Research 2022 Overview

Pronto para começar?

Junte-se a milhares de utilizadores da Libertex.

85% das contas dos investidores a retalho perdem dinheiro

INTRO

2021

Looking back at the year gone by, we can say that it was a bullish one for most stock indices, commodities, the dollar and cryptocurrencies. According to the Chinese calendar, it was the year of the white metal bull. One thing's for sure: we all need to develop nerves of steel in order to overcome the volatility and inflationary pressure of 2021.

We, as a company, have done ourselves proud in 2021. In 2021, the Libertex group of companies received a raft of new prizes, including Best Trading Platform from Forex Report, Best Forex Broker from European CEO and Most Reliable Broker in Europe from Ultimate Fintech. Our trading platform has been filled with oodles of new features, and our clients now have access to a new type of account: Libertex Invest, a special investment account for those who prefer traditional investing without the use of leverage.

Read about how various segments will perform in our 2021 Roundup and 2022 Forecasts.

CURRENCIES

Early in 2021, the US dollar was feeling fairly confident, while the US Dollar Index was able to rise by more than 4%. The US dollar managed to strengthen against most of its major competitors.

In periods of instability, the US national currency usually experiences heightened demand. In 2021, the world was rocked multiple times: there were coronavirus restrictions, new coronavirus strains, rising geopolitical tensions and defaults. Faced with all of that, investors tried to diversify their portfolios by converting some of their wealth to USD.

In addition to all of the above, the US Federal Reserve has also signalled that it is tapering its quantitative easing programme. This is yet more good news for the dollar. If that wasn't enough, the ECB is still unwilling to face the truth and take decisive action to fight inflation, which has already more than doubled the 2% target rate set by the regulator. Furthermore, Europe is on the verge of an energy crisis, which is also an obstacle to the strengthening of the euro and sterling. The Aussie and New Zealand dollars are traditionally viewed as risk-on assets. For this precise reason, they have weakened against the US dollar, even despite the fact that the RBNZ had already moved to raise rates in 2021.

Forecast for 2022

When it comes to currencies in 2022, the one that will come out on top will be the one whose country is able to strike the ideal balance between tamping down inflation and ensuring economic stability. It's no secret that, for the last few years, the world economy has been in a state of constant stimulus. If the money printing press was suddenly stopped, it would cause a massive crisis that would be comparable to the Great Depression. Therefore, inflation is one of the few instruments capable of lowering the debt burden.

This is especially true, first and foremost, for the United States' debt burden. US government debt is already approaching $29 trillion, and Congress will soon be deciding whether to increase the debt ceiling further. If it fails to do so, the US is headed for an inevitable recession.

For the time being, though, there's every chance that the dollar will remain among the strongest currencies. According to the results of its final meetings of 2021, the Fed has already made it clear that the regulator is prepared to raise rates in 2022.

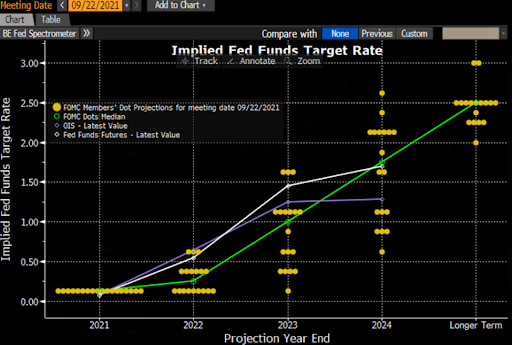

Fig. US Federal Reserve members' rates predictions. Source: Bloomberg

As such, the movement of the world majors against the dollar will be determined by differences in monetary policy direction. The euro, in particular, could remain the weak link. That is because ECB President Christine Lagarde has made it clear that the European regulator is unlikely to raise rates in 2022. She has stated that any monetary tightening at the moment could stifle economic recovery, which means the euro could fall further to somewhere around 1.0910.

Unlike the euro, sterling could put up a decent fight against the dollar, provided that it can cope with the energy crisis and challenges of COVID-19. Overall, the economy is recovering, and the Bank of England is preparing to tighten its monetary policy out of concern over rising inflation (4.2% annualised). As such, we could see the GBP/USD pair move within a range between 1.3300 and 1.4000.

