The 2020 US Presidential Election. Two Scenarios, Two Strategies

Prêt à commencer ?

Rejoignez des milliers d'utilisateurs de Libertex.

85 % des comptes des investisseurs particuliers perdent de l'argent

Introduction

Voters don't decide issues; they decide who will decide issues.

George Will (American political commentator)

The world has already seen plenty of surprises in 2020. Next in line is the US presidential election, which will be held on 3 November 2020. While the presidential race is in full swing, we'll try to see what collective baggage the US is heading into the upcoming election with, what the candidates' plans are and how the US and the world will change after the election. Most importantly, we'll look at how financial markets will react to the election results and which investment portfolio is best to form.

Concerning the US election, investments in the pre-election race environment before and after the vote, in a new study: 'The 2020 US Presidential Election. Two Scenarios, Two Strategies'.

Generally speaking, if the sitting US president runs for a second term, the election effectively becomes more of a referendum in which the American public assesses the country's achievements and failures. President Trump finds himself in this unenviable position. On the one hand, voters have traditionally been less supportive of politicians who have held office during recessions, financial crises and natural disasters, even if the measures they took to combat those crises were adequate and effective. On the other hand, the proportion of voters in the baby boomers and millennial generations have evened out, with the latter coming out to voice their protest against President Trump in 2016.

The 2020 election is also a struggle between the Republican and Democratic parties, which hold differing views on domestic and foreign policy. This means that Trump's foreign policy and monetary policy may change, thus altering the configuration of financial markets.

This report isn't just about the successes and failures of Trump and his rivals; it's about a new world, how it could play out and financial opportunities.

We hope 'The 2020 US Presidential Election. Two Scenarios, Two Strategies' provides you with enjoyable reading and useful information.

The US as a world superpower

The state of the economy

There are differing opinions of the United States. You can love the country or hate it. You can admire its democratic values, or you can decry its lack of them. You can be horrified by the protests taking place in the country or support them. You can agree with the foreign and domestic policies pursued by the US government or entirely disagree with them. But something that can't be denied is the huge role this country plays in the world economy and geopolitics.

Indeed, everything that happens in the US economy subsequently spreads to other countries' economies, just as the aftershocks of an earthquake reaches nearby regions. This shouldn't come as a surprise to anyone given that the United States is one of the world's largest economies.

According to data from the United Nations, the US economy ranks highest in terms of gross domestic product (GDP).

| Rating | Global Economy |

GDP (USD $ million) 85,804,390.60 |

|---|---|---|

| 1 | The United States | 20,494,100.00 |

| 2 | China | 13,608,151.86 |

| 3 | Japan | 4,970,915.56 |

| 4 | Germany | 3,996,759.29 |

| 5 | The United Kingdom | 2,825,207.95 |

| 6 | France | 2,777,535.24 |

| 7 | India | 2,726,322.62 |

| 8 | Italy | 2,073,901.99 |

| 9 | Brazil | 1,868,626.01 |

| 10 | Canada | 1,712,510.03 |

| 11 | Russia | 1,657,553.77 |

| 12 | South Korea | 1,619,423.70 |

| 13 | Australia | 1,432,195.18 |

| 14 | Spain | 1,426,189.14 |

| 15 | Mexico | 1,223,808.89 |

Table: The 15 largest world economies by GDP at the end of 2019

There is another very telling indicator that emphasises the strength and importance of the US economy — the Global Competitiveness Index, which has been published in a report by the World Economic Forum since 2004. The Global Competitiveness Report ranks countries according to this index, which measures the set of institutions, policies and factors that determine sustainable current and medium-term economic prosperity. If you look at the 2019 report's data, the United States came in second behind only Singapore.

Figure: Top 20 countries on the global competitiveness index. Source: http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf

It should be noted that the US economy has been near the top of this world ranking for over 100 years. In nominal terms, its share of world GDP is 20-25%. However, if you look at a metric such as GDP in terms of purchasing power parity, then the United States (16.14%) in 2019 is slightly behind China (16.32%), ranking second according to data from the IMF.

The US economy is highly dependent on the service sector, which accounts for 78% of the US economy. Manufacturing accounts for 21%, while agriculture makes up only 1%. This distribution has a logical explanation. The industrial sector's small share of the economy is due to the fact that in the 1980s, American companies began to transfer production to Asian countries with lower labour costs, which made it possible to reduce the cost of goods. This led to the formation of manufacturing chains in which Asian countries acted as product assemblers and the United States as a developer. The US derived certain advantages from this structure, although its position simultaneously weakened. After all, it will take time and considerable financial expenditures to return manufacturing to the United States. The effect on the prices of American products will be far from positive. Moreover, at this stage, Asian companies have gained a lot of experience and will be quite capable of competing.

So, at first glance, it seems that the US economy has serious structural imbalances, but, if so, this is only partially true. Let's take a closer look at where the strength of the American economy lies. We won't go into too much detail on the structure of various sectors. We'll only look at them in general terms because, going forward, we'll be able to better understand the consequences of certain decisions by the president and the US government.

Despite the fact that manufacturing's share in US GDP is relatively small, it looks impressive on a global scale. The volume of US manufacturing exceeds $4 trillion. When we look at the GDP of the top 15 countries by this metric, it becomes clear that manufacturing in the US alone makes up as much as the entire economies for the overwhelming number of countries overall. Germany's GDP, for example, is $4 trillion, which puts it at fourth in the global rankings.

At the same time, the United States occupies high positions in a number of industries. In particular, the machine manufacturing industry is well developed in the country and accounts for about 40% of industrial manufacturing. The United States ranks first in the world in terms of chemical production. The United States is the source of 16.4% of the world's aluminium and 18% of its copper. In addition, 11.1% of the world's oil production also comes from the United States. The country ranks second in natural gas production and first in electricity generation.

It should be said that agriculture's 1% share of GDP also plays an important role in the world. The US provides a third of the world market for corn and soybeans. The country ranks third in sugar beet production, fifth in cane harvesting and eleventh in rice cultivation. At the same time, about 16% of the world grain harvest also comes from the United States.

The service industry in the United States is generally diversified. The country sees developed areas in finance (30%), education, science, health care and the social sphere (about 25% altogether), trade (20%), transport and communications, government services and various professional and personal services. It's worth noting that the financial sector plays an outsized role. For example, the United States is ahead of other financial centres in the world in terms of the volume of financial instruments traded on the New York Stock Exchange (NYSE) and NASDAQ. This creates an imbalance and carries certain risks. For instance, this segment's growth (as well as the tech segment's growth) can lead to the formation of a bubble, as we saw in 2000 and 2008. A bubble is fraught with the potential for a sharp collapse in a crisis and can even lead to more serious consequences, such as the collapse of the global financial system.

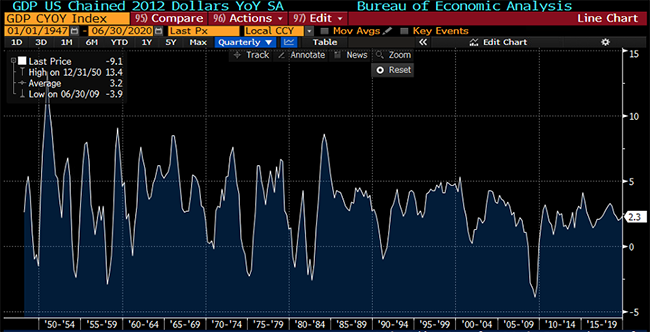

On the whole, the US economy shows fairly stable growth rates.

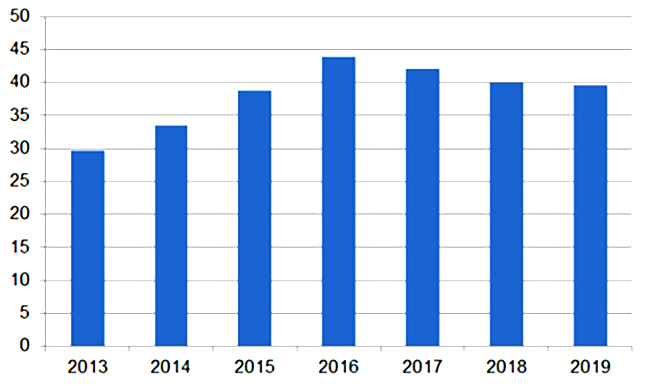

Figure: The growth rate of US GDP in annual terms (excluding the Q2 2020, when a collapse occurred due to the coronavirus pandemic). Source: Bloomberg Professional

On average, the GDP grows about 1.1% per quarter and 3.2% per year (excluding the consequences of the COVID-19 pandemic). The numbers may not seem especially impressive, but if we pay attention to the absolute size of the US GDP, the growth turns out to be rather impressive.

However, this does not mean that the American economy hasn't had its difficulties. Like any other economy in the world, it fell due to various crises and, often, precisely because of its size, acted as a catalyst for big changes in the entire world economy.

