How to Invest in GameStop

The diverging views on GameStop Investing run deep, but this article will provide some useful information so that you can make that decision. If you want to find out about the history of GameStop, fundamental and technical analysis of GameStop's stock and more, read on.

The History of GameStop Corp.

GameStop Corp. (GME) was founded almost four decades ago in 1984 in Dallas, Texas. The company was originally named Babbage's and focused on selling games for the Atari 2600 and Nintendo game systems. In 1999, the company rebranded as GameStop and was purchased by Barnes & Noble Booksellers.

Over the years, GameStop has branched out, selling games for the PlayStation and Xbox game systems as well as for Nintendo consoles. The company sells the consoles themselves in addition to gaming accessories. It also accepts trade-ins on older consoles and video games, which it then sells second-hand.

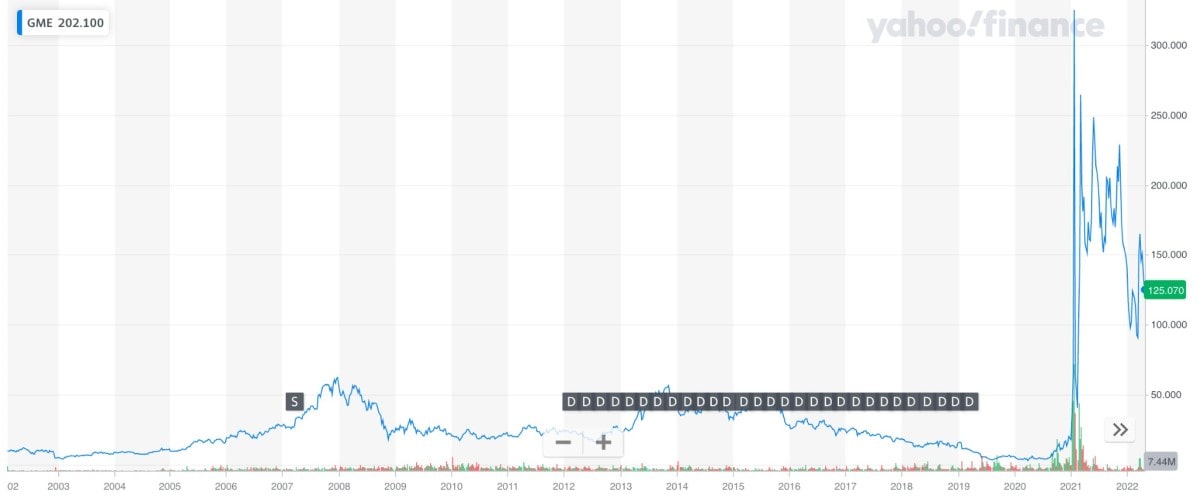

Source: Yahoo! Finance

GameStop shares are traded on the New York Stock Exchange (NYSE). At the beginning of 2021, after several years of poor performance on the market, it was targeted by Reddit users from the subreddit r/WallStreetBets, a forum for retail investors. When it was announced that a number of hedge funds had taken large short positions, these Redditors used trading platforms to purchase a great many GME shares. This pushed up GameStop's stock price, pressuring these hedge funds to buy the stock at higher and higher prices.

GameStop stock was valued at about $17 per share at the beginning of 2021 but reached a high of $483 during this short squeeze. As of 29 April 2022, over a year later, the price has dropped to $123.50 per share.

Should I Invest in GME Stocks?

GameStop's short squeeze is long past, but you may wonder if it's worth investing in GME stock nonetheless. Before making that decision, you should take the time to carry out the basic fundamental and technical analysis of the company and its stocks.

This section of the article will take a closer look at the fundamental and technical analysis of GameStop shares. It will also answer some useful questions regarding ETFs with GameStop shares, GME stock volatility and share dividends.

Fundamentals You Should Know Before Investing in GameStop Shares

Looking at a stock's fundamentals is a good way of trying to gauge its worth. With fundamental analysis, an investor will try to evaluate the inherent value of a stock.

So, what do GameStop's fundamentals reveal about its possible performance on the market? Many analysts believe that things are looking bad for the company and that they will not pick up this year. GameStop's chart and fundamentals are currently underperforming 86% compared to other companies.

