Alibaba (BABA) Stock Forecast

In 2013, it recorded $5.78 billion in sales during its 11.11 shopping event. The Chinese company is an international B2B platform that connects suppliers and buyers worldwide in one place. Just recently, Alibaba announced that the gross merchandise volume (GMV) from the 11-day sale reached up to 540.3 billion yuan or $84.54 billion.

Alibaba's stock has been rapidly fluctuating for some weeks now. We'll take a closer look into this and include the Alibaba stock forecast for 2022 and beyond.

About Alibaba (BABA) Stock

Alibaba Group Holding Limited or Alibaba is a giantChinese multinational technology company founded in June 1999. Since then, it's been connecting small-to-medium-sized businesses (SMBs) to professional business buyers. It's helped increase sales with their B2B optimised tools.

In 2014, its initial public offering (IPO) on the New York Stock Exchange raised up to $25 billion. This resulted in the company's market value reaching $231 billion, the largest IPO in world history by then. Recently, in 2020, it was included in the Top Five AI Companies.

Alibaba has three main sites: Taobao, Tmall and Alibaba.com. It offers millions of products under different categories like apparel, electronics, machinery, cloud, entertainment and more. Jack Ma and Joseph Tsai, the two founders of the company, are the two largest stakeholders.

Alibaba technology stock sustained solid growth for many years after its official IPO. It started with an initial $88 per share and trading at $92.70. At the time of writing (end of 2021), Alibaba's stock price is over $119.

What Affects the Alibaba (BABA) Stock Price

Here are some factors that can influence the price movement of BABA shares:

- Business restrictions

- An antitrust probe of the company from China's State Administration for Market Regulation (SAMR)

- Change in management and operations

- Investors/shareholders decisions

- Trade conflict

- Fines and restrictions

- Political pressure

- Company sales

- News and events

Alibaba Stock Price in the Past

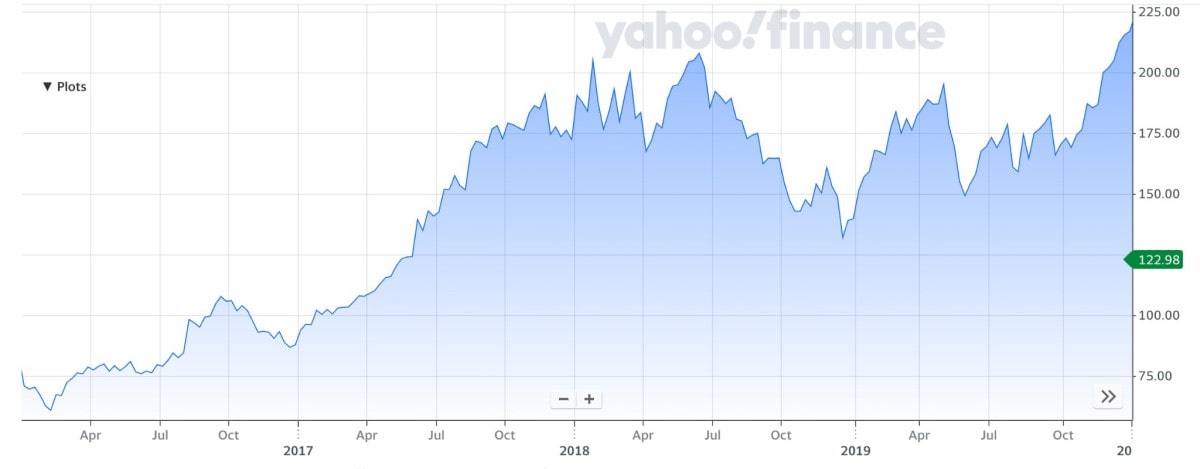

We're starting from a low stock price in 2016 because the company faced a shroud of scandal and controversy. But Alibaba quickly rose again after Taobao crested 580 million active monthly users and Tmall hit 500 million monthly users.

From an all-time low stock price, Alibaba's value started to rise in 2018. This is because the market liked Alibaba's spending spree that year. In 2018, the company spent over $41.6 billion on product development, sales and marketing, general administration and the cost of revenue. Many analysts consider this to be disciplined spending.

It continued to rise in 2019, the same year that Jack Ma stepped down as the head of the company. Its mobile user base reached 1.1 billion in the same year, and revenue grew by 42%. Its workforce reached 86,000 global workers, and the company delivered 57 million packages a year. Because of all of this, the stock price increased robustly.

