GameStop (GME) Stock Forecast for 2022 and Beyond

2021 was a good year for GME traders who got in early: but is it too late to invest in GameStop? What does 2022 hold for this gaming retailer? This guide will examine the intricacies of GameStop price movements and present predictions from top experts.

About GameStop Stock: History and Price Factors

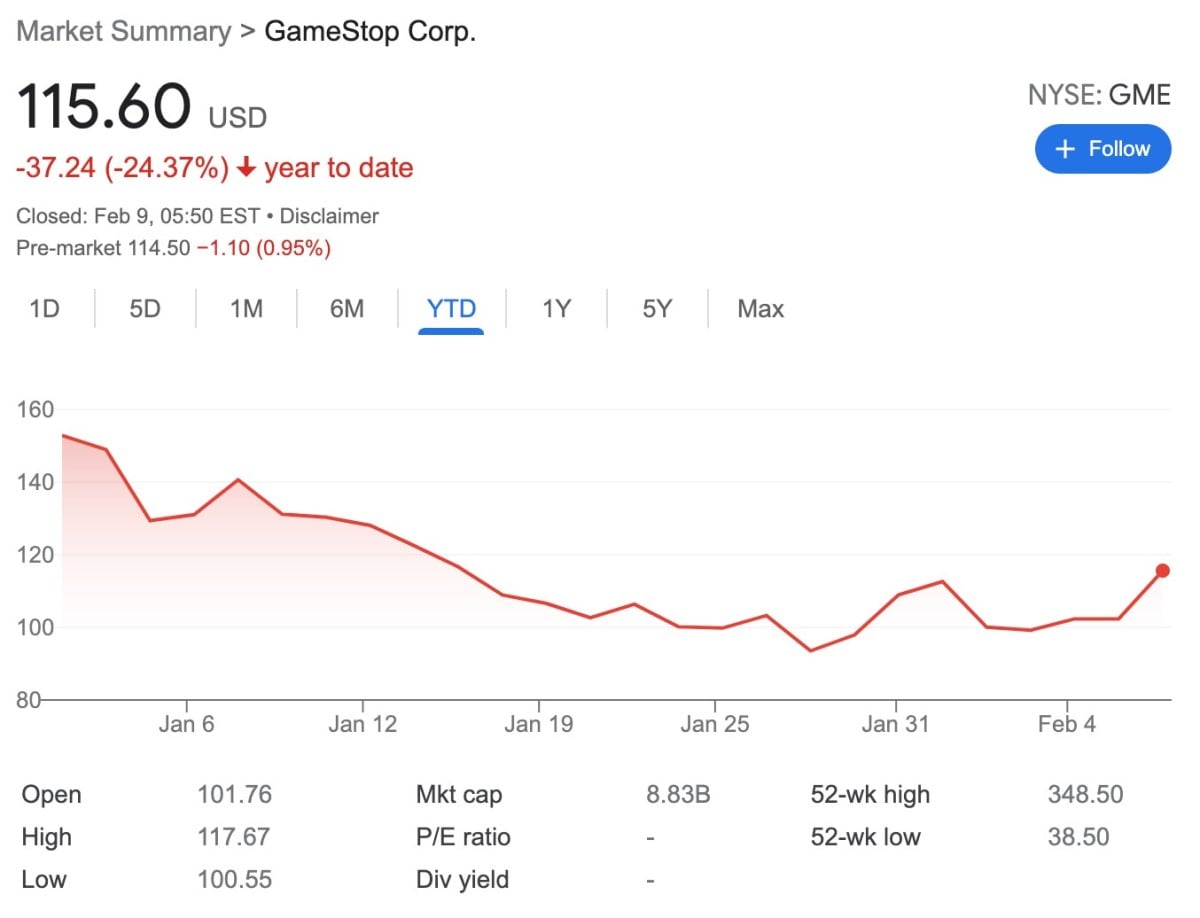

GameStop stock snapshot, 7 February 2022:

