High Dividend Stocks

Read on to understand what dividends are and how they work. Find out the metrics used to evaluate stocks and the top 30 high dividend stocks you should consider in 2022.

What Are Dividends and How to Invest in Them?

A company can choose to use its profits in three major ways primarily: it can reinvest it in the business for growth, repurchase shares of its stock in the open market, or distribute it among its shareholders. A dividend is the distribution of profits by a company to its shareholders. When investors are looking for companies and stocks to make an investment in, one of their major concerns is the dividend paid.

Dividends are paid by companies not only to maintain their goodwill and enhance their brand value but also to build and maintain trust among their shareholders. However, one of their prime purposes is to increase investor confidence in the stock by showcasing the company's financial health.

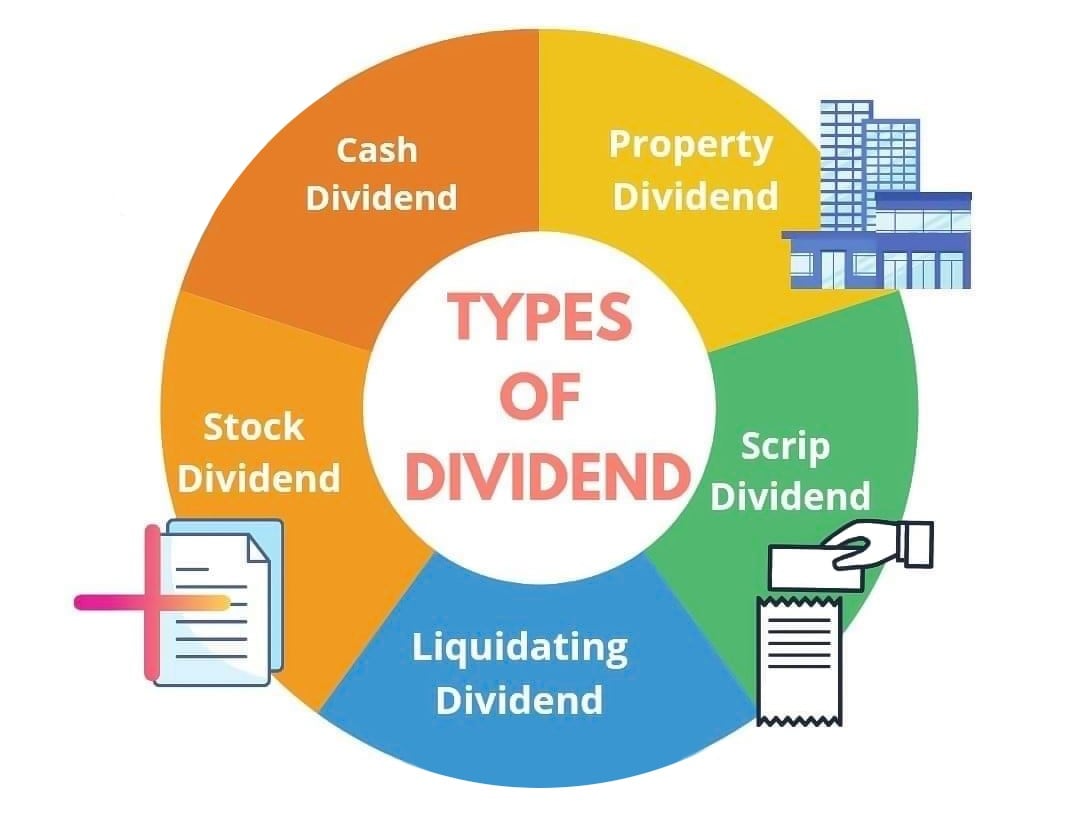

Dividends are not always in the form of money. While cash payments are the most common way for dividend payment, a company may choose to issue additional stocks or assets as rewards to its shareholders. There are also scrip dividends where a company issues a promissory note to distribute dividends at a later date, essentially creating a note payable.

