How to Invest in Coca-Cola Stock

As the stock climbs to pre-pandemic levels, you may be interested in learning more about it and perhaps even buying some shares. To help you make the right choice, let's take an in-depth look at Coca-Cola stock (NYSE: KO).

Coca-Cola Company History and Overview

The Coca-Cola Company manufactures, markets and sells beverages like sparkling soft drinks, water, enhanced water, sports drinks, juice, dairy, plant-based beverages, tea, coffee and energy drinks. Overall, the company has over 3,000 beverage products and more than 500 brands in its portfolio. But carbonated drinks account for 78% of total revenue.

The company was established by Dr John Pemberton in 1886. In 1889, the formula and brand were sold, and since 1919, Coca-Cola has been a publicly-traded company. At the time of the IPO, a single share cost $40. To keep the price low, the company split its stock 11 times since then.

Stock summary:

- Exchange: NYSE

- Sector: Consumer Non-Durables

- Industry: Beverages (Production/Distribution)

- Share Volume: 10,605,054

- Market Cap: 233,576,965,102

- Price-To-Earning Ratio: 32.44

- Payout Ratio: 86.15%

- Earnings Per Share: $1.67

- Annualised Dividend: $1.60

- Current Yield: 3.1%

- Liquidity Ratio: 1

Why Should You Invest in Coca-Cola Stock?

Coca-Cola is a perfect example of a low-volatility blue-chip stock, with a huge market cap, a splendid reputation and many years of success. But what exactly makes it that way?

The Strongest, Broadest, Most Flexible Portfolio of Brands in the Industry

The biggest selling point of Coca-Cola stock is the sheer amount of consumers their products can serve. On top of flagship products, they also offer healthier options and premium products. For example, zero-sugar and diet variants have been on the rise, just like the lucrative sparkling segment. Different price points also help with the growth across different demographics.

Exposure to Growth Markets

Coca-Cola is strengthening in emerging and developing markets like Armenia, Belarus, Bosnia & Herzegovina, Bulgaria, Moldova, Montenegro, Nigeria, North Macedonia, Romania, the Russian Federation and Serbia. The affordability of Coca-Cola products is a huge advantage.

In developed markets, 75% of beverages consumed are commercial products. But in emerging markets, it's only 25%. Since 80% of the world's population lives in developing economies, it's a huge opportunity for Coca-Cola's commercial strategies.

Relentless Focus on Cost and Efficiency

Operating leverage and margin expansion are the company's strong sides. Most of their current large-scale restructuring work has been done for performance- and cost-enhancing reasons. So far, the strategy has been a success.

Since the company strives for further efficiencies, investors can expect a positive effect from such strategies.

Healthy Dividend

With the end of the pandemic in sight, investors may be surprised by how well-suited Coca-Cola is for funding dividend payments compared to competitors. Even before, the company hasn't failed to raise its dividend for 59 consecutive years. In February this year, they announced a quarterly payment increase by a penny to $0.42 per share.

How Much Does Coca-Cola Stock Cost?

At the time of writing, here's the most recent data about the Coca-Cola stock, according to Yahoo! Finance.

|

Date |

Open ($) |

High ($) |

Low ($) |

Close ($) |

Adj Close ($) |

Volume |

|

Jul 06, 2021 |

53.99 |

54.09 |

53.55 |

53.88 |

53.88 |

7,592,810 |

Fundamental Analysis of Coca-Cola Stock

Fundamental analysis of a company includes growth, valuation, profitability, health and a few other factors. Let's measure Coca-Cola's intrinsic value together by examining all of its available economic and financial indicators and drivers.

What Affects Coca-Cola's Stock Price?

Below are the three main factors that are likely to determine the KO stock price in the upcoming years and months.

- Brands in the portfolio. Since 2006, 11 billion-dollar brands have been added to the company's portfolio, which now has over 500 brands. Each of them (or at least the majority) needs to do relatively well to keep the revenue and stock growing.

