Natural Gas Price Forecast: How Fears Over Supply Affect Projections

But all is not lost in the gas market, and we're here to clear up contradictory outlooks. The article will provide a natural gas forecast for 2022 and far beyond. You'll also find out what affects price changes, projections of supply and demand and historical price analysis.

Why are gas prices rising so quickly, and when will it end? Let's find out!

In Short

- Gas prices are hitting record highs in 2022.

- Consumption in different sectors of the market is likely to continue rising.

- Future prices of natural gas are subject to heightened levels of uncertainty, one of the biggest factors being historically low supplies from Russia.

- Europe is expected to take the biggest hit when it comes to price surges. In the next few years, the situation might level off.

Background Information and Use Cases

Natural gas is mostly made up of methane (70%-90%). Methane is created by intense heat and pressure deep beneath the earth's surface, and the biggest deposits are in Russia, Iran, Qatar and the United States. The majority of natural gas imports in the UK come from Qatar and the US and are transported by sea. Other major suppliers include the Netherlands, Sweden and Belgium.

The UK also produces gas, about half of which comes from the North Sea. A third of it is exported to Norway.

Despite being ranked 41st for proven gas reserves, the UK ranks 11th in the world for natural gas consumption, with about 2.1% of the world's total consumption. Natural gas provides more than 84% of the UK's heating needs and close to 40% of electricity generation. If we zoom in on electricity use, we see that natural gas is predominantly used in the production of chemicals and foods & beverages.

- Chemicals - 21,685 GWh

- Food & Beverages - 21,007 GWh

- Mineral Products - 14,840 GWh

- Mechanical Engineering - 11,612 GWh

- Vehicles - 5,327 GWh

- Construction - 4,832 GWh

- Paper & Printing - 4,629 GWh

- Iron & Steel - 4,028 GWh

- Textiles & Leather - 2,901 GWh

What Factors Influence the Price of Natural Gas?

The price of natural gas is largely determined by:

- Production levels vs consumption indicators: Whether supply meets the demand.

- Policies: Regulatory forces in the country affect energy security and macroeconomic resilience.

- International relations: Whenever a major supplier faces unrest and conflict, it has major implications for the entire region.

- Weather: Extremely hot or cold weather increases gas demand. The weather can cause artificial scarcity caused by delayed deliveries.

- Competition among resources: The interrelated nature of fuel markets causes all fuel prices to swing collectively.

- Fuel switching: The development and trials of solutions to switch from high- to low-carbon fuels and then to clean energy sources.

- Storage: An uptick in storage fees can cause a corresponding increase in natural gas prices.

A side note about fuel switching: Gas power plants produce more electricity than any other fossil fuel technology. So, as part of the UK's commitment to reach net-zero carbon emissions by 2050, natural gas is not the first to be phased out; coal is.