While most dividends are paid quarterly, with some corporations choosing to issue them annually or monthly even, a company might decide to issue a special dividend at any time if it has excess cash that it wants to distribute among its shareholders.

In order to invest in dividends, you need to look for dividend-paying stocks since not all companies pay dividends. Dividends are announced on their declaration date, where all the details such as price per share and the payment date are shared with the public.

To be eligible for a stock's dividends, you need to buy the shares before the ex-dividend date. After this date, even if you buy shares of the stock, you will not be issued the upcoming dividend. That being said, some companies have conditions for holding the shares for a minimum period of time, so it is necessary to conduct thorough research into the dividend-paying stock you are interested in.

How to Evaluate Stocks

With numerous dividend-paying stocks available as options to invest in, it is a daunting task to shortlist high dividend stocks that you should choose from. This is why knowing how to evaluate stocks is important.

Given below are four basic elements to determine stock value. Note that, sometimes, estimating the value from one of these metrics is not sufficient. It is important to evaluate a company using all these metrics while keeping the relevant industry in mind.

Price-To-Book Ratio

The price-to-book (P/B) ratio gives the value of a company if it is closed and sold today. This is useful because many companies in mature industries are stagnant in terms of growth, but their value lies in their assets.

Price-To-Earnings Ratio

The price-to-earnings (P/E) ratio measures a company's current share price relative to its earnings per share. It is possibly the most important valuation metric of stocks. P/E ratio essentially tells how long a stock will take to pay back for an investment if there is no change in the business. Additionally, this metric can be used for comparison only among companies in similar industries and markets.

Price-To-Earnings Growth Ratio

The price-to-earnings growth (PEG) ratio does not only look at the price and earnings of a stock but also takes into account the historical growth rate of a company's earnings. This ratio is calculated by dividing the P/E ratio by the year-over-year growth rate of a company's earnings.

Dividend Yield

The dividend yield is a dividend expressed as a percentage of the current share price. This metric essentially tells the percentage of a company's share price that it pays out in dividends each year.

30 High Dividend Yield Stocks to Invest in 2022

We've compiled a list of 30 high dividend stocks evaluated according to the aforementioned metrics. To further support your selection choice, we have categorised them according to different regions and types. These stocks are listed in no specific order and are among some of the best-yielding stocks in 2022.

High Dividend European Stocks

Here are some of the most popular European dividend stocks that have a high dividend yield in 2022.

EVRAZ (LON: EVR)

- Dividend Yield: 14.15%

- Market Capitalization: £8.46 billion

- P/E Ratio: 7.56

- Average Volume: 2.18 million

Seen in multiple lists of high dividend stocks in 2022, EVRAZ is a British multinational steel manufacturing and mining company. Headquartered in London, England, it operates in Russia, Ukraine, Kazakhstan, the United States, Czech Republic, Italy, South Africa, and Canada. It is listed on the London Stock Exchange.

EVRAZ pays dividends quarterly, and its last quarterly dividend amount was £20.51. It aims to pay dividends of a minimum of $300 million each year, making it one of the best dividend-paying companies on this list.

BHP (ASX: BHP)

- Dividend Yield: 8.63%

- Market Capitalization: 233.12 billion AUD

- P/E Ratio: 15.09

- Average Volume: 7.84 million

BHP is a mining company headquartered in Melbourne, Australia. As one of the largest mining companies in the world, it engages in the production of iron, steel, copper, silver, aluminium, oil, and gas. In addition to this, it is also involved in transport and engineering. The quarterly dividend paid by BHP is 1.01 Australian dollars. BHP has approved dividend growth for the past 10 years at approximately 13% a year on average. The BHP stock is listed on the Australian Securities Exchange (ASX).

Vodafone (VOD)

- Dividend Yield: 9.68%

- Market Capitalization: $44.31 billion

- P/E Ratio: 17.5

- Average Volume: 6.27 million

Vodafone Group is a British multinational telecommunications company, one of the major British corporations offering high dividend stocks. The quarterly dividend amount paid by Vodafone is £0.04. The company's next dividend payment is scheduled for 4 February 2022.

