Microsoft (MSFT) Stock Forecast: What Experts Think 2022 Has in Store

Microsoft has earned a great reputation in the financial world for its long-term leadership, quarterly dividends and high IBD Relative Strength Rating.

But over the last couple of years, the COVID-19 pandemic triggered a recession that turned many seemingly-strong companies on their heads. How does Microsoft stack up against today's challenges? Is it a good buy for investors in 2022? Let's find out.

About Microsoft (MSFT) Stock

Microsoft stock snapshot as of 9 February 2022:

- Market cap: $2.33 trillion

- Volume: $41 million

- Current price: $311.21

- Year range: $224.26 - $349.60

- Primary exchange: NASDAQ

Microsoft is one of the largest tech companies in the world. It became a household name in the mid-1980s after the release of Microsoft Windows. Flash-forward to today and over 1.3 billion devices run on Windows 10.

Microsoft has its finger in many pots; besides Windows, the tech giant is known for its Microsoft Office Suite (Word, Excel Publisher, etc.), a search engine (Bing) and web browsers (Internet Explorer and Edge).

What Affects Microsoft's (MSFT) Stock Price?

A stock's price moves up and down based on several factors. Of course, the most obvious one is supply and demand. When there are more buyers than sellers, the price increases. The opposite occurs when the dynamics are reversed. But what influences demand?

- Interest rates: When interest rates are high, people don't have as much disposable income. Therefore, they may have to cut back on the amount of money they invest. Conversely, lower interest rates lead to lower payments on loans, giving investors more funds to put in the market.

- Dividends: When companies make dividends announcements, the number of shares purchased typically increases, especially if the dividends are higher than expected. However, if the dividends are lower than in previous payouts, the share price could decline.

- Management: New management can have a very positive effect on share price (in the next section of this guide, you'll see that this happened with Microsoft). But if the new management lacks integrity and has a differing vision from investors, the share price may lower.

- Economy: Under favourable economic conditions, share prices are at their highest. During recessions, they fall; during depressions, they're at their lowest.

Microsoft Stock Price in the Past

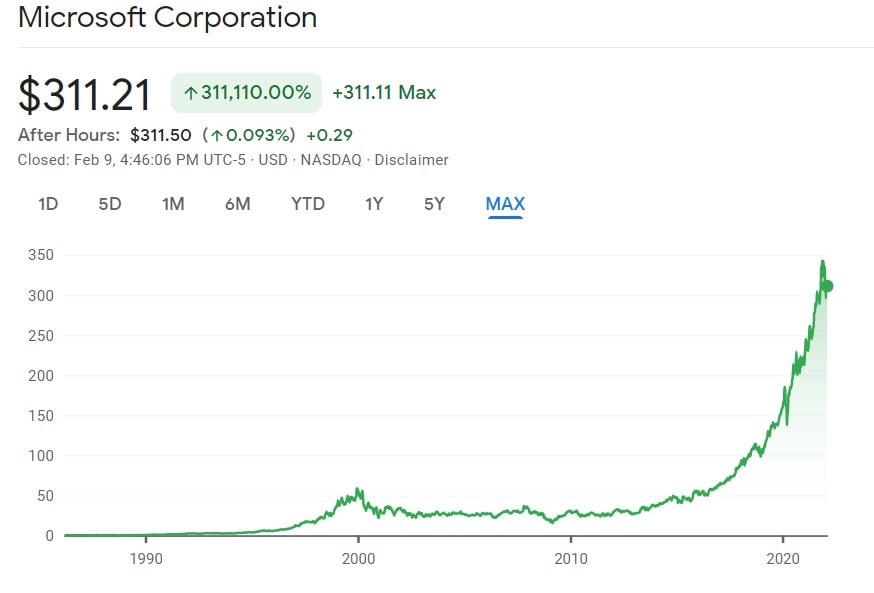

Microsoft went public on 13 March 1986, and its IPO price was $21. By the end of the company's first trading day, over 3.5 million shares were traded, and the price was up to $28. This day was called "the IPO of the year" by analysts, and the software giant managed to generate $61 million (worth $150+ million by today's standards). This amount granted Microsoft a market cap of $777M (worth nearly $2B today).