- Market cap: $7.81B

- Volume: $3.50M

- Current price: $102.34

- Year range: $38.50 - $348.50

- Primary exchange: NYSE

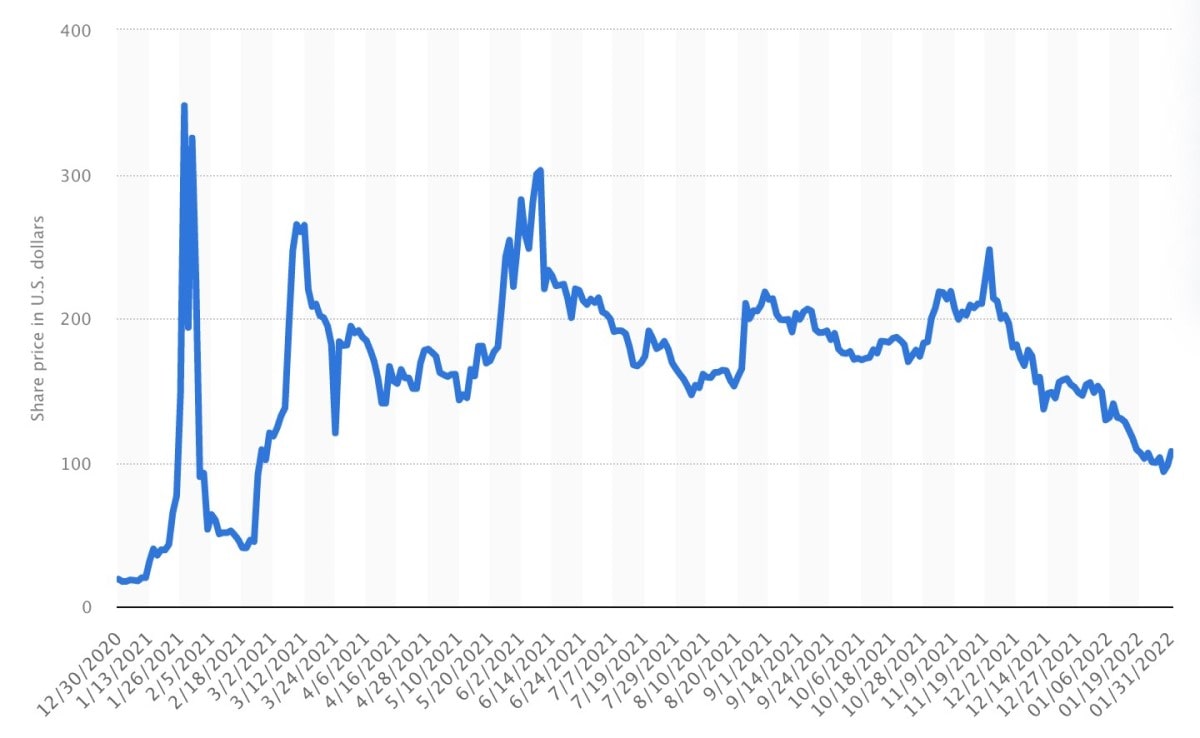

GameStop's stock made headlines throughout 2021. What started as a meme culture became a global movement: The price skyrocketed, growing by 1,745% between 1 January and 26 January 2021.

Now, let's take a look at how it's performed over a longer timeframe.

GME had a positive year in 2020 — but prices were in the red between 2014 and 2019.

|

Year |

Average Stock Price ($) |

Year Open ($) |

Year High ($) |

Year Low ($) |

Year Close ($) |

Annual Change |

|

2021 |

169.70 |

17.25 |

347.51 |

17.25 |

148.39 |

687.63% |

|

2020 |

7.14 |

6.31 |

20.99 |

2.80 |

18.84 |

209.87% |

|

2019 |

7.54 |

13.07 |

15.98 |

3.21 |

6.08 |

-51.82% |

|

2018 |

14.81 |

18.26 |

19.96 |

11.67 |

12.62 |

-29.69% |

|

2017 |

21.57 |

25.37 |

26.52 |

16.00 |

17.95 |

-28.94% |

|

2016 |

27.96 |

28.31 |

33.38 |

20.73 |

25.26 |

-9.91% |

|

2015 |

40.47 |

33.80 |

47.44 |

28.04 |

28.04 |

-17.04% |

|

2014 |

39.71 |

49.65 |

49.65 |

31.92 |

33.80 |

-31.38% |

|

2013 |

40.04 |

25.66 |

57.59 |

22.61 |

49.26 |

96.33% |

With the video game market booming, why was GameStop performing so poorly from 2014 to 2019? Well, even though the industry is experiencing a great CAGR, those gains are primarily experienced in digital games.