M&G (LON: MNG)

- Dividend Yield: 8.57%

- Market Capitalization: £5.56 billion

- P/E Ratio: 91.33

- Average Volume: 8.00 million

M&G is a global investment management company headquartered in London, England. It invests in and manages a wide array of assets, including equities, fixed income, and real estate. The company pays quarterly dividends and is listed on the London Stock Exchange.

Imperial Brands (LON: IMB)

- Dividend Yield: 8.15%

- Market Capitalization: £16.15 billion

- P/E Ratio: 5.70

- Average Volume: 1.98 million

A popular name in high dividend stocks in the UK, Imperial Brands is a British multinational tobacco company headquartered in Bristol, England. As per market share, it is the world's fourth-largest international cigarette company. The company pays dividends four times a year in March, June, September and December.

Best American Dividend Stocks

America is home to some of the biggest and most successful names in the corporate world. Given below are a few of the most interesting high yield dividend stock options investors are paying attention to in 2022.

VF Corporation (NYSE: VFC)

- Dividend Yield: 2.77%

- Market Capitalization: $28.38 billion

- P/E Ratio: 23.22

- Average Volume: 2.45 million

Another popular name among high dividend stocks, VF Corporation is an American global apparel and footwear company. Headquartered in Denver, United States, the company has 3 brands that are categorised into three types: outdoor, active, and work. In fact, VF Corporation owns nearly 55% of the US backpack market with its brands JanSport, Timberland, Eastpak, and North Face.

The company pays dividends four times a year, and the quarterly dividend amount of VF Corporation is $0.50.

People’s United Financial (NASDAQ: PBCT)

- Dividend Yield: 3.41%

- Market Capitalization: $9.17 billion

- P/E Ratio: 30.96

- Average Volume: 3.98 million

The American bank holding company People's United Financial is listed on the NASDAQ Stock Exchange. The bank has a total of 403 branches spread across the United States. It offers personal banking, credit cards, loans, mortgages, investment, and insurance solutions.

People's United Financial issues dividends on a quarterly basis, and its dividend amount is $0.18. The company has announced to pay its next dividend on 15 February 2022.

Ecolab (NYSE: ECL)

- Dividend Yield: 0.94%

- Market Capitalization: $61.91 billion

- P/E Ratio: 55.10

- Average Volume: 917,380

Ecolab Inc., which is headquartered in Minnesota, is an American corporation that offers water, hygiene, and infection prevention solutions and services. The company aims to make the world healthier, cleaner, and safer. It facilitates companies worldwide, both public and private, to treat their water for not only drinking purposes but also for use in food, healthcare, hospitality, and other industries.

Ecolab pays its dividends, like most other companies, four times a year. The dividend per share of the company is priced at $0.51. The latest pay date is 18 January 2022.

Illinois Tool Works (NYSE: ITW)

- Dividend Yield: 2.00%

- Market Capitalization: $76.54 billion

- P/E Ratio: 28.37

- Average Volume: 874,450

Illinois Tool Works is another example of a high dividend yield stock that regularly offers dividends. This American Fortune 200 company produces engineered fasteners and components, equipment and consumable systems, and speciality products. Some of its notable subsidiaries include Hobart, Miller Electric, Paslode, Brooks Instrument, and the Wolf Range Company.

The dividend per share Illinois Tool Works issues is $1.22, which it pays out quarterly. The dividend price has gone up over the years. In 2019 and 2020, the company paid quarterly dividends of $1.07.

PPG Industries (NYSE: PPG)

- Dividend Yield: 1.43%

- Market Capitalization: $39.17 billion

- P/E Ratio: 27.71

- Average Volume: 1.08 million

PPG Industries Inc. is an American fortune 500 company that supplies paints, coatings, and specialty materials. Headquartered in Pittsburgh, Pennsylvania, the company operates in over 70 countries across the world. It is the largest coatings company in the world by revenue.