If we turn to history, the US economy has repeatedly experienced crises and upswings. One of the most famous was the Great Depression, which was partially triggered by the dynamic economic growth of the 1920s. From 1925 to 1929, GDP grew by more than 14% to USD $103.6 billion, the median annual income of an American grew by $1,500, and unemployment was below 4%. However, it's a cruel joke that Americans paid for most of their consumption with debt. This increased standard of living led to the stock market's rapid development. Both professional traders and everyday Americans flocked to Wall Street. The key factor behind the collapse was margin trading, as banks borrowed more money from the stock and real estate markets than they did from commercial enterprises. As a result, America's economic growth contracted by 31% in the early years of the Great Depression. Even then, the collapse that began in the United States had a significant impact on most countries around the world.

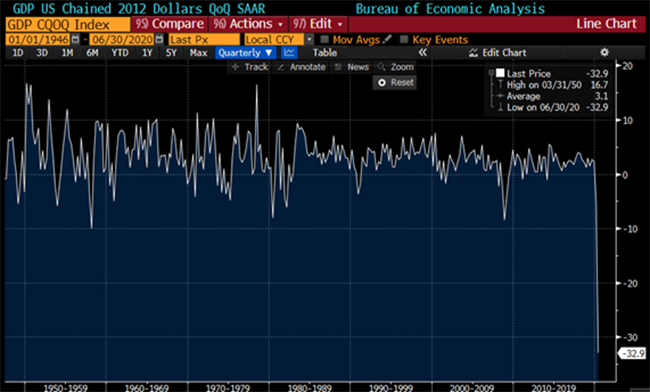

We're witnessing the second, equally large collapse in modern history, triggered by the coronavirus pandemic.

Figure: US GDP growth rate in quarterly terms. Source: Bloomberg Professional

The US economy plunged 32.9% in Q2 2020, breaking a nearly century-old record. With figures like these, the IMF's forecasts that the total global economy will fall by 4.9% in 2020 are not surprising.

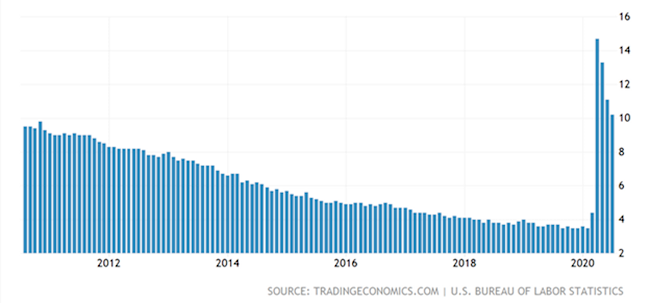

But, let's get back to the United States. The strong economic downturn was largely provoked by the service sector's enormous contribution to the US economy and the rise in the unemployment rate, which reached 14.7% at its peak. Lockdown measures have heavily affected trade, tourism, restaurants and other consumer services.

Figure: US unemployment rate. Source: tradingeconomics.com

There were other crises as well, but they are hardly comparable in scale to those mentioned above.

That said, the American economy hasn't only experienced collapses. For example, since the crisis of 2008-2009, it grew for 11 straight years. The maximum growth rate the US GDP recorded was 16.7% in 1950 when most of the world's economies were recovering from World War II. The US came out of the war better off than other countries did and became a global producer of goods. Pegging the dollar to gold under the Bretton Woods Agreement also helped. This allowed America to tie the entire world financial system to itself, but more on that later.

The US in the world marketplace

In addition to the play a large role in the financial sector, the United States also has a significant position in world trade.

The US is an import-oriented country; put another way, the country buys more foreign products than it sells for export. The movement of the country's trade balance confirms this. In the last 30 years, the metric has formed a negative balance, i.e., the US is running a trade deficit.

Figure: US quarterly trade balance. Source: Bloomberg Professional

On the one hand, a trade deficit is a negative factor. On the other hand, this state of affairs is, to some extent, important for the United States. The country needs to constantly issue dollars, which is predicated on leaders continuing the outflow of the dollar supply. Moreover, all US trading operations are carried out only for dollars.

The US has a very interesting import/export structure. If you look closely at the figures, you can see that the country simultaneously imports and exports goods in the same category.

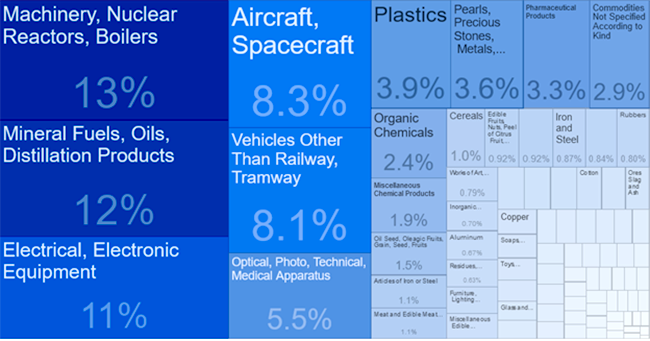

Figure: US exports by category. Source: tradingeconomics.com

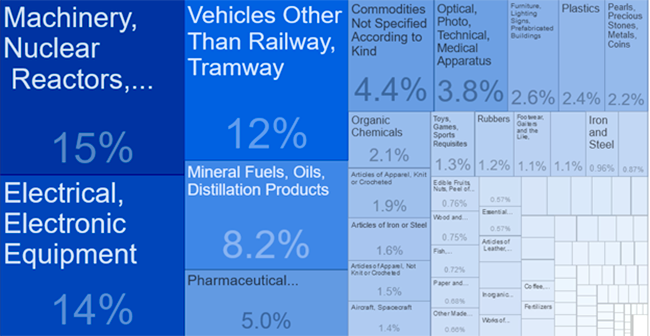

Figure: US imports by category. Source: tradingeconomics.com

For example, the country actively sells cars and other machinery on the foreign market, making this category one of the largest US export items. At the same time, the country buys even more of the same kind of products, for example, cheaper Chinese cars. Or cars from the EU, where Germany alone supplies about 600,000 cars a year. In terms of imports, the share of machinery and related products makes up 15%. The same applies to various digital devices, such as computers and mobile phones, to name a few.

Gas and petroleum products play an important role in US exports, but the country often imports crude oil, refines it and exports finished products.

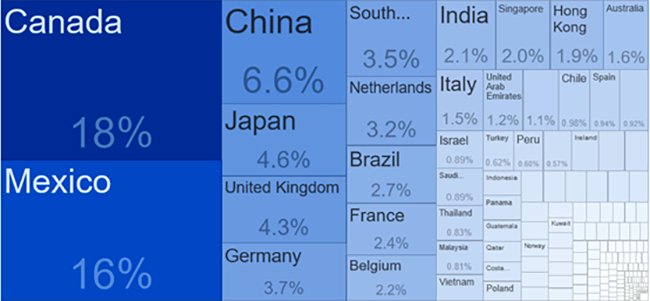

The US has several key trading partners, namely, Canada, Mexico, China, Japan and Germany.

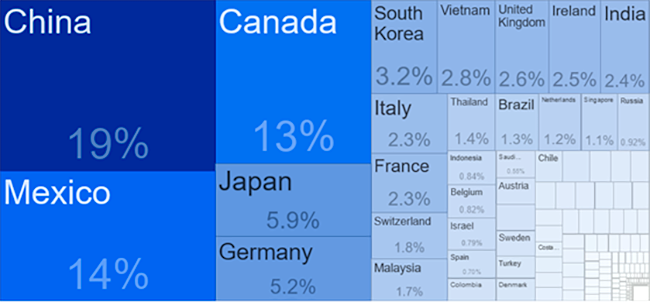

Figure: Exports from the US by country. Source: tradingeconomics.com

Figure: US imports by country. Source: tradingeconomics.com

It should be noted that China and Mexico are the biggest exporters to the United States. Overall, this isn't surprising given the fact that a considerable share of manufacturing is located in these regions. However, there is one more very remarkable fact: Vietnam recently has joined the list of the top ten exporters to the United States. The explanation for that is fairly straightforward. From 2018 to 2019, the US was actively engaged in trade wars, with China as one of its main opponents. President Trump is completely discontent that the US trade deficit with China is so huge. At the end of 2019, it amounted to $345.62 billion, the lowest figure since 2014. But the United States is as dependent on products from China as the PRC is on exports to the US.

To circumvent draconian US import duties, China is exporting goods to Vietnam, where they are relabeled and shipped under the guise of products made there. The second measure China is taking is supplying components to Vietnam, Taiwan, Mexico, where finished products are then assembled.

