General Electric (GE) Stock Forecast

In 2020, the company reported consolidated earnings on revenues of over $79 billion with over $5 billion from common shareholders. Just recently, in November 2021, it announced that it would split into three major companies. Where does that put future expected stock prices? Let's find out.

Overview: General Electric (GE) Stock

General Electric Co. is one of the oldest companies around, having been incorporated in 1892. The company emerged after the Thomson-Houston Company and the Edison General Electric Company merged. It started with Appliance and Lighting services.

Now, it operates as a finance, infrastructure and technology company worldwide. Its main expertise lies in the following segments:

- Aviation

- Capital

- Healthcare

- Power

- Renewable energy

As of 14 January 2022, its current stock price is $103.16.

Factors Affecting the General Electric (GE) Stock Price

Here are some factors that can influence GE stock exchange price:

- Workforce layoff

- Change in management or operations

- Investors sentiments

- Inflation

- Industry performance

- Announcement of dividends

General Electric Stock Price in the Past

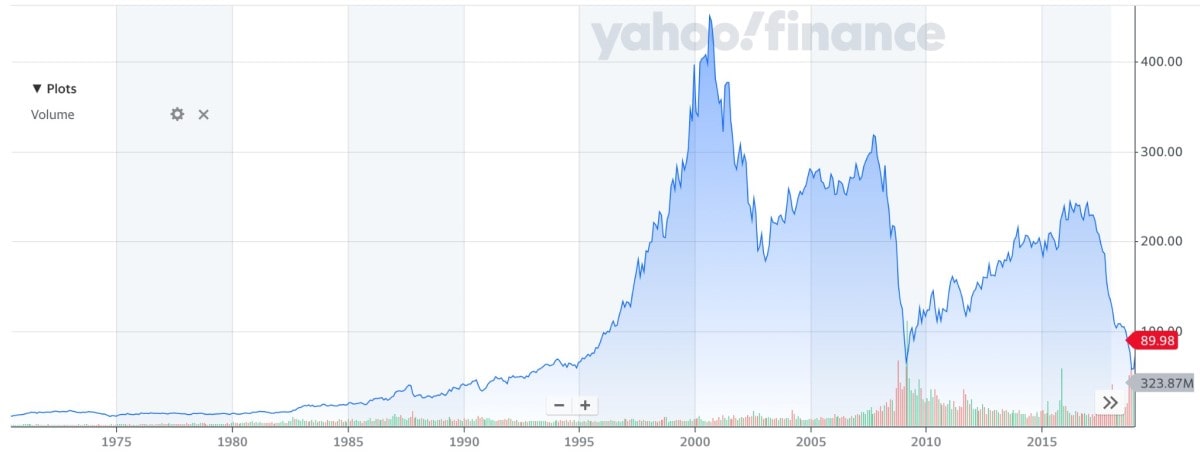

The stock market price started low in the 1960s and 1970s. During these years, GE was a pioneer in laser light technology and medical imaging. Over the next few years, the price started to fluctuate more until it peaked during 2000. In August 2000, it reached a closing price of $480, making it the most valuable company in the world.

However, its price drastically dropped in 2008, when the company encountered a crisis. In 2001, Welch left the company as a $130 billion conglomerate. But in 2008, GE stock dropped 42%, with the capital financial segment being the main reason. Although Warren Buffet invested $3 billion to stabilise and counter this fall, the crisis didn't end.

The following year, the company had to cut its yearly dividend from $1.24 to $0.82 and fell lower in 2010. The price continued to fluctuate through the following years and didn't drop until 2019.

The company had a good year in 2019. H. Lawrence Culp, the new chairman and CEO of the company, made significant improvements and helped the company recover slightly. By the end of 2019, the stock was up at about 50%. He reduced the $55 billion debt to half in 2020. Culp also sold unproductive stakes and subsidiaries.