The dividend per share issued by PPG Industries Inc. is $0.59, which is given four times a year. There has been a steady increase in the dividend amount, which went from $0.48 to $0.51 in 2019 and has now reached $0.59.

The Clorox Company (NYSE: CLX)

- Dividend Yield: 2.49%

- Market Capitalization: $22.93 billion

- P/E Ratio: 54.00

- Average Volume: 1.21 million

The Clorox Company, headquartered in Oakland, California, is an American manufacturer and marketer of consumer and professional products. The company has four primary segments it operates in: health and wellness, household, lifestyle, and international.

Considered among high dividend stocks in 2022, CLX is listed on the New York Stock Exchange. The Clorox company issues dividends to its shareholders on a quarterly basis, and the most recent dividend amount was $1.16. The upcoming payable date for the CLX dividend is 11 February 2022.

Expeditors International (NASDAQ: EXPD)

- Dividend Yield: 0.95%

- Market Capitalization: $20.61 billion

- P/E Ratio: 17.99

- Average Volume: 1.10 million

Expeditors International is an American logistics and freight forwarding company. It is headquartered in Seattle, Washington. The company has been providing critical logistics solutions for over 40 years. It has more than 350 locations in over 100 countries.

Expeditors International also issues its dividends quarterly, with the payment amounting to $0.29. The payment date for its next dividend is 15 June 2022. While some companies can choose to issue stocks or assets as dividends, Expeditors International pays all of its dividends as cash.

Stanley Black & Decker (NYSE: SWK)

- Dividend Yield: 1.64%

- Market Capitalization: $31.41 billion

- P/E Ratio: 17.46

- Average Volume: 1.33 million

Stanley Black & Decker, which was formerly known as The Stanley Works, is an American multinational company. Headquartered in Connecticut, the company came into being in 2010 with the merger of The Stanley Works and Black & Decker. It manufactures industrial tools and household hardware while also providing security products.

The quarterly dividend amount of SWK stock is $0.79. As is evident and is the standard practice, Stanley Black & Decker also pays its dividends four times a year. Its next dividend will be paid on 22 March 2022.

NextEra Energy (NYSE: NEE)

- Dividend Yield: 1.85%

- Market Capitalization: $163.22 billion

- P/E Ratio: 69.43

- Average Volume: 7.71 million

NextEra Energy is an American multinational energy company that has the capacity to generate 58 GW of energy. In terms of market capitalisation, it is the largest electric utility holding company. NextEra Energy, with its subsidiaries, is the world's largest generator of renewable energy.

With a dividend amount of $0.38, NextEra Energy issues dividends to its shareholders four times a year. The company has a long history of paying dividends since 1989, which boosts investor confidence in its stock, making it another one of our high dividend stocks.

Exxon Mobil Corporation (NYSE: XOM)

- Dividend Yield: 4.90%

- Market Capitalization: $304.27 billion

- P/E Ratio: 21.02

- Average Volume: 21.80 million

Exxon Mobil Corporation, often stylised as ExxonMobil, is an American multinational oil and gas company. Headquartered in Texas, it is one of the world's largest companies by revenue. As a matter of fact, from 1996 to 2017, Exxon Mobil Corporation hovered between the first- to sixth-largest publicly traded companies in the world by market capitalisation.

Paid four times a year, the dividend amount is $0.88. Not only has Exxon Mobil Corporation been paying dividends to its shareholders for over 100 years, but the company has also managed an annual dividend increase for 39 consecutive years.

Sherwin-Williams (NYSE: SHW)

- Dividend Yield: 0.71%

- Market Capitalization: $80.88 billion

- P/E Ratio: 42.20

- Average Volume: 1.09 million

Sherwin-Williams is an American multinational corporation that manufactures and sells paints, coatings, floorings, and relevant products. Headquartered in Ohio, it has operations in over 120 countries. The company has been around for more than 150 years, and as a giant in the industry, it can offer regular dividends to its shareholders, which is why many consider Sherwin-Williams to be a high dividend yield stock.