- Market volatility. The global presence of Coca-Cola leaves it vulnerable to political and economic instability in certain regions. If any of the markets suffer from an economic downturn and cautious consumer spending, the stock follows the same pattern.

- The public health debate. There's a long-standing war between the public health community and private industry. The company has been accused of shifting the debate but promised to do a better job engaging both the public health and scientific communities. If it fails to meet the 'healthier' debate, the stock will be impacted negatively.

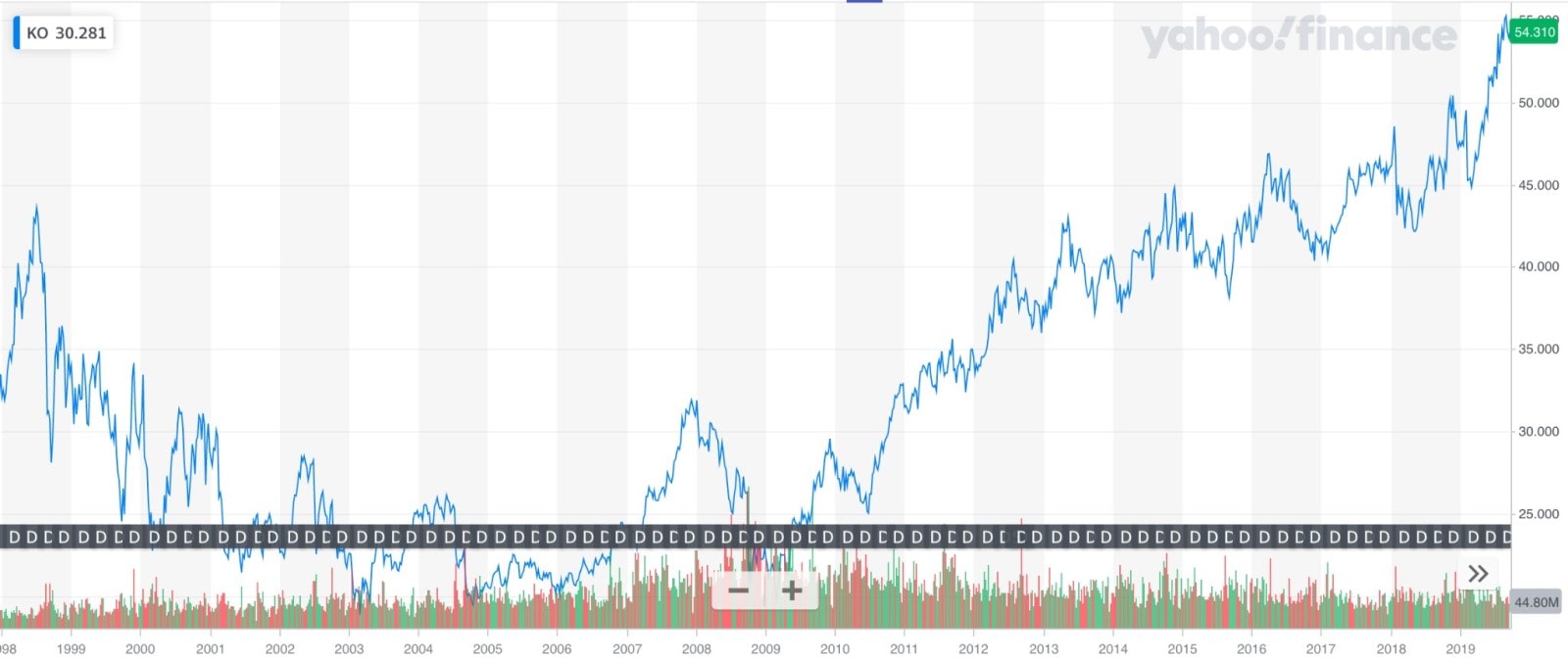

Historical Performance of Coca-Cola Stock

Let's start with Coca-Cola's peak performance in the late 1990s and look through the highest price jumps up to this day:

- $44: 100-year partnership with the National Basketball Association and rising interest from institutional investors in 1998

- $21: Early 2000s recession

- $30: The mediocre recovery due to the company's acquisitions in 2002

- $19: Pesticide controversy of 2003, during which the company underperformed

- $24: Volume grew by 2% to 19.8 billion unit cases in 2004

$19: The lowest point of the 2007-2009 financial crisis

- $33: The company increased its 2011 advertising spending by 78%

- $42: Rising consumer spending in 2012-2013

- $38: Coca-Cola declared 2015 a transition year

- $43-$55: A long streak of solid financial results in 2016-2019

- $60: The highest stock price in the company's history was followed by a sharp drop in 2020 down to $38

- $38-$56: Steady rise from the pandemic-related difficulties

How Coca-Cola Responded to the Coronavirus Outbreak?

Coca-Cola entered 2020 with solid momentum. But as the COVID-19 spread, the company suffered from sudden changes in consumer purchase patterns, such as sharp drops in away-from-home channels.

As a response, Coca-Cola cut about 2,200 jobs globally and implemented a restructuring plan. According to the company's spokesman, annual savings were expected to be $350-$550 million. By the end of 2020, full-year free cash flow was $8.7 billion, up 3%.

The global unit case volume is now back to 2019 levels since at-home consumption was still high. The company's representatives mentioned that their recovery is asynchronous around the world. Revenue from restaurants and sporting venues is still suffering.

Coca-Cola Q3 2021 Results

The company's Q4 earnings call is scheduled for 10 February 2022, so let's look at key results in Q3 2021 in the meantime:

- Global unit case volume grew by 6%

- Net revenues increased by 16%

- Operating income rose by 26%

- EPS grew by 41% to $0.57

Overall, the performance is incredibly positive. One of the reasons was the focus shift to the assortment of multi-serve can products in take-home outlets. On-premise sales channels are also doing better thanks to easing COVID-19-related restrictions. These results indicate that the company is back on the path to success.

What Does Coca-Cola Have for the Future?

The Coca-Cola Company is conducting a portfolio rationalisation process, reinforcing 5 categories with the strongest consumer opportunities:

- Coca-Cola

- Sparkling flavours

- Hydration, sports, coffee and tea

- Nutrition, juice, milk and plant

- Emerging categories

Another new venture is Platform Services. Under this unit, Coca-Cola will offer data management, consumer analytics, digital commerce and social/digital hubs. This is very likely to become a steady source of future revenue.

The company's structural changes made investors hopeful. Twenty-two analysts offered 12-month price forecasts for Coca-Cola, resulting in a consensus Buy rating.

But the structural changes aren't all positive. They also require reallocation of existing resources, and further cuts are on the way. There's currently a voluntary separation program, but it's not clear how smoothly the process will go. Coca-Cola representatives noted they would share more information in the future.

Technical Analysis of Coca-Cola Stock

Looking at the chart, we can see that the stock broke the previous resistance level of $57.00 and moved into a Double Bottom formation. Daily signals are bullish with expected further upside, although it's important to consider new support and resistance levels.

Key levels to watch out for:

- Support 3: 57.61

- Support 2: 58.27

- Support 1: 59.56

- Resistance 1: 61.51

- Resistance 2: 62.17

- Resistance 3: 63.46

On a monthly chart, technical indicators are leaning towards a Buy. Below, you'll find detailed info for some of the most popular ones.

