Amazon (AMZN) Stock Price Prediction

In 2020, the company was referred to as "one of the most influential economic and cultural forces in the world".

So, is Amazon's stock future bright enough for you to invest in? Let's find out.

Amazon Stock Prices: An Overview of the Past

Let's have a quick glance at the key events of AMZN share price in the past:

- The first AMZN scare price was $18 in March 1997. The first few years of its existence failed to bring any success or extraordinary performance.

- The dot-com bubble in 1999-2000 hit many companies hard, yet Amazon managed to survive thanks to its product offering.

- It took until 2004 for the first major benefit to be seen; the share price rose to $52 due to the growing popularity of the company.

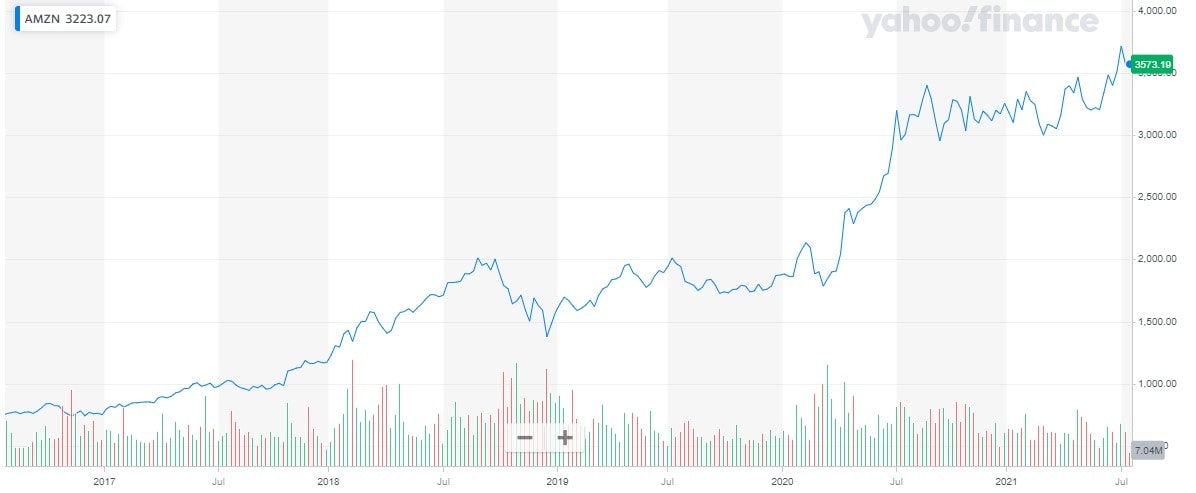

- In 2017, Amazon displayed 165% growth compared to the three previous years due to a significant jump in revenue.

- The deteriorating relationship between China and the United States saw the AMZN stock price fall significantly – below $1,500. Still, it hit a record of $2,050 in September 2018.

- As e-commerce growth accelerated, Amazon generated hefty gains for its shareholders in 2020. The maximum value was in September of the same year – $3,499.12.

- The performance of AMZN stock price in 2021 has had its ups (due to the information about the company's huge revenue) and downs (due to the announcement of celebrity founder Jeff Bezos' retirement), but, overall, it was stable with positive results.