The movements of commodities-backed currencies — the Canadian, Australian and New Zealand dollars — will be largely determined by commodities prices. What's more, if we assume that the coronavirus situation will stabilise and that business activity gradually rises throughout the world (including in the tourism sector), these three currencies could enjoy a moderate recovery.

METALS

Precious metals didn't have the best year in 2021. Gold and silver have spent much of the year trading within pretty wide ranges, while platinum group metals have been under pressure, despite attempts to pick up some positive momentum earlier in the year.

This lack of uniformity is at the very heart of the metals sector. On the one hand, precious metals serve as defensive instruments and experience higher demand during periods of instability. And there was plenty of that in 2021, like coronavirus lockdowns, uncertainty surrounding central bank monetary policy, risk of major corporate defaults, political instability and supply chain ruptures, to name a few. But the fact that markets chose to focus on higher-yield assets like stocks, which experienced growth amid liquidity injection policies from a majority of central banks, prevented precious metals from exhibiting positive results.

Moreover, practically all metals have some industrial use, and the decline in industrial demand thus had an adverse impact on their prices. For instance, around 90% of global palladium demand is attributable to automobile manufacturing, and 2021 wasn't one of the best years this industry has seen. Production output fell everywhere. In August 2021, Toyota announced that its production was down 40%. In October 2021, the UK's production was at the same level as it was in 1956, representing a 41% decline versus 2020. It is expected that the full year's data (which will only be released in early 2022) will show a 7-million unit decrease in global automobile production in 2022. All of this has led to palladium declining by 26.5% over the course of 2021.

Forecast for 2022

We must begin by noting that one of the key risk factors with the potential to shuffle the entire deck remains coronavirus. It is constantly mutating, new strains are emerging, outbreaks are popping up in various regions, and all of this is leading to new restrictions and negative economic consequences.

It is unlikely that 2022 will be any better than 2021 for industrial metals. A potential tightening of central bank monetary policy could lead, at the very least, to a short-term cooldown in the real economy. This is, of course, a negative factor for industrial metals. Platinum is not currently as widely used in car building as palladium, which means the outlook is even more negative for platinum. It is expected that platinum will have a supply surplus of 637,000 ounces in 2022. As a result, its price could drop to somewhere around $754.80, where it has strong support.

Palladium could feel a little more confident as it is expected that the car manufacturing sector will stabilise by mid-2002. As such, demand for this metal could accelerate during this period. Consequently, the forecast deficit for the year stands at 200,000-300,000 ounces. Furthermore, the metal is also used to produce new processors, and that market is a large one. We also ought not to forget that both China and the US have implemented stringent output restrictions, smelting and the use of palladium ore on account of their negative impact on the environment. Thus, while the first half of 2022 doesn't look too optimistic amid price declines to around $1500 an ounce, palladium could regain its losses by the end of the year to return to somewhere in the $2300-$2400 range.

Things look even better for gold and silver. These metals are traditionally considered by the market to be defensive assets. And investors will definitely have a few things to defend themselves against.

First, the stock market looks overbought. But this is hardly surprising given the huge amounts of liquidity pumped into the system by the world's central banks since the start of the pandemic. The US Federal Reserve's balance sheet has swollen by $3.5 trillion in the space of 18 months to reach record highs above $8.5 trillion.

Fig. The US Federal Reserve's balance sheet. Source: federalreserve.gov

As soon as the liquidity tap is turned off (and central banks are already saying it's time to taper their QE programmes, with many already taking steps to do exactly this), investors will start looking for assets to hold during a falling stock market.

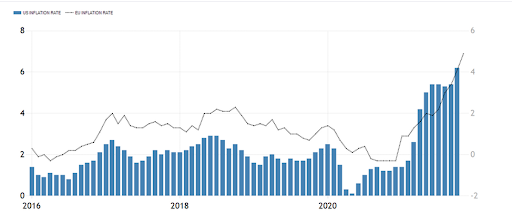

Second, the liquidity injections, coupled with the coronavirus-induced restrictions that have broken supply chains for materials and components and increased transportation times, have led to a sharp rise in inflation. In the US, the consumer price index has reached its highest level in 30 years, rising to 6.2%. Euro-area inflation has also risen above the ECB's target rate to reach 4.9%. Meanwhile, UK inflation is already twice the target rate set by the Bank of England.