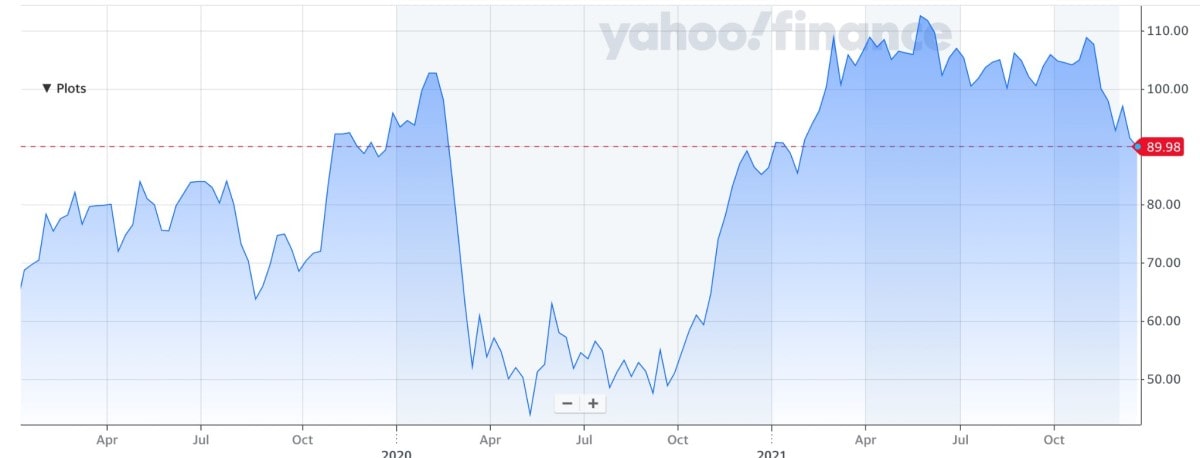

However, in 2020, the COVID-19 pandemic significantly affected the company's steady price increase from 2019. On 15 May 2020, the GE stock price dropped to about $44, its lowest in two decades. GE's Aviation unit was the most affected since it had to lay off 10%-25% of its workforce in 2020.

Fortunately, the company began to recover in 2021. The stock price started to increase again. It even reached up to three digits in March until May and continued to drop and rise slightly afterwards.

General Electric Stock Technical Analysis

GE stock moved past a buy point on 9 November 2021. According to the MarketSmith Chart analysis, the relative strength line for the stock is lagging again. It also earned an IBD Composite Rating of 34 out of 99 with an RS Rating of 32, which means it outperformed 32% of all stocks for the past year.

Using pivot points and different indices, here's a summarised technical analysis of NYSE:GE stock:

- A bullish alert on 17 December 2021, after a bearish swing on 16 December 2021.

- The stock is at a short-term and long-term downward trend based on Moving Averages.

- Bearish trend movement according to 200 DMA and Relative Strength Index.

- With a Neutral score from Oscillators and a Sell from MAs, the GE stock is experiencing slight selling pressure.

- Its strongest support and resistance levels are at 6, 13 and 104.

General Electric Stock Forecast for 2022 by Experts

Experts have done their own analysis on GE's performance for next year to create a GE stock price forecast. Although most of them predicted the stock price to increase in the following year, some say that it wouldn't happen so quickly. The one thing they have in common is that there'd be no massive drop in its price in 2022.

Coin Price Forecast

The forecasted stock price at the end of 2021 is $92.97. It'll then increase by 9% in early 2022, and its price is predicted to reach up to $95.86. In the second half of the year, $0.53 will be added, closing the year at $96.39.

Long Forecast

|

Month |

Minimum ($) |

Maximum ($) |

Closing Price ($) |

Total |

|

January 2022 |

82 |

92 |

87 |

-6.45% |

|

February 2022 |

78 |

88 |

83 |

-10.75% |

|

March 2022 |

79 |

89 |

84 |

-9.68% |

|

April 2022 |

81 |

91 |

86 |

-7.53% |

|

May 2022 |

82 |

92 |

87 |

-6.45% |

|

June 2022 |

84 |

94 |

89 |

-4.30% |

|

July 2022 |

85 |

95 |

90 |

-3.23% |

|

August 2022 |

86 |

96 |

91 |

-2.15% |

|

September 2022 |

90 |

102 |

96 |

3.23% |

|

October 2022 |

90 |

102 |

96 |

3.23% |

|

November 2022 |

95 |

107 |

101 |

8.60% |

|

December 2022 |

100 |

112 |

106 |

13.98% |

The Economy Forecast Agency predicts the GE stock price to end this year at $89. It's forecasted that the price will constantly decrease, peaking at a drop by 10.75% in February, not until September 2022, with a 3.23% increase. This would continue to go up until the end of the year with a $106 and 13.98% increase.