Oscillators:

- Relative Strength Index (14) - 61.09 - Neutral

- Stochastic %K (14, 3, 3) - 81.46 - Neutral

- Average Directional Index (14) - 14.70 - Neutral

- Awesome Oscillator - 3.77 - Buy

- Momentum (10) - 8.13 - Sell

- MACD Level (12, 26) - 2.23 - Buy

Moving Averages:

- Exponential Moving Average (50) - 50.61 - Buy

- Simple Moving Average (50) - 50.20 - Buy

- Exponential Moving Average (100) - 46.43 - Buy

- Simple Moving Average (100) - 46.25 - Buy

- Exponential Moving Average (200) - 39.08 - Buy

- Simple Moving Average (200) - 37.60 - Buy

Pros and Cons of Buying Coca-Cola Stock

We summarised the argument for and against buying the stock.

|

Pros |

Cons |

|

|

What Can You Do With Coca-Cola Stock?

Investors who are in the know were in an optimistic mood about Coca-Cola. But even if you're confident about buying Coca-Cola shares, you need to decide whether you want it to be a short-term or a long-term purchase. Find out below whether you'll make a good investor or a good trader.

Investing

There are two ways investors can potentially benefit:

- Selling their investments for more than they paid.

- Receiving payments in the form of dividends.

Both can work well with Coca-Cola in the long term. Regardless of the strategy you take, investing requires you to study important company fundamentals, such as:

- Earnings

- Sales

- Debt and debt-to-asset ratio

- Equity

- P/E ratio

- PSR

- ROE

Who should diversify their investment portfolio with Coca-Cola stock? Those who:

- Want to possibly grow wealth over a longer period of time

- Are more risk-averse

- Don't want to constantly be involved in market movements

Trading

The process may be confusing for beginner traders at first but buying stocks is actually straightforward:

- Choose your broker, open an account and fund it.

- Analyse the market and don't focus too narrowly on one single aspect of the trading game.

- Choose your order type: market order (Buy or Sell), pending order (Sell Stop, Sell Stop, Buy Limit or Sell Limit).

- Go to the Coca-Cola chart in the trading platform and enter how many shares you want to purchase.

- Monitor your position and adjust technical parameters that favour profit and loss targets if needed.

You won't be required to track the fundamentals nearly to the same extent, but you will need to learn at least the basics of technical analysis - charts, indicators, trends, patterns, and entry signals.

Only market makers and ECNs may trade in the pre-market (4:00-9:30 am EST) and the after-hours market (4:00-8:00 pm EST). These are the periods when stock prices usually fluctuate more quickly. Regular trading hours for the NYSE and Nasdaq are 9:30 am to 4 pm ET on weekdays (except for stock market holidays).

Who should speculate on Coca-Cola stock? Those who:

- Don't want to hold a position for years

- Are eager to participate in the market more actively

- Seek higher returns

- Tolerate more risk

Conclusion

Coca-Cola shows incredible fundamentals and operates the sector's largest distribution and logistics chain. The fact that it can adapt to changes can also help the company leverage its position for both existing and new brands.

If you keep your investment strategy simple, you have the chance to see some acceptable returns over a longer timeframe. However, it's not the only viable option you have. Some might actually prefer to play the short-term game. But please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital. And for beginners, there is a perfect introduction to trading activities.

If you want to master the tools of stock CFDs trading, practice on a Libertex demo account first. Without any financial risk, you will learn how to analyse price actions, chart figures, support/resistance lines, market's hours, among other things. Get access to a virtual portfolio and train on live quotes under real market conditions risk-free.

FAQ

Should I Sell Coca-Cola Stock?

That is not the recommendation that most experts have. On the contrary, the company is expected to continue with aggressive investments into developing markets. This should drive sustainable long-term growth that may reward those who stick to their shares.

Does Coca-Cola Stock Pay Dividends?

Yes, the company pays dividends. Moreover, it's one of the reasons investors choose this stock. Compared to the 1.6% yield you can expect from the average S&P 500 stock, Coca-Cola's yield is quite generous, about 3% per year. It's definitely not the biggest percentage you can find on the market, but for such a consistently profitable company, it is more than decent.

Is Coca-Cola a Good Dividend Stock?