Fig. Annualised US (blue bars) and euro area (black line) inflation. Source: Trading Economics

What's more, despite the US regulator's confidence that high price pressure is only transitory, there is reason to believe that this is not the case and that the elevated levels of inflation will continue for an extended period, at least until the end of 2022. Fed chair Jerome Powell has also made it clear that the new COVID-19 variant could adversely affect inflation risks.

High energy prices will persist due to rising inflation, which is brought on by, among other things, the European energy crisis. Moreover, if we look at the UN's Producer Price Index, the trends here don't look at all encouraging. The latest data (for October 2021) show that this indicator is 31.3% higher than its level at the same time last year, a high not seen since July 2011.

Fig. Food and Agriculture World Food Price Index. Source: Bloomberg

Growing inflation could prompt the US Federal Reserve and other central banks to raise rates sooner than planned. However, gold already has two rate hikes in 2022 priced in. That's why even the start of monetary tightening is hardly likely to lead to long-term price drops for gold and silver. All told, by the end of 2022, we could see XAU/USD and XAG/USD at around $2000 and $28.40 an ounce, respectively.

OIL

Brent crude oil recorded impressive growth in 2021. Short-term Brent futures started the year at around $51 per barrel and ended it at around $80.

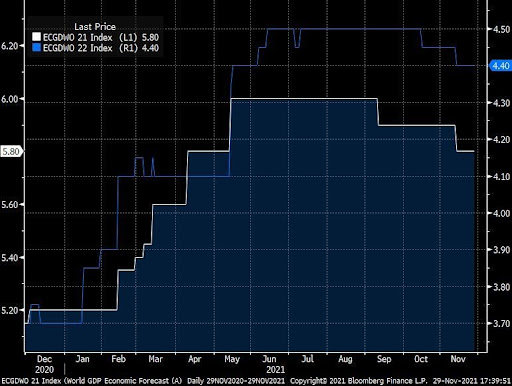

The main reason for this was the vigorous global economic growth and improved forecasts for this indicator. Indeed, over the course of 2021, global GDP growth forecasts were mostly adjusted up from 5.2% to 6.0%.

Fig. Global GDP growth forecasts for 2021 (white, left-hand scale) and 2022 (blue, right-hand scale). Source: Bloomberg

Furthermore, the improved global economic growth forecasts came amid a more than 20% reduction in worldwide production.

Demand factors in 2022

Demand for oil will continue to rise in 2022. Economists' consensus forecast presented by Bloomberg stands at +4.4%. An additional growth driver will be the natural gas crisis. According to Citibank and Goldman Sachs, inflated natural gas prices could create additional oil demand of up to 1 million barrels per day.

Supply factors in 2022

As demand rises, we'll also see additional supply return to the market extremely reluctantly. While OPEC production was 34 million bpd at the start of the crisis, the latest figures for November 2021 has it at just 27.5 million bpd. And it's not just OPEC that is keen to keep output low; the US is also unwilling to ramp up production. Whereas US pre-pandemic output stood at 13 million bpd, it was only 11.1 million in November 2021.

Fig. US oil production. Source: Bloomberg

In this context, the US president's threatening rhetoric about having lots of tools to reduce prices looks to be nothing more than a populist platitude.

As things stand, we can say that prices have finally reached the levels that enable OPEC countries to balance their budgets. As such, they will continue to fight with all their might to preserve this capability. This is why OPEC+ responded to the US sell-off of 30 million barrels from its strategic reserves by announcing its intention to reduce the speed of its programme to increase output.

It must be acknowledged that selling strategic reserves is a highly dubious and ineffective measure, which can only work temporarily while also creating pent-up supply for the future. After all, reserves will have to be replenished sooner or later. That's why they're called "strategic".

Forecast for 2022

According to the IMF, the price that allows Saudi Arabia to balance its budget in 2022 will be around $70 a barrel. In 2021, this number stood at $76 per barrel.

We are convinced that Riyadh and its allies can hit the average annual price they need. They have all the levers they need to do so, and their buyers don't currently have anything to counter them. However, price volatility will naturally remain. The intensity of these fluctuations can easily reach 20% in both directions. Accordingly, our predicted price range for 2022 ranges from $66 to $84 per barrel.

The closer the price is to $66, the more attractive a buying opportunity it will be. On the other hand, the closer the price gets to $84-$90, the more you should consider shorting oil.