AI Pickup

|

Month |

Price Target ($) |

Change |

|

January 2022 |

91.58 |

0.15% |

|

February 2022 |

87.54 |

-4.42% |

|

March 2022 |

83.10 |

-5.07% |

|

April 2022 |

77.36 |

-6.91% |

|

May 2022 |

71.50 |

-7.57% |

|

June 2022 |

65.95 |

-7.77% |

|

July 2022 |

61.34 |

-6.99% |

|

August 2022 |

58.17 |

-5.16% |

|

September 2022 |

56.36 |

-3.12% |

|

October 2022 |

55.29 |

-1.89% |

|

November 2022 |

54.21 |

-1.95% |

|

December 2022 |

54.23 |

0.03% |

According to Wall Street analysts, slight price growth is expected in January. After that, it'll continue to decline in the year's remaining months, dropping the highest in June 2022. Fortunately, the year will end with the price slightly increasing by 0.03% from its previous predicted price of $54.21.

LeoProphet

|

Month |

Rate Forecast ($) |

Min Rate ($) |

Max Rate ($) |

Volatility, % |

|

January 2022 |

96.64 |

89.20 |

102.27 |

12.78% |

|

February 2022 |

100.78 |

93.91 |

109.65 |

14.36% |

|

March 2022 |

105.77 |

101.58 |

110.19 |

7.81% |

|

April 2022 |

97.40 |

94.61 |

101.68 |

6.95% |

|

May 2022 |

88.72 |

84.42 |

94.57 |

10.73% |

|

June 2022 |

96.91 |

93.93 |

100.43 |

6.48% |

|

July 2022 |

106.72 |

100.15 |

113.06 |

11.42% |

|

August 2022 |

111.77 |

102.80 |

114.35 |

10.11% |

|

September 2022 |

106.73 |

99.45 |

115.07 |

13.57% |

|

October 2022 |

114.13 |

108.10 |

117.52 |

8.01% |

|

November 2022 |

105.97 |

102.70 |

111.68 |

8.04% |

|

December 2022 |

97.57 |

95.21 |

102.40 |

7.02% |

From LeoProphet's GE stock forecast, the price will increase rapidly but decrease as well in 2022. Its price will continue to go up until March, then drop until May, and continue to rise again. However, starting from November and until the end of the year, it's expected to drop to $97.57. It's also predicted that the highest market volatility will be experienced in February.

Wallet Investor

|

Date |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2022 |

92.251 |

92.672 |

92.248 |

92.769 |

0.45% |

|

February 2022 |

92.634 |

93.594 |

92.634 |

93.620 |

1.03% |

|

March 2022 |

93.516 |

94.328 |

93.510 |

94.378 |

0.86% |

|

April 2022 |

94.373 |

96.113 |

94.373 |

96.113 |

1.81% |

|

May 2022 |

96.310 |

96.769 |

96.272 |

96.836 |

0.47% |

|

June 2022 |

96.789 |

97.333 |

96.773 |

97.419 |

0.56% |

|

July 2022 |

97.350 |

100.074 |

96.985 |

100.074 |

2.72% |

|

August 2022 |

101.266 |

104.287 |

101.266 |

105.123 |

2.9% |

|

September 2022 |

104.230 |

105.553 |

104.230 |

105.696 |

1.25% |

|

October 2022 |

105.523 |

106.509 |

105.392 |

106.509 |

0.93% |

|

November 2022 |

106.417 |

106.709 |

106.197 |

106.840 |

0.27% |

|

December 2022 |

106.623 |

102.992 |

102.902 |

106.623 |

-3.53% |

Wallet Investor analysts announced a prognosis for the GE stock price to have a stable upward movement in the next year. Although they only range from zero to about a 3% increase, no significant drop is expected. Not until December 2022 where the price will experience a 3.53% reduction.

Short-Term General Electric (GE) Price Prediction for 2022

Many analysts have stated their GE stock predictions in the coming year. Here's a summary of the forecasts for 2022 from five high ranking analysts based on Wall Street:

|

Analyst (Firm) |

Rating |

Action |

Price Target ($) |

Upside/ Downside |

|

John Walsh (Credit Suisse) |

Hold |

Maintain |

114 |

+24.66% |

|

Joshua Pokrzywinski (Morgan Stanley) |

Strong Buy |

Maintain |

125 |

+36.69% |

|

Julian Mitchell (Barclays) |

Strong Buy |

Maintain |

16 |

-82.50% |

|

Nicole Deblase (Deutsche Bank) |

Strong Buy |

Upgrade |

131 |

+43.25% |

|

Deane Dray (RBC Capital) |

Buy |

Maintain |

130 |

+42.15% |

Most analysts gave a buy trading recommendation for the stock since they expect the price to go higher in 2022, indicated by the positive price change percentages. Most of them also predicted a three-digit stock price next year compared to the two-digit price now.