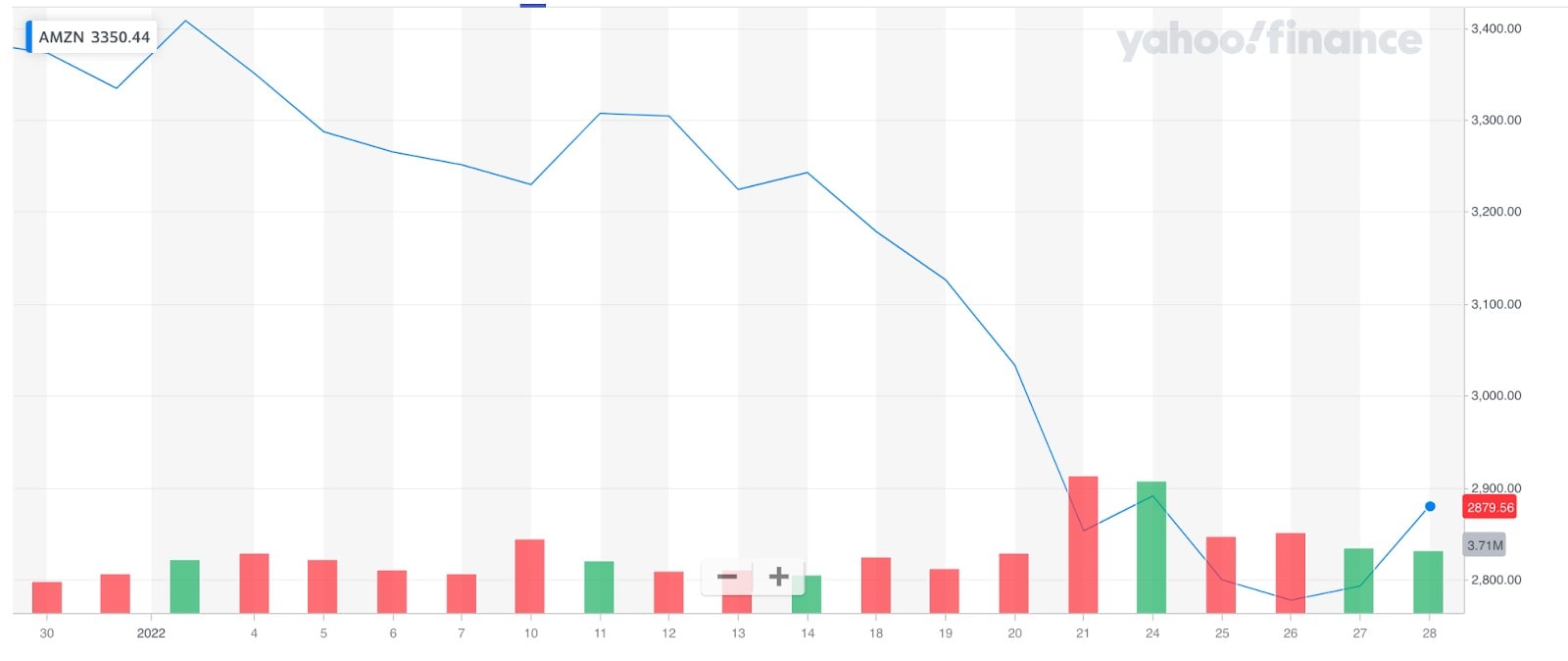

- The second day of February 2023, Amazon declared a 9% surge in revenue comparing with the prior year, outperforming the prognostications of Wall Street by a staggering $4 billion. The year 2022 manifested as Amazon's most sluggish annum on record, with rampant inflation impeding growth. The increase in prices and interest rates, that were results of the customer's renewed interest in physical stores led to a decline in Amazon's value, almost cutting its stock price in half during 2022.

Amazon Stock Price Forecast for Today

In 2023, the price of Amazon's stock opened at $84.00. As of today, the stock is being traded at $106.96, which represents a 27% increase in price since the start of the year. Market analysts are predicting that by the end of 2023, the price of Amazon stock will reach $120, which represents a year-to-year increase of 43%. From today until the end of the year, the price is expected to increase by 12%, reaching $109 per 1 Amazon in the middle of 2023.

Amazon Stock Price Predictionfor 2025

As the forthcoming five-year period unfolds, a considerable surge is anticipated: Amazon's stock valuation will experience a shift from $167 to $315, marking an 89% elevation. The Amazon stock predictions 2025 will initiate with a base of $167, then experience an ascension to $195 during the initial sextet of months, ultimately culminating the year at $218. This signifies a +104% increment from the present day.