After a promising beginning, Microsoft stock didn't start experiencing growth until around 1995. It increased significantly from 1995 to 2000, then remained stable for about 15 years. But between 2015 to the present day, the share price has drastically increased.

So, what exactly happened to influence a change in price after years of stagnation? Well, in 2000, MSFT reached an all-time high right before the tech bubble burst. You may not have been investing during the dot-com bubble, so here's a quick recap:

The dot-com/tech bubble occurred in the late 1990s. There was massive growth in the number of people using the internet. As such, the market experienced excessive speculation of internet-related companies, including Microsoft.

When the bubble burst, some companies failed entirely, and most of the others lost a huge amount in their stock values and market capitalisations. All things considered, Microsoft didn't do too badly. Its share price fell from $58 in December 1999 to $21.68 in December 2000. That was a nearly 60% decrease, but hundreds of dot-com companies plummeted by 80% or more.

After the bubble burst and Microsoft's price went down, it remained pretty stagnant until around 2015, when it took a short turn for the better. This was largely due to Satya Nadella being named the company's new CEO. Nadella shifted the company's focus to mobile products and cloud services. The company was brought back to relevancy and even competed with Amazon for major corporate cloud contracts. In 2017, Microsoft was named the "preferred cloud partner" for Maersk, the world's biggest shipping firm.

Microsoft has managed to stay at the forefront of the tech world, rivalling companies like Apple, Amazon, Google and Facebook. From 2015 to 2022, the annual price change was positive and twice surpassed the 50% mark.

|

Year |

Average Stock Price ($) |

Year Open ($) |

Year Close ($) |

Annual Change |

|

2021 |

275.9408 |

217.6900 |

336.3200 |

51.21% |

|

2020 |

193.0261 |

160.6200 |

222.4200 |

41.04% |

|

2019 |

130.3820 |

101.1200 |

157.7000 |

55.26% |

|

2018 |

101.0340 |

85.9500 |

101.5700 |

18.74% |

|

2017 |

71.9840 |

62.5800 |

85.5400 |

37.66% |

|

2016 |

55.2593 |

54.8000 |

62.1400 |

12.00% |

|

2015 |

46.7136 |

46.7600 |

55.4800 |

19.44% |

Microsoft Stock: Recent Events — 2020 to 2022

We've seen that Microsoft has made great efforts to maintain its position at the forefront of the tech and cloud computing industry. Does the same hold true for 2022? Let's look at recent events and see whether they indicate positive or negative price movements.

13 March 2020: Bill Gates, Microsoft's founder, left the company's board. However, he remains a tech advisor to Nadella and other company leaders. After his announcement, the shares jumped in price by 14% to $158.83.

June 2020: When COVID really started heating up, Microsoft closed most of its physical stores around the world. This didn't have too much of an impact, as Microsoft doesn't really sell a lot of popular consumer goods. The company's physical store generated negligible retail revenue, so it wasn't really bad news for investors. As such, the share price only dropped by 2%.

October 2020: Microsoft made a deal with Verizon to use the Azure cloud computing unit in Verizon's core 5G network and automate operations via AI. There was some controversy regarding 5G, with some consumers thinking that the technology is bad for your health. Although that was debunked, the stock still fell by 2.5%.

January 2021: Microsoft reached an all-time high of $232.90 the day after releasing its earnings report. The report revealed that the company's revenue had jumped by 33% as people continued to work and play video games from home on Microsoft systems.

June 2021: Microsoft announces that it will launch Windows 11. This is the first upgrade to the Windows OS in the past six years. The share price increased by 0.5% following this announcement.

November 2021: After releasing Q3 earnings, MSFT shares rose by 7% across three trading sessions. Microsoft was named the world's most valuable company, and it had a record-high share price of $331.62.

January 2022: Azure revenue was up by 46%, which was lower than forecasts. The stock sank by 5% following this announcement. However, Microsoft did an earnings call, which reassured investors that Azure would perform better this quarter, and prices immediately did a turn-around into positive territory.

Microsoft has some big moves planned for the future, which could help share prices increase even further, as long as the company continues to publish favourable earnings reports. Some upcoming things that could impact the company's stock price:

- Microsoft plans to launch an open, universal app store.

- The company is hiring a Director of Crypto Business Development.

- Microsoft may possibly purchase Mandiant, a cybersecurity organisation.