General Electric Price Forecast for 2023-2025

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End,% |

|

2023 |

104.00 |

111.37 |

+22% |

|

2024 |

128.08 |

134.37 |

+47% |

|

2025 |

149.49 |

153.43 |

+68% |

It's predicted that in the following years, from 2023 to 2025, GE stock price will continue to increase. This means that in 2025, the forecast increase is by 68% compared to the present price.

Long-Term General Electric Stock Price Prediction 2026-2030

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End,% |

|

2026 |

165.11 |

178.62 |

+95% |

|

2027 |

192.02 |

205.31 |

+125% |

|

2028 |

209.54 |

213.95 |

+134% |

|

2029 |

218.55 |

223.35 |

+144% |

|

2030 |

228.37 |

233.62 |

+155% |

Even in 2026, the price will continue to increase. This would continue until 2030 with a 155% increase from the current price. There's no hint of a drop in the forecast as theprice goes up throughout each year.

Conclusion

General Electric stock is starting to get its upward movement again after facing a crisis in 2008. Although they're in debt, it's clear that the company is taking measures to pay it off. The company is doing better now, even after the turbulent pandemic times.

Since it's an old company, this performance shows how the company is managed. Overall, it's a good choice for investment since most GE stock predictions show that its price is likely to increase. The stock is doing pretty well in the market, too, based on its share forecast. However, it's best to do your own research first and then try investing on your own.

If you're still uncertain, you can try a demo account from Libertex. Explore its various features designed to help you develop your skills for building your portfolio. With a demo account, you can practice trading stock CFDs first before you do so in real life.

Disclaimer: The price predictions are all based on gathered data from different sources. It's encouraged not to use this as investmentadvice, and users should perform their own research before investing. Please keep in mind that this article doesn't guarantee the future price of the stock mentioned.

FAQ

Is General Electric a buy or sell?

Currently, the GE stock shows signs of a sell movement, so it's a sell. This is based on various technical analyses.

Will General Electric stock split soon?

GE stock had a 1-for-8 reverse split of common shares on 2 August 2021. Although it's not certain if it'll split soon, the chances of it happening are low since it split already only a few months earlier.

Is General Electric a good long-term investment?

Yes, it is. GE's turnaround is showing progress, and problems encountered seem to be temporary. The stock price is expected to grow in the following years.

Is now a good time to buy General Electric stocks?

This would depend on your personal analysis. But based on the General Electric stock forecasts and available analysis, now is a good time to get GE stock before the price increases more.

Does General Electric stock pay dividends?

Unlike other stocks, you can get dividends from GE stock. GE stock pays dividends every three months. Their recent dividend date had the rate increased from $0.01 to $0.08.

How much is General Electric worth in 2022?

If the predicted increase happens in 2022, General Electric stock would be worth over $100 to $120 by the end of the year.

How much will General Electric be worth in 2025?

If the analyses and forecasts are true, GE stock could cost up to over $150 in 2025, provided that the price continues to increase.

How much will General Electric be worth in 2030?

GE will be worth over $200 in 2030 if its progress continues until that year. If not, the price can decrease to $60 with more than a 30% price drop from now.

Is General Electric a Buy, Sell or Hold?

Currently, GE stock shows a sell movement in the market based on technical analysis. Because of this, you can either buy or hold stocks as the price is lower.

Is General Electric overvalued?

GE appears overvalued to many, given the crisis it faced in 2008. However, it can be noted that its performance is starting to stabilise, debt is being paid, and many investors are buying Culps turnaround plans and still find it a potentially good investment.

What is the target price for General Electric stock?

According to CNN Business, analysts set a target price of an average of $125 for the next 12 months. This is about a 32% increase projection from its current price.

Why is General Electric stock so low?

The COVID-19 pandemic affected most of GE's segments, specifically aviation. Because of this, the company had to cut the workforce from their aviation company. This resulted in the price fall that the company is still recovering from.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.