Wallet Investor

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

|

January 2025 |

41.772 |

39.129 |

38.835 |

41.772 |

|

February 2025 |

39.455 |

34.234 |

34.234 |

39.620 |

|

March 2025 |

33.697 |

34.160 |

33.058 |

34.174 |

|

April 2025 |

34.202 |

32.092 |

32.092 |

34.357 |

|

May 2025 |

31.779 |

26.984 |

26.575 |

31.779 |

|

June 2025 |

27.295 |

27.358 |

26.594 |

27.460 |

|

July 2025 |

27.535 |

27.690 |

27.535 |

29.310 |

|

August 2025 |

27.309 |

24.964 |

24.964 |

27.309 |

|

September 2025 |

24.823 |

18.115 |

18.115 |

24.823 |

|

October 2025 |

18.002 |

13.298 |

13.298 |

18.002 |

|

November 2025 |

12.677 |

10.393 |

10.393 |

12.677 |

|

December 2025 |

9.978 |

5.300 |

5.244 |

9.978 |

As the forthcoming five-year period unfolds, Wallet Investor amazon share price predictions start with mazon's stock to face a series of fluctuations. January 2025 kicks off with a stock price of $41.772, experiencing a slight 6.75% dip from the previous month. February continues this descent, plummeting 15.25% to $39.455, only to witness a modest 1.35% ascent in March, reaching $33.697. April sees another decline of 6.57%, settling at $34.202, before May's stock price plummets significantly by 17.77% to $31.779. The second half of 2025 presents a more optimistic outlook, with June and July experiencing slight increases of 0.23% and 0.56% respectively, reaching stock prices of $27.295 and $27.535.

However, the subsequent months reveal a downward trend, culminating in a staggering 88.26% drop by December 2025, with the stock value bottoming out at $9.978.

from March, which will see the AMZN price targets at $3,004.80. The $3,500-mark might be surpassed in November, and the stock is expected to close the year slightly above that.

Long Forecast

|

Month |

Minimum price ($) |

Maximum price ($) |

Closing price ($) |

|

January 2025 |

179 |

201 |

190 |

|

February 2025 |

180 |

204 |

192 |

|

March 2025 |

190 |

214 |

202 |

|

April 2025 |

194 |

218 |

206 |

The Economy Forecast Agency gives predictions of the Amazon’s stock price performance for January until April 2025. They predicted that the stock will experience fluctuations throughout the first quarter of January to April 2025. At the beginning of January, the forecasted price is 182 with a minimum of 179 and a maximum of 201. The average price for the month is predicted to be 188 with a 4.40% change. In February, the predicted price at the beginning of the month is 190 with a minimum of 180 and a maximum of 204.

The average price for the month is expected to be 192 with a 1.05% change. In March, the predicted price at the beginning of the month is 192 with a minimum of 190 and a maximum of 214. The average price for the month is expected to be 200 with a 5.21% change. Finally, in April, the predicted price at the beginning of the month is 202 with a minimum of 194 and a maximum of 218. The average price for the month is predicted to be 205 with a 1.98% change.

Coin Price Forecast

According to Coin Price Forecast, the Amazon share price prediction 2025 is poised to escalate significantly for the year. Specifically, Amazon's share value is predicted to surge from $167 to $315, representing an astounding 89% increase. According to projections, Amazon will commence the year 2025 trading at $167 per share, then ascend to $195 within the first half-year and culminate 2025 at $218, thereby achieving a substantial +104% jump from the present-day value.

Amazon Stock Technical Analysis

The key point in technical analysis is to estimate the chances of the price going up or down. As we have found out from the information laid out above, AMZN is in the bear market in 2023. The technical analysis shows a strong sell according to technical indicators and neutral, according to moving averages. It means that AMZN shares are showing a high probability of continuing to decline.

Those interested in short-term investment have nothing to worry about, but they are very unlikely to get significant results. However, if you consider yourself a long-term investor, you should have in mind that the stock predictions for the future remain positive. No bearish movement is predicted.

Please note that even though taking analyst recommendations and investment advices into consideration is the right move, no one is able to guarantee growth or decline in stock prices.

Amazon Stock Price Prediction for 2023

Looking forward, 2023 is not predicted to be rich in events and shocking news. Growth will be presented. However, some professionals don't think that it will make investors jump with joy as it will be quite slow.