Microsoft Stock Technical Analysis

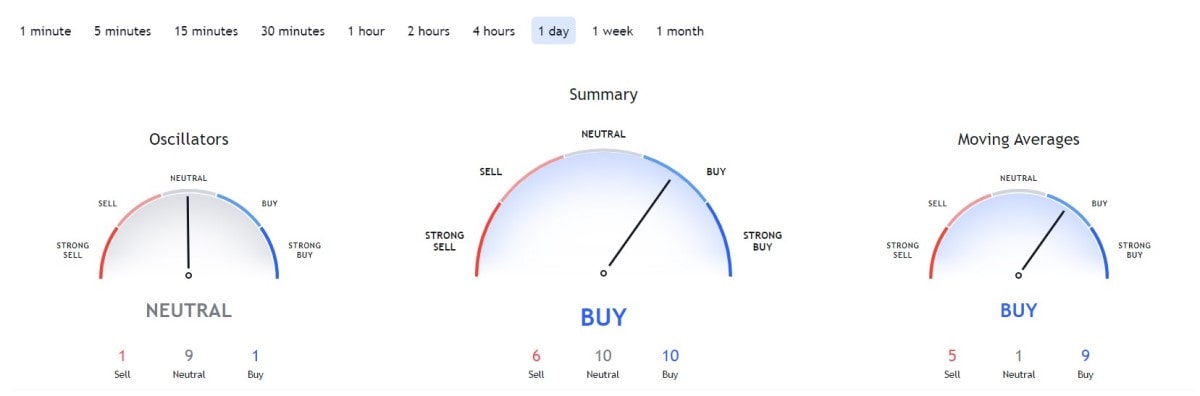

Investors look at a stock from a long-term perspective, whereas traders use technical analysis to see what could be in store over shorter timeframes. Technical analysis can help you decide whether a stock should be bought or sold in 1 minute, 5 minutes, an hour or a day. You could also do technical analysis a week in advance, but this is typically less accurate.

Let's take a look at a 1-day technical analysis for MSFT.

According to the indicators available on TradingView, MSFT is currently a buy. It has 9 moving averages indicating buy, 5 indicating sell and only 1 neutral. The oscillators, on the other hand, are largely neutral. The only negative indicator is Momentum, and the only positive one is the MACD level.

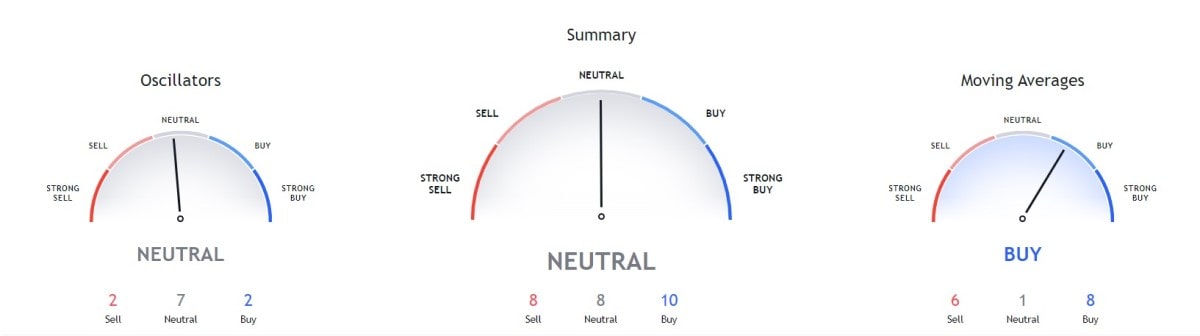

Zooming out to a week-long perspective, the technical analysis is neutral, with 8 sell indicators (2 oscillators and 6 moving averages), 8 neutrals and 10 sells (2 oscillators and 8 moving averages).

Microsoft Stock Forecast for 2022 by Experts

What do the experts think about MSFT's potential stock performance for 2022? Currently, 26 top analyst firms have offered opinions about MSFT. Based on their ratings, Microsoft stock is a strong buy and has an average price target of $375.55.