GameStop's business model is at odds with the shift towards digitalisation. The company relied on making profits through trade-ins: customers would come into the stores and trade in their new games for in-store credit. GameStop offered fairly low compensation for trade-ins, pushing their profit margin to 46%. It was a great deal for GameStop — not so much for gamers, who were increasingly frustrated by the low offers.

And as it became commonplace to purchase and download games directly on gaming consoles, people started going to GameStop less and less. Platforms like the PlayStation store often ran huge sales, with discounts offered on hundreds of games. Gamers would rather purchase a cheap digital download than go to a physical store, trade in a used game for just a couple of dollars, and then buy a full-priced game. As such, GameStop's price decreased pretty quickly — at least until the mass movement of late 2020 and early 2021.

Between 2016 and 2019, the company's operating income decreased from $653 million to $314 million. Then, when the COVID-19 pandemic first hit, Gamestop experienced an operating loss of over $200 million up until 30 October 2020. Since then, the company has closed 449 locations.

Will the Price Keep Going Up?

Later in this guide, we'll present you with some price predictions from various experts. First, we'd like to address what factors must be present for the GME price to stay high. It's already experienced a pretty big decline since the boom in January 2021 (which was to be expected). It has increased since the start of 2022, with a -33.26% YTD drop.

Why so? GameStop was struggling because it couldn't keep up with the digitised video game industry. The company was singled out for investment by Redditors — not because they believed that GameStop had anything great to offer but because they wanted to teach short-sellers a lesson.

Essentially, GameStop caught a lucky break: They became relevant again due to sheer chance. But they didn't take this opportunity to alter their business model. Therefore, many experts believe that GME's prices will nosedive when the hype dies down.

For GameStop's prices to go up over a longer timeframe, the company must show that it can stay relevant and competitive in a world dominated by digital game downloads. GameStop recently announced that it's launching an NFT marketplace. But is that enough? Only time will tell.

What Affects GameStop (GME) Stock Price?

To recap, the factors that have affected the GME stock price include:

- Digitalisation of the video game industry

- Public sentiment towards the trade-in model

- Mass trading movements, i.e., "Gamestonk".

GameStop Stock Technical Analysis

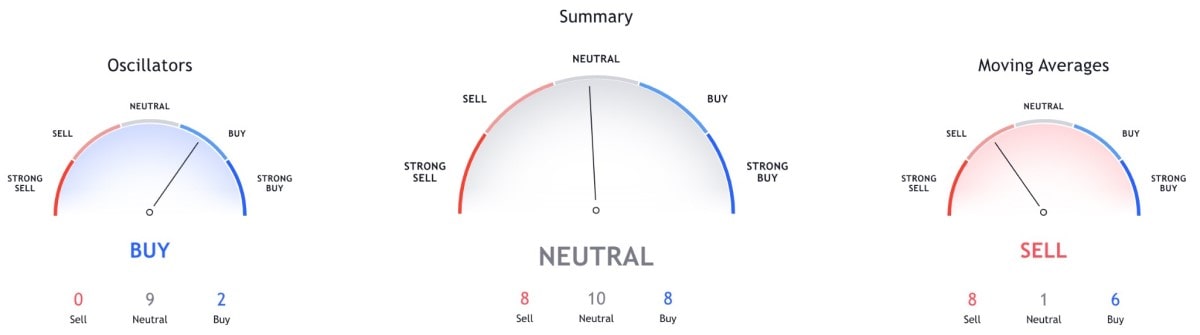

We've given you a general sense of what to expect from GameStop (GME): It had a bull run for the first half of 2021 but is now quite bearish. Now, let's take a closer look at the specifics. Traders can conduct a technical analysis to predict short-term price movements: Timeframes can be as short as one minute. We'll look at GameStop's 1-day and 1-week technical analyses.

