Palladium Price Forecast: Will Record-Breaking Surges Continue?

There is a lot of information to consider when analysing and forecasting any type of asset. With the price of palladium, which is affected by everything from armed conflicts to climate change, it may be even more difficult. We have searched far and wide for different opinions and expert analyses to offer you a palladium price forecast for different periods, both short-term (2022-2023) and long-term (2025-2030).

Will the price of palladium go higher over the years? Let's find out.

In Short

- The price of the precious metalpalladium has soared.

- The pressures driving its price up are unlikely to ease anytime soon.

- Unless supply takes a huge leap to catch up with demand, a further price surge is very likely.

Palladium: Properties, Uses and Facts

Palladium (Pd) is a soft silvery-white metal, one of the platinum group metals (PGMs) along with platinum, ruthenium, rhodium, osmium and iridium. It is dense, stable and rare.

The majority of the world's supply comes from mines located in the Ural Mountains, Australia, North and South America and Africa. With 82,000 kilograms, Russia is the top producer, followed by South Africa, Canada and the United States. Before global sanctions on Russia, Russia's company Norilsk Nickel (currently unavailable on the stock market) was the largest palladium producer, accounting for 39% of world production.

Because finely divided palladium is a good catalyst, it is used for hydrogenation and dehydrogenation reactions. In fact, catalytic converters account for the largest use of palladium today. It is also used in:

- Electronics, for electrical contacts, ceramic capacitors, and soldering materials

- Technology, as electrodes in electrochemical studies

- Dentistry, for dental amalgams to decrease corrosion

- Jewellery, as one of the metals used in white gold alloys and hardware plating on accessories

- Photography, for fine art black-and-white prints

What Affects the Price of Palladium?

Major factors to track are:

- Supply and demand (specifically, the balance between the two)

- Shifts in the auto manufacturing industry

- Strength of economies in countries with high consumption (the United States, China, Japan and Germany)

- Precious metals prices (gold, silver and platinum)

- Changes in government regulations (budget decisions, foreign investment and industry procedures)

- Inflation (higher inflation = higher commodity prices)

Palladium Demand Forecast for 2022 by Sectors

Analysts at Australia and New Zealand Banking Group (ANZ) project that in 2022, demand for palladium will increase by 449,000 ounces, further widening the deficit in supply. Automotive catalysts are likely to account for most of it. Another essential projection is the rise of the global auto catalyst market, a CAGR of 3.6%. Even without the increase, nearly 85% of palladium demand comes from the auto sector.

Metals Focus, an independent precious metals research consultancy, expects demand to "grow by 20% y/y in 2022, boosted primarily by rising heavy-duty diesel loadings, predominantly in Asia".

The global jewellery market size is expected to expand at a CAGR of 8.5% from 2022 to 2030. Palladium fits into the 'other' segment and follows a similar dynamic as platinum, gold and diamonds.

Palladium Price Prediction for 2022 by the Experts

Capital Economics commodities economist Luke Nickels said, "It will be difficult for buyers to substitute Russian palladium with alternative sources of supply. As a result, we now expect palladium prices to remain elevated for some time".

On the same note, Macquarie analyst Marcus Garvey also believes that the market looks opportunistic. He said, "With these levels, we're bullish". According to their estimates, the price will return to $2,500 an ounce or higher.

Citigroup Inc has raised its end-Q2 forecast to $2,700 per ounce. Analyst Max Layton: "Whatever price we see in the next 12-24 months, this will be the high of the cycle". After that, the market may reach a point of stabilisation.

If you're interested in monthly dynamics, Wallet Investor has a detailed forecast for palladium in 2022.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

May 2022 |

2,597.34 |

2,613.54 |

2,596.47 |

2,613.54 |

0.62% |

|

June 2022 |

2,615.41 |

2,631.72 |

2,615.41 |

2,631.72 |

0.62 % |

|

July 2022 |

2,633.56 |

2,684.72 |

2,633.56 |

2,685.96 |

1.91% |

|

August 2022 |

2,680.59 |

2,685.06 |

2,668.98 |

2,685.06 |

0.17% |

|

September 2022 |

2,685.35 |

2,677.88 |

2,669.02 |

2,685.45 |

-0.28% |

|

October 2022 |

2,682.38 |

2,724.15 |

2,682.38 |

2,724.15 |

1.53% |

|

November 2022 |

2,724.77 |

2,749.29 |

2,724.77 |

2,749.29 |

0.89% |

|

December 2022 |

2,750.37 |

2,787.24 |

2,750.37 |

2,787.24 |

1.32% |

For another perspective, look at Long Forecast and its bearish outlook.