Natural Gas Supply & Demand Forecast for 2022-2023 by Sectors

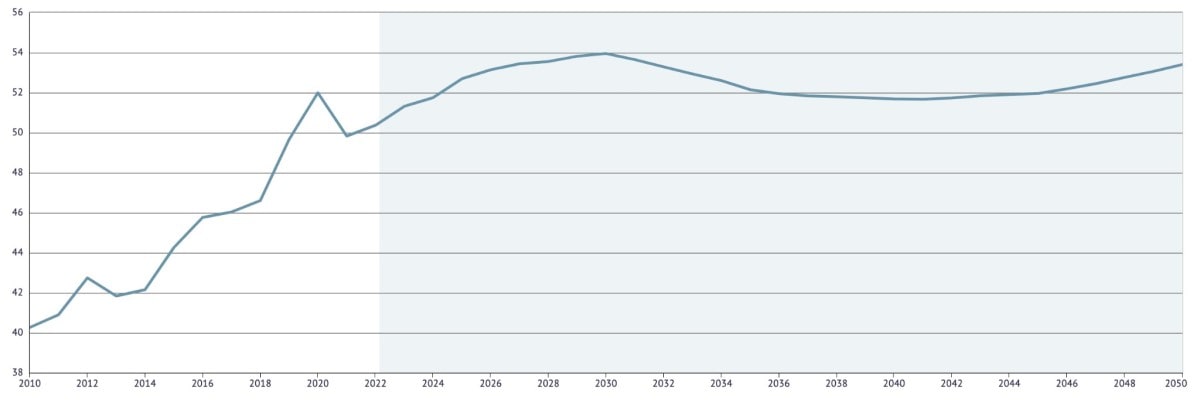

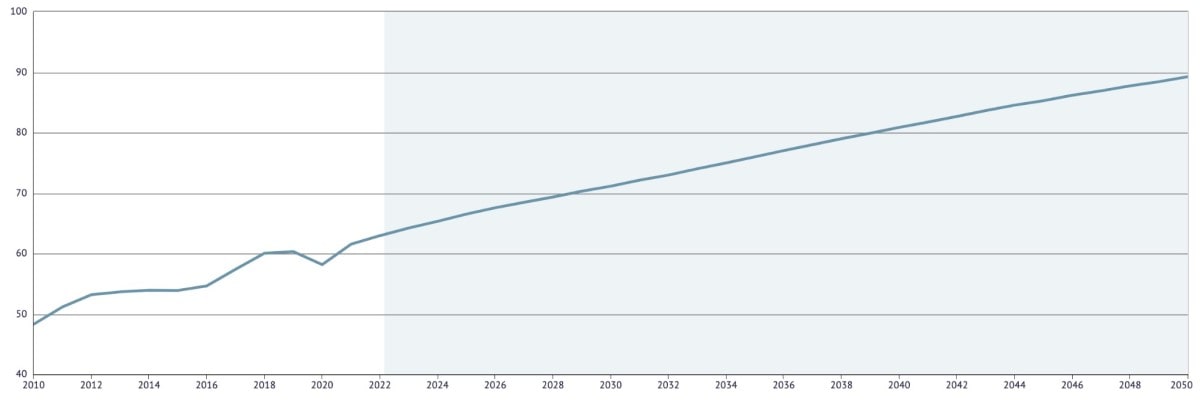

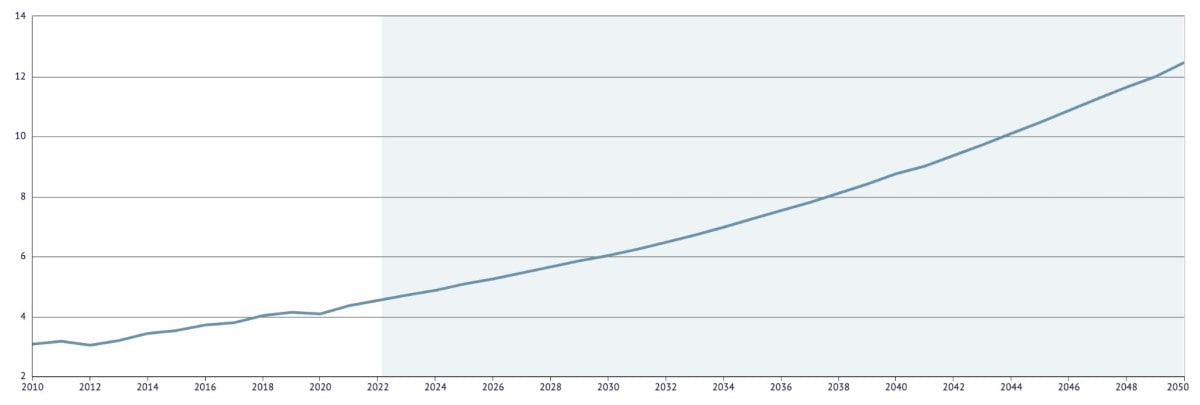

The ever-increasing demand for gas in industrialised countries around the world, including the UK, was negatively impacted by the pandemic. By 2022, it had started to rebound as economies got back to business and consumers returned to pre-pandemic activities. So, demand (or consumption) is expected to increase in 2022-2023 at its normal annual rate.

Consumption (billion cubic feet per day)

|

2021 |

2022 |

2023 |

|

|

Residential Sector |

12.75 |

13.53 |

13.25 |

|

Commercial Sector |

8.94 |

9.35 |

9.16 |

|

Industrial Sector |

22.46 |

23.49 |

23.64 |

|

Electric Power Sector |

30.88 |

30.05 |

29.90 |

|

Total Consumption |

82.97 |

84.59 |

84.26 |

The changes in supply are not as clear-cut. On the one hand, gas transiting Ukraine will likely be disrupted, affecting the supply to several Central and Eastern European countries. On the other hand, UK gas suppliers are reliable enough to meet the anticipated rising demand.

Natural Gas Supply Forecast (billion cubic feet per day)