1-Day Technical Analysis

According to almost every moving average available on TradingView, GME is a strong sell. The only buy is the Hull Moving Average, Ichimoku Base Line is neutral, and all others are sell. Conversely, all oscillators are neutral, except for Momentum and MACD Level. When combined, GME has 13 sell indicators, 10 neutrals, and 3 buy indicators, making it a solid sell for the 1-day timeframe.

1-Week Technical Analysis

When looking at GME from a week-long perspective, things are a little more optimistic. But not enough to push the stock into the neutral range. There are now 4 buy moving averages and 3 buy oscillators; overall, there are 11 sell indicators, 8 neutrals and 7 buys.

GameStop Stock Forecast for 2022 by Experts

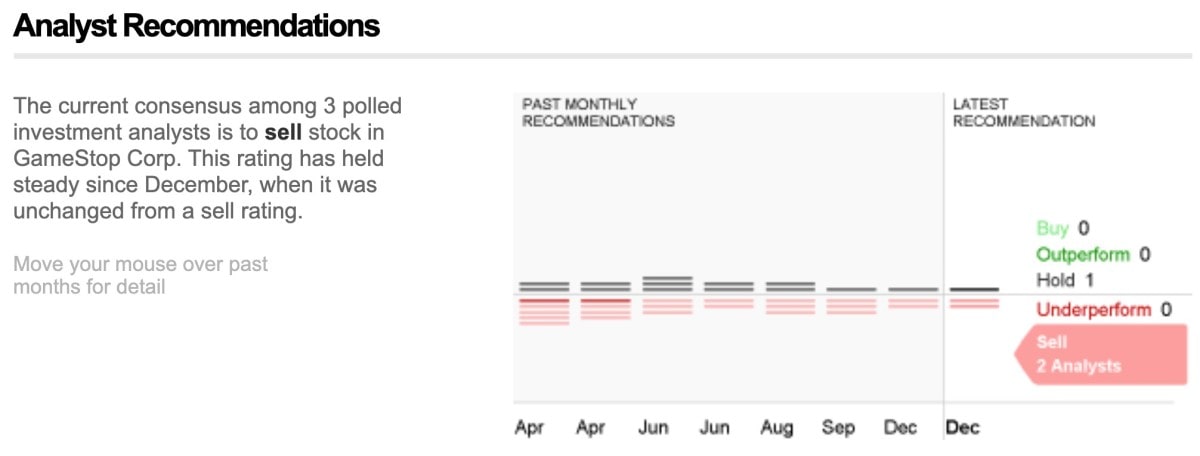

A year ago, nine Wall Street analysts covered GameStop but dropped out; only three top analysts remain. We have clear quotes from two of them. Let's see what they have to say about GameStop's potential for 2022:

"We've long past the time where anyone who values my advice is involved in GameStop…Yet again, management failed to provide clarity around a long-awaited digital transformation plan that has been hinted at in the past but has yet to crystallise. Instead, management spared a few details for shipping, headcount expansion, a new credit facility and the potential of exploring blockchain technology," opines Michael Pachter of Wedbush.

"Recent headlines re: GameStop's involvement in the growing metaverse and NFT marketplace are intriguing, but still very difficult to size and to apply value in our financial model," said Stephanie Wissink of Jeffries

The current consensus among all three Wall Street analysts covering GameStop is to sell.

And it's not just Wall Street top analysts that have low hopes for GME stock:

"Now it seems that meme stocks are becoming a thing of the past…The speculative frenzy, and just betting on stocks with nothing more than the hope that they're going to keep going up, has faded away." - said Craig Birk, Personal Capital

"If you see the prices now [for GameStop] — that tells me that diamond hands or apes [are all talk]...We are seeing our traders and our investors take money off the table in GameStop." - said Anthony Denier, Webull

The general consensus is that GameStop's stellar performance in 2021 was a fluke brought about by meme culture, and the company hasn't made enough of an effort to modernise its business model.