Figure: Movement of changes in imports from China to Vietnam, Taiwan and Mexico and imports of products from those countries to the United States in 2019. Source: https://asia.nikkei.com/

If we look at the sitting president's policies, we can see that he tried to influence precisely those regions on which US trade depends most strongly in order to create more acceptable conditions for the US and "make America great again". But unilateral advantages aren't good enough for anyone, since every leader has a similar goal. President Trump has already made it clear that he could sever economic relations with China altogether, which, in our opinion, is unlikely, since it will take time and money to return manufacturing to the United States. In the current environment, in which the country is struggling with the consequences of the coronavirus pandemic, money injections into the real economy are unlikely to be very big. Furthermore, most of the United States' debt is held by China. There are no guarantees that China wouldn't hold back from selling it if the trade conflict saw a sharp escalation. That action alone would cause irreparable consequences, and, for the US, it's extremely important that it preserve the dollar's hegemony so that the country can maintain its leading position in the world.

The dollar in the world

The US dollar was dealt a significant blow in 2020. If the greenback was ascending at the beginning of the crisis triggered by the coronavirus pandemic (because most investors traditionally consider the dollar to be a defence asset), it has since seen a rapid decline in the last 5 months. There is an explanation for this. The US Federal Reserve is carrying out an unprecedented economic stimulus programme and actively printing money. This should have led to a fairly rapid start to economic recovery, but the liquidity injections are flowing into financial markets more than they are into the real economy. That's a problem.

Furthermore, the US national debt is growing rapidly. Since the beginning of 2020, the country's debt has grown by more than $3 trillion according to the US Treasury Department. By the end of August 2020, the debt had reached $26.65 trillion. The reasons for this are obvious: Many countries with trade surpluses invest the surplus in US government debt. Naturally, this negatively affects the rates of long-term US securities, which can negatively affect the country's financial stability.

Nevertheless, the fall of the dollar has once again called into question its status as the primary reserve currency. But is it worth worrying about now?

Yes; recently, there has been more talk about de-dollarisation, and many countries are moving in this direction — especially those with rather tense relations with the United States. For example, Russia and China are increasing the share of settlements in their national currencies. And that's the right decision since depending on your potential adversary is the wrong call. It's no secret that all dollar payments are made through American bank accounts, which increases the risks of transactions. That's why the dollar's share in trade between Russia and China in Q1 2020 reached an all-time low of 46%.

At the same time, a trend is emerging towards a decrease in the dollar's share in international settlements. At the end of 2019, it reached 39.9%, a 4-year low.

Figure: The share of the dollar in international settlements as a percentage of total turnover (according to SWIFT data).

But, this is happening rather slowly.

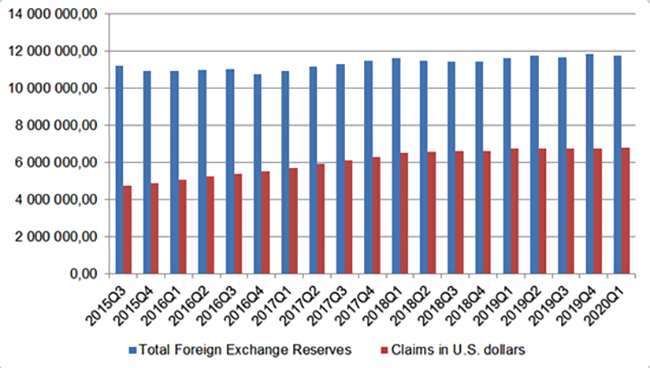

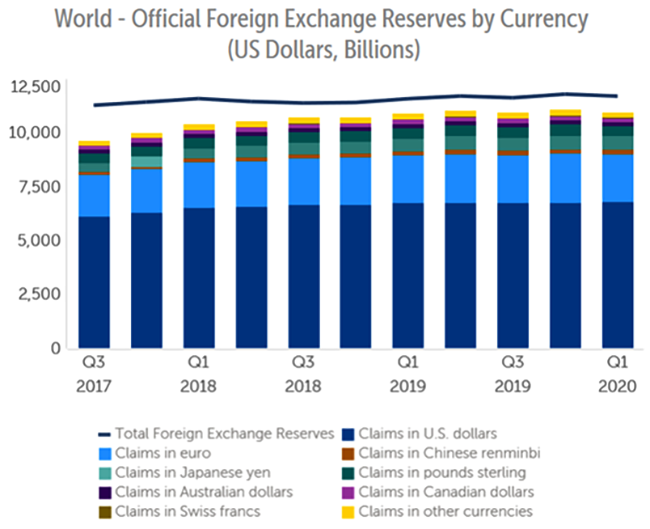

At the same time, according to the IMF, dollar assets in the Q1 2020 still account for over 62% of world central banks' reserves. However, the dollar accounted for about 70% of various countries' foreign exchange reserves in the early 2000s.

Figure: The dollar's dynamics in world foreign exchange reserves. Source: https://data.imf.org

That said, there's also a trend towards a gradual decline in the dollar's share, while other currencies are increasing theirs.

Figure: World foreign exchange reserves. Source: https://data.imf.org

The trends are not in the dollar's favour, yet the fact remains that the United States is pursuing a fairly aggressive foreign policy, actively imposing sanctions — especially against developing countries, which, in turn, are seeking payment and reserve alternatives to the American currency. These countries are increasingly trying to use their national currencies and euros as a means of payment, and gold as reserves. Consequently, the dollar's stability is highly dependent on US foreign policy. If Trump and the Republicans retain control of the White House, the situation is not likely to change for the better, since the current president has made it clear that he isn't ruling out a complete break in economic relations with China. The consequence of that development could be the reduction in China's investment in US Treasury bonds.

For these reasons, the dollar's role in the world economy will decline, but it will do so extremely slowly. In the next 5-10 years, the dollar's share in world reserves may drop to 50-55%. Nevertheless, the greenback is far from completely losing its reserve currency status. At this stage, no other world currency is ready to take its place. Practically every region has its own complexities, which keeps the world from quickly throwing its preference behind any one alternative. Meanwhile, the US Treasury bond market boasts high liquidity and zero defaults. It's worth also bearing in mind that the United States' economy can only be compared to China's economy, which is still technically classified as developing. The simple fact that the yuan is now on the list of world reserve currencies doesn't make it a worthy alternative at present.

In sum, the service sector's outsized role in the US GDP doesn't make America's economy lopsided. On the contrary, this demonstrates a diversified post-industrial economy that plays an extremely important role in the world. The same is true of the dollar, which is unlikely to lose its status within the next 20-30 years. There will be a gradual paradigm shift, but even then, the dollar won't be completely rejected as a payment method and reserve currency. Its share in trade and gold and foreign exchange reserves will simply decrease to 20-30%.

Because the United States holds such a significant position in the world economy, the election of the country's president and government plays an extremely important role. The person sitting in the White House will determine the country's foreign policy, trade policy and economic relations. By extension, that means that person will affect the dynamics of many world currencies and stock indices. Let's now turn our attention to the US electorate's political preferences and the candidates' platforms.

Playing political patience: the battle for the White House

The election is right around the corner, scheduled to take place on Tuesday, 3 November. Let's take a look at the current alignment of political parties, probable scenarios and predictions of who will make America great again in the next four years.

Traditionally, the biggest race for the highest office in the nation unfolds between the two political parties with the greatest support among US citizens: the Republicans and the Democrats. The Republicans have long known who their candidate would be: the incumbent, President Donald Trump, who filed to run in the 2020 election just a few hours after his inauguration in 2017. That choice was not as readily apparent for the Democrats.

The candidates

The Democratic primaries — the intraparty competition to vie for the nomination — began in the summer of 2019. Around 30 contenders took part, of which only two reached the finish line.

The parties' nominees

Presidential race dropouts

27 Democrats, 3 Republicans

Joe Biden was the presumed favourite in the Democratic primaries. After serving as Barack Obama's vice president for eight years, he was well-known and confidently led the national polls. At the Democratic Convention in late August 2020, Joe Biden was nominated as the party's candidate in the general presidential election.

Third-party candidates

In addition to the Democratic and Republican candidates, several other figures will contend in the election, notably Jo Jorgensen for the Libertarian Party and Howie Hawkins for the Green Party.

Jo Jorgensen |

|

|---|---|

| An activist and professor of psychology at Clemson University. Like many of her party members, she believes in free human rights and decreasing the government's role in everyday life. For example, she doesn't think the government should impose rules on wearing masks or other restrictions during the on-going pandemic. |  |

Howie Hawkins |

|

|---|---|

|

Former UPS employee. He's been involved in Green Party politics for decades and even attended the party's first national convention in 1984. He is a longtime union activist, socialist and environmentalist. |

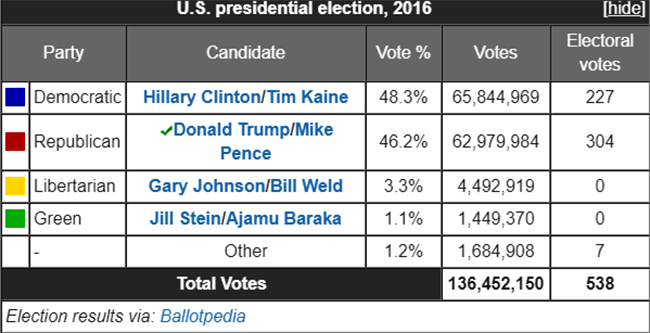

Figure: Results of the 2016 presidential election.