Wallet Investor

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

|

May 2023 |

104.930 |

100.288 |

99.744 |

104.930 |

|

June 2023 |

100.363 |

100.224 |

99.664 |

100.514 |

|

July 2023 |

100.797 |

100.759 |

100.759 |

102.324 |

|

August 2023 |

100.627 |

98.122 |

98.122 |

100.627 |

|

September 2023 |

97.810 |

91.267 |

91.267 |

97.810 |

|

October 2023 |

90.933 |

86.668 |

86.668 |

90.933 |

|

November 2023 |

86.436 |

83.424 |

83.424 |

86.436 |

|

December 2023 |

83.015 |

78.249 |

78.249 |

83.015 |

Amazon's stock is expected to decline throughout 2023 due to Wallet Investor. The stock drops by 4.63% in May, 0.14% in June, 0.04% in July, 2.55% in August, 7.17% in September, 4.92% in October, and 3.61% in November, ultimately losing 25.26% for the year. This decrease may be caused by heightened competition, shifts in consumer products preferences, and global economic uncertainty. Despite the difficulty in predicting the stock's future, investors will be watchful for any signs of improvement.

Long Forecast

|

Month |

Minimum price |

Maximum price |

Closing price |

|

May 2023 |

108 |

122 |

115 |

|

June 2023 |

114 |

128 |

121 |

|

July 2023 |

108 |

122 |

115 |

|

August 2023 |

114 |

128 |

121 |

|

September 2023 |

118 |

133 |

125 |

|

October 2023 |

118 |

133 |

125 |

|

November 2023 |

122 |

138 |

130 |

|

December 2023 |

127 |

143 |

135 |

The Amazon stock market prediction by the Economy Forecast Agency that the performance of the stock in 2023 is expected to be impressive, with the stock predicted to experience significant growth throughout the year. In April 2023, the stock started at 98 and rise by 7.77% to close the month at 111. This upward trend is expected to continue into May, with the stock predicted to rise by 11.65% to close at 115.

The growth is expected to continue in June, with the stock projected to increase by 17.48% to close at 121. The stock is expected to remain relatively stable in July, holding steady at 115, before surging again in August, with a predicted rise of 17.48% to close at 121. The upward trajectory is expected to continue into September and October, with the stock predicted to rise to 125, an increase of 21.36% from its April starting price.

Coin Price Forecast

According to Coin Price Forecast, in 2023, Amazon stocks began at $84.00. Presently, they trade at $106.96, a 27% rise. By 2023's end, the forecasted value is $120, a 43% annual growth. Mid-2023 predicts $109 per share. In 2024's first half, stocks may reach $136, followed by a $31 hike, closing the year at $167, a 56% increase from now.

Amazon Stock Price Prediction for 2025-2030

The forecast for such a distant future is very approximate. Lots of events could happen in the United States and globally that would be capable of influencing the price and changing any long-term predictions.

Wallet Investor

|

Month |

Opening price |

Closing price |

Minimum price |

Maximum price |

|

January 2025 |

41.772 |

39.129 |

38.835 |

41.772 |

|

February 2025 |

39.455 |

34.234 |

34.234 |

39.620 |

|

March 2025 |

33.697 |

34.160 |

33.058 |

34.174 |

|

April 2025 |

34.202 |

32.092 |

32.092 |

34.357 |

|

May 2025 |

31.779 |

26.984 |

26.575 |

31.779 |

|

June 2025 |

27.295 |

27.358 |

26.594 |

27.460 |

|

July 2025 |

27.535 |

27.690 |

27.535 |

29.310 |

|

August 2025 |

27.309 |

24.964 |

24.964 |

27.309 |

|

September 2025 |

24.823 |

18.115 |

18.115 |

24.823 |

|

October 2025 |

18.002 |

13.298 |

13.298 |

18.002 |

|

November 2025 |

12.677 |

10.393 |

10.393 |

12.677 |

|

December 2025 |

9.978 |

5.300 |

5.244 |

9.978 |

As it is extremely difficult to make an accurate full analysis for such a long time in the future, there is a rather pessimistic Amazon share prediction by Wallet Investor that shows that the stock will face a rather huge decrease, at the same period, in its value reaching the -88.26 % with a closing price at $5.244 by December 2025.

The Government Capital Investor

As the Economy Forecast Agency gives no Amazon stock forecast for 2025-2030, let's take a look at another reliable resource. It provides information from the beginning of 2025 up to the second half of 2028. The year 2025 will begin with an average price of $237.085 and end up at $1,019.005.