The dividend amount of SHW is $0.55, paid quarterly. The dividend cover is nearly 0.6.

Becton, Dickinson and Company (NYSE: BDX)

- Dividend Yield: 1.33%

- Market Capitalization: $74.86 billion

- P/E Ratio: 38.32

- Average Volume: 1.25 million

Benton, Dickinson and Company, which is also referred to as BD, is an American multinational medical technology company. The company is renowned for manufacturing and selling medical devices, instrument systems, and reagents. In certain parts of the world, it even offers consulting and analytics services. With the rise in the profits of healthcare-based companies due to the Covid-19 pandemic, it comes as no surprise that BDX is among our high dividend stocks in 2022.

Benton, Dickinson and Company also distributes profits among its shareholders quarterly. The dividend amount each quarter is $0.87.

Cintas (NASDAQ: CTAS)

- Dividend Yield: 0.96%

- Market Capitalization: $41.23 billion

- P/E Ratio: 37.10

- Average Volume: 557,390

Cintas Corporation is an American company headquartered in Ohio, United States. It offers a wide variety of products and services to businesses, including uniforms, mops, mats, cleaning and restroom supplies, first aid and safety products, fire extinguishers and testing, and safety courses, among others. A publicly held company, Cintas is traded on NASDAQ and is one of the largest names in its industry.

The quarterly dividend amount of Cintas stock is $0.95. The company has been paying cash dividends since it went public in 1983. Its dividends have been paid on a quarterly basis.

Walmart (NYSE: WMT)

- Dividend Yield: 1.52%

- Market Capitalization: $402.38 billion

- P/E Ratio: 50.78

- Average Volume: 9.99 million

Headquartered in Arkansas, Walmart is an American multinational retail corporation. The company operates a chain of hypermarkets, discount department stores, and grocery stores, totalling over 10,566 stores worldwide. As the world's largest company by revenue, it comes as no surprise that WMT stock is often listed among very high dividend yield stocks.

As per the board of directors of Walmart, the dividends are to be paid every quarter. The dividend amount is $0.55, and the last dividend payment was made on 3 January 2022.

Johnson & Johnson (NYSE: JNJ)

- Dividend Yield: 2.53&%

- Market Capitalization: $441.86 billion

- P/E Ratio: 25.09

- Average Volume: 7.42 million

Ranking among some of the top names in high dividend stocks in 2022, Johnson & Johnson is known for developing medical devices, pharmaceuticals, and consumer packaged goods. After the Covid-19 pandemic, the company has become a household name due to its contribution to curbing and controlling the virus with its vaccine. While biotech companies are generally in a boom at this time and investors are looking favourably upon such dividend-paying stocks, JNJ is an altogether different story due to its Covid-19 vaccine.

The quarterly dividend amount is $1.06. Johnson & Johnson typically pays dividends four times a year, excluding special dividends, and its dividend coverage is 2.3.

Highest Blue-Chip Dividend Stocks

Blue-chip dividend stocks are stocks belonging to world-renowned, high-quality companies that are leaders in their respective industries. These corporations have stood the test of time and often make regular and growing dividend payments.

The Procter & Gamble Company (NYSE: PG)

- Dividend Yield: 2.18%

- Market Capitalization: $386.73 billion

- P/E Ratio: 29.20

- Average Volume: 8.57 million

The Procter & Gamble Company is an American multinational consumer goods corporation. Specialising in a wide range of personal health/consumer health and personal care and hygiene products, the company is headquartered in Ohio, United States.

The quarterly dividend payments of Procter & Gamble amount to $0.87. The company has been paying dividends for 131 consecutive years since its incorporation in 1890, making it a favourite blue-chip company among investors.

The Coca-Cola Company (NYSE: KO)

- Dividend Yield: 2.74%

- Market Capitalization: $265.17 billion

- P/E Ratio: 30.20

- Average Volume: 19.25 million

The Coca-Cola Company is an American multinational beverage-producing corporation. The company focuses on the manufacturing, retailing, and marketing of non-alcoholic beverage concentrates and syrups, and alcoholic beverages.