With low ratings, these candidates pose little threat to Trump and Biden in the upcoming election. According to polls in late August, Jo Jorgensen has about 2% of the vote, while Howie Hawkins has 1%.

Statistics from previous elections also show a low result for these political parties.

That's why we'll focus our attention on the leading candidates.

Trump and Biden's positions on key foreign and domestic policy issues

| Joe Biden | Donald Trump |

|---|---|

| Economic policy | |

| Biden favours increasing taxes for corporations and individuals, especially those with the highest income. He proposes trillions in new federal spending on infrastructure and research projects in the United States, arguing that "economic security is national security." | Trump has focused on tax cuts and deregulation in economic policies, which he says has spurred growth, innovation and employment. The coronavirus pandemic caused a recession in the country in 2020, while budget deficits and public debt surged amid unprecedented coronavirus-related spending. |

| Immigration | |

| Biden supports comprehensive immigration reform. In the past, he has supported more restrictive policies. He stresses the need to address the root causes of immigration in the countries of origin. | Immigration is an important issue for Trump and a serious conflict between his administration and its Democratic opponents. Advocating for drastic cuts in both legal and illegal immigration, he has taken steps within the executive branch to change asylum, deportation and visa policies. |

| Foreign trade | |

| Biden has been a longtime proponent of trade liberalisation and a critic of Trump's tariffs, arguing that Washington should take the lead in creating global trade rules and lowering trade barriers around the world. However, he is also critical of some aspects of trade. | Throughout his presidency, Trump has attacked the global trading system, which he claims is directed against US interests and is responsible for large trade deficits and cuts in US manufacturing and offshore US jobs. |

| Diplomacy | |

| Biden emphasises that the United States cannot meet the new challenges it faces without close relationships with its allies and cooperation with international organisations. He says Trump's withdrawal from treaties and his vilification of alliances "bankrupted America's word in the world." | Trump has removed the United States from international agreements and commitments that he believes are depleting US resources. He's feuded with longtime allies on issues ranging from defence to trade, and criticised global institutions, which he said are forcing the United States to "abandon its sovereignty". His budget proposals were aimed at reducing foreign aid and verbally supporting the United States. |

| Defence | |

| Biden has supported some US military interventions overseas and opposed others. He has often championed narrow goals with the use of force and expressed scepticism about the United States' ability to change foreign societies. He fears unilateral efforts, stressing the importance of diplomacy and influence through alliances and global institutions. | Trump is supporting the military by pushing for more defence spending, major new weapons programmes and a new space-focused industry. He also pledged to cut US military commitments in Afghanistan and the Middle East, focusing on great power competition with China and other countries. |

| Coronavirus | |

| Biden has put forward a national plan to combat the COVID-19 pandemic. He promises to strengthen presidential leadership and spend "whatever it takes" to expand testing, contact tracing, treatment and other health services and to support the economy and prepare for future pandemics. He criticises Trump's actions as "political theatre" and pledges to restore the United States to its position as a global leader in the fight against the crisis. | Trump has repeatedly downplayed the danger of COVID-19 and has resisted decisive federal efforts to combat it. He originally said the spread of the virus was under control in the United States, despite receiving warnings of an impending pandemic from intelligence and health authorities in January 2020. |

| China | |

| Biden described the rise of China as a major challenge. He criticised the country's "offensive" trade practices, saying he would rebuff China more effectively than Trump and work more closely with allies to pressure Beijing. | Trump has sought to counter a host of economic abuses by China: intellectual property theft, currency manipulation, export subsidies and economic espionage. He says aggressive action is needed to protect American workers and reduce the United States' large trade deficit. |

| Russia | |

| Biden said that, under President Vladimir Putin, Russia is "attacking the foundations of Western democracy" in an effort to weaken NATO, divide the European Union and undermine the US electoral system. He also expressed the opinion that Russia is using Western financial institutions to launder billions of dollars, which, Biden says, are then used to influence politicians in different countries. | Trump maintains a warm relationship with Russian President Vladimir Putin. He denied accusations that his campaign contributed to Moscow's interference in the 2016 US election. He has advocated for closer cooperation with Russia, while simultaneously yielding to Congressional pressure, extending sanctions on Moscow, expanding military aid to Ukraine and withdrawing from the US-Russia arms control treaty. |

| Latin America | |

| Biden believes that the US has distanced itself from Latin America and allow other global players, especially China, to make deep economic and diplomatic inroads in the region through investment and trade. Joe Biden's position is to bring US foreign policy back to more traditional, less confrontational and less fluid tactics. | Under the Trump administration, US relations with Latin America and the Caribbean have shifted towards a more confrontational approach. A number of actions have been taken on migration, trade and economic policies that have negatively impacted the region. |

Who is leading the race?

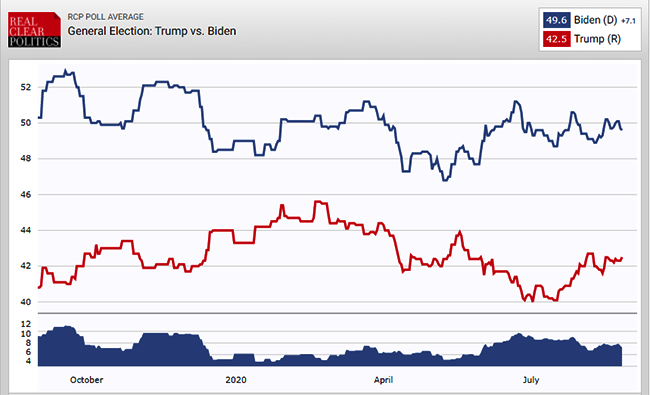

Figure: Support for Joe Biden and Donald Trump by US voters since October 2019, expressed as a percentage.

Since the start of the presidential campaign in the fall of 2019, Biden has had a noticeable 4-7% lead over Trump. But things aren't that simple…

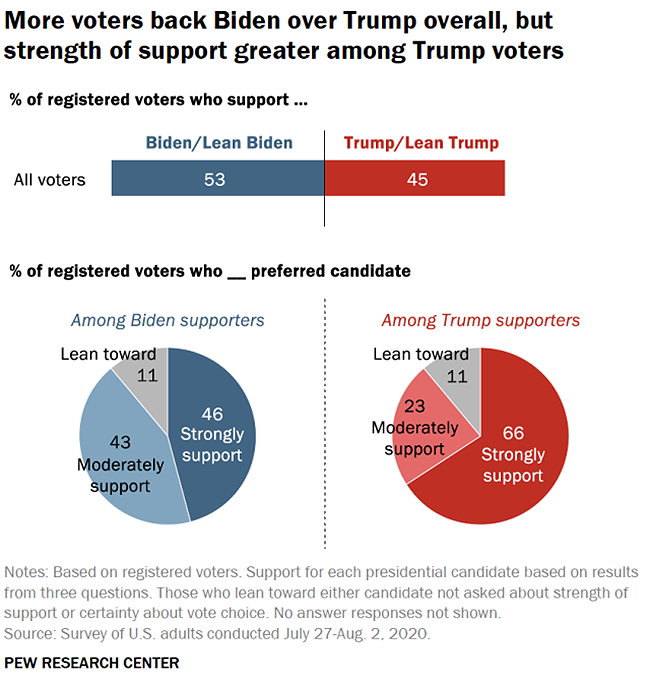

Less than three months before Election Day, Biden is leading Trump among voters: 53% of registered voters say that if the election were held today, they would vote for Biden or lean toward voting for him, while 45% would vote or lean toward voting for Trump.

Figure: Percentage of support for Joe Biden and Donald Trump by US voters.

Biden currently has a broader base of support among all voters, while Trump has support among those who say they will definitely vote for him and have already made up their minds. Two-thirds of Trump supporters (66%) say they strongly support him, compared to less than half (46%) of Biden's supporters. This suggests that Trump still has the opportunity to lure away some of Biden's supporters while not losing his ardent backers.

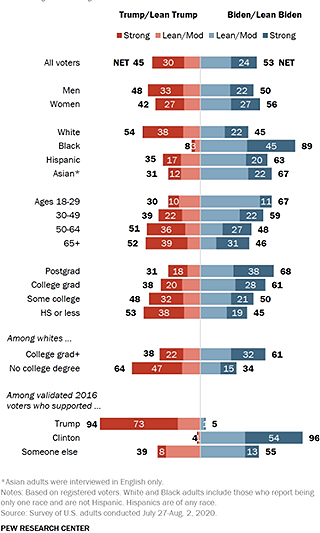

Figure: Demographic cross-section of support for Joe Biden and Donald Trump in the 2020 election, expressed as a percentage.