The COVID correction

The main factor that could change our estimates would be any future mutations of COVID-19. New variants of the virus will continue to emerge, which is always the case with viruses, the flu included. Concerns about vaccine ineffectiveness will begin to grow, so the most important detail in this information flow will be whether new social distancing measures are actually introduced. If so, forecasts will lose their relevance.

The natural gas crisis in 2022

In 2021, Europe experienced a natural gas crisis, the likes of which had never been seen before. What's more, the crisis itself came so unexpectedly that it prompted a host of complaints against Europe's biggest gas supplier, Russia.

In 2021, Gazprom dutifully fulfilled its obligations to supply gas to Europe. However, it did so at the expense of the reserves stored in its Rehden storage facility, the biggest in Germany and Europe. As such, by the end of 2021, it was only 5% full. Naturally, such a drop in reserves ahead of winter is bordering on catastrophic.

We will refrain from philosophising on whether or not this was intentional. However, we will note that this bona fide energy crisis has done huge reputational damage to Russia as a reliable supplier of gas to Europe, resulting in a shift on the Old Continent towards more expensive gas from other regions, including US liquefied natural gas. That is something that Moscow simply cannot afford to do, and so we are convinced that Gazprom will be forced to ramp up supply in 2022, which will stabilise the situation and prompt a significant drop in prices.

The start of the downtrend will most likely come in January-February 2022, the time of year when seasonal price drops are typically seen.

Fig. Henry Hub natural gas price movements by month. Source: Bloomberg

STOCKS

2021

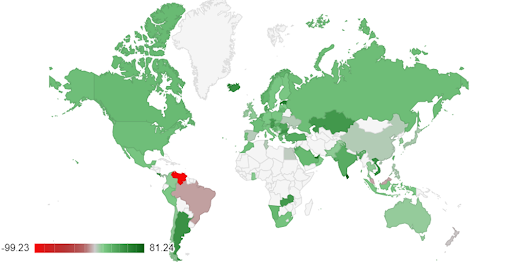

This year was a fairly successful one for stock market investors. As of early December, most countries' stock indices had recorded strong YTD growth. Some of the biggest gainers were the US, Europe and Asia, while China proved to be among the outsiders.

Fig. Percentage change in stock indices by country for 2021. Source: Countryeconomy.com

Among the key drivers of this vigorous growth, we can identify the following:

- Soft central bank monetary policy, particularly from the US and EU. When money is "cheap", this stimulates both business and consumer spending.

- Stimulus programmes. Many countries have allocated huge resources to stimulate their economies and combat the fallout from COVID-19. The US, for instance, has set aside more than $4 trillion for such programmes.

- The labour market recovery. Following mass vaccination, businesses began to recover and take on new staff, which stimulated economic growth.

- Rising commodities prices. This came as a boost to most countries with commodities-based economies.

- Inflation. The sharp rise in inflation in 2021 redirected capital away from fixed-income assets and into corporate stocks, which provided a sort of protection from rising inflation.

What can we expect from 2022?

Many sceptics believe that the stock market has already reached its top and has nowhere left to grow. They were saying the same thing in 2019 when the S&P 500 rose by 31.5% in a single year, but it has almost doubled since then. And it's because there aren't many alternatives with the same potential return as the stock market without the volatility of cryptocurrencies. Money should always be working, especially when it's cheap, like right now. For this reason, as long as the central banks refrain from ending their stimulus programmes or raising rates, the stock markets will continue to have fuel for further growth. Our estimates indicate that the potential for growth will continue until mid-2022 at the very least.

Key drivers of growth in 2022

What could generate future growth?

- Continuation of low interest rates. Provided regulators do not start raising rates, businesses will still have access to cheap credit, which allows companies to maximise profits. According to the latest forecasts, the US will keep rates low for the duration of 2022, while the EU won't be raising them at all over this same period.

- Growth of corporate profits. Some of the key problems that companies have mentioned this year in their quarterly reports are procurement issues due to supply chain ruptures, with one notable example being the shortage of chips, demand for which has soared. This was caused by a combination of manufacturing stagnation and inflationary processes. Thankfully, it is only a temporary effect, and forecasts predict that it should resolve itself by 2022. Thus, companies will begin earning more, which will lead to share price and index growth.

- Improvement of pandemic situation. Vaccination campaigns have seen many people return to work, but labour restrictions still persist in numerous countries.