|

Month |

Open ($) |

Low-High ($) |

Close ($) |

Mo,% |

Total,% |

|

April 2022 |

2,256 |

2,063-2281 |

2,172 |

-3.7% |

-12.7% |

|

May 2022 |

2,172 |

2,172-2422 |

2,307 |

6.2% |

-7.3% |

|

June 2022 |

2,307 |

2,307-2573 |

2,450 |

6.2% |

-1.6% |

|

July 2022 |

2,450 |

2,450-2732 |

2,602 |

6.2% |

4.5% |

|

August 2022 |

2,602 |

2,319-2602 |

2,441 |

-6.2% |

-1.9% |

|

September 2022 |

2,441 |

2,418-2672 |

2,545 |

4.3% |

2.2% |

|

October 2022 |

2,545 |

2,268-2545 |

2,387 |

-6.2% |

-4.1% |

|

November 2022 |

2,387 |

2,127-2387 |

2,239 |

-6.2% |

-10.0% |

|

December 2022 |

2,239 |

2,038-2252 |

2,145 |

-4.2% |

-13.8% |

Technical Analysis of Palladium Price

Technical analysis utilises prior price or volume action to predict future moves. In the commodities market, the most common indicators used in assessments are:

- Moving averages: To smooth out short-term noise from long-term trends

- Oscillators: To find overbought or oversold conditions

- Volatility indicators: To see potential market reversals

- Volume indicators: To determine the strength of price movements

Bear in mind that the same signals apply to all charts and all timeframes.

Below is an example of a palladium chart with several technical indicators applied.

An important part of analysing chart patterns is the concept of support & resistance. These levels tend to act as barriers and are considered to prevent the price from getting pushed in a certain direction. Here are technical analysis trends for palladium as of 29 March 2022:

|

Short-Term |

Mid-Term |

Long-Term |

|

|

Trend |

Bearish |

Bullish |

Neutral |

|

Resistance |

$2,688 |

$3,283 |

$3,006 |

|

Spread/Res. |

-15% |

-31% |

-24% |

|

Spread/Supp. |

7.8% |

21% |

30% |

|

Support |

$2,109 |

$1,873 |

$1,749 |

Palladium Price Prediction for 2023

According to Wallet Investor, palladium might have a mild bullish run. The asset is likely to enter and finish the year at the relatively same price, with only a 1%-2% difference.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2023 |

2,796.10 |

2,879.25 |

2,796.10 |

2,879.25 |

2.89% |

|

February 2023 |

2,881.49 |

2,970.24 |

2,881.49 |

2,970.24 |

2.99% |

|

March 2023 |

2,972.74 |

2,972.33 |

2,952.20 |

2,974.53 |

-0.01% |

|

April 2023 |

2,982.26 |

3,017.21 |

2,982.26 |

3,020.14 |

1.16% |

|

May 2023 |

3,015.00 |

3,031.49 |

3,013.58 |

3,031.49 |

0.54% |

|

June 2023 |

3,032.44 |

3,048.56 |

3,032.44 |

3,048.56 |

0.53% |

|

July 2023 |

3,053.61 |

3,099.35 |

3,053.61 |

3,103.51 |

1.48% |

|

August 2023 |

3,097.52 |

3,102.22 |

3,085.51 |

3,102.22 |

0.15% |

|

September 2023 |

3,102.57 |

3,093.14 |

3,086.59 |

3,102.57 |

-0.3% |

|

October 2023 |

3,097.31 |

3,140.45 |

3,097.31 |

3,140.45 |

1.37% |

|

November 2023 |

3,142.65 |

3,166.29 |

3,142.65 |

3,166.29 |

0.75% |

|

December 2023 |

3,167.37 |

3,201.02 |

3,167.37 |

3,201.02 |

1.05% |

On a vastly different note, palladium is expected to turn its sharp bearish trend into a bullish one by the end of the year (taken from Long Forecast).