Short-Term GameStop Price Prediction for 2022

We've scoured the web for GME price predictions for 2022 — out of the ones available, Gov.Capital seems to be the most moderate. It doesn't predict extraordinary gains nor huge losses, opting instead for a middle-of-the-ground route.

|

Month |

Average Price ($) |

Min Price ($) |

Max Price ($) |

|

March 2022 |

143.846 |

122.269 |

165.422 |

|

April 2022 |

138.992 |

118.143 |

159.840 |

|

May 2022 |

158.343 |

134.591 |

182.094 |

|

June 2022 |

150.398 |

127.838 |

172.957 |

|

July 2022 |

133.855 |

113.776 |

153.933 |

|

August 2022 |

154.631 |

131.436 |

177.825 |

|

September 2022 |

141.251 |

120.063 |

162.438 |

|

October 2022 |

145.366 |

123.561 |

167.170 |

|

November 2022 |

153.632 |

130.587 |

176.676 |

|

December 2022 |

139.388 |

118.479 |

160.296 |

GameStop Price Forecast for 2023-2026

Gov.Capital also extends its GME price forecast for several more years. The further a price forecast extends, the less reliable it is, so just keep that in mind.

|

Year |

Beginning of Year ($) |

Mid-Year ($) |

Year-End ($) |

Change |

Overall Change |

|

2023 |

139.721 |

216.892 |

203.517 |

+45.6596% |

+98.86% |

|

2024 |

203.730 |

307.215 |

284.046 |

+39.4228% |

+177.55% |

|

2025 |

286.103 |

359.369 |

349.460 |

+25.6083% |

+241.47% |

|

2026 |

349.753 |

438.870 |

426.369 |

+21.9057% |

+316.62% |

Long-Term GameStop Stock Price Prediction for 2027 and Beyond

Once you reach this sort of timeframe, making price predictions is futile: so much can change in 5+ years. This is especially true when you're forecasting the performance of a retailer. While the prices of gold and oil can be speculated on far in advance, GME's performance largely hinges on whether the company can stay relevant. Gold is here to stay…but is GameStop?

Conclusion

Gamestop is down for the year by over 30%. Even though this meme stock experienced incredible success in 2021, it might not be wise to buy shares. Rather than following along with what thousands of Redditors are doing, step back and look at whether GameStop has a viable UVP for the digital age. Would the price continue to increase based on the company's merit if it lost the attention of r/Wallstreetbets? If so, then perhaps it's a good investment after all. And if not… then look elsewhere for shares to add to your portfolio.

Disclaimer: The price prediction is a compilation of data gathered from various sources. It is not meant as investment advice. Users should do their own research before investing.

FAQ

Is GameStop a good stock to buy right now?

It depends on who you ask. Top Wall Street analysts recommend selling GameStop stock — but there are also dedicated holders who are adamant that the price will recover. Just keep in mind that GameStop has experienced a price decline of over 30% so far this year. If you think the stock will recover, then buying low could be a good strategy. If you think the price will just keep dropping, then stay away.

What is the future of GameStop stock?

We covered this pretty extensively, but to sum up: GameStop doesn't seem to have a bright future unless it makes significant changes to its services.

Is GameStop a good long-term investment?

The further out you go, the less stable price predictions are. Perhaps GameStop is a good investment for the 1-2 year timeframe, but it's difficult to say beyond that.

Does GameStop stock pay dividends?

No, it does not pay dividends.

How much is GameStop worth in 2022?

As of 7 February 2022, GME is worth $102.34.

How much will GameStop be worth in 2025?

Gamestop could be worth $349.460 by the end of 2025 if it makes moderate gains.

How much will GameStop be worth in 2030?

This is too far in advance to give a concrete answer, but some forecasts list it as being worth $2,000-$3,000 in 2030.

Is GameStop a Buy, Sell, or Hold?

If we follow the advice of top Wall Street analysts and technical indicators, GameStop is a sell.

Is GameStop overvalued?

In January 2020, GameStop may have been overvalued, but what about now that the price has dropped to $102.34? If we ask Wall Street analysts, then yes, GME is still overvalued, with a price target of $34.

What is the target price for GameStop stock?

According to the abovementioned analysts, GameStop's price target is $34.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.