What's more, it's thought that during this fiscal year, GME could lose up to $122 million total. This is largely due to the fact that GameStop sells its games in a physical format from brick-and-mortar stores based in malls around America. By contrast, more and more gamers are buying and downloading their games online.

That said, some analysts still believe that there is a reason for optimism. It could be that there are plans in the works to turn GME into a tech company, with NFTs, e-commerce and hardware all possibilities for the future. This might well turn GameStop's luck around.

Technical Analysis of GME Stock

Where fundamental analysis is based on fundamental characteristics of a stock, technical analysis is instead based on interpreting information from charts. Some people believe this method of analysis is superior to fundamental analysis, but real stock experts will use a combination of the two, knowing when one is more appropriate to a situation than the other.

On 29 April 2022, the value of GameStop was 15.72% lower than it was a year ago and 24.92% lower than it was just 20 days ago. In less than a month, the value of GME stock has dropped by almost a full quarter.

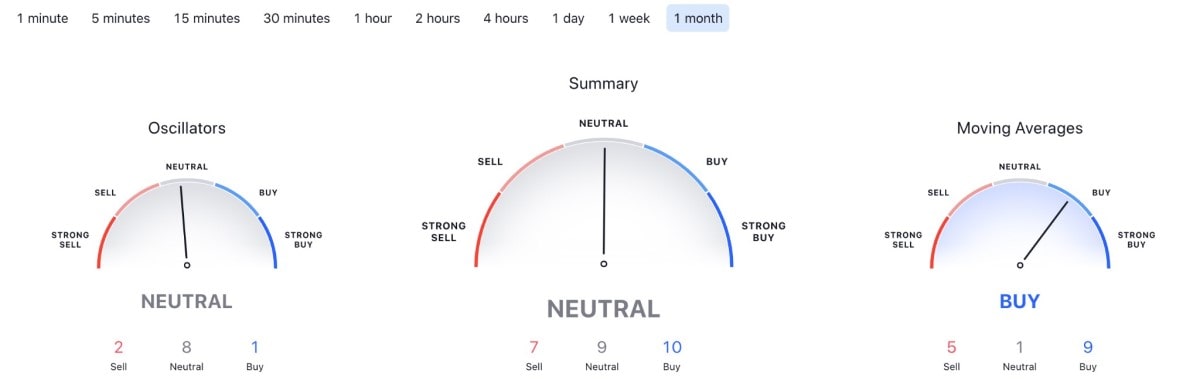

Source: Trading View

Are There ETFs With GameStop Shares?

ETFs, or exchange-traded funds, are a good way of investing in stock while also minimising risk to your portfolio through diversification (although risk can't be avoided entirely). An ETF can be thought of as a bundle of assets that are sold all together on an exchange. They include all sorts of investments, from stocks and bonds to commodities and more.

Given the usefulness of ETFs, you may wonder if there are any with GameStop shares. There are! In fact, more than 100 ETFs currently hold GME stock.

The top three best-performing ETFs with GameStop shares are SoFi Social 50 ETF (SFYF), Defiance Digital Revolution ETF (NFTZ) and ProShares Ultra Consumer Services (UCC).

The top three ETFs with a substantial number of GME stocks are iShares Core S&P Mid-Cap ETF (IJH) with 1.77M shares, SPDR S&P Midcap 400 ETF Trust (MDY) with 540.09K shares and iShares S&P Mid-Cap 400 Growth ETF (IJK) with 416.65K shares.

How Volatile Is the Price of GME Stock?

GameStop's stock does have something of a reputation for high volatility. January 2021 saw gains of more than 2,700% when GME rose from $17 to $483 per share over the course of the month. On 24 February 2021, the price surged again by more than 100% to $91.71 by the closing hours of the day.

The share price of GameStop has shifted irregularly ever since. So far, GME is performing less favourably in 2022 than it did the year previous.

One popular method of calculating the volatility of a stock is by looking at its beta. The beta of a stock is a measure of its volatility compared to the market, which has a beta of 1.0. Stocks with a beta greater than 1.0 move more than the stock market over a given period of time, while stocks with a beta smaller than 1.0 move less. The former are considered riskier stocks to invest in but have the potential for reaping higher rewards, whereas the latter are considered less risky but are also generally less profitable.