In terms of the demographic breakdown, Biden enjoys more support among female, black, Hispanic and Asian-American voters, while Trump does better among older and less-educated voters.

Millennials may provide support for Biden in this election. They number almost as much as baby boomers, and according to polls, they support Democrats to a greater extent than they do Trump. However, some millennials will be inclined not to vote for Biden, but against Trump. For them, the choice is a classic 'lesser-of-two-evils' scenario that will be reflected in the subsequent results.

The political risks of a Joe Biden victory

In the previous US presidential election in 2016, the polls at the time also predicted the Democratic candidate, Hillary Clinton, would win. But as we know, everything turned out differently; the outsider in the presidential race became the 45th president of the United States. That experience has shown that Trump has an ace up his sleeve that he can play in his favour this time, too.

An unprecedented number of Americans are expected to vote by mail this year due to the COVID-19 pandemic. Over the past several months, US states have seen a record number of Americans requesting ballots. According to Michael McDonald, a professor at the University of Florida who is closely monitoring voter turnout, mail-in ballots could account for 50% of all votes cast this autumn. This will be a huge increase compared to 2016 and 2018 when only about a quarter of votes were sent by mail.

This increase means that the United States Postal Service (USPS) will play a much larger role in the presidential election than ever before. Trump understands this well. In June of this year, he appointed his associate and a major sponsor of his election campaign, Louis DeJoy, as postmaster general. As a result, DeJoy now has more powers than any other official in the country to influence the outcome of this year's presidential election.

After taking office, DeJoy began cutting USPS spending by prohibiting overtime hours, which has overloaded the delivery system. In many states, massive complaints are coming in that mail has not reached recipients for weeks. There are also reports that the USPS is removing sorting machines from facilities, which could further slow the agency's work down. USPS has already formally warned states that it will not guarantee on-time delivery of ballots for the 3 November presidential election.

Most voters who support or lean toward Biden say they prefer to vote by mail in the presidential election (58%), while most Republicans want to cast their ballot at the polls, according to a Pew Research Center study.

Louis DeJoy could be Trump's ace up the sleeve to sail by Biden and the Democrats this time, too.

No scenario can be ruled out, which means there are at least two scenarios for how the election can impact the world economy and financial markets. We'll explore these scenarios more in-depth further on.

Two main scenarios for the impact on the world

It is possible to view the impact of political events on capital markets and the profitability of various asset classes through a variety of different lenses. First of all, we can look at the role of geopolitics and its relationship to regional and domestic political trends. The second framework in which to view the impact is through any pronounced ideological shifts that may take place. Alternatively, we could focus on transformational changes in the political context, such as independence from central bank control or deregulation of capital markets. Finally, we can consider cyclical changes in monetary and fiscal policy.

So without further ado, let's examine each of these factors individually.

Globalisation/deglobalisation

Globalisation refers to the process of worldwide economic, political, cultural and religious integration and harmonisation.

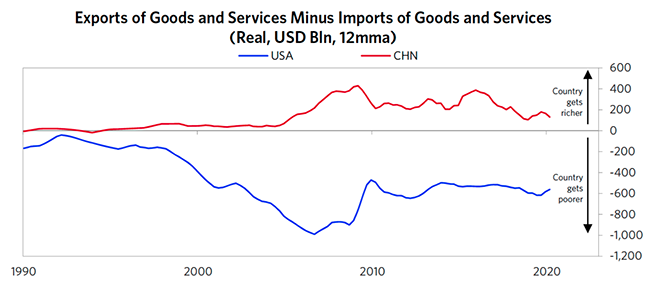

There were several key developments that helped facilitate globalisation. The first of these was the roll-out of the internet to the general public, which took place on 6 August 1991. This marked the beginning of the dotcom/tech boom and led to the establishment of the World Trade Organisation on 1 January 1995. Then followed an age of technological development and globalisation, beginning in 1990 and running more or less right up until the 2016 election of Donald Trump, during which many American workers (particularly in the manufacturing sector) lost their jobs. Over the course of nearly 30 years, the concept of countries and the borders between them lost much of their significance. Companies typically declared their profits in whichever jurisdiction was most fiscally advantageous to them. This led to manufacturing growth across developing markets, an acceleration in labour mobility, a reduction in the wealth gap between rich and poor nations and increased domestic inequality within these countries. Low-income workers in developed countries were the biggest losers, while higher-income workers in productive developing countries were able to amass wealth. Employees from developing nations (China in particular) and machines displaced many middle-class workers in the US. The image below shows net exports of goods and services for both the US and China since 1990 in real dollar terms (adjusted for inflation). China is still operating a trade surplus, while the US is at a deficit.

Figure: Net goods and services exports for the US and China

Source: World Trade Organisation

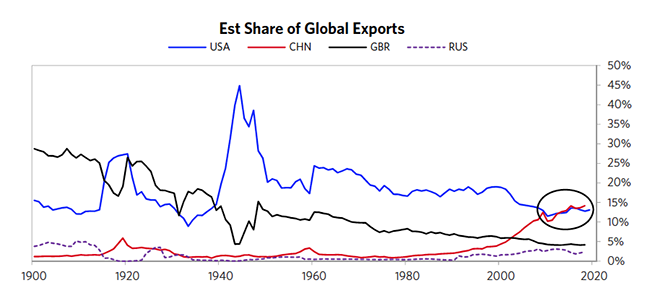

Figure: Share of international exports for US, China, Germany and Russia.

Source: World Trade Organisation

Donald Trump has been trying to reverse precisely this trend during his term in office. After electing to follow a clear protectionist path, the US president has waged a series of trade wars. Is this status quo liable to change with the arrival of a new commander-in-chief?

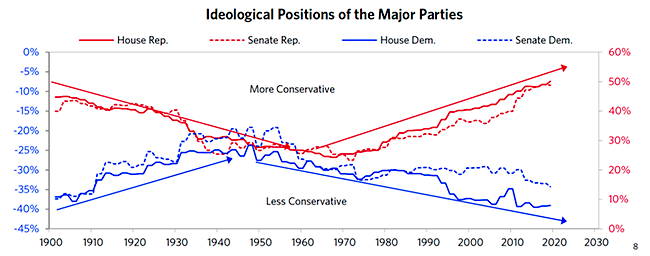

Despite the widening gap between the two extremes of the political spectrum (see image below) — with the fervently capitalist Republicans on one side and the equally fervently liberal Democrats on the other — anti-Chinese sentiment is shared by both parties.

Fig. 3. Ideological positions of Democrat and Republican members of the US House of Representatives and Senate. This graph shows the extent of Republican conservatism and Democrat liberalism. The larger the disparity between Democrat and Republican viewpoints and the more radical their sentiment, the more the lines of the graph diverge.

Notwithstanding this, we would do well to remember that each candidate will have a different approach to realigning US-Chinese relations.

Republicans

Trump is both a populist and a nationalist and has historically taken a highly aggressive stance in international negotiations related to matters of economic and/or geopolitical disagreement:

- With international adversaries, China and Iran in particular.

- With US allies like the EU and Japan on issues such as trade and military expenditures.

The conflict with China on trade, technology, geopolitics and capital has been the most significant and is only likely to intensify with time.

US President Donald Trump's "America First" policy is seeing international trade law undermined with increasing intensity and severity and is tied to the huge losses being experienced both by the US and its trading partners around the world. With the US's exit from the Trans-Pacific Partnership (TPP), the overhaul of trade agreements with Mexico and Canada (NAFTA) and South Korea (KORUS), the blocking of the appointment of new members to the Appellate Body of the World Trade Organisation's (WTO), the imposition of tariffs on steel and aluminium and the escalation of the US-Chinese tariff war, Trump clearly represents a break with the liberal trading policy of his predecessors.

Despite widespread opinion, the level of geopolitical risk and global authoritarianism is actually within the average historic range. As such, financial markets have, for the most part, remained resilient to any geopolitical developments. History shows that, in the absence of other long-term factors affecting commodities markets (e.g., the 1970s oil crisis), geopolitical events only have a short-lived impact on markets.

President Trump wants to return jobs to the US. But his policy on trade represents a serious risk both to the economies of the US and its key trading partners.

If Trump is re-elected, this protectionist policy will continue. That scenario would be damaging for companies and sectors that depend on cheap labour and migration policy, such as the agricultural industry. Supply chains could be ruptured as a result of higher tariffs, subjecting import-dependent companies to higher costs and/or supply uncertainty.

We can therefore conclude that regional markets will be more sensitive to regional and domestic factors than they will be to global trends. As a result, there will be less correlation between different regions, which will complicate the process of active investment management.