In short, yes. If you consider buying Coca-Cola stock for dividends, it can be a very lucrative opportunity. Some of the reasons are the company's long-standing commitment to raising dividends, strong free cash flow, and a better yield than in the rest of the market.

For example, even when the sales fell by 9% in 2020, the company's free cash flow was $8.7 billion, which was more than enough to pay $7 billion of dividends.

Is Coca-Cola Publicly Traded?

Yes, Coca-Cola is publicly traded and listed on the New York Stock Exchange under the ticker symbol KO. The IPO of Coca-Cola took place more than a century ago. Ever since, KO has been traded on the stock exchange and as part of multiple stock indices.

How Many Shares Does Coca-Cola Have?

Coca-Cola has more than 4.3 billion outstanding shares (the number of shares held by shareholders, including insiders). 4.3 billion shares also assume the conversion of all convertible debt, securities, warrants, and options.

Why Is Coca-Cola Stock Down?

The biggest drop in recent years was last year. Coca-Cola's revenues were dragged down by the closure of restaurants, bars, and other venues.

But the most recent drop, although less severe, had a spurious correlation to the comment made by Cristiano Ronaldo. Celebrities affect the positioning of brands in consumers' minds, including iconic brands like Coca-Cola. As a result, Coca-Cola lost $4 billion in market value and $3 in share price.

How to Buy Coca-Cola Stock?

Here is how you can become a shareholder:

- Find a good online broker that offers stock trading.

- Create a brokerage account.

- Deposit money to your account using a credit/debit card, electronic wallet, or any other available method.

- Open the trading terminal, indicate the number of shares you wish to buy, and click buy.

- Review your position regularly, even if you used a stop-loss order.

Should I Buy Coca-Cola Stock?

Coca-Cola is practically set for success. Over the years, Coca-Cola has made some radical changes to adapt to the market, and the company's global market still has tremendous opportunities. It performs better than its peers, and finally, its reach is far more extensive in restaurant chains and food outlets than any other soft drink brand.

Will Coca-Cola Stock Continue Dropping?

Unlikely. The reason for Coca-Cola shares dropping in 2020 was not exclusive to the company. The whole market took a hit, and most didn't even recover to the same level as Coca-Cola. As for the 2021 price drop, it is impossible for any company to avoid short-term corrections. But in this case, the company's fundamentals are too strong for celebrity remarks to deeply affect it in the long term.

Is Coca-Cola Stock a Good Buy?

Coca-Cola has been a value investor choice for many decades. Plus, the company has received a consensus rating of Buy from experts. But even in times of disruptions and volatility, there are great opportunities for traders. So, there might be profitable prospects both for investors and traders.

How to Buy Coca-Cola Stock Without a Broker?

Coca-Cola shares can be purchased through a Direct Stock Purchase and Dividend Reinvestment Plan. The purchase will be facilitated by Computershare Trust Company. If you want to know more details, including any fees associated with the Plan, they can be viewed on the company's website. However, the process is a bit more complicated than with a broker and isn't commission-free.

How Much Is One Share of Coca-Cola Stock?

At the time of the update (28 January 2022), one Coca-Cola share was worth $60.84. Compared to the previous day's close, it dropped $0.49.

Is Now a Good Time to Buy Coca-Cola Stock?

The stock is currently going through a volatile period after a minor media controversy. With the price slightly lower than it was before the turmoil, you can buy low and sell high. With a company of this size, it won't take long to recover and close at a new high.

When Will Coca-Cola Stock Split?

The last Coca-Cola 2-for-1 stock split happened in 2012, and the one before that occurred in 1996. Because of this long interval between past splits and based on the company's stable performance, there are no significant reasons to assume there will be another stock split any time soon.

Will Coca-Cola Stock Make a Good Long-Term Investment?

Investing is inherently risky, but there are many signs that Coca-Cola stock can be a good addition to a portfolio, as provided above.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.