Nevertheless, the situation will gradually improve. The impending arrival of new COVID-19 therapeutics to healthcare facilities everywhere constitutes another positive development in this area. This will improve the labour and business climates, creating new possibilities for growth.

What sectors should we be watching in 2022?

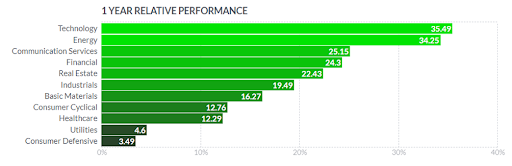

This year was a successful one for many economic sectors. Looking at the US economy, the Tech and Energy sectors were the biggest winners amid the digitalisation of many business operations and rising energy prices.

Fig. Percentage change of US economy by sector. Source: Finviz

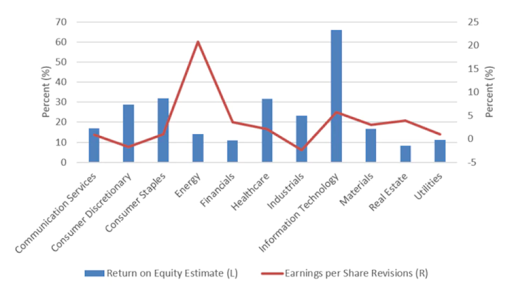

To determine which sectors will perform best in 2022, we need to analyse them according to fundamental criteria: the revenue and profit of the companies in the particular industry. A good indicator of fundamental strength is Return on Equity (ROE), which measures how effectively companies in a given sector are generating profit compared to their capital expenditure. According to forecasts for 2022 from Bloomberg and Charles Schwab, out of all sectors studied (blue histogram), the tech sector has the highest return on equity, and the upward adjustment of EPS predictions for 2022 places it once again among the strongest of sectors (red line).

Fig. Return on equity forecast for 2022 (blue histogram) and three-month percentage change in EPS (red line) for each sector of the S&P 500. As of 12.11.2021. Source: Bloomberg and Charles Schwab

If forecasts are to be believed, it would be wise to pay attention to the energy, finance, materials and healthcare sectors in 2022.

What indices should we be watching in 2022?

The biggest growers in the year ahead could be indices in the US, Europe and a range of commodities-based economies. The bulk of US indices growth will come in the first half of the year, while the Fed still hasn't ended its bond purchasing programme, which will stimulate markets. Europe will also have a chance of ending the year in positive growth territory, so long as it can resolve its energy crisis and provided that the pandemic situation improves. Interest rates on the Old Continent will remain close to zero for some time, and the ECB has not yet begun tapering its stimulus programme. For this reason, it's advisable to keep an eye on the major European indices. According to various assessments, commodities and energy prices will remain high in 2022, which will buoy the economies and stock markets of commodities-producing countries, where the rising prices will be reflected in the value of their domestic indices.

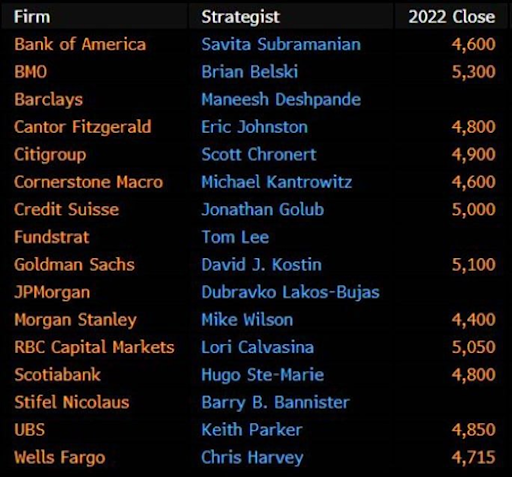

Fig. Investment bank forecasts for the S&P 500 at year-end 2022.

In light of the above, we can conclude that 2022 is unlikely to prove a bear market year. At the very least, we may see growth and even new all-time highs on the S&P 500 by June. The forecasts made by many investment banks are in line with our conclusions. However, H2 2022 could see a slight correction. Nonetheless, prices should remain balanced until the end of the year.

However, some forecasts also talk about a potential global economic slowdown. For that reason, it's crucial that we keep an eye on potential risks, such as the energy crisis, the pandemic and inflation. To minimise potential risk, you should select the companies and sectors that are most resilient to the risks in question as these will outperform the market.