As of 29 April 2022, GME's beta, calculated using figures from the past five years, is roughly -1.52. In simple terms, this means that when the stock market has moved up or down, GameStop's stock has gone against this trend.

Generally speaking, stocks that have a beta of more than 1 or less than -1 tend to have higher volatility. So, GME's beta of -1.52 would seem to indicate that it's quite a volatile stock. The volatility of GameStop shares is made evident when we compare its beta to those of similar companies.

|

Stock |

Beta |

|

GameStop Corp. (GME) |

-1.52 |

|

Nintendo CoLtd (NTDOY.US) |

0.62 |

|

Sony Group Corp. (SNE.US) |

0.81 |

|

Microsoft Corp. (MSFT.US) |

0.91 |

Have GameStop's Shares Ever Split?

A stock split is when a business decides to raise the liquidity of a stock by increasing the total number of shares. Stock splits do not affect the value of a company, but the number of shares held by investors is multiplied.

GameStop has split once in the past. Back in 2007, they underwent a 2-for-1 split, meaning that every stock an investor owned would turn into two stocks by the next day.

The company also plans to stock split later in 2022. Before that, they need permission from their main shareholders. Until these shareholders confirm this request, it is unlikely that more specific details will be released. Historically, shareholder meetings have taken place in June, so it's reasonable to assume we may hear more in June 2022.

GameStop Share Dividends

Due to declining revenues and increasing debt, GameStop isn't currently paying dividends. Furthermore, it's unlikely that the company will pay dividends any time within the next year or so. If this is a deal-breaker for you, then you will not want to invest in GME any time soon.

How to Invest in GME

There are a few steps you have to take to invest in GME This section will briefly break down the process for you.

-

Find a platform with access to GME stock

There are several services that have access to GME stock, but you shouldn't just choose the first one you happen to find. Instead, you should carefully compare different platforms to see which suits you best.

Perhaps the most important thing to consider is the overall cost of the services. Is there an account minimum? Does the platform charge higher fees than others? Especially when you're just getting started investing and haven't yet built up a lot of capital, you should be careful about how much you spend.

There are other points to consider besides cost, however. Different platforms offer different features to their users. Some might offer educational programming, a wide variety of assets or paper accounts. You should also consider things like the accessibility and user-friendliness of the services and the helpfulness of their customer service.

-

Open a brokerage account

The next step is to open an account with a broker. Brokers should be seen as a gateway to the stock market. Without going through a broker, it is impossible to invest or trade in stocks.

Again, carefully consider what you want from your broker before completing your application to one. Some brokers offer more services than others, though this does come at a slightly higher cost.

For example, full-service brokers offer a consultancy service for their users alongside regular broker services, which might be especially handy for new investors. On the other hand, if you're looking to save money where you can, it might be worth considering a discount broker.

As with choosing a platform, you shouldn't consider the cost alone but should also see what types of services one broker might offer that others don't.

-

Deposit funds into your account

Once you've chosen your service and have successfully applied to your broker of choice, it's time to deposit funds into your account. To do so, you'll first have to confirm your payment details. You'll also have to provide personal information, contact details and your National Insurance number.

Different platforms offer a variety of payment methods, including everything from bank transfers to e-wallets. If certain payment methods suit you better than others, you should check before applying to a broker what payment methods they accept.

-

Find out more about the stock

Before making any purchases, make sure that you've found out as much about the stock as you can. This is something you should do for all investments, not just investments in GME shares.

You can find the stock by searching for its name or for its stock ticker — GME, in the case of GameStop Corp. Check to see how it's been performing on the market and see if you can identify any stock chart patterns. It's also worth looking to see what predictions expert analysts are making about the stock. Performance forecasts should not be seen as a guarantee, but they can be a good way of gauging how shares might behave.

-

Purchase shares

After you've done your research, you're ready to purchase shares. You can either purchase stock immediately or wait until the stock has come to the desired price point.

After you've decided how you'd like to purchase your shares, decide how many you want to buy. If you're new to investing, it's generally advisable to start small. That way, you can potentially limit the amount of risk you put yourself at.

-

Track your stock

Once your purchases have been made, the only thing left to do is to track your stock. By monitoring your investment, you'll be in a better position to optimise your portfolio.