|

2021 |

2022 |

2023 |

|

|

Marketed Production |

101.41 |

105.02 |

107.81 |

|

Dry Gas Production |

93.56 |

96.69 |

99.15 |

|

Pipeline Imports |

7.63 |

6.89 |

6.75 |

|

LNG Imports |

0.06 |

0.22 |

0.22 |

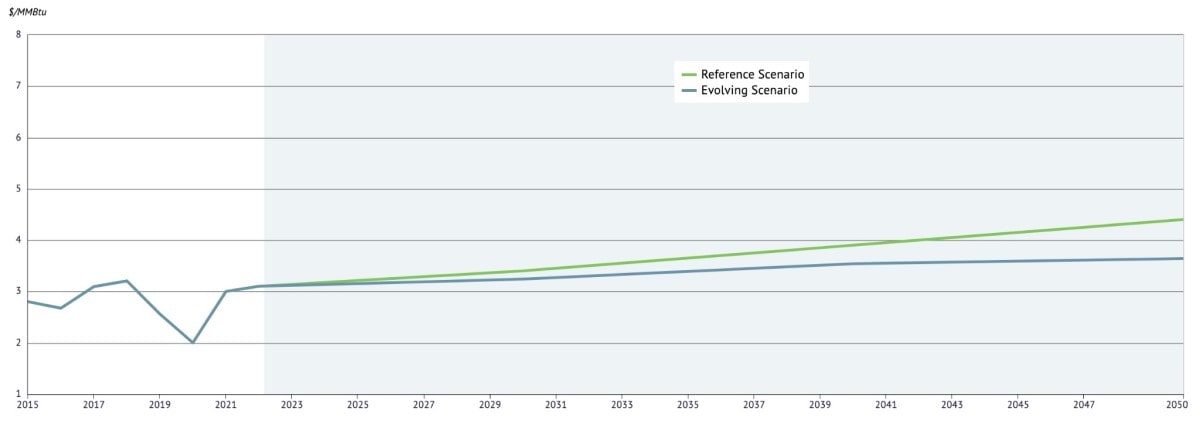

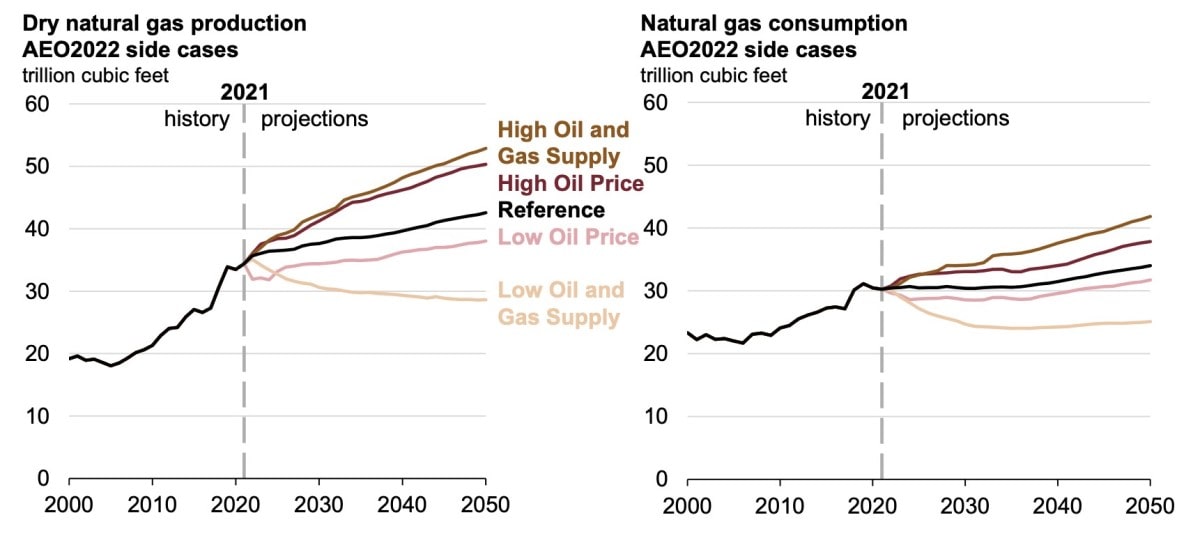

Thus, we can conclude that gas production (including imports) will match consumption (demand). The charts below strongly indicate a market equilibrium not only in the next year or two but also in the long term.

