Professional Trader Eligibility

- A Professional Client waives their right to the following:

- 1) Extended risk disclosures

- 2) Compensation from the Investor Compensation Fund (ICF)

- 3) Financial Ombudsman Dispute Resolution

Please refer to our Client Categorisation Policy for more information

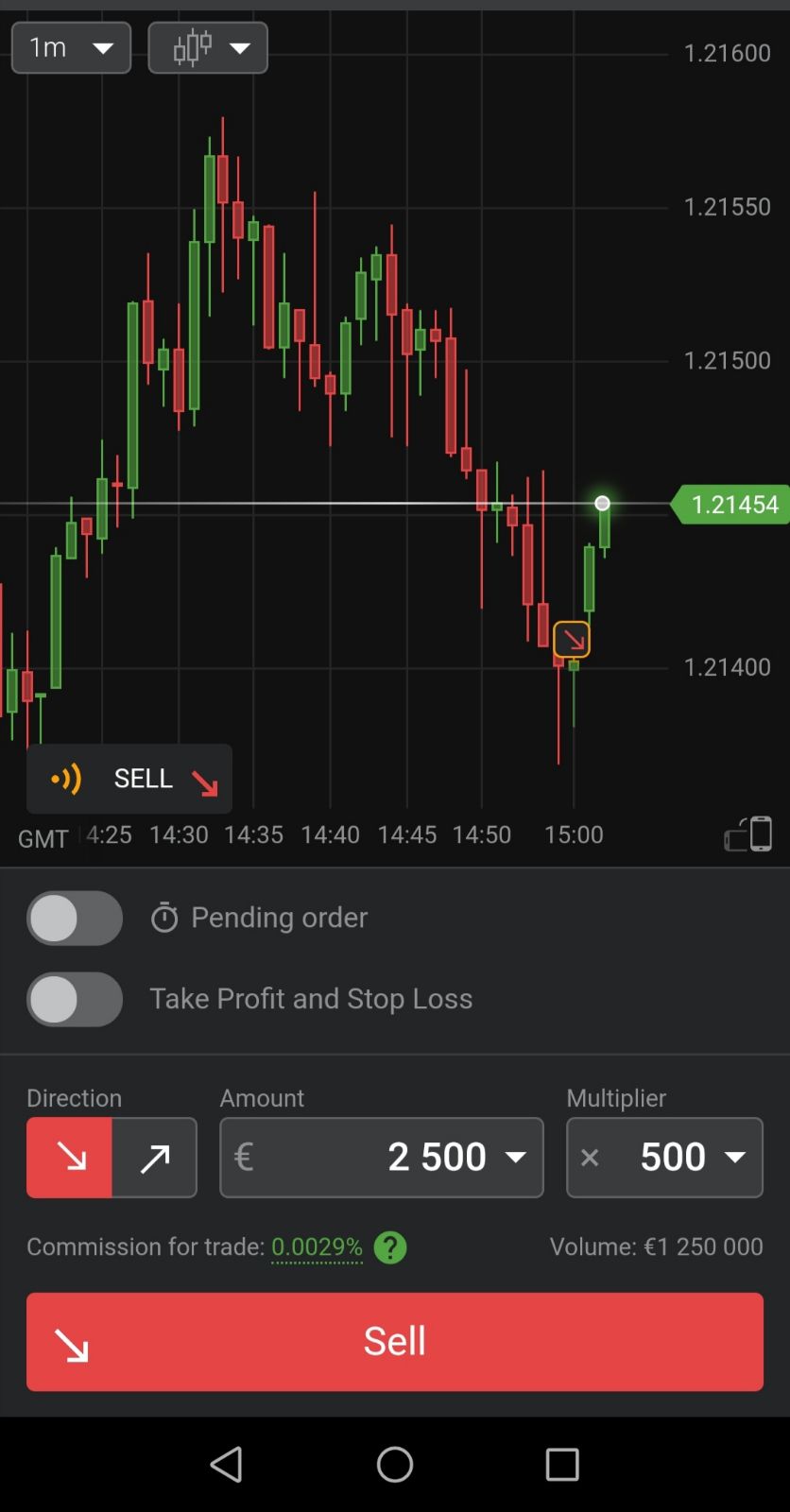

Professional Trader status allows you to trade with a maximum multiplier on Libertex. To obtain the status, you must meet two of three criteria:

-

You have carried out a significant amount of transactions at an average frequency of 10 per quarter over the previous four quarters in one of the markets represented on Libertex or other trading platforms.

-

You have at least one year of experience in the financial services industry in a professional role that requires knowledge of the relevant transactions or services.

-

Your portfolio of financial instruments, including savings and financial instruments, is valued at more than EUR 500,0001.

The portfolio of financial instruments includes stocks, derivatives (only cash deposits made to the fund / profits from investing in derivatives), debt instruments and cash deposits. It does not include portfolios of property, direct ownership of goods, or the notional value of leveraged instruments.