|

Month |

Open ($) |

Low-High ($) |

Close ($) |

Mo,% |

Total,% |

|

January 2023 |

2,145 |

2,002-2,212 |

2,107 |

-1.8% |

-15.3% |

|

February 2023 |

2,107 |

1,931-2,135 |

2,033 |

-3.5% |

-18.3% |

|

March 2023 |

2,033 |

2,033-2,267 |

2,159 |

6.2% |

-13.3% |

|

April 2023 |

2,159 |

2,159-2,408 |

2,293 |

6.2% |

-7.9% |

|

May 2023 |

2,293 |

2,252-2,490 |

2,371 |

3.4% |

-4.7% |

|

June 2023 |

2,371 |

2,113-2,371 |

2,224 |

-6.2% |

-10.6% |

|

July 2023 |

2,224 |

2,182-2,412 |

2,297 |

3.3% |

-7.7% |

|

August 2023 |

2,297 |

2,185-2,415 |

2,300 |

0.1% |

-7.6% |

|

September 2023 |

2,300 |

2,300-2,565 |

2,443 |

6.2% |

-1.8% |

|

October 2023 |

2,443 |

2,211-2,443 |

2,327 |

-4.7% |

-6.5% |

|

November 2023 |

2,327 |

2,261-2,499 |

2,380 |

2.3% |

-4.4% |

|

December 2023 |

2,380 |

2,380-2,654 |

2,528 |

6.2% |

1.6% |

Palladium Price Prediction for 2024

Wallet Investor has a similar outlook for 2024 as the year prior: mild volatility with no significant trend.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2024 |

3,209.06 |

3,297.13 |

3,209.06 |

3,297.13 |

2.67% |

|

February 2024 |

3,298.41 |

3,389.65 |

3,298.41 |

3,389.65 |

2.69% |

|

March 2024 |

3,390.89 |

3,385.45 |

3,369.56 |

3,391.04 |

-0.16% |

|

April 2024 |

3,394.91 |

3,431.71 |

3,394.91 |

3,437.21 |

1.07% |

|

May 2024 |

3,432.30 |

3,449.48 |

3,430.48 |

3,449.48 |

0.5% |

|

June 2024 |

3,451.26 |

3,463.87 |

3,451.26 |

3,463.87 |

0.36% |

|

July 2024 |

3,468.18 |

3,516.01 |

3,468.18 |

3,520.78 |

1.36% |

|

August 2024 |

3,514.76 |

3,519.37 |

3,502.36 |

3,519.37 |

0.13% |

|

September 2024 |

3,519.05 |

3,512.35 |

3,504.40 |

3,519.05 |

-0.19% |

|

October 2024 |

3,513.47 |

3,559.60 |

3,513.47 |

3,559.60 |

1.3% |

|

November 2024 |

3,560.85 |

3,583.29 |

3,560.85 |

3,583.29 |

0.63% |

|

December 2024 |

3,585.66 |

3,624.85 |

3,585.66 |

3,624.85 |

1.08% |

Long Forecast continues with its bullish outlook for 2024.

|

Month |

Open ($) |

Low-High ($) |

Close ($) |

Mo,% |

Total,% |

|

January 2024 |

2,528 |

2,528-2,819 |

2,685 |

6.2% |

7.9% |

|

February 2024 |

2,685 |

2,532-2,798 |

2,665 |

-0.7% |

7.1% |

|

March 2024 |

2665 |

2,548-2,816 |

2,682 |

0.6% |

7.8% |

|

April 2024 |

2,682 |

2,390-2,682 |

2,516 |

-6.2% |

1.1% |

|

May 2024 |

2,516 |

2,242-2,516 |

2,360 |

-6.2% |

-5.2% |

|

June 2024 |

2,360 |

2,360-2,631 |

2,506 |

6.2% |

0.7% |

|

July 2024 |

2,506 |

2,506-2,794 |

2,661 |

6.2% |

6.9% |

|

August 2024 |

2,661 |

2,661-2,946 |

2,806 |

5.4% |

12.7% |

|

September 2024 |

2,806 |

2,728-3,016 |

2,872 |

2.4% |

15.4% |

|

October 2024 |

2,872 |

2,872-3,203 |

3,050 |

6.2% |

22.5% |

|

November 2024 |

3,050 |

3,050-3,401 |

3,239 |

6.2% |

30.1% |

|

December 2024 |

3,239 |

3,099-3,425 |

3,262 |

0.7% |

31.1% |

Palladium Price Forecast for 2025-2030

According to Wallet Investor, 2025 might be where palladium breaks over $5,000.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2025 |