The company pays a quarterly dividend of $0.42, and there has been a historical dividend payout since 1964. This makes it a popular name among high dividend stocks.

AT&T Inc. (NYSE: T)

- Dividend Yield: 7.65%

- Market Capitalization: $194.09 billion

- P/E Ratio: 229.29

- Average Volume: 61.59 million

AT&T is the world's largest telecommunications company and the largest provider of mobile telephone services in the United States. It pays a quarterly dividend of $0.52, and since around 2011, the company has raised its dividend by approximately 1.9% a year on average.

Apple (NASDAQ: AAPL)

- Dividend Yield: 0.51%

- Market Capitalization: $2.83 trillion

- P/E Ratio: 30.83

- Average Volume: 103.92 million

A name that needs no introduction among high dividend stocks, Apple is an American multinational technology giant that specialises in consumer electronics, computer software, and online services. The company pays a quarterly dividend of $0.22. Apple has regularly paid dividends from 1987 to 1995, after which it took a break in dividend payment. The company then continued paying dividends from 2012 and, to date, pays dividends to its shareholders.

International Business Machines (NYSE: IBM)

- Dividend Yield: 4.89%

- Market Capitalization: $120.36 billion

- P/E Ratio: 25.42

- Average Volume: 5.69 million

Headquartered in New York, the United States, the International Business Machines Corporation is an American multinational technology company. IBM pays a quarterly dividend amounting to $1.64 per share of its common stock. It has paid dividends to its shareholders since 1989.

Verizon Communications

- Dividend Yield: 4.80%

- Market Capitalization: $220.59 billion

- P/E Ratio: 10.02

- Average Volume: 23.20 million

Verizon Communications., a name common across many lists of high dividend stocks, is an American multinational telecommunications company. Commonly referred to as Verizon, the quarterly dividend payment distributed by the company amounts to $0.64. For the past 14 years, the board of directors at the company has approved a quarterly dividend increase.

Mastercard (NYSE: MA)

- Dividend Yield: 0.53%

- Market Capitalization: $365.65 billion

- P/E Ratio: 45.75

- Average Volume: 4.30 million

Headquartered in New York, Mastercard is an American multinational financial services company. As one of the leading names in financial technology, Mastercard is a global pioneer in payment innovation and technology. The company has been regularly paying dividends since 2006. Its quarterly dividend amount is $0.49.

Companies That Give Dividends Monthly

Sometimes investors are not interested in blue-chip dividend stocks that pay only quarterly but consider those dividend-paying stocks that make payments monthly. In certain cases, such investments make more sense to investors and traders. You would also notice that the names in this section have a very high dividend yield.

AGNC Investment Corp. (NASDAQ: AGNC)

- Dividend Yield: 9.41%

- Market Capitalization: $8.04 billion

- P/E Ratio: 5.72

- Average Volume: 6.85 million

High dividend stocks paying monthly dividends often attract investors due to the regular stream of income they generate. One such stock is that of AGNC Investment Corp., which is a real estate investment trust company founded in 2008. The company primarily invests in agency residential mortgage-backed securities on a leveraged basis. Its dividend amount is $0.12 per common share, which is distributed among shareholders monthly.

Broadmark Realty Capital (NYSE: BRMK)

- Dividend Yield: 8.58%

- Market Capitalization: $1.30 billion

- P/E Ratio: 16.17%

- Average Volume: 1.19 million

Broadmark Realty Capital is a group of money lenders specialising in construction loans designed for real estate investors and developers. The company pays a monthly dividend to its shareholders. The dividend amount for January 2022 was announced to be $0.07 per share of common stock.

Dynex Capital (NYSE: DX)

- Dividend Yield: 9.22%

- Market Capitalization: $620.39 million

- P/E Ratio: 3.59

- Average Volume: 768,160

Dynex Capital is a financial services and real estate investment trust company. The company invests in mortgage loans and securities on a leveraged basis. The monthly dividend of the common stock of Dynex Capital is $0.13.