Crypto. 2021 Roundup

The 2020 cryptocurrency market rally continued into early 2021, thus generating a positive net gain for the entire year. It's true that 2021 saw incredible volatility, but the crypto world is ending it on a largely positive note, nevertheless.

If we are talking about the overall trend in 2021, a key reference point would have to be Bitcoin, whose value has practically doubled since the beginning of the year. Meanwhile, the leaderboard of the top ten cryptocurrencies by market cap has had quite the shakeup. Both Solana and Cardano have cemented their place in the rankings as 'Ethereum killers', but the most striking development in our view was the penetration of the meme coins Dogecoin and Shiba Inu into the Top 10. Elon Musk's digital doggies emerged as a feature of every crypto trader's life, becoming the headline makers of 2021.

Fig. Percentage changes in cryptocurrencies' prices during 2021. Top 10 by market cap. Source: Libertex

As we take the final stock of 2021, we would like to take a moment to mention all of the major market-impacting events of this year. Far from exhaustive, this list includes:

- All-time price highs

- China's mining ban

- The highest-ever institutional participation in the crypto market

- The meme coins Dogecoin and Shiba Inu

- Ripple's court case

- The first-ever SEC-approved Bitcoin futures ETF

- The IPO of the largest crypto exchange in existence, Coinbase

- The London Ethereum update

- NFT tokens and gaming mania

- The addition of digital currencies to PayPal

- The recognition of Bitcoin as a legal tender currency in El Salvador

These are just the main milestones recorded by the crypto industry in 2021. It's hard to imagine what we can expect from 2022, but we will nevertheless try to make a prediction.

Factors influencing 2022

Bitcoin is entering the second year following its third halving, which took place in 2020. If we compare this period with the previous halving, we see that Bitcoin reached all-time highs but then suffered a severe correction. This pattern could repeat itself during the current halving phase, i.e., 2022 could see new highs followed by a significant correction.

As has been stated on numerous occasions already, the era of cheap money will continue into 2022. Global central banks are in no hurry to raise interest rates, particularly in light of the appearance of more infectious coronavirus strains. The risk-on phase will likely continue to the middle of the following year, which should spell positive results for digital currencies, helping them to reach new price highs.

The global rate of inflation will most likely continue to rise in 2022. Prices for commodities and services will thus keep rising rapidly, along with the crypto market, which has traditionally proven a safe haven from the devaluation of fiat currencies. The first to be hit will be developing markets' currencies. One example of this phenomenon would be the devaluation of the Turkish lira, which provoked both mass civil unrest in the country and a sharp uptick in cryptocurrency purchases by the general population.

Geopolitical risks will remain high up on the agenda for the duration of the year ahead. Rising tensions in so-called "geopolitical hotspots" could lead to higher demand for cryptocurrencies as a defensive asset.

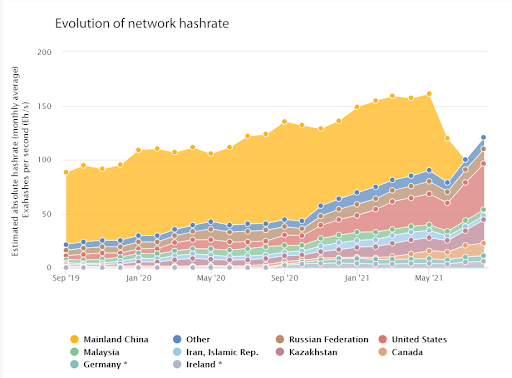

The worldwide crypto community has already come to terms with the Chinese mining ban, and the majority of miners have either shut down or moved their operations to other locations, such as the US, Kazakhstan, Canada or Russia. As such, the mining process itself should take place fairly stably over the course of the following year.

One key precondition for such stability will be sustainable energy prices, which may not be the case in 2022. The massive price hikes in energy resources, gas and coal, in particular, are already making it virtually impossible for energy prices to return to their previous levels. Therefore, the cost of mining will increase, which could then force the closure of smaller mining farms and reduce the supply of BTC on the market. As a result, cryptocurrency prices would rise.

Fig. Map of Bitcoin mining hashrate distribution by country. Source: https://ccaf.io/cbeci/mining_map

Forecasts for 2022

Industry experts' forecasts are currently fluctuating within a wide range, from $10,000 to $1,000,000 per BTC by the end of 2022, but most fall within the $120,000-$150,000 range. Amid worldwide inflation, Bitcoin could feasibly reach these levels within the first half of the year, while H2 could see a profound correction once the Fed begins raising interest rates.

The crypto decline is unlikely to be as dramatic as on previous occasions. We estimate that if energy prices double, the cost of mining will also double. This will put the price of mining 1 BTC at $45,000-$55,000, so the price is unlikely to drop below these levels.

The cryptocurrency market is beginning to mature, and we already know that institutional investors are intent on perpetuating its expansion. They will do their utmost to increase their share of the market, flooding the market with 'smart' liquidity. According to current estimates, the share of institutional players in Bitcoin's market cap stands at around 10%. Of course, that's not much. As is well known, big money doesn't like volatility, and we expect that the gradual increase in the proportion of major investors will reduce the frequency of sharp market movements and calm the amplitude of fluctuations. In all probability, we'll stop seeing short impulsive growth spurts and sudden extreme declines.

OUTRO

2022 Overview

The year 2022 has three 2s in it. That's a pretty rare occurrence. Think about it. There have only been two other times that this has happened in the last two thousand years: in 222 CE and 1222 CE. And 2022 marks the third time.

Numerologists say that the number 2 is an "axis of symmetry", a point of balance. Anything that knocks it out of balance constitutes a direct threat to one's fortunes, requiring swift action to restore order and harmony.

Over the past decades, the global economy and financial markets have accumulated considerable imbalances that have only been intensified by COVID-19. Now is the time to restore order and bring the financial system back into a state of equilibrium. At the top of the agenda are the high level of inflation (at a 30-year high in the US), supply chain ruptures, the exorbitant levels of debt accumulated during the zero-rates period, overheated stock markets as a result of central bank stimulus measures and new coronavirus strains. We expect that 2022 will mark the turning point and a move towards normalising the situation and restoring balance.

Since 2009, the markets have been under the virtually constant influence of central bank stimulus and capital injections. Unfortunately, it seems that central banks simply do not know how to work outside the paradigms of monetary stimulus and avoid damaging the economic recovery while also keeping a lid on inflation. As a result, they have no choice but to keep the economy and markets hooked up to the liquidity drip while waiting for prices to stabilise. If they are unable to reign in prices, the only other option will be to tighten monetary policy.

However, high inflation plays right into the hands of central banks. There aren't many methods in this world for reducing debt burdens and sterilising money: just war, default and inflation, really. And compared with the first two, inflation seems to be the most painless option. In any case, 2022 will be a year characterised by the struggle against inflation, with attention remaining focused on this indicator. In the second half of spring, the markets will reassess their inflation expectations and, if there is no slowdown, this could be a correction signal. If there is a new wave of lockdowns, global inflation could fall for a short time, but then it would work itself into another tsunami since new restrictions will mean additional supply chain ruptures. Therefore, in the long-term perspective, global inflation concerns are only intensifying.

We will see an increasing number of defaults in 2022 as an inevitable consequence of the coronavirus crisis years, high energy prices, runaway inflation and the tightening of monetary policy. Against this backdrop, reliable borrowers will become even more valuable.

The world will have its eyes fixed on China, whose economy, after a multi-year boom, will slow due to reduced consumer spending, increased competition and changes to anti-monopoly legislation.

Eastern Europe (Belarus, Ukraine, Russia and Poland), the Euro Area, the South Caucasus, Taiwan, China, the US, South and North Korea, Japan, Afghanistan and the Middle East will remain geopolitical regions hotspots in 2022. That said, we don't expect to see direct conflict between major states or military blocks.

Natural disasters and global warming will be towards the top of the agenda for yet another year. In 2022, we expect world governments to take clearer, more practical steps towards fighting for higher environmental standards. In addition, energy price growth will accelerate the transition to green technologies.

What's more, 2022 is the year of the black water tiger. That's quite an unexpected combination, isn't it? However, it's said that this animal embodies justice and wisdom, as well as bravery and short temperament.

It looks like there will be no way to avoid volatility.

If you're unsure about where to start, what instruments to select or what to expect in the market, you can check out some of our Libertex Academy products.

WE WISH YOU ALL HEALTH AND PROSPERITY FOR 2022!

LIBERTEX ACADEMY

Pronto para começar?

Junte-se a milhares de utilizadores da Libertex.

85% das contas dos investidores a retalho perdem dinheiro