Here are some quotes on the Microsoft stock forecast:

- "[The hike in the price of Office365 was a] smart strategic poker move that could be another $5 billion+ incremental tailwind for Redmond [Microsoft's campus] in 2022… numbers could continue to move higher." — Wedbush Analysts

- "MSFT posted another strong quarter, and while the sequential deceleration in Azure growth created initial noise in the print, these concerns were quickly allayed with management's guide of a Q/Q acceleration in Azure CC growth." — Stifel Analysts

- "After the 14% YTD sell-off that appears overdone, growth investors buy MSFT on a [decent] risk-reward." — Piper Sandler Analysts

- "[Microsoft stock is] still a strong buy." — Morgan Stanley Analysts

Short-Term Microsoft Price Prediction for 2022

There are numerous Microsoft stock forecasts available, so we're presenting one that seems to be very realistic: LongForecast. According to their 2022 prediction, Microsoft shares may be worth $350-$394 at the end of 2022.

|

Month |

Minimum Price ($) |

Maximum Price ($) |

Close ($) |

Total Change |

|

March 2022 |

290 |

328 |

309 |

0.00% |

|

April 2022 |

276 |

312 |

294 |

-4.85% |

|

May 2022 |

282 |

318 |

300 |

-2.91% |

|

June 2022 |

283 |

319 |

301 |

-2.59% |

|

July 2022 |

297 |

335 |

316 |

2.27% |

|

August 2022 |

301 |

339 |

320 |

3.56% |

|

September 2022 |

316 |

356 |

336 |

8.74% |

|

October 2022 |

331 |

373 |

352 |

13.92% |

|

November 2022 |

348 |

392 |

370 |

19.74% |

|

December 2022 |

350 |

394 |

372 |

20.39% |

Microsoft Price Prediction for 2023-2025

For 2023-2025, we've chosen to present CoinPriceForecast's Microsoft price prediction, which sees MSTF reaching $535 by the end of 2025.

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End |

|

2023 |

358 |

398 |

+31% |

|

2024 |

429 |

457 |

+50% |

|

2025 |

487 |

535 |

+76% |

Long-Term Microsoft Price Prediction 2026-2030

CoinPriceForecast has also published a Microsoft stock price prediction for 2026-2030. Keep in mind, though, that predictions this far out are not as reliable. This forecast sees MSFT reaching $863 by the end of 2030.

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End |

|

2026 |

589 |

642 |

+111% |

|

2027 |

695 |

747 |

+145% |

|

2028 |

776 |

792 |

+160% |

|

2029 |

809 |

826 |

+171% |

|

2030 |

844 |

863 |

+183% |

Conclusion

Microsoft has experienced excellent gains over the last several years, ever since Satya Nadella was named the new CEO. The company has moved beyond being a one-trick pony. Rather than just offering an operating system, it has become a key player in cloud computing and gaming, and it's making a foray into blockchain technology. Its regular dividends and favourable earnings reports have helped Microsoft earn the trust of many investors, and the company is currently considered a "Strong Buy" by top analysts.

If you're ready to add Microsoft to your portfolio, consider creating a demo account on Libertex. You may be unsure whether trading or investing in MSFT is right for you; the demo account can help you hone your trading strategies and improve your skills.

Disclaimer: This article compiles opinions and forecasts from various sources and is not intended as investment advice. Before making any trading or investment decisions, conduct research or speak with a financial advisor.

FAQ

Is Microsoft a good stock to buy right now?

According to Wall Street analysts, Microsoft is a Strong Buy.

What is the future of Microsoft stock?

According to various Microsoft stock forecasts, MSFT could be worth over $800 per share in 2030.

Is Microsoft a good long-term investment?

Microsoft has the potential to be a good long-term investment if it continues to remain at the forefront of cloud computing and other internet technologies.

Does Microsoft stock pay dividends?

Yes, Microsoft pays quarterly dividends when meeting certain conditions.

How much is Microsoft worth in 2022?

As of 9 February 2022, Microsoft is worth $311.21.

How much will Microsoft be worth in 2025?

It could be worth $535 per share by the end of 2025.

How much will Microsoft be worth in 2030?

It could be worth $863 per share by the end of 2030. However, it is too far in the future to give an accurate Microsoft stock forecast.

Is Microsoft a Buy, Sell or Hold?

According to most analysts, Microsoft is a Strong Buy.

Is Microsoft overvalued?

No, Wall Street top analysts do not believe Microsoft is overvalued.

What is the target price for Microsoft stock?

The target price for Microsoft stock is $375.55.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.