Natural Gas Price Forecast for 2022 by EIA and Experts

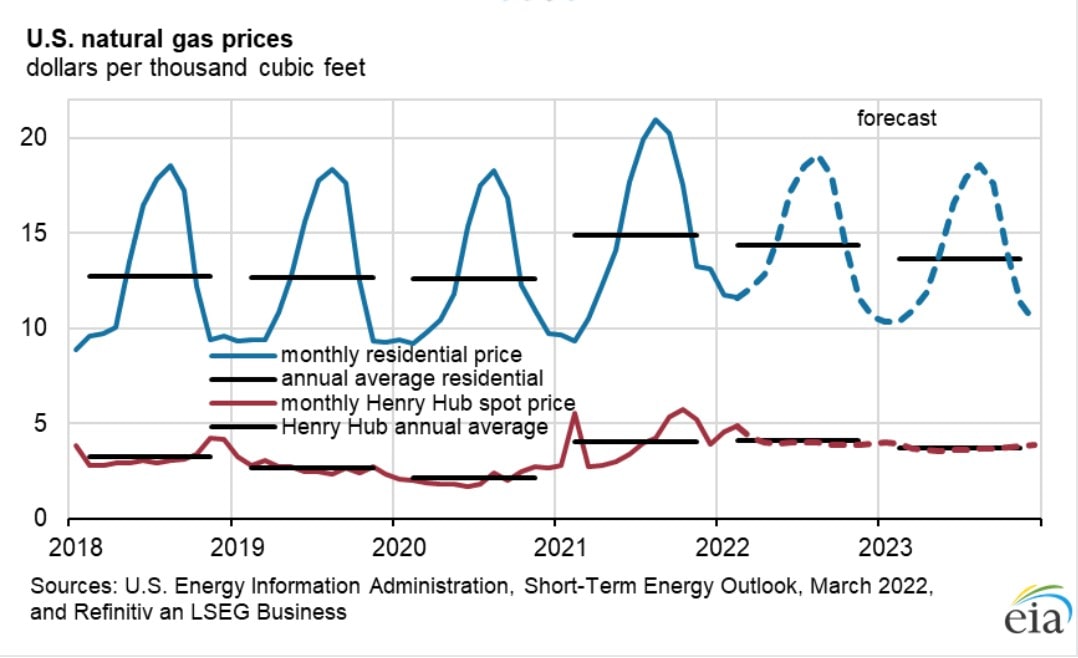

The US Energy Information Administration (EIA) releases its Annual Energy Outlook each year to provide updated projections of energy markets. But what's even more relevant are the monthly short-term forecasts. Here is the EIA natural gas production forecast released in March.

The agency expects production to rise from February levels, which will contribute to a lower average gas price. The report also added: "Although Europe's inventories are low, the additional LNG imports, as well as a mild winter, are helping bring inventories closer to the five-year average than they were at the beginning of the winter".

Some analysts are refraining from downgrading economic growth forecasts, although a hit to economic activity seems inevitable. Shikha Chaturvedi, Head of Global Natural Gas and Natural Gas Liquids Strategy at J.P. Morgan, reckons that the only way to soothe an exceptionally sharp price increase is government-mandated energy rationing. For now, the firm took into account the current geopolitical risk premium and added 10%-20% to its annual natural gas forecast.

Here is what Long Price Forecast expects from natural gas prices in 2022. By December, the price might be up 10% (in line with J.P. Morgan's estimations).

|

Month |

Min ($) |

Max ($) |

Close ($) |

Mo,% |

Total% |

|

April 2022 |

4.86 |

5.38 |

5.12 |

4.9% |

11.3% |

|

May 2022 |

4.62 |

5.12 |

4.86 |

-5.1% |

5.7% |

|

June 2022 |

4.85 |

5.36 |

5.10 |

4.9% |

10.9% |

|

July 2022 |

4.61 |

5.10 |

4.85 |

-4.9% |

5.4% |

|

August 2022 |

4.38 |

4.85 |

4.61 |

-4.9% |

0.2% |

|

September 2022 |

4.16 |

4.61 |

4.38 |

-5.0% |

-4.8% |

|

October 2022 |

4.37 |

4.83 |

4.60 |

5.0% |

0.0% |

|

November 2022 |

4.59 |

5.07 |

4.83 |

5.0% |

5.0% |

|

December 2022 |

4.82 |

5.32 |

5.07 |

5.0% |

10.2% |

Technical Analysis of Natural Gas Prices

Both the American and European weather models extend warmer trends. Above-normal temperatures indicate a lower need for gas after months of bullish, stronger-than-normal demand. This drop in demand to the lightest levels in months can cause a milder pattern.

EBW Analytics Group senior analyst Eli Rubin mirrors the same sentiment. Projected demand losses after mid-March already shocked the market into a fundamental reawakening.

Even though the weather trends are winning out, the market will be destabilised as long as the geopolitical situation remains a source of uncertainty. The charts are bouncing from intraday highs to short breaks to recover. In March, natural gas met significant resistance, which may suggest trouble could be brewing for the bulls.

Pivot points (as of 25 March 2022):

- S3 - $5.366

- S2 - $5.40

- S1 - $5.413

- P - $5.434

- R1 - $5.447

- R2 - $5.468

- R3 - $5.502

Natural Gas Price Prediction for 2023

The UK and Europe's gas prices will not catch a break in 2023 either. This is already evident from gas futures prices for next winter, which are surging to record highs. One of the reasons is an anticipated energy shortage.