Democrats

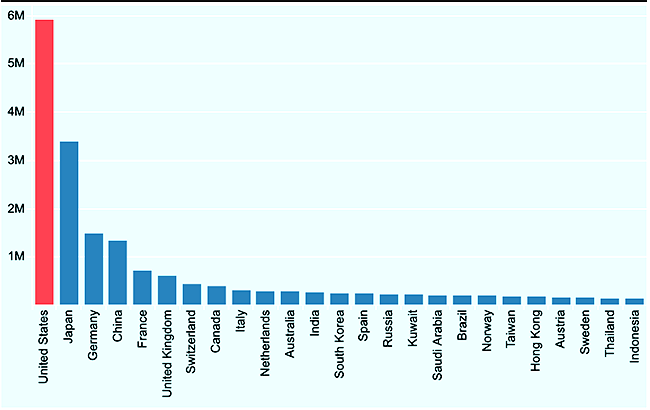

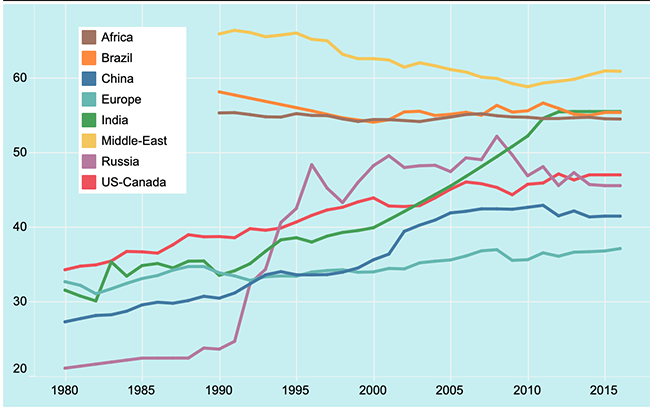

It's unlikely that Democrats will be able to restore globalisation to its pre-2016 level. Many factors associated with globalisation, such as immigration, have become so overcharged that they are bound to provoke a severe political and public reaction. The most striking confirmation of this is the fact that transnational corporations constantly find themselves at the centre of debates and inquiries regarding monopolies and tax avoidance. Many blame globalisation for much of the conflict surrounding the inequality between rich and poor, both domestically and between different countries. The income gap is indeed huge. For example, the median wealth of the average American is four times that of his or her European counterpart, ten times higher than the average Chinese resident, almost 50 times higher than the average Indian, and more than 100 times that of the average African.

Figure: Number of dollar millionaires by country. The US is the clear front-runner when it comes to the number of millionaires per capita.

Source: 2020 Capgemini World Wealth Report

Figure: Income share held by the richest 10%. In virtually every country on Earth, inequality is either growing or remains at its current levels.

Source: World Inequality Lab

In the event of a Biden White House, we would most likely see efforts to ease strained relations with Europe and strengthen this key alliance, increased readiness to work with international organisations like the World Trade Organisation (WTO), calls to reinstate the Iran nuclear deal and a generally more diplomatic approach to resolving trade-related issues and other matters with China. In our view, Biden would be more likely to pursue a path of multipolarity.

A multipolar world is one in which a small number of key regions become increasingly autonomous in their politics, society, economy, finances and technology. In our opinion, the US, Europe and China have already formed what appear to be major poles in line with a multipolar world structure. In the short to medium term, we could see the emergence of regional zones led by India and the United Arab Emirates. Medium-sized independent countries like Russia, the UK and Japan could strive to establish their own spheres of influence in this new world order, but they will always remain back-seat drivers since they don't possess enough economic clout to qualify as a "pole".

Monetary policy. Will the money printing press be put to work?

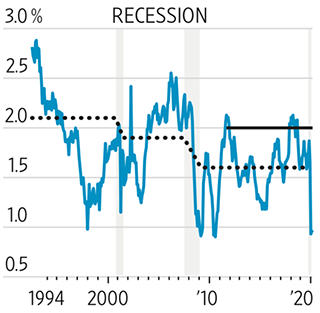

The Federal Reserve's maintenance of its current monetary policy constitutes an inconspicuous yet unambiguous priority shift away from inflation and towards employment. The practical effect of this move is not particularly significant because inflation is already below its 2% target level and unemployment is above 10% while interest rates will remain close to zero for several years to come. Nevertheless, it does mark a key institutional and philosophical paradigm shift. It's the response to a changing world.

Central banks have long worked on the assumption that there is a direct link between employment and inflation. When unemployment dips below a certain 'natural' level, inflation starts to accelerate. This inverse relationship is known as the Phillips curve. In 2019, however, unemployment fell to a 50-year low, and inflation remained subdued, thus disproving this classic theory. The lesson from this was that it's possible to maintain a stable labour market without sparking inflation.

Recent US action constitutes an attempt to avoid the low inflation trap that Europe and Japan have fallen into. These latter countries are suffering from a combination of consistently low growth rates and low actual and projected inflation, which will inevitably lead over time to lower interest rates. The upshot of this is that low rates during normal times mean that central banks have less leeway when it comes to lowering them during times of adversity.

Source: BBC

Though the Fed has not changed its 2% target level, it has stated that it would welcome inflation above this level. Such an increase would lead to a rise in price pressure. In this event, inflation-immune assets (stocks and gold) would become more valuable, while the dollar would depreciate against the currencies of developed and developing countries. The drop in demand for the US dollar can be attributed to the Federal Reserve's unprecedented economic stimulus and large-scale money printing.

Figure: Annual inflation rate (blue line), target rate (black line) and average inflation rate during periods of economic growth (black dotted line) expressed as a percentage.

Source: Wall Street Journal

We believe that regardless of which candidate is ultimately elected, the Fed's monetary policy direction will not be impacted. It's no secret that it is within the president's remit to appoint senior members to the Federal Open Market Committee. However, it is generally accepted that the country's central bank is an independent institution. In the interest of fairness, however, we must point out that there were instances in 2019 when Trump published tweets demanding that the Fed cut interest rates in order to stimulate economic growth.

A new paradigm for the tech sector

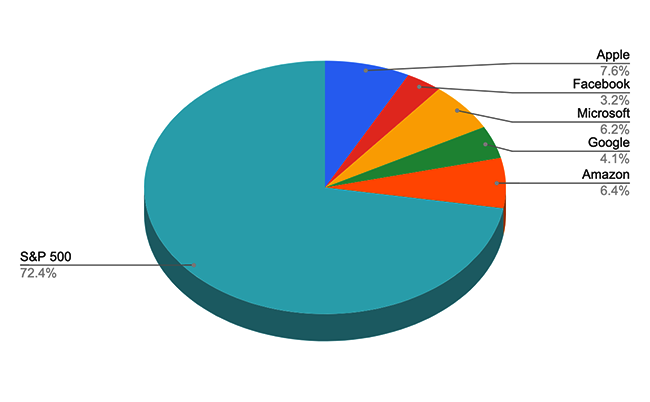

At the end of August 2020, the top five tech firms in the world (Apple, Amazon, Facebook, Microsoft and Google) accounted for 28% of the S&P 500's total market cap (see figure below). These companies' excessive weighting in the US economy could become a problem for whoever is elected president this year.

Figure: Tech giants make up almost 30% of the value of all the companies in the S&P 500.

Source: Libertex Academy calculations

Virtually all of the S&P's 2020 growth is attributable to these companies (see figure below).

Figure: The Top 10 tech companies in the S&P 500 index (turquoise line) compared to the S&P 500 index, excluding these Top 10 companies (red line).

Source: Libertex

The members of both parties have expressed concern regarding the consolidation of power in the hands of Silicon Valley companies, which, in their words, have become too big and are hindering competition, with some even wielding media influence. The Washington Post, for instance, is owned by Amazon founder Jeff Bezos. In any case, whoever comes to power in the US will have a relatively significant say in the future course of the tech sector.

Republicans

Tech firms will likely flourish in a climate of low interest rates and the continuation of Trump's tax policy.

Democrats

Some Democrat politicians are critical of tech giants for selling user data. Many of these companies are effective monopolies, which is why we often hear Democrats calling for them to be broken up as the Standard Oil Trust was. This idea gained traction amid the on-going Federal Trade Commission's antitrust investigation into all five big tech firms in which the FTC is seeking to determine whether the industry’s giants acquired smaller rivals in ways that harmed competition. With trillions in market capitalisation, these firms are powerful enough to ride out any storm, whether it's COVID-19 or any other local crisis.

The Biden administration would most likely move to impose stricter regulation on the tech sector. This would include stricter anti-competition regulations, as well as stronger enforcement of anti-monopoly legislation, and enhanced user privacy and cybersecurity policies. In all likelihood, the Democrats would strengthen support for tech SMEs in a bid to provide better protections for users and foster greater market competition.

