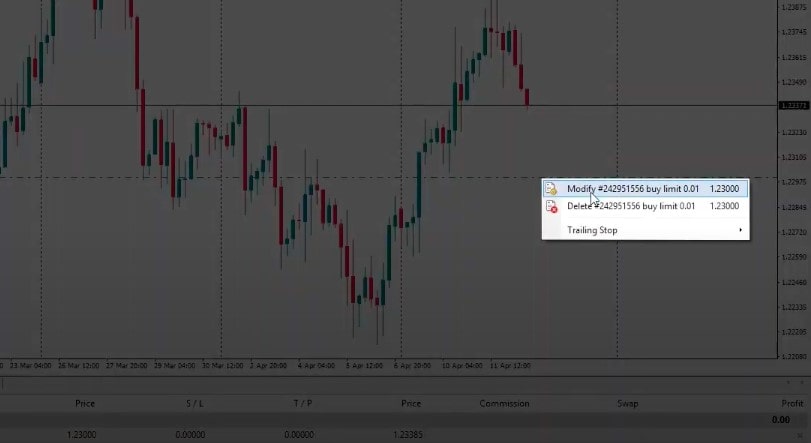

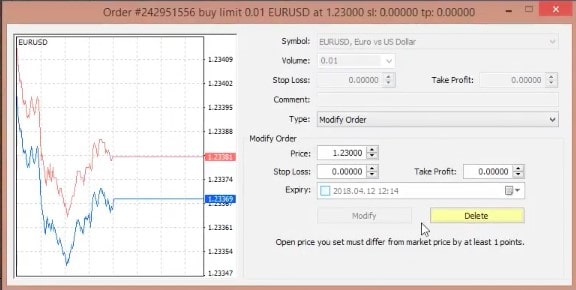

You can place a Take Profit not only before opening a position. Even if you have placed an order but are willing to set a Take Profit level, you can just modify the trade and add the TP.

Take Profit Strategy

We will consider several helpful strategies to set an efficient Take Profit order.

Risk/Reward Ratio

Every trader should know the basics of money management. The standard risk/reward ratio is 1/2. This means that the reward should exceed the risk two times. So, if the Stop Loss equals 50 pips. The Take Profit order should be 100 pips from the opening price. However, this ratio doesn't always work. Sometimes, traders use a 1/3 ratio or even more significant ratio.

Still, you should remember that the smaller the difference between Stop Loss and Take Profit is, the weaker trade you will have. If the risk/reward ratio is smaller than 1/2, there is no point in entering the trade. There are odds you will waste more than you earn.

Your possible profit should exceed the possible loss by at least two times.

Let's say you trade the EUR/USD pair. You opened a buy trade at 1.1130. The Stop Loss level is at 1.1099. To set the Take Profit, you need to subtract 1.1099 from 1.1130. You get 31 pips. So, if we use the smallest risk/reward ratio of 1/2, the Take Profit will be at 1.1192. Although we see that the price kept rising, you couldn't know this in advance. Still, 1.1192 could be a possible reversal point as previously, the price pulled back from that level.

Trailing Take profit

Do you remember that at the beginning of the article, we said that experts might provide several Take Profit levels? This happens so that the price continues moving in your favour if the trend is strong.

Trailing Take Profit is another option to increase your profit. We mentioned that a Take Profit order prevents you from making wrong decisions based on greed. Nevertheless, if you see that the trend is solid, you can increase the Take Profit level and just move it to the next point, which is supposed to become the reversal.

If you see that the trend is solid, you can increase the potential Take Profit level and just move it to the next point.

For instance, you decided to sell the GBP/USD pair. You entered the trade at 1.3120. The first Take Profit could be placed at 1.2750, the previous reversal point. However, you saw that the trend is strong. Thus, you could move the Take Profit to the next level of 1.2198.

Support and Resistance

When talking about calculations, we told you that it's worth using such technical instruments as support and resistance levels. These are some of the most valid points of price reversal. Thus, they can be considered Take Profit points. Look at a profit order example.

Use support and resistance levels to set a Take Profit order.

We place the resistance level at 1.0985. Thus, if you open the buy trade at 1.0822, it will be closed at 1.0985.

Avoid Mistakes

It's not difficult to set a profit order, but traders tend to make common mistakes. Check and keep this in mind to implement the order more efficiently:

- Don't overestimate. Act wisely if you want to place a profitable Take Profit order. If your order is too far, the price won't reach it, and the price may turn against you much earlier than you earn something.

- Don't fear. It's also important not to underestimate the accuracy of your forecast. Take Profit level. If you are not sure how far the price will go, you may set a small Take Profit. Thus, you will only limit possible earnings.

- Don't use it in times of high volatility. It's challenging to set Take Profit orders while the volatility is quite enormous. There are high risks that the trade will be closed too early.

- Don't avoid it. Some traders don't place Take Profit levels. However, it's better not to rely only on yourself. Imagine, if you miss the turning point, all of your possible gains will disappear.

Conclusion

We can say that Take Profit orders are a crucial part of possible successful trading. You should use them to save time and avoid taking the wrong steps that are common for every trader.

However, it's crucial to set the Take Profit level correctly. Otherwise, the Take Profit order could turn into a loss. It's worth relying on support and resistance levels that will help you determine a favourable Take Profit order.

Please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital. To practice, use a Libertex free demo account, which provides real-time market conditions.

Some questions you still may have in your head.

FAQ

What is a Take Profit Order?

A Take Profit order is a kind of limit order. It's a command to close the trade with profit at a specific level when the price touches it.

How Do You Set Up a Take profit?

To set a Take Profit order, you simply need to place a new order on the trading platform and type the level in the order setting window.

When Should I Take Profit Level in Trading?

To determine the perfect Take Profit order, you need to either use a formula or, even better, you should find the closest point where the price changed its direction.

What Is the Difference Between Stop Loss and Take Profit Level?

Both orders are used to exit the market. However, Take Profit is filled when the trade is profitable. In contrast, Stop Loss is executed when the price moves in the opposite direction to your expectation.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.