Moderna (MRNA) Stock Forecast

Learn why Moderna is currently among the most popular stocks, what affects its stock price, and what is the Moderna stock forecast according to the experts. If you're looking for longer-term information, you can also check out the price predictions for the years beyond 2026.

About Moderna (MRNA) Stock

Moderna Inc. is a US pharmaceutical and biotechnology company based in Cambridge, Massachusetts. It specialises in RNA therapeutics, with a primary focus on mRNA vaccines. These vaccines use messenger RNA, or mRNA, which is a copy of a molecule, to produce an immune response in the body.

Currently, the biotech company has only one commercial product, namely the Moderna COVID-19 vaccine. Since its inception, the company has worked towards building a leading mRNA technology platform, created infrastructure to accelerate drug discovery and developed an expanding pipeline to create a new generation of transformative medicines for patients.

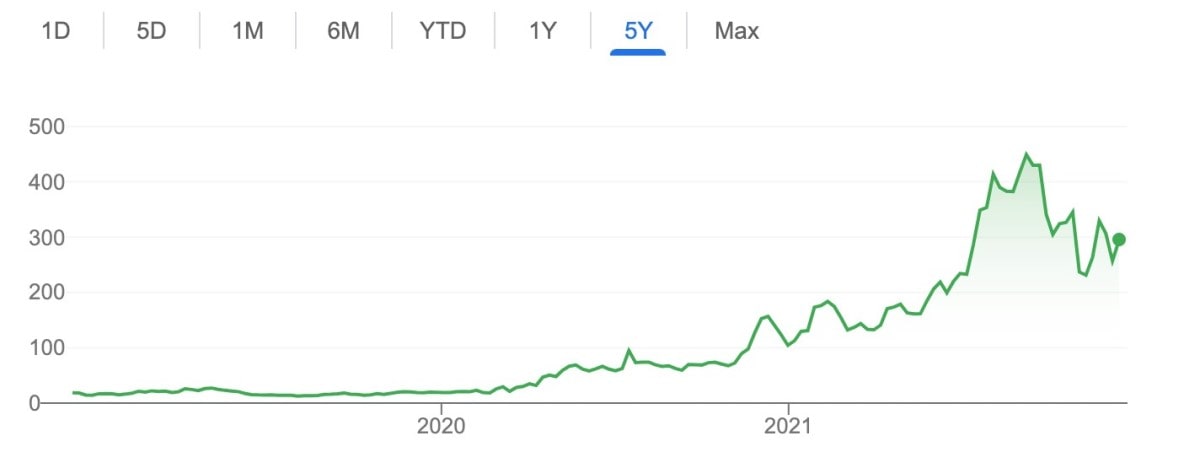

Moderna is listed on the Nasdaq stock exchange as MRNA, and as of 20 December 2021, its stock price is $294.80. This is a very high price for the stock considering many leading and well-known publicly-traded companies have stock prices far below this. It would not be unfair to primarily attribute this high price to Moderna's coronavirus vaccine.

What Affects Moderna (MRNA) Stock Price

Knowing the factors that drive the price of MRNA is essential if you are considering buying, selling, or holding Moderna stock. So, what is the key performance indicator when evaluating Moderna stock forecast?

For Moderna, the primary source of revenue as of late has been its COVID-19 vaccine, which has been the main driver behind Moderna's high stock price on the Nasdaq stock exchange. Reliance on one commercial product for revenue is not very unusual for a large company, considering that Moderna was founded in 2010. In 2018, it had its IPO, where it set the record for the largest IPO in biotech history. The company was not even expected to roll out a commercial product using its revolutionary mRNA technology, but it surprised the world with the accelerated development and manufacture of the Moderna vaccine. For now, the company's stock price is closely linked to the coronavirus vaccine, supply and demand for it, and its relevance in the future.

In addition to this, most Moderna investors have confidence in the claim that mRNA-based vaccines will drastically raise the antibodies in humans. However, the first human trial results from Moderna's experimental seasonal flu shot failed to meet expectations, signalling that mRNA-based vaccines do not always turn the body into an antibody-making machine. This led to a 14% drop in the company's stock price in early December 2021.

As such, it can be concluded that apart from the circumstances surrounding the COVID-19 pandemic, the results and efficacy of any product that Moderna rolls out will directly affect its stock price.

Moderna Stock Price in the Past

As Moderna went public in 2018, there is only 3 years' worth of data to analyse its past performance. The company went from zero product revenue and a net loss to billions in revenue in just a few months. In 2018, the year-open price was $18.60, while the year close price was $15.27, with an average price of $16.4338.

The following year saw some improvement in the performance on the stock exchange, with the year-open price at $15.33, whereas the year close price was $19.56, which was a 28.09% increase over 2018. The average price for 2019 was $18.1192.

It was in 2020 when things took a drastically positive turn for Moderna and its financials. Moderna was among the leading manufacturers of a COVID-19 vaccine. This propelled the biotech company into mass popularity, with its stock rising to $104.47 at year's end compared to only $19.23 when it started the year. This was an annual change of 434.10%, a game-changer for Moderna.

Moderna Stock Technical Analysis

When considering buying, selling or holding Moderna stock, it's essential to consider the most technical of indicators that determine the stock's status at any given time. These indicators can be studied by conducting a technical analysis of the stock.

The charts above present the overall summary of Moderna stock price comprising all the technical indicators (top) and the buy/sell condition determined by the oscillators (left) and moving averages (right). According to these charts, there is currently buying sentiment. The moving averages are also pointing towards buying Moderna stock right now, and the oscillators are painting the same picture, as well.

This can be attributed to the fact that vaccination is a vital and regularly discussed necessity in the world right now. Coupled with this are the new variants of the COVID-19 virus (Omicron being the latest of them all), which are making the vaccines a more important and attractive investment than ever.

As such, there is no selling pressure at the moment, and most, if not all, technical indicators paint a positive picture for Moderna shares.

Moderna Stock Forecast for 2022 by Experts

While the last two years have proved phenomenal for Moderna, investors are now starting to worry about future orders for the vaccine. Let's explore what the expert opinions regarding Moderna stock forecasts are.

Interestingly, many analysts think that COVID-19 will transition from being pandemic to endemic, with regular (perhaps annual) booster shots necessary for everyone. This means that the company would remain highly relevant, and its stocks would interest investors to a great extent, as well.

When evaluating the future of Moderna, most analysts consider two dimensions. The first is the longevity of the virus as well as the emergence of new variants. Any new variant, such as the current Omicron variant, makes Moderna attractive for investors as the entire world looks to Moderna and a few other biotech companies for a prompt solution.

On the other hand, experts also look at competition from other companies such as Pfizer and AstraZeneca since their rise in popularity could hurt the chances of Moderna's stock rising further.

With such market uncertainty regarding the pandemic and the relevance of vaccines, many experts are unable to suggest a number for Moderna's estimated future stock price.

Short-Term Moderna (MRNA) Price Prediction for 2022

Here are predictions from some of the most renowned traders and technical publications about the price of Moderna in 2022.

Wallet Investor

According to Wallet Investor, Moderna could end 2022 at a price of $379.241. estimates suggest bullish movement throughout the year, with the price constantly rising.

Long Forecast

Although Long Forecast has a similar view regarding Moderna's stock price, it does expect Moderna to perform far better than many other assets. It predicts that the year would start at a minimum of $299 and could end the year anywhere close to $428. If these figures seem too optimistic to you, remember that the Omicron variant has just emerged, and Moderna has already put out a vaccine that it claims works efficiently against the new variant.

Moderna Price Forecast for 2023-2025

While the pandemic's longevity and the need for vaccines are still being heavily studied and debated, Moderna stock predictions for 2023 to 2025 are extremely bright.

According to Wallet Investor, the price is expected to keep growing, although the rate at which it is likely to grow will fluctuate throughout the mentioned time period. In fact, Wallet Investor has forecasted that Moderna's price may go as high as $702.107 by the end of 2025.

Such confidence in the appreciation of the company can be attributed to the fact that the COVID-19 vaccination is still a significant health issue worldwide, and precautions against the Omicron variant are already being taken seriously.

Long-Term Moderna Stock Price Prediction 2026-2030

Making predictions so far ahead in time can be tricky because stock prices rise and drop quite often within a year for estimates more than 5 years out to be accurate. However, it's still important to make these estimates to potentially reduce the risk of any long-term investments.

According to CoinPriceForecast, Moderna stocks could hit a value of $1,348 by 2030, which is an upward change of 357% from the current price. Even for the previous years, the price is expected to rise gradually. The market sentiment is so positive for this company that analysts at Nasdaq are discussing the possibility of Moderna becoming a trillion-dollar company by 2030.

Conclusion

There is absolutely no doubt that Moderna's coronavirus vaccine made its stock a big pandemic winner. However, the question remains whether Moderna will be able to continue this run once the pandemic has subsided. And despite all the forecasts and expert opinions, its relevance in the industry beyond COVID-19 will eventually determine the future of its stock's performance.

If you're inexperienced in trading or simply want to try your hands at stocks CFDs before risking any real money, you can explore multiple options with a demo account at Libertex. Not only will it let you practice in a simulated environment, but it will also suggest expert strategies to you along the way.

Disclaimer: While the information presented in this article has been gleaned from authoritative and trustworthy sources, the purpose of this post is purely informational. It is not meant to be considered a guide, recommendation, or professional advice. Before putting your money into Moderna, ensure that you have done your own research and are aware of any possible risks.

The following section will give you a quick and precise overview of Moderna stock currently and its predictions for the future.

FAQ

Is Moderna a buy or sell?

As suggested by the technical analysis, all technical indicators (including the moving averages and the oscillators) point towards Moderna being a Buy at present.

Will Moderna stock split soon?

As of now, there is no news regarding a Moderna stock split in the near future.

Is Moderna a good long-term investment?

The answer to this question is heavily dependent on how long the COVID-19 virus prevails on the planet. This is because Moderna's COVID-19 vaccine is the only commercial product of the company at the moment, and its stock price is very closely linked to the demand and necessity of this vaccine in the next few months.

Is now a good time to buy Moderna stock?

Yes, as suggested by short-term Moderna stock predictions and technical analysis, now may be a good time to buy Moderna stock.

Does Moderna stock pay dividends?

No, Moderna Inc. does not pay any dividends.

How much will Moderna be worth in 2022?

Moderna may cross the $350 mark in 2022.

How much will Moderna be worth in 2025?

Moderna's stock is estimated to be in the range of $500 to $700 in 2025.

How much will Moderna be worth in 2030?

Most predictions are confident that Moderna will keep growing exponentially in the future, even up to 2030. One very positive analysis even discussed whether Moderna could reach a market cap of $1 trillion in 2030.

Is Moderna a Buy, Sell or Hold?

Currently, Moderna is a Buy.

Is Moderna overvalued?

This is a rather subjective question, with those who see potential in Moderna believing that its stock price is undervalued. However, some people already believe that the post-pandemic world is here and think that the stock is overvalued.

What is the target price for Moderna stock?

Based on the figures provided by Wall Street analysts, the average target price for Moderna stock is $311.83.

Why is Moderna's stock price so low?

Moderna's stock is not low; at $294.00, it's among the most expensive stocks listed on the stock exchange.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.