3,629.14 |

3,715.35 |

3,629.14 |

3,715.35 |

2.32% |

|

February 2025 |

3,719.06 |

3,806.54 |

3,719.06 |

3,806.54 |

2.3% |

|

March 2025 |

3,808.33 |

3,807.69 |

3,787.49 |

3,808.33 |

-0.02% |

|

April 2025 |

3,810.62 |

3,850.00 |

3,810.62 |

3,853.97 |

1.02% |

|

May 2025 |

3,849.64 |

3,865.54 |

3,847.52 |

3,865.54 |

0.41% |

|

June 2025 |

3,867.44 |

3,883.05 |

3,867.44 |

3,883.05 |

0.4% |

|

July 2025 |

3,884.29 |

3,933.58 |

3,884.29 |

3,938.04 |

1.25% |

|

August 2025 |

3,932.35 |

3,935.86 |

3,919.56 |

3,935.86 |

0.09% |

|

September 2025 |

3,936.29 |

3,928.54 |

3,920.88 |

3,936.46 |

-0.2% |

|

October 2025 |

3,931.21 |

3,976.5513 |

3,931.21 |

3,976.55 |

1.14% |

|

November 2025 |

3,979.35 |

3,999.27 |

3,979.35 |

3,999.27 |

0.5% |

|

December 2025 |

4,001.53 |

4,042.23 |

4,001.53 |

4,042.23 |

1.01% |

Long Forecast doesn't see palladium going over $4,500.

|

Month |

Open ($) |

Low-High ($) |

Close ($) |

Mo,% |

Total,% |

|

January 2025 |

3,262 |

3,074-3,398 |

3,236 |

-0.8% |

30.0% |

|

February 2025 |

3,236 |

3,236-3,609 |

3,437 |

6.2% |

38.1% |

|

March 2025 |

3,437 |

3,148-3,480 |

3,314 |

-3.6% |

33.1% |

|

April 2025 |

3,314 |

3,198-3,534 |

3,366 |

1.6% |

35.2% |

|

May 2025 |

3,366 |

2,999-3,366 |

3,157 |

-6.2% |

26.8% |

|

June 2025 |

3,157 |

3,157-3,521 |

3,353 |

6.2% |

34.7% |

|

July 2025 |

3,353 |

3,353-3,739 |

3,561 |

6.2% |

43.1% |

|

August 2025 |

3,561 |

3,383-3,739 |

3,561 |

0.0% |

43.1% |

|

September 2025 |

3,561 |

3,531-3,903 |

3,717 |

4.4% |

49.3% |

|

October 2025 |

3,717 |

3,717-4,144 |

3,947 |

6.2% |

58.6% |

|

November 2025 |

3,947 |

3,755-4,151 |

3,953 |

0.2% |

58.8% |

|

December 2025 |

3,953 |

3,953-4,408 |

4,198 |

6.2% |

68.7% |

Gov Capital expects the price of palladium to be $9,439.91 at the start of 2027. As for 2030, Coin Price Forecast anticipates the price to climb to $11,633-$12,215.

Remember that long-range forecasting may not be accurate. Value predictions for such a distant future are just an approximate idea based on historical performance.