Is GameStop Stock Undervalued or Overvalued?

One of the most difficult tasks in investing is accurately valuing stock. Any one metric must be seen within the context of the big picture, and you cannot lose sight of this. That being said, there are some key statistics that investors and traders often use to try and calculate value.

This section will look at two of these metrics to try and ascertain how valuable GameStop stock is. These two metrics are GME's price/earnings-to-growth (PEG) ratio and its Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA).

Source: Yahoo! Finance

GameStop's PEG Ratio

A company's PEG ratio is calculated by taking its price/earnings ratio and dividing it by its rate of growth. A PEG ratio of less than 1 can indicate that the stock's shares are not overvalued, given its current growth rate.

The PEG ratio of a business gives a broader sense of how it's performing in the market. This is because it looks forward, taking the company's growth rate into account to give an analyst greater insight into how much value it will hold in the future.

GME's PEG ratio is 0.86, indicating that its shares are not overvalued. GameStop's PEG ratio is significantly less than those of other video game retailers, as the below table shows.

|

Stock |

PEG ratio |

|

GameStop Corp. (GME) |

0.86 |

|

Nintendo CoLtd (NTDOY.US) |

4.18 |

|

Sony Group Corp. (SNE.US) |

1.94 |

|

Microsoft Corp. (MSFT.US) |

1.91 |

GameStop's EBITDA

EBITDA is used to determine the financial performance of a company. In certain scenarios, analysts may use this metric instead of net income. One downside of EBITDA, however, is that it doesn't take into account various business expenses, such as capital spent on property and equipment. Despite this, EBITDA remains a popular way of measuring corporate performance as it shows a company's revenue before various financial deductions.

GameStop's EBITDA is $111.3 million, which, when compared to that of similar companies, is fairly low. See the table below for examples.

|

Stock |

EBITDA ($) |

|

GameStop Corp. (GME) |

111.3 million |

|

Nintendo CoLtd (NTDOY.US) |

603.8 billion |

|

Sony Group Corp. (SNE.US) |

11.7 billion |

|

Microsoft Corp. (MSFT.US) |

90.8 billion |

Should You Buy or Sell GameStop Stock?

So, should you sell or buy GameStop stock? Ultimately, only you can decide whether you are willing to take the risk involved with investing. However, their article has outlined some of the pros and cons of purchasing GME stock.

On the one hand, GameStop does have a history of very high prices. If the company makes a move to become a tech company, as it is thought they might, then their value will go up thanks to them branching out into NFTs, hardware and more.

On the other hand, GME stock has been declining in value fairly steadily since its short squeeze last year. It has also shown itself to be quite a volatile stock.

It is difficult to predict how GME will perform for the rest of 2022. But, as with any investment, it would be prudent to proceed with caution. Do your research, and make sure you engage in proper market analysis before making any kind of investment decision.

FAQ

Is it still worth investing in GameStop?

Opinions are mixed on whether or not GameStop is still worth investing in. While GME stock did see a dramatic increase in cost at the beginning of 2021, its value has since declined. What's more, GameStop appears to be quite volatile.

Can you invest in GameStop stock?

Yes, you can invest in GameStop stock on the NYSE. To do so, you will first have to make an account through an online brokerage. Make sure that before you invest in GME stock, you take the time to thoroughly research the company first. Also, please note that, due to the volatile nature of the stock, some exchanges have prohibited its purchase.

Can you still sell GameStop stock?

Yes, you can still sell GameStop stock. It may not bring in as many earnings as it would have if you had sold them in the short squeeze of January 2021, but it is still possible. Don't wait too long for the 'perfect price' to come along; many investors fall into this trap and end up losing money in the long term.

What is a short squeeze in the stock market?

A short squeeze takes place when a particular stock increases sharply in price. This forces any investors who have shorted the stock to buy it so that they don't incur greater losses. In January 2021, this is what happened to GME stock when retail investor accounts from Reddit invested in GameStop en masse, driving its value up.

Is GME's short squeeze over?

Yes, GME's short squeeze is over. The short squeeze was relatively short-lived, lasting throughout January 2021 and surging briefly at the end of February 2021. Since then, GameStop's stock value has been dwindling.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.