Conclusion

When choosing high dividend stocks, it is important to not just consider the stocks that have a high dividend yield today but also to account for stocks that have a high current income and promising future prospects. Just like investors evaluate stocks thoroughly before making their investment decisions, you should also use metrics like the P/E ratio, PEG ratio, dividend date, etc., to determine how valuable a stock is.

This, however, is not as simple as merely knowing the figures and statistics. As seen throughout the article, while all the mentioned dividend stocks are high-yielding, they all have different values across their evaluation metrics. While one stock might have a high P/E ratio with a low dividend yield, another might present the opposite case. This makes it important to know how to understand these metrics in conjunction with one another.

Continue reading to get answers to some of the most important questions you need to consider before making an investment in stocks for dividends.

FAQ

Which stock gives the highest dividend?

As of January 2022, the following stocks are being viewed among the highest dividend yield stocks:

- Annaly Capital Management (NLY)

- AGNC Investment Corp. (AGNC)

- New Residential Inv (NRZ)

- Southern Copper Corporation (SCCO)

- TFS Financial Corporation (TFSL)

What stocks give dividends monthly?

Although it is not the standard protocol, there are dividend-paying stocks that offer monthly payments to shareholders. Some of the examples include:

AGNC Investment Corp. (AGNC)

Broadmark Realty Capital Inc. (BRMK)

Horizon Technology Finance Corp. (HRZN)

PennantPark Floating Rate Capital Ltd. (PFLT)

Prospect Capital Corp. (PSEC)

Sabine Royalty Trust (SBR)

Stellus Capital Investment Corp. (SCM)

What are the seven dividend stocks to buy and hold forever?

While this depends largely upon your preferences and future goals, the following dividend stocks can be bought in 2022 to be held forever because they appear to have the potential to grow with the market.

- Johnson & Johnson (NYSE: JNJ)

- Exxon Mobil (NYSE: XOM)

- McDonald’s (NYSE: MCD)

- Apple (NASDAQ: AAPL)

- Chevron (NYSE: CVX)

- PepsiCo (NYSE: PEP)

- Lockheed Martin (NYSE: LMT)

Bear in mind that nothing is guaranteed because even stocks of well-established companies are volatile and unpredictable.

How long do I have to own stock to get the dividend?

There is no definite answer to the amount of time a stock has to be held to get the dividend. A shareholder needs to be registered on the record date in order to get the dividend. For this to happen, they need to buy the stock before the ex-dividend date, which is a day before the record date. Nonetheless, there are companies that might have additional conditions regarding the holding period – the minimum amount of time for which the shares have to be held.

What is a good dividend yield?

The dividend yield is the ratio of the dividends to the current share price, calculated annually. A dividend yield of 2% to 6% is generally considered good. However, there are many factors that influence whether a higher or a lower dividend yield would mean a better stock investment.

Can you buy a stock the day before the dividend?

Buying a stock a day before the dividend is paid is not considered useful because once the ex-dividend date has passed, a shareholder is not eligible for the upcoming dividend. That being said, technically, a stock can still be bought.

Do all stocks pay dividends?

No, all stocks do not pay dividends. You need to especially look for dividend-paying stocks.

Are dividends free money?

Although it may appear so, dividends are not free money. A dividend is a return on investment made into a company's stocks. Moreover, dividends are not always guaranteed either since a company that is not performing well financially may announce a dividend cut.

Is the dividend paid monthly?

Dividends are usually paid on a quarterly basis but may also be paid monthly, semi-annually, or annually. In addition to this, special dividends can be paid at any time of the year. The decision regarding when and how often to pay dividends lies with the board of directors of a company.

How many shares do you need to get dividends?

Although you can buy as many shares as you want or even have just a few to be eligible for a dividend, some companies might have policies in place restricting the number of shares one can or must buy.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.