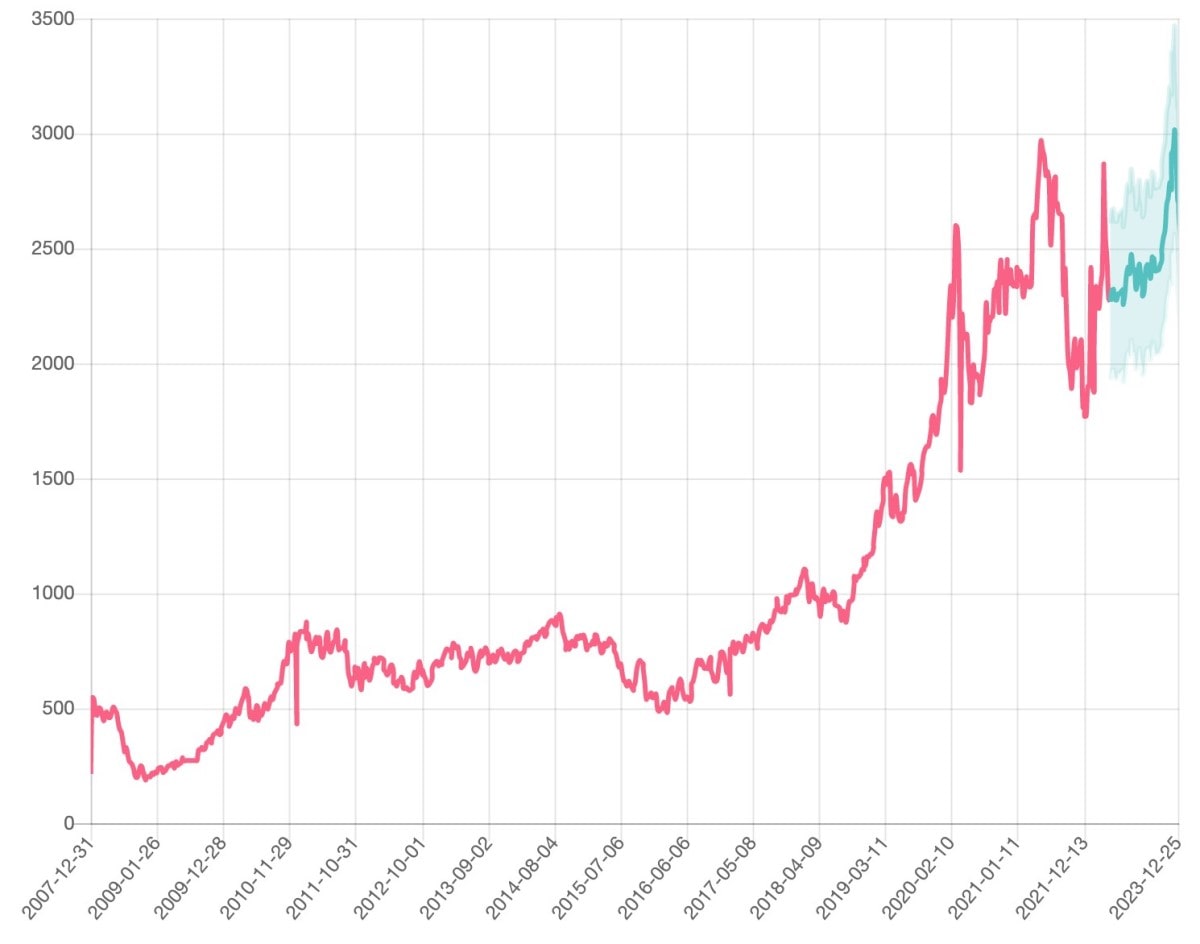

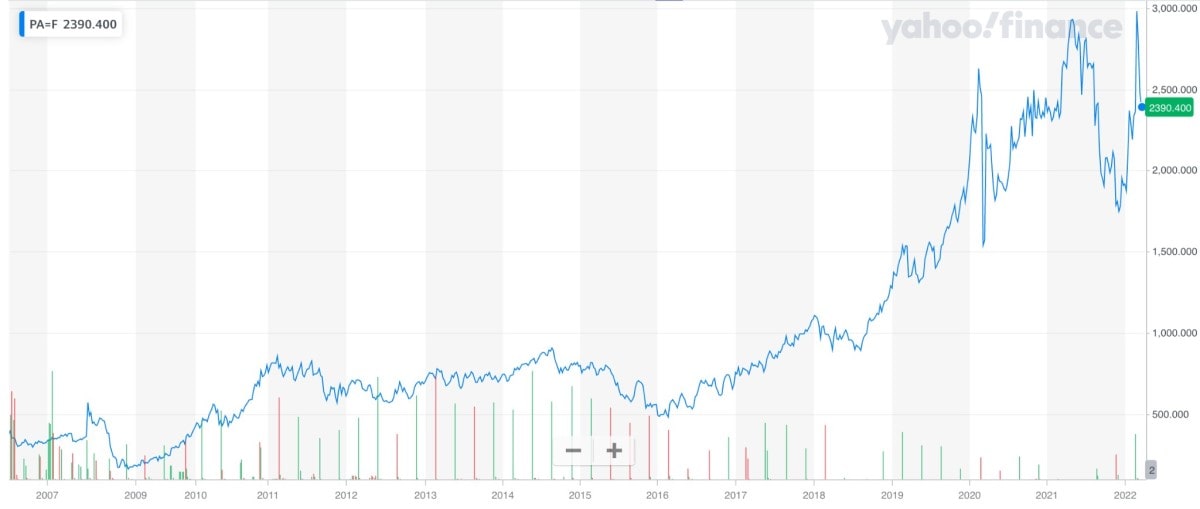

Palladium Price History for the Past 15 Years

Most commodity prices declined after the 2008 financial crisis. In that case, palladium fell below $500. Since then, the price per ounce has moved in a steady uptrend, bringing the price to $1,890.40 by August 2019.

At the start of 2020, palladium shot up to $2,627.30, which did not last. Just a few weeks later, the commodity was worth $1,539.20.

In 2021, demand for the metal in car manufacturing was hurt by global computer chip shortages. The price plummeted to roughly the same levels as at the early stages of the pandemic. To be more specific, after hitting a record high of around $3,018 an ounce in April 2021, it fell down to around $1,800 in May.

But in 2022, the price shot up over concerns of a shortage. Flight bans were the first sign of a dramatic change in the palladium market. The scale of failures is not fully understood. But as companies examine alternative routes to supply the metal to their customers, the price spike is already easing, dropping from $2,979.90 on 27 February to $2,390.40 on 20 March.

Are Palladium Companies Stocks a Buy or a Sell Now?

Many sources expect the price of palladium to increase over the years. Take a look at the table below for a detailed projection up to 2030.

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End,% |

|

2022 |

3,159 |

4,258 |

+82% |

|

2023 |

4,667 |

5,717 |

+144% |

|

2024 |

6,052 |

6,532 |

+179% |

|

2025 |

7,372 |

7,831 |

+234% |

|

2026 |

8,403 |

8,618 |

+268% |

|

2027 |

9,323 |

9,334 |

+298% |

|

2028 |

9,980 |

10,622 |

+353% |

|

2029 |

11,259 |

11,892 |