Biden plans to raise the corporate tax rate to 28% (scrapping Trump's decision to cut it to 21%), return the maximum tax rate to 39.6% (from 37%) and treat capital gains and dividends as ordinary income for taxation purposes.

From the above, we can conclude that, while some matters are outside the sphere of influence of the president and government, these actors can still enact various foreign economic and domestic policies. That means that financial instruments will behave differently, which is exactly why we are looking at putting together two separate portfolios.

Two trading portfolios

Presidential election cycles

People and investors sometimes start letting their emotions guide their behaviour once the presidential race heats up.

A recent RBC Capital Markets survey of more than 100 institutional investors showed that 73% of respondents were concerned by the election. Meanwhile, 68% and 63% reported that they were concerned about a second coronavirus wave and new job losses, respectively. When investors were asked what keeps them up at night, the majority said the 2020 election, followed by Fed policy and the pandemic.

Given that the 2020 US presidential election worries investors more than anything else, the impact of this event on investor behaviour is likely to be larger than ever before. Nonetheless, our statistical analysis enables us to more or less maintain our traditional paradigm for making investment decisions connected with the presidential race in the world's biggest economy.

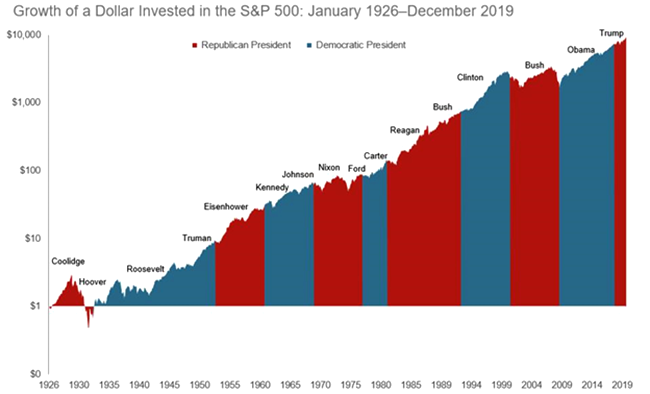

Figure: Movement of the S&P 500 over the term of every US President since 1926. Republican presidents are marked in red, Democrats in blue.

Source: Forbes

Ever since the end of World War II, when the US was led by Harry S. Truman, the S&P 500 has only posted negative results under two presidents — George W. Bush Jr. and Richard Nixon. And these two were both in office during the biggest economic crises their country has ever faced: the oil embargo and the 2008 financial crisis. For more information, see the table below.

|

President |

Party* |

Term |

Percentage yield |

|---|---|---|---|

|

William J. Clinton |

D |

1993-2001 |

210 |

|

Barack H. Obama |

D |

2009-2017 |

182 |

|

Dwight D. Eisenhower |

R |

1953-1961 |

129 |

|

Ronald W. Reagan |

R |

1981-1989 |

117 |

|

Harry S. Truman |

D |

1945-1953 |

87 |

|

George H. W. Bush |

R |

1989-1993 |

51 |

|

Lyndon B. Johnson |

D |

1963-1969 |

46 |

|

Donald J. Trump |

R |

2017- |

43 |

|

Jimmy E. Carter |

D |

1977-1981 |

28 |

|

Gerald R. Ford |

R |

1974-1977 |

26 |

|

John F. Kennedy |

D |

1961-1963 |

16 |

|

Richard M. Nixon |

R |

1969-1974 |

-20 |

|

George W. Bush |

R |

2001-2009 |

-40 |

D - Democrat

R - Republican

The average yield over profitable presidential terms is 85%, while the average loss is 30%. However, it's important to note that the distribution of profitable terms is rather skewed, from +210% under Bill Clinton to +26% under Gerald Ford (John Kennedy's term of office will be excluded from our analysis).

The average yield under Republican presidents is 80.8%, while the corresponding value for Democratic presidents stands at 94.8%. This is mainly due to the fact that Republicans tend to win re-election less frequently (3 in 5 Republican presidents compared to 4 out of 5 Democratic presidents). On the basis of these data, we are unable to conclude that the index's yield during any given president's term of office is correlated to any significant degree to his or her party allegiance.

We're inclined to assume that regardless of who wins the 2020 US presidential election, the stock market's long-term trends will remain more or less unchanged in spite of the inevitable heightened volatility in the short term.

Presidential Cycle theory posits that, depending on the party to which a given president-elect belongs and his or her individual programmes, certain sectors might have an advantage over others.

We have not back-tested this theory and are thus unable either to confirm or refute it. However, we did perform a much more pertinent analysis of the link between the chances of a Trump or Biden victory and the movements of key sectoral indices of the US stock market. We worked on the assumption that any correlation should have already become apparent at the time the material was prepared (less than 100 days prior to the election).

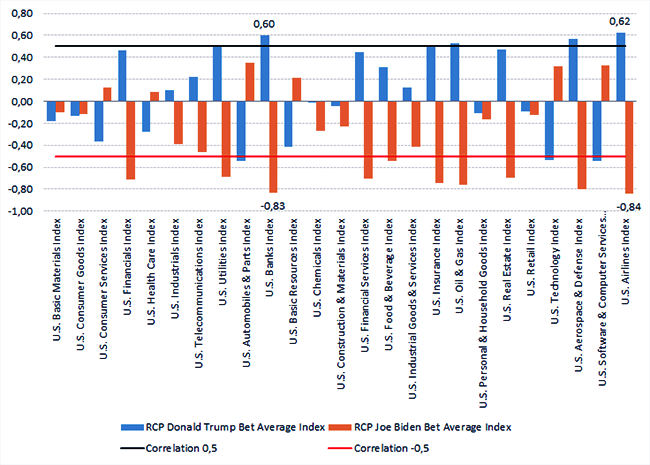

Our method involved determining the correlation between the RCP Donald Trump Bet Average Index and the RCP Joe Biden Bet Average Index — which are calculated using data from various bookmakers on each candidate's chances of victory — and Dow Jones's key sectoral indices.

Figure: Correlation between sectoral indices and the Trump/Biden average bet indices calculated on bookmaker data. The correlation between the indices and the odds of a Trump victory is marked in blue, while the correlation of the indices with the odds of a Biden victory is marked in orange.

Source: Bloomberg

The resulting data indicate that the stock market is not very keen on having Biden in the Oval Office. Not a single one of the sectors analysed correlated particularly positively with higher odds of a Biden victory. In fact, several key sectors actually decline as the odds of a Biden win increase and grow as his odds fall.

Our analysis of the resulting data allows us to make the following conclusions:

- Public utilities, banking, insurance, oil production and the air travel/aerospace industries would all react positively to a Trump victory.

- Meanwhile, a second term for Trump would have an adverse impact on car manufacturing and direct materials.

- A Biden victory, on the other hand, would be poorly received by the entire financial sector, including insurance, utilities, oil and gas and air travel/aerospace.

Summarising everything we discussed above, we can note that, regardless of who wins the election, stocks will most likely continue on their long-term uptrend. Isolated sectors may react differently to the victory of one or another candidate, which means the safest instruments to trade won't be individual stocks, but rather index futures.

Accompanying factors

Despite the COVID-19 pandemic and the March market crash, US stocks are looking very healthy at the moment, and the high tech NASDAQ-100 index is already at new all-time highs. In spite of the potential high volatility during the US election, these trends will most likely continue.

There are two main reasons for this:

- The Fed is running a monetary policy of economic stimulus worth more than $3 trillion. To put things into perspective, at the time of the much more severe 2008 crisis, after which indices rose more than 400%, the Fed's $4 trillion stimulus programme gave stocks a colossal boost.

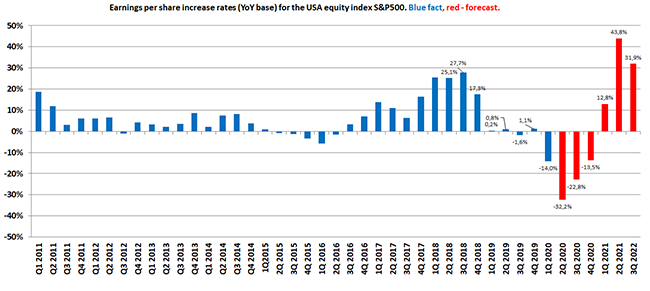

- Corporate earnings projections for 2021 and 2022 are very optimistic (see figure below).

Figure: Earnings forecasts for S&P 500 companies 2020-2022

Source: Bloomberg

Generally speaking, stocks' uptrend could continue in the long term.

But what about the short term? Now, this is where the data get intriguing.

