Limit Order vs Market Order

There are three main types of orders: a market order, limit order and stop order. Choosing one over the other can completely change the outcome of your trading, which underlines the significance of understanding these orders in depth.

In this article, we'll look at a limit order vs market order, how they differ from each other and when to use each one.

Limit Order: Explanation and Usage

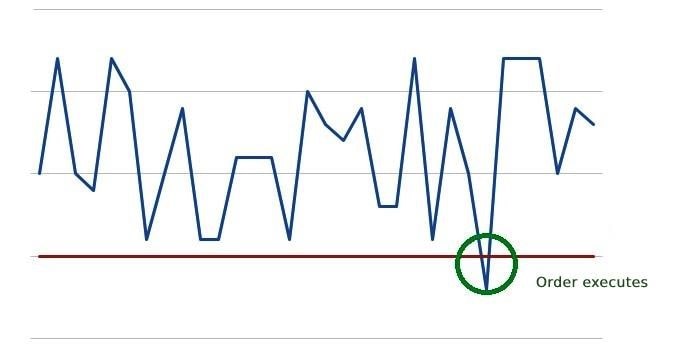

A limit order is an order to buy or sell a stock with a limit or restriction placed on the minimum price to receive or the maximum price to pay for the stock. There's no guarantee that the trade will be executed when it's a limit order because the order is filled only when the specified price is met or better. If the stock never reaches the specified limit price, the trade will never execute.

The main focus of a limit order is on making a trade when the price is desirable. An investor decides on their limit price for a particular stock, and if the stock reaches that price, the order is highly likely to be filled. In fact, at times, the vendor might even fill your order at a slightly better price. The usual timeframe for limit orders to execute once you have entered them is three months.

There are two types of limit orders: a sell limit order and a buy limit order. A buy limit order is executed at the limit price or lower, whereas a sell limit order is executed at a price equal to or higher than the limit.

Example

If a stock is trading at $10, someone looking to buy it might set a limit of $9 and only buy the stock at $9 or lower. Conversely, someone wanting to sell their shares might set a limit of $11 and only sell their shares at this price or higher.

This way, the investor ensures that no matter how the stock market is performing, no trigger would cause their stocks to be bought or sold at a loss. While playing safe with stocks is appreciated, such an investment strategy might leave one bereft of the high profits that often accompany slightly riskier orders.

What to Keep in Mind When Trading

The biggest disadvantage of this type of order remains the lack of a guarantee that the trade will execute. If the price never reaches the set limit, the trade will not go through. Interestingly, even if the price does reach the limit, there might not be enough supply to cater to the demand, or there simply might not be enough demand in the first place. In fact, this is often the case for illiquid stocks. This highlights the need to set careful, thoroughly-researched and well-calculated limits when placing a limit order.

When making the choice of limit order vs market order, the following are a few of the scenarios where experts might prefer a limit order.

- A limit order can be useful when you want to quote a price that is very different from the market price.

- This kind of order can also be beneficial if you're looking to trade an illiquid stock or a stock whose bid-ask spread is huge.

- It can also be advantageous when trading a large number of shares.

Market Order: Explanation and Usage

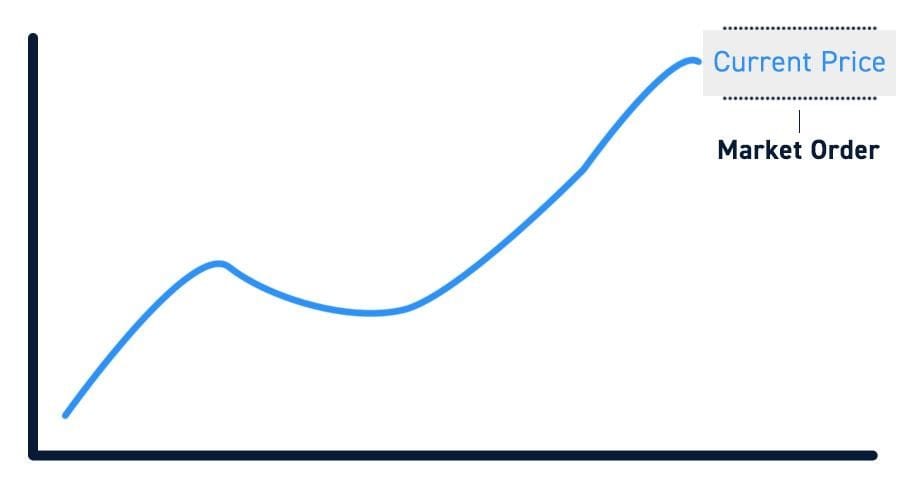

A market order buys or sells a stock at the current best price of the market. It focuses on guaranteed execution of the trade at the stock's going price. This brings the benefit of your broker being able to execute the trade quickly since they will take the best price available at any given moment. This means that when buying a stock, the price will be what the seller demands, whereas, when selling, it'll be set according to how much the buyer deems fit.

What to Keep in Mind When Trading

The main disadvantage of this order is that an investor can't set their own price. The trade has to be executed at the price decided by the buyer or seller. However, this issue is not as problematic as it seems because it often does not even matter, particularly for large corporations with highly liquid stocks.

Another problem associated with a market order is that of volatility. If the price of a stock swings drastically, an investor can end up trading at a very different price from when they entered the market. Although this is not a common occurrence at all, it's still possible.

To be on the safer side, market orders are usually placed during market hours. This is because if a market order is placed after the closing of the market, it can only be executed at the next market open, and there is no telling whether it would be higher or lower than its previous close.

When debating limit order vs market order, a market order is a useful choice in the following situations.

- Choose a market order when execution is your highest priority.

- A market order is preferred with a stock with high liquidity and a narrow bid-ask spread (usually only a penny).

- When trading very few shares, opt for a market order.

- A market order is common among experts who are looking for a long-term investment in a security. In this case, it's better to buy the stock at its current price.

Limit Order vs Market Order: Comparison

Presented below is a comparison of limit order vs market order according to leading factors that are considered when assessing financial orders.

|

Factor |

Limit Order |

Market Order |

|

Execution Timing |

The order will not be executed if the target price is not met. |

The order executes immediately at the best price available. |

|

Execution Price |

There is control over the order price, which executes at the investor's set limit. |

Order usually executes at the most recent market price. |

|

Additional Fees |

Orders can be more complicated and, thus, often incur extra expenses. |

There are no additional fees associated with market orders. |

|

Trade Execution |

The orders may be partially filled. |

The order always goes through. |

As is evident from the comparison above, one can't choose just one between limit order vs market order because both can be beneficial and disadvantageous in different kinds of situations. To choose one over the other, make a meticulous assessment of your requirements and preferences before researching which of these two better suits those needs.

Conclusion

Regardless of whether you're buying or selling, it's crucial to identify your main goal when trading. This can be having your order filled as soon as possible at the current market price or when setting your own price. Only then can you begin determining the right order type for you. Additionally, and especially for beginners, it can be useful to experiment and become familiar with the different ways of controlling your order before you begin trading with your money.

To try your hand at different order strategies free of cost and in a completely risk-free space, you can start with a Libertex demo account (which has no account fee) to learn the basics of limit and market orders. You can also find professional investment advice regarding different orders there.

FAQ

Is a Limit Order Better Than a Market Order?

When it comes to the choice of limit order vs market order, market orders are generally considered less risky than limit orders because the former is guaranteed to execute a trade.

How Does a Limit Order Work for Buying?

A buy limit order can only be executed at the limit price or lower.

Do Market Orders Get Filled Before Limit Orders?

Yes, market orders are filled before limit orders.

Can You Lose Money on Limit Orders?

If limit orders get executed in response to news in the markets, money can be lost.

Are Market Orders Bad?

Market orders have drawbacks, such as no say in selecting the price, but they come with their own advantages.

Why Is A Limit Order Better Than A Market Order?

A limit order may or may not be better than a market order depending upon the exact requirements and market conditions. So, there's no clear winner in the limit order vs market order scenario.

Do Limit Orders Move Prices?

A limit order doesn't shift the market or stock prices the way a market order can.

Is It Safe to Place Market Orders?

Market orders are usually considered when the market is moving swiftly against you, and you want to exit the trade immediately. Otherwise, many experts suggest avoiding them.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.