+407% |

|

2030 |

11,904 |

12,499 |

+433% |

As for the companies and their stocks, it's important to make individual assessments. Here is what analysts think about the most prominent companies in the field:

- Sibanye Stillwater Ltd (NYSE:SBSW): 7 analysts rate it as Buy, 1 puts it at Outperform and 3 say to Hold.

- Impala Platinum Holdings Ltd (ADR:OTC): The average score from 7 ratings is Outperform.

- Anglo American Platinum Ltd (OTC:ANGPY): 1 analyst says to Buy, 1 rate it as Outperform, 1 opines it will Underperform and 4 say to Sell.

- A-Mark Precious Metals Inc (NASDAQ:AMRK): 2 analysts said it's a Buy.

As you can see, ratings vary from company to company, so there is a lot of homework to do before buying. Before you consider making any of these stocks (or any other) an investment asset, gain as much experience as you can. The best way to start is by signing up for a demo account on Libertex. This way, you'll see how various markets and assets move without putting your own money and only switching to a live account when you feel ready.

Any forward-looking statements and projections in this article do not guarantee future palladium prices. They were made by various sources and market analysts and are given for educational use only. Please do your own analysis and be aware of risks.

FAQ

What will platinum be worth in 2030?

According to Coin Price Forecast, palladium will be trading at $11,904 by the middle of 2030 and at $12,499 by the end of the year. Compared to its price in early 2022, this is an appreciation of more than 430%.

What is the future price of palladium?

Outlooks range from bearish to extremely bullish. In the first scenario, prices will go down