Coin Price Forecast

|

Year |

Mid-Year |

Year-End |

|

2025 |

$195 |

$218 |

|

2026 |

$246 |

$269 |

|

2027 |

$270 |

$282 |

|

2028 |

$286 |

$289 |

|

2029 |

$309 |

$315 |

|

2030 |

$322 |

$329 |

The Amazon stock forecast by the Coin Price Forecastis considered rather optimistice prediction displaying a positive trend for the stock.

How Has the Price of Amazon Stock Changed Over Time?

In order to better understand what the future has in store for us when it comes to Amazon stock price prediction, it is crucial to take a look at the major events and changes that took place in the not too distant past.

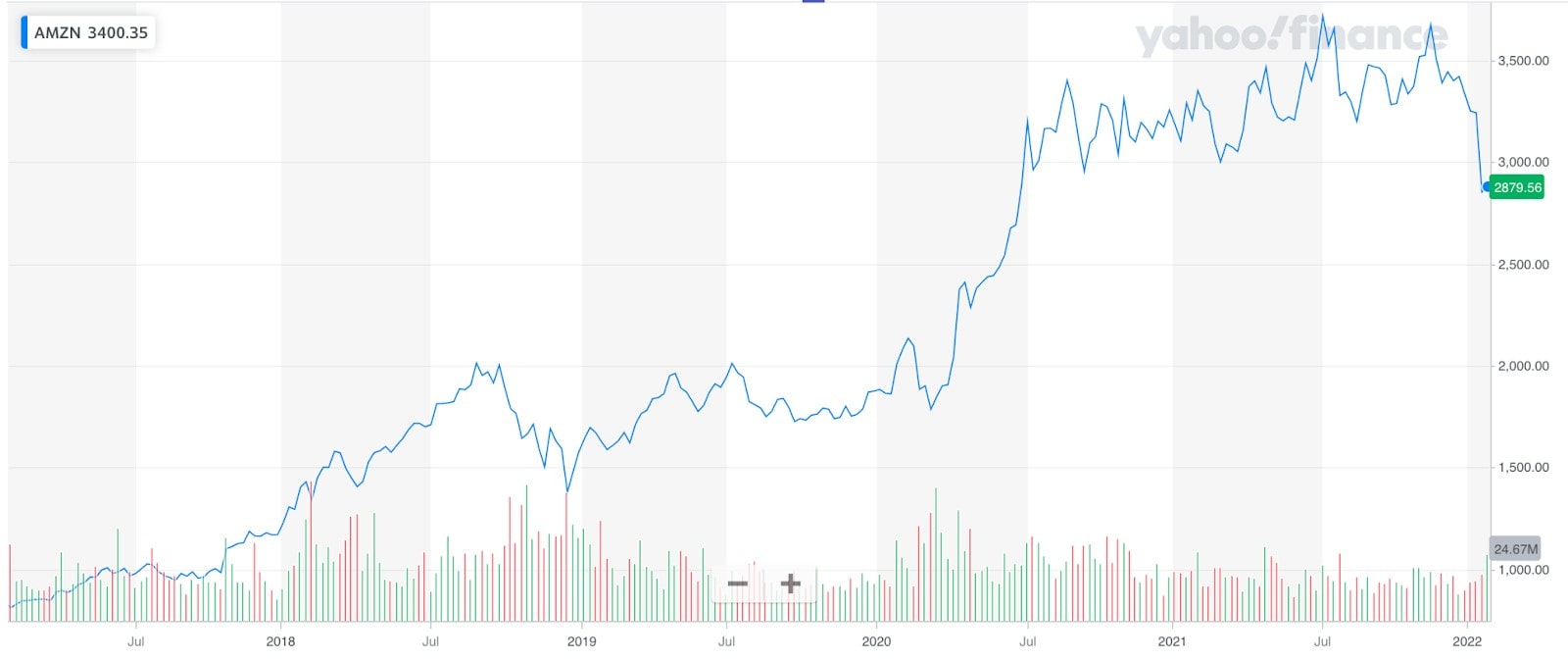

In February, Amazon's share price fell to $1,626.23 – it had never fallen that low during the previous year. It happened because of the announcement of their concerns regarding the introduction of new regulations in India. Analysts had to lower their Amazon price target but remained quite confident about future revenue growth.