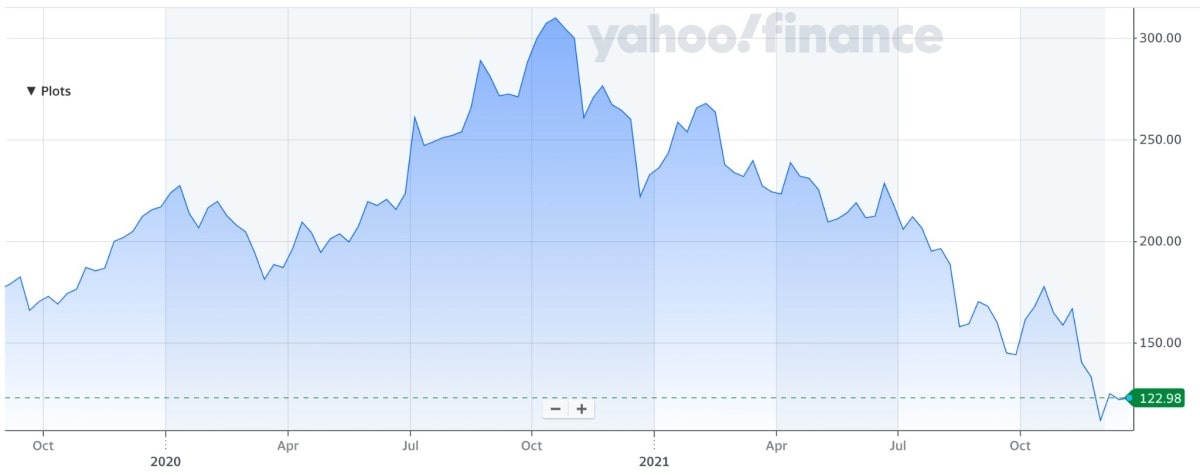

In 2020, the value declined slightly as the State Administration for Market Regulation (SAMR) fined the company in China. Alibaba had to pay a $2.82 billion fine and end its exclusive deals. SAMR also imposed additional fines against the company over previously unapproved acquisitions. These anti-competitive practices and challenges placed analysts' expectations of 30% sales growth in uncertainty.

Unfortunately, in 2021, the company's stock price began to drop after its big issues with financial regulators and the Chinese government. Some analysts think many will avoid the stock until these issues are resolved. But in August, there was a 22% rise in quarterly profit and a 46% jump in revenues to $31.9 billion. Then the stock dropped again on 10 November after Chinese regulators announced new draft anti-monopoly rules for platforms like Alibaba.

Alibaba Stock Technical Analysis

For a one-month timeframe, the technical analysis from Trading View showed that overall, BABA shares showed a sell trend. This used the most popular technical indicators — Moving Averages, Oscillators and Pivots. The stock shows a strong sell trend based on MAs, while the oscillators indicate buying movement.

The price is below its 5, 20 & 50-day exponential moving averages, and it's being strongly bearish, moving downwards. These results show that the stock isn't doing quite well in the market. That's why there's a strong sell recommendation.

Alibaba Stock Forecast for 2022 by Experts

Analysts have made their predictions for BABA's stock price in 2022. Forecasting makes use of historical and recent data as well as technical indicators and tools. However, not all Alibaba stock forecasts are the same. Here are some from experts:

CNN Business

Analysts from CNN Business offer a 12-month forecast for investors with expected prices of $302.90 as the highest price, $199.95 as the median and $140.05 as the lowest. Based on these amounts, they've predicted that it will go up next year compared to the current price of Alibaba stock. The consensus among 56 analysts from the firm indicates a buy recommendation for the stock.

Long Forecast

|

Month |

Minimum ($) |

Maximum ($) |

Closing Price ($) |

Total |

|

January 2022 |

96 |

108 |

102 |

-16.39% |

|

February 2022 |

91 |

103 |

97 |

-20.49% |

|

March 2022 |

96 |

108 |

102 |

-16.39% |

|

April 2022 |

101 |

113 |

107 |

-12.30% |

|

May 2022 |

104 |

118 |

111 |

-9.02% |

|

June 2022 |

108 |

122 |

115 |

-5.74% |

|

July 2022 |

109 |

123 |

116 |

-4.92% |

|

August 2022 |

111 |

125 |

118 |

-3.28% |

|

September 2022 |

114 |

128 |

121 |

-0.82% |

|

October 2022 |

117 |

131 |

124 |

1.64% |

|

November 2022 |

119 |

135 |

127 |

4.10% |

|

December 2022 |

125 |

141 |

133 |

9.02% |

The Economy Forecast Agency from Long Forecast expects to begin January 2022 with $107 and end it with $102. However, this would mean that they expect the price to drop in early 2021. This drop would also seem to continue until September 2022. The largest drop would be in February 2022, the price decreasing by over 20% from its current price.

Luckily, they also predicted Alibaba to gain control and go up again starting October 2022. Based on their BABA stock forecast, 2022 will end with a 9.02% price increase.

Wall Street Zen

From 16 analysts in Wall Street Zen, the predicted prices are shown above. Their maximum price forecast is at $407 with a great 253.91% price increase while the minimum is $200, still 73.91% greater than BABA's current price. Based on these prices, it's clear that they expect only great things for the stock in 2022.

Panda Forecast

|

Month |

Target ($) |

Pessimistic ($) |

Optimistic ($) |

Vol. |

|

January 2022 |

↓121.55 |

115.90 |

127.20 |

8.89% |

|

February 2022 |

↑134.13 |

129.91 |

149.42 |

13.06% |

|

March 2022 |

↑135.54 |

125.58 |

141.23 |

11.08% |

|

April 2022 |

↑132.29 |

118.60 |

145.38 |

18.43% |

|

May 2022 |

↑133.48 |

127.07 |

145.69 |

12.78% |

|

June 2022 |

↑150.70 |

140.52 |

167.20 |

15.95% |

|

July 2022 |

↑150.47 |

145.28 |

157.02 |

7.48% |

|

August 2022 |

↑149.79 |

136.76 |

154.74 |

11.62% |

|

September 2022 |

↑156.53 |

144.56 |

170.62 |

15.28% |

|

October 2022 |

↑176.02 |

166.78 |

181.30 |

8.01% |

|

November 2022 |

↑175.76 |

165.48 |

187.62 |

11.80% |

|

December 2022 |

↑187.62 |

173.55 |

197.19 |

11.99% |

The predicted target prices are shown with arrows to indicate their movements relative to their recent price. In this regard, analysts from Panda Forecast expect to welcome the new year with a price increase. It will continue to increase until March, the end of the first quarter, and then slightly drop in April. Overall, there are more expected price increases compared to drops.

The monthly volatility is also indicated, with February being the most volatile month and July being the least. At the end of the year, the price is expected to reach up to $187 with almost 12% volatility.

Wallet Investor

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2022 |

124.315 |

128.394 |

124.315 |

129.081 |

3.18% |

|

February 2022 |

128.601 |

123.267 |

123.267 |

128.601 |

-4.33% |

|

March 2022 |

123.350 |

115.334 |

115.285 |

123.350 |

-6.95% |

|

April 2022 |

115.075 |

117.139 |

115.075 |

118.273 |

1.76% |

|

May 2022 |

117.006 |

113.686 |

112.600 |

117.141 |

-2.92% |

|

June 2022 |

113.906 |

114.255 |

113.452 |

115.457 |

0.31% |

|

July 2022 |

113.974 |

114.471 |

113.974 |

117.291 |

0.43% |

|

August 2022 |

113.524 |

112.991 |

109.311 |

113.524 |

-0.47% |

|

September 2022 |

112.601 |

105.620 |

105.620 |

112.601 |

-6.61% |

|

October 2022 |

106.485 |

111.621 |

106.485 |

112.086 |

4.6% |

|

November 2022 |

111.877 |

103.392 |

103.392 |

111.877 |

-8.21% |

|

December 2022 |

102.693 |

103.157 |

101.315 |

103.616 |

0.45% |

Like most analysts, those from the Wallet Investor predict Alibaba's January price to be greater than its current price. Based on the forecast, January will have over $124 with a 3.18% price increase. However, like with most analysts again, this will drop in February, too.

Throughout the year, the price is expected to fluctuate. The biggest positive change would be in October 2022 and the lowest drop in November. Fortunately, the price is expected to increase before the year ends.

Short-Term Alibaba (BABA) Price Prediction for 2022

Here's a short-term prediction for 2022 from Gov Capital, focusing on the first day of the month.

|

Month |

Average price ($) |

Minimum price ($) |

Maximum price ($) |

|

January 2022 |

115.366 |

98.0611 |

132.6709 |

|

February 2022 |

136.880 |

116.348 |

157.412 |

|

March 2022 |

138.127 |

117.40795 |

158.84605 |

|

April 2022 |

132.172 |

112.3462 |

151.9978 |

|

May 2022 |

141.959 |

120.66515 |

163.25285 |

|

June 2022 |

134.524 |

114.3454 |

154.7026 |

|

July 2022 |

149.742 |

127.2807 |

172.2033 |

|

August 2022 |

153.389 |

130.38065 |

176.39735 |

|

September 2022 |

168.383 |

143.12555 |

193.64045 |

|

October 2022 |

156.268 |

132.8278 |

179.7082 |

|

November 2022 |

178.110 |

151.3935 |

204.8265 |

|

December 2022 |

162.257 |

137.91845 |

186.59555 |

Throughout January, the estimated expectation is for the price to increase, ending the month with a $133 target. Aside from this, top analysts from Wall Street Zen also recommend a buy movement now because they expect the price to increase as well.

Alibaba Price Forecast for 2023-2025

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End,% |

|

2023 |

158 |

165 |

+43% |

|

2024 |

171 |

193 |

+68% |

|

2025 |

195 |

215 |

+87% |

It's predicted that Alibaba's price will increase in the following years, up to 2025. It started from a 43% increase from its current price in 2023, increasing up to 87% by 2025.

Long-TermAlibaba Stock Price Prediction 2026-2030

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End,% |

|

2026 |

234 |

250 |

+117% |

|

2027 |

265 |

269 |

+134% |

|

2028 |

275 |

281 |

+144% |

|

2029 |

287 |

293 |

+155% |

|

2030 |

300 |

307 |

+167% |

2026 is expected to start with a 117% increase in price to $234. The stock's price is then predicted to increase each year until ending 2030 with an over $300 market value.

Conclusion

Even if Alibaba has faced extreme challenges recently, Alibaba continues to show great potential. The positive Alibaba stock forecast of many analysts can support this. Moreover, Alibaba has a good record in the market and is a big company worldwide. Overall, the BABA stock would still be a good investment and trading asset. Please keep in mind that the stock market can be ruthless and react to world events very sharply.

If you're unsure, try using a demo account from Libertex. Not only can you invest in a controlled environment, but you can also use all the traditional trading tools and features and build your own portfolio. This way, you can practice CFD trading, investing, monitoring and analysing the market before entering real conditions.

Disclaimer: Although different sources are used to suggest Alibaba's stock future price, please bear in mind that the stock market is volatile and is affected by various factors. Potential investors are urged to do their own research to come up with their own conclusion.

FAQ

Is Alibaba a buy or sell?

Currently, Alibaba is a sell in the market. This is because of its recent and current performance downward.

Will Alibaba stock split soon?

The last Alibaba stock split happened in 2019. The company did an eight-for-one stock split to help its company grow. However, there's no announcement if there will be the next one, so it's unlikely to happen soon.

Is Alibaba a good long-term investment?

Based on its record and analysts' forecasts, Alibaba still makes a good investment, especially as a long-term one. The company is still not backing down from its challenges, so there's a chance for the stock to boom again.

Is now a good time to buy Alibaba shares?

Since Alibaba is a sell right now, it may be a good time to buy. The stock price is still lower compared to its price in early 2021. However, it would be best if you also considered the "sell" trend to avoid risks and losses.

Does Alibaba stock pay dividends?

Unfortunately, Alibaba doesn't pay dividends, unlike other stocks.

How much will Alibaba be worth in 2022?

Many predict Alibaba to increase in price in 2022. One of them, Coin Price Forecast, expects the price to reach $125 up to $152.

How much will Alibaba be worth in 2025?

Alibaba's stock price is forecasted to be worth over $195-$215 in 2025. This is an 87% increase from its current price.

How much will Alibaba be worth in 2030?

Alibaba will reach over $300 in 2030 based on predictions. A 167% price increase!

Is Alibaba a Buy, Sell or Hold?

If you have BABA, it's currently a sell because of its recent performance in the market.

Is Alibaba overvalued?

Some say that Alibaba is overvalued. However, based on its investments for development and the challenges it's facing right now, Alibaba is more likely undervalued, also considering that it's a big company.

What is the target price for Alibaba stock?

The year-end target price of Alibaba stock this 2021 is over $120.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.