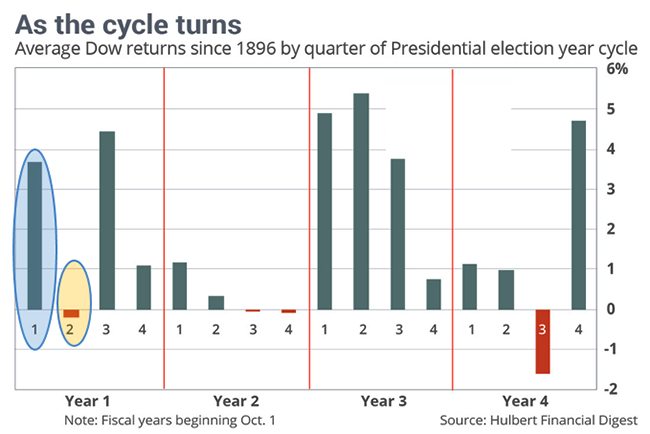

In the first quarter after a presidential election, the average yield of the S&P 500 is around 3.8%, dropping close to 0% in the second quarter.

Figure: Average yield of the Dow Jones by quarter of the presidential cycle. From the first to the fourth year of each term of office since 1896. The first and second quarters are represented by an oval.

Source: Hulbert Financial Digest

It would appear that once the election is over, stocks tend to enjoy vigorous growth as a result of reduced uncertainty. However, after the first quarter, the rally runs out of steam, and a correction begins.

Coronavirus

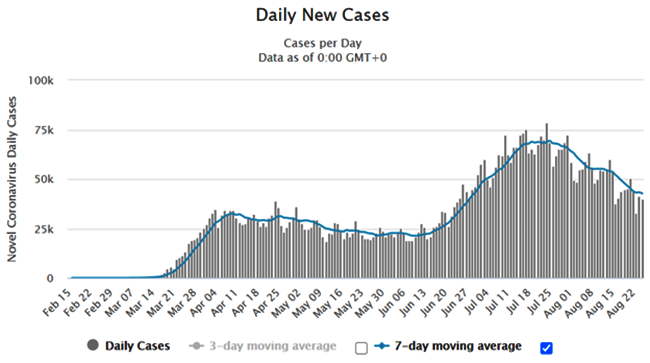

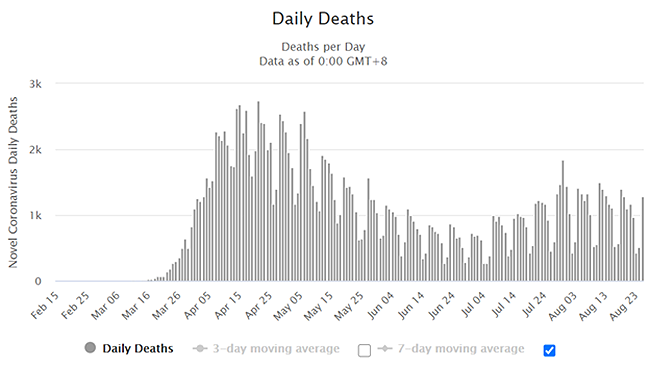

The COVID-19 pandemic is unlikely to end at the same time as the US presidential election. However, the latest information suggests that the virus mutated over the summer and is now much weaker. It's not just experts saying this; all the statistical data confirm the fact unequivocally.

Figure: Daily new COVID-19 cases in the US

Source: https://www.worldometers.info/

As we can see, since social distancing measures were relaxed, the number of newly registered cases in the US from peak to peak rose by 300% (from 25,000 per day to 75,000 per day). However, at the same time, the number of deaths fell by 250%. As such, lethal outcomes declined by 750% from the start of the pandemic, which puts the coronavirus in the same category as any other standard acute respiratory viral infection.

Figure: Daily lethal outcomes of COVID-19 in the US

Source: https://www.worldometers.info/

We'll refrain from discussing the disease and its risk factor at this time, but with statistics like these, we're not likely to see a reinstatement of social distancing measures, which significantly reduces the scale of this pandemic's impact on the economy's health.

We should also bear in mind the pandemic's unique character. Historically speaking, the electorate has been less likely to support politicians who were in power during recessions, financial crises and natural disasters, even when their responses to these events were adequate and effective. As it happens, Trump will experience this phenomenon for himself. It's not his fault that the vaccine has taken so long to develop and test, but one thing's for sure: coronavirus will definitely impact the election and the markets in one way or another.

Natural disasters

Another factor that is unlikely to affect financial markets' long-term trajectory, but which could easily constitute a hefty 'black swan' event with indeterminable consequences, are natural disasters.

No matter who's elected US president, there's no doubt that the new commander-in-chief will have to deal with the climate change crisis and develop a working strategy to tackle this issue. We should note that Trump is more of a profit-oriented politician for whom the climate is just an annoying component of the economy, whereas Biden would prefer a cleaner, more environmentally-friendly economic model. As a consequence, green technology could enjoy greater support from a Biden White House.

Investment strategy

Based on our research into the candidates' economic and foreign policy programmes, we've developed the following investment portfolios:

| Asset | Comments |

|---|---|

| Gold (XAUUSD) |

Gold. The US Federal Reserve has made a statement of intent to buy the economy with its $3 trillion stimulus package and is prepared to accept higher inflation. The programme will go ahead no matter who wins the election. Increased inflation always drives gold prices higher. |

| NASDAQ-100 (NQ) | NASDAQ-100. The stimulus policy, coupled with optimistic corporate earnings forecasts, will buoy indices. However, since Biden plans to raise the corporate tax rate from 21% to 27%, share price growth could be more conservative. |

| LatAm-40 (ILF) | LatAm-40. Trump plans to press on with his aggressive foreign policy in Latin America, while Biden would look to take a more measured stance. |

| China 50 (HSI) |

China-50. China is gradually adapting to the consequences of the trade war. In this area, as with Latin America, Trump is more aggressive than Biden. |

| EU 50 (FESX) |

EU-50. This choice was also influenced by Biden's less aggressive foreign policy stance. |

| Tesla Inc (TSLA) |

Tesla. A big part of Biden's programmes is dedicated to alternative energy, which will most likely favour the development of electric vehicles. |

| Pfizer Inc (PFE) |

Pfizer. Pfizer could play a leading role in mass-producing the coronavirus vaccine that will undoubtedly push this company's stock higher. That said, Biden's planned corporate tax hike could restrain share price growth if he wins the election. |

| Bank of Am. (BAC) | Bank of America. Trump is neutral to the banking sector. Meanwhile, Biden isn't just threatening a higher corporate tax rate; he also intends to tighten regulation. |

| Crypto3.0 (Crypto3.0) |

This is our alternative and anti-inflation position. |

| VIX (VIX) |

VIX. Whatever the result of the election, increased volatility is virtually inevitable. We hope to mitigate this volatility by buying the VIX index. |

Conclusion

The great American writer, journalist and social activist Mark Twain once said: "If voting made a difference, they wouldn't let us do it". But the author was talking about the America of the late 19th century. A lot has changed since then. However, despite being a guardian and preacher of democracy, it's odd that the US only comes in at number 25 in the world democracy rankings (per 2019 data from the Economist Intelligence Unit). In any case, whether there is any real choice or not, and whoever is transparently or otherwise inaugurated as president, the only way to legitimise the result is to hold an election. This is precisely why we're sure to see a heated battle between the candidates and parties, who all have aces up their sleeves and are waiting for the perfect moment to play them for maximum effect.

That's our take on the situation along with our analysis on the latest goings-on in US political life. We sincerely hope that you find our material to be a useful guide as we enter this new era.

P.S. But what about the markets? After reading what we've written, it might seem that we're optimistic about the markets. Well, we are...more or less. After all, for the US, the financial and stock markets are the American dream. They represent people's savings, loan funds, pensions and investments. As a result, the powers that be will do everything to protect and save them, from liquidity injections to stimulus. But they're not a perpetual motion machine, so we must prepare for corrections during which the markets are forced to power down for a time. That's exactly why is best to diversify your investments across different asset classes, regions and sectors, including a combination of traditional, risk-off and alternative assets in your portfolio.

@Indication Investments Ltd

LIBERTEX is a trading platform used by Indication Investments Ltd. a Cyprus Investment Firm which is regulated and supervised by the Cyprus Securities and Exchange Commission (CySEC) with CIF Licence number 164/12.

DISCLAIMER: The content of this material represents a general view of the market news and does not take into consideration individual readers’ personal circumstances, investment experience or current financial situation. The content of this material constitutes Marketing Communication or Investment Rеsеаrсh and does not constitute Investment Аdviсе. Indication Investments Ltd and/or its brands may provide general commentary that is not intended as investment аdviсе and must not be construed as such. Indication Investments Ltd shall not accept any responsibility for any losses of traders due to the content of this material or its use.

Indication Investments Ltd assumes no liability for errors, inaccuracies or omissions. Further, it does not guarantee the accuracy or completeness of information, text, graphics, links or other items contained within these materials.

Prêt à commencer ?

Rejoignez des milliers d'utilisateurs de Libertex.

85 % des comptes des investisseurs particuliers perdent de l'argent