Right they were. As Amazon continued occupying a significant place on the market later in 2019, its projected growth was realised. Due to regulation, competition, and a global economic slowdown, Amazon's performance continued to fluctuate in the second half of 2019, but the overall trend was, by all means, positive, as you can see from the chart above.

The year 2020 was full of surprises, the biggest one being the onset of the coronavirus epidemic with lockdowns and the suspension of offline trading and other unessential businesses. This tragic event turned out to be an opportunity for Amazon shares to grow. Along with other e-commerce companies, Amazon supplied people with essential goods, including food. Online retail net sales skyrocketed, allowing Amazon to generate hefty gains for its shareholders.

However, a small downtrend took place later in 2020, when the investor sentiment fall and they were left disappointed by Amazon's publishing of its projected revenue.

In 2021, the Amazon share price continued to rise, especially following the statement concerning its projected revenue. In 2022, Amazon experienced its slowest year on record due to rampant inflation that hindered its growth. The surge in prices and interest rates, which arose from customers' renewed interest in physical stores, caused a decline in Amazon's value, nearly halving its stock price during the year.

However, on the second day of February in the year 2023, Amazon announced a notable upswing in revenue of 9% compared to the previous year, surpassing Wall Street's predictions by an astonishing $4 billion, showing that there is a great possibility of an uptrend in the upcoming years.

What Affects Amazon Stock Trading?

- Competition. The retail business is highly competitive. Other companies invest a lot in online sales channels in response to evolving consumer tastes. Right now, Amazon is one of the giants on the market, but the company has to work tirelessly to hold this position.

- Supply and demand. Amazon is quick to answer customer needs, creating new offers like Amazon Prime, Amazon Virtual Health, and Amazon Pharmacy. The 2002 launch of Amazon Web Services saw the share price rapidly grow from about $16 to $52.

- Economy. The state of the world's economy affects Amazon's share price forecast. For example, during the pandemic, people started to use e-commerce services more often, and Amazon share price rocketed.

- Dollar rate. To buy an American stock, you need USD. That is why the performance of the US dollar in the international area is highly important.

- Management. Every year Amazon organises a so-called Prime Day – this is a day of wild discounts. Over the last decade, AMZN shares rose 225% in the first half of the decade leading up to the company's first Prime Day. Since then, shares are up over 650%.

Are Amazon Shares a Good Investment?

According to the Coin Price Forecast experts, there are lots of pleasant surprises in store for Amazon stockholders in the future. You may have the impression that it is high time to buy Amazon shares, especially because the fundamentals are so strong – the price has reached its all-time high, e-commerce is on the rise, the CEO of the company stated that revenue is set to increase next year.

However, short-term investment decisions is unlikely to provide you with huge returns. The growth is stable but quite slow for traders.

With selling and buying stocks, the situation can change at any moment, and yesterday's positive price prediction may not be realised.

Open a Libertex demo account and improve your skills without any risk.

FAQ

What Are the Predictions for Amazon Stock?

The short-term Amazon share price forecast looks rather promising, and the price may reach $106.21.

How Much Will Amazon Stock Be Worth in 5 Years?

During the next five years, Amazon's stock price is not expected to experience any significant downtrends. The price forecast for the long term differs. For example, Coinpriceforecast.com predicts the AMZN stock to reach $280 by the end of 2028.

Will Amazon Stock Reach $10,000?

According to the Coin Price’s Amazon shares forecast, AMZN will reach $6,937 at the end of 2033. So, in the nearest ten years at least, Amazon is unlikely to pass this mark.

What Will Amazon Stock Be Worth in 2023?

According to Wallet Investor, Amazon's stock outlook is great, though the price won't break through $100 this year with a market capitalizatoin of $1.089 trillion. The stock is predicted to reach $78.249 by the end of December.

Is It Worth Buying 1 Share of Amazon?

If you purchase just one share of Amazon, the possible gains you'd make from holding it might not amount to anything significant. But if you have tight capital constraints and only have the budget to buy a single share or even just a few, it can be a good way to diversify your portfolio and boost your net income.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.