Long Price Forecast expects the price will continue to increase in 2023. The highest jumps are expected to occur in February, May and November.

|

Month |

Min ($) |

Max ($) |

Close ($) |

Mo,% |

Total% |

|

January 2023 |

5.05 |

5.59 |

5.32 |

4.9% |

15.7% |

|

February 2023 |

5.31 |

5.87 |

5.59 |

5.1% |

21.5% |

|

March 2023 |

5.04 |

5.59 |

5.31 |

-5.0% |

15.4% |

|

April 2023 |

4.96 |

5.48 |

5.22 |

-1.7% |

13.5% |

|

May 2023 |

5.21 |

5.75 |

5.48 |

5.0% |

19.1% |

|

June 2023 |

4.95 |

5.48 |

5.21 |

-4.9% |

13.3% |

|

July 2023 |

4.70 |

5.21 |

4.95 |

-5.0% |

7.6% |

|

August 2023 |

4.94 |

5.46 |

5.20 |

5.1% |

13.0% |

|

September 2023 |

4.83 |

5.33 |

5.08 |

-2.3% |

10.4% |

|

October 2023 |

5.06 |

5.60 |

5.33 |

4.9% |

15.9% |

|

November 2023 |

5.32 |

5.88 |

5.60 |

5.1% |

21.7% |

|

December 2023 |

5.08 |

5.62 |

5.35 |

-4.5% |

16.3% |

Natural Gas Price Prediction for 2024

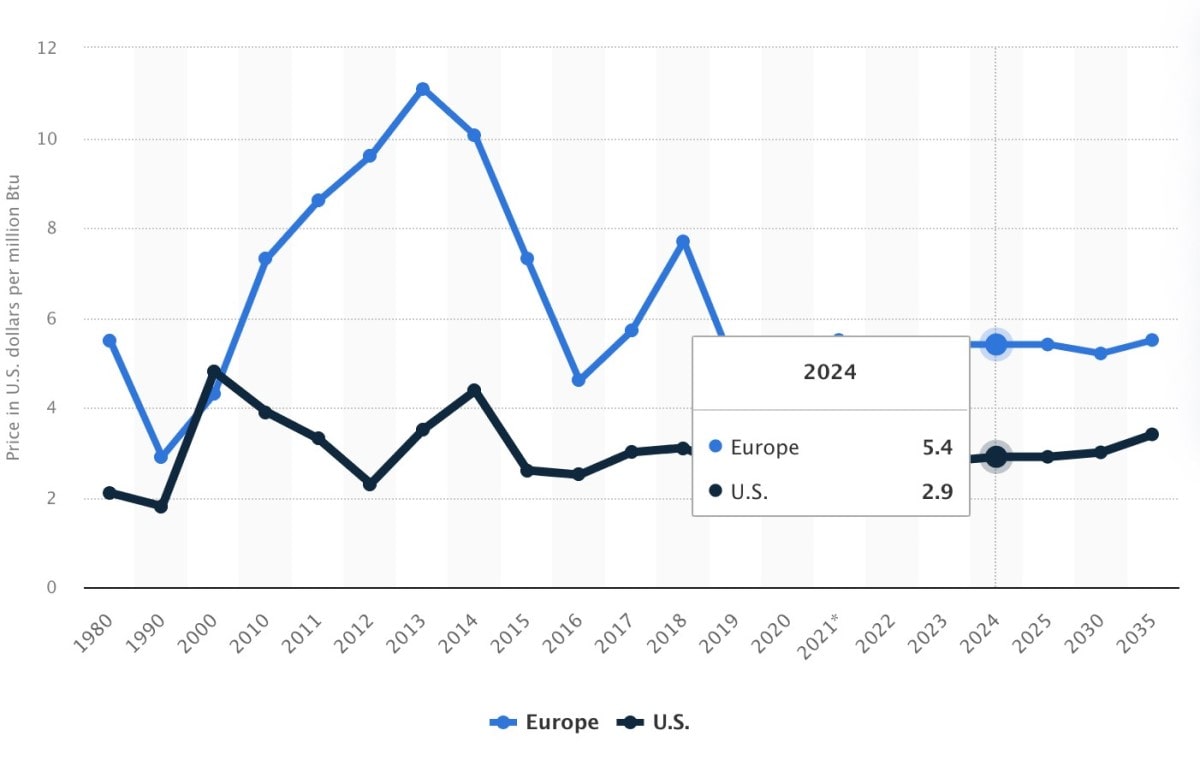

S&P Global Ratings, which has raised the gas spot price from $3.50/MMBtu (Metric Million British Thermal Unit) to $4/MMBtu for 2022 and from $3/MMBtu to $3.25/MMBtu for 2023, did not do the same for 2024. Their estimate remains unchanged at $2.75/MMBtu.

Meanwhile, the World Bank gives a higher projection: $3.90 per MMBtu for natural gas in the United States and $8.90 per MMBtu in Europe.

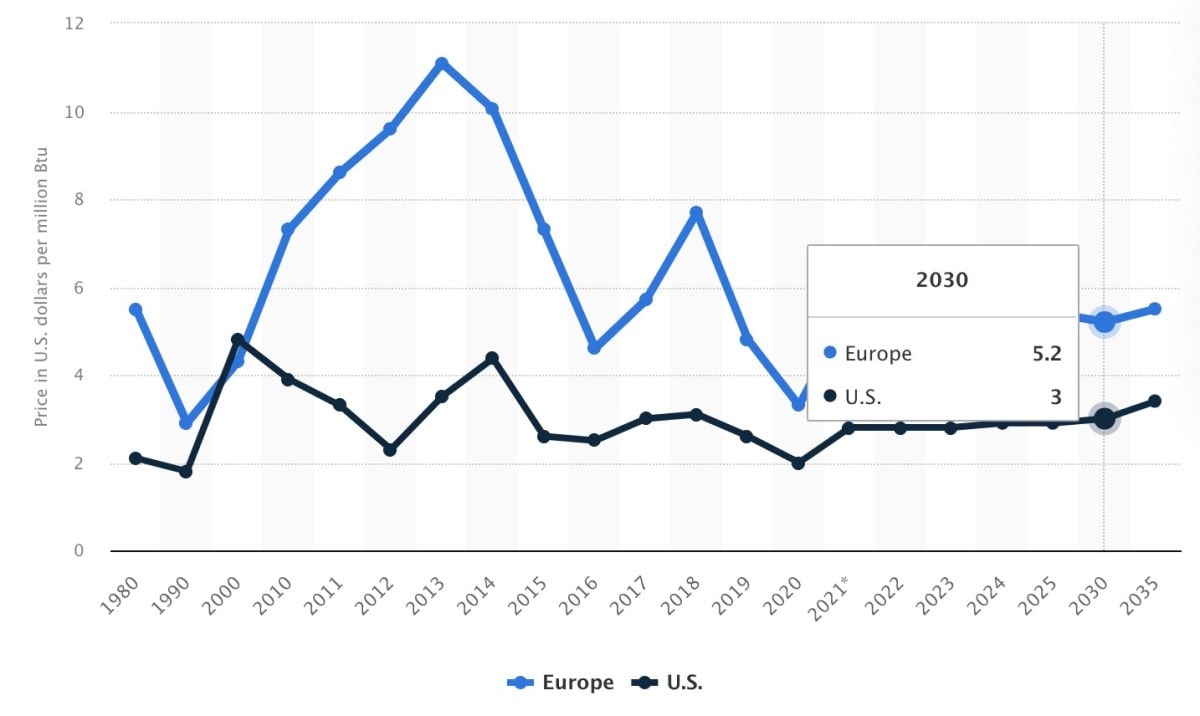

Unsurprisingly, Statista expects European future gas prices to be twice as high as US prices. The source puts the price of natural gas in 2024 at $2.90 in the United States and $5.40 in Europe.

Long-Term Natural Gas Price Forecast for 2025-2030

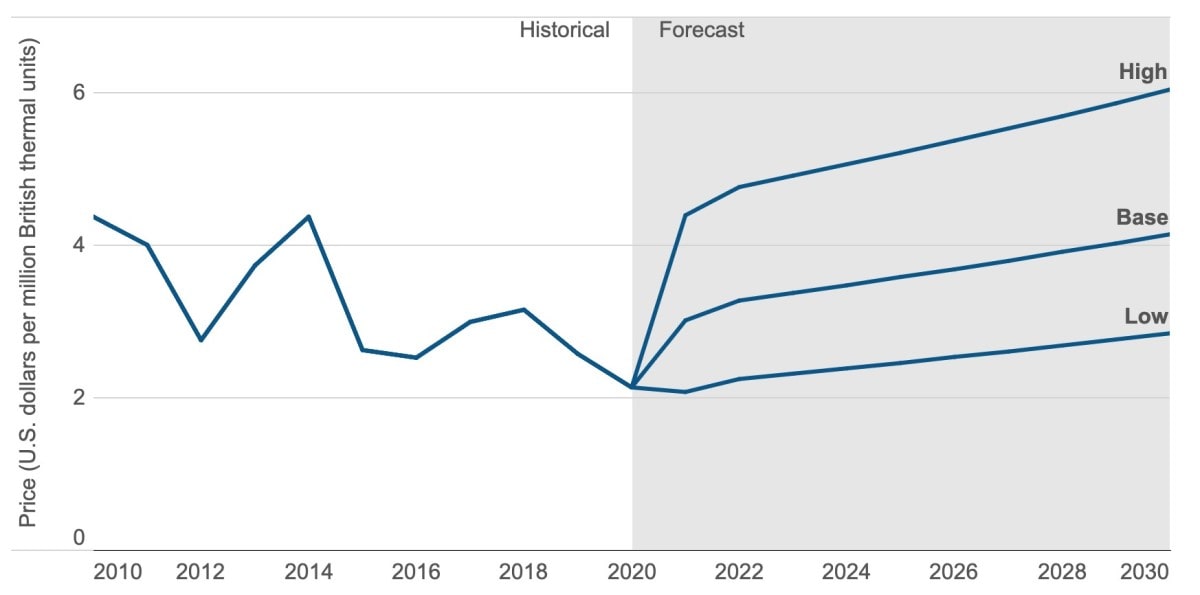

The first long-term forecast comes from AER and is based on historical prices and the EIA natural gas storage forecast. The lowest projection puts the price at $2.84, the base projection comes in at $4.14 and the highest one is at $6.04.

The more positive and the more negative assumptions capture how short-term and long-term volatility may affect the price. Below are some scenario considerations for both.

Low-price case:

- The economy is slower, fewer businesses and individuals have extra money to spend.

- Natural gas production (or imports) ramps up, exceeding growth expectations.

- The government lowers the energy price cap.

High-price case:

- The economy is recovering rapidly.

- Manufacturing activity supports global demand.

- Fewer wells are drilled, and imports are halted.

- Natural gas is used as a low-carbon substitute for higher content fossil fuels (coal and oil).

Looking at Statista once again, we can see that by 2030, the price is predicted to rise to $5.20 in Europe and $3.00 in the United States.

The last natural gas forecast for today's article is from the World Bank. Its Commodities Price Forecast for 2025 places gas prices at $8.70 in Europe and $3.90 in the United States. The difference will be reduced by 2030 to $7.50 and $4.00, respectively.

Price estimates are approximate, especially the further you look into the future. Please bear this in mind when determining the direction of future trends.

How Has the Price of Natural Gas Changed Over Time?

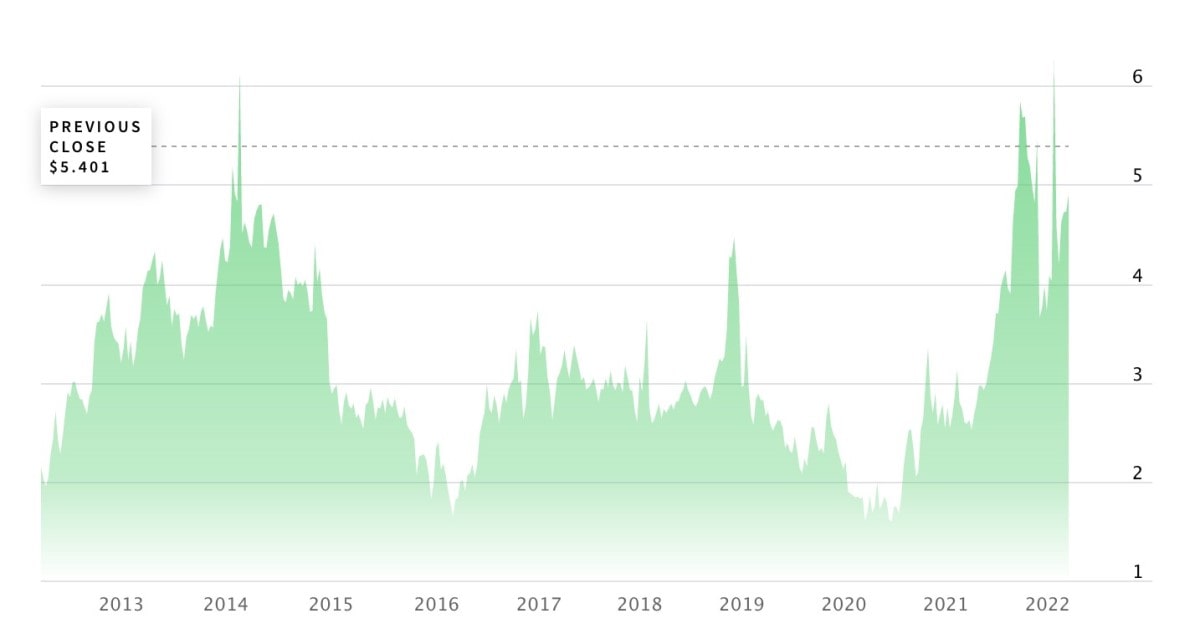

In 1994, the average gas price was $0.962. This figure rose to $4.11 by 2008. While we can't compare the global financial crisis of 2008 and the social and health crisis prompted by the Covid-19 pandemic of 2020-2021, pricing activity in the gas market behaved very similarly.

Over the last year, the gas market chaos has driven prices 280% higher in Europe and resulted in a 100%-plus surge in the United States.

The current average price is almost exactly what it was in 2014. This is another eerily similar situation. In 2014, gas and oil prices rose on fears that the conflict between Ukraine and Russia could cut off key energy supply routes, which is what is happening in 2022.

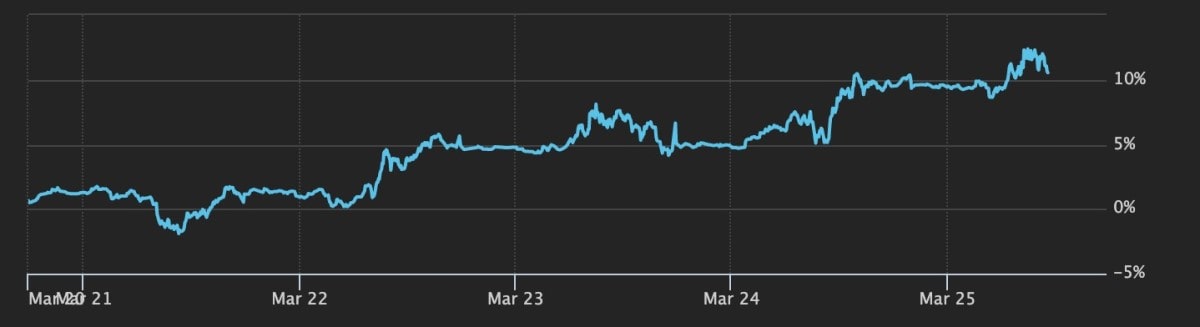

Are Gas Companies' Stocks a Buy Now?

Demand for natural gas should continue growing in the coming years, and judging by analyst projections, the supply in the UK should balance out demand. Projected market prices in the United States suggest the same, although European gas prices in the next few years will stay at a heightened level.

|

United States ($) |

Europe ($) |

|

|

2022 |

4.00 |

12.60 |

|

2023 |

3.90 |

9.29 |

|

2024 |

3.91 |

8.94 |

|

2025 |

3.92 |

8.68 |

|

2030 |

3.96 |

7.51 |

|

2035 |

4.00 |

6.50 |

As for stocks in the oil and gas sector, it depends on the company. Let's look at three companies that make up the majority of the market cap in the UK's energy sector:

- Harbour Energy (LSE:HBR): 7 analysts issued a Buy rating, 2 had Sell ratings and 1 said Hold.

- Energean (LSE:ENOG): 8 analysts think the stock is a Buy.

- Capricorn Energy (LON:CNE): 2 analysts said it's a Buy, 2 think it's a Sell and 5 opined that it's a Hold.

Analysts are optimistic about the gas stocks of UK companies. For investors willing to do their homework, there are even more companies to discover. If you want to find positions that are selling at attractive prices relative to the company's strong, asset-heavy balance sheets, find them on Libertex! Open a demo account to get actual practice in a live market environment without investing real money.

This article is for educational purposes only and should not be considered as advice or encouragement. Statements and figures given are taken from various sources and do not guarantee future performance. Please do your own research, whether for the purpose of making an investment decision or otherwise.

FAQ

Will gas prices go up in the UK in 2022?

Yes. In a recent statement by Ofgem, the Office of Gas and Electricity Markets, the agency announced that they would be raising the price cap for gas and electricity from 1 April 2022. The new maximum amount a utility company can charge an average customer in the UK is £1,971 (up £693 from £1,277).

Will gas prices go back down in the UK?

It depends on whether the UK manages to reduce its dependence on Russian gas. Energy analyst Ano Kuhanathan said that reducing demand for gas should be at the centre of the UK's response to high prices. However, he noted that the IEA's plan to cut dependence by a third in just one year is too aggressive and hardly possible.

Will gas and electricity prices increase in the UK in 2022?

Yes, analysts expect a jump in heating and electric bills. Because gas prices are hitting record highs and the legal price cap has been increased, utility companies are likely to raise their price for consumers. Many suppliers, including the big six energy providers, have already raised the price to the highest level allowed.

Will energy prices rise in the UK in 2023?

Electricity and gas suppliers have warned that energy bills are likely to remain high until 2023. If the government provides relief to companies struggling with a cash flow crunch, the price increases can be minimised. Overall, energy prices will depend on what action is taken to smooth out the increases over a longer period.

What will gas cost in 2023?

The price of natural gas is likely to be 10%-15% higher than the price in 2022 (according to the price of natural gas future prediction from Long Price Forecast). EIA expects the price to be vastly different for the United States and Europe in 2023, at $3.90 and $9.29, respectively. Many analysts are adjusting their projections daily based on Russia-Ukraine conflict updates and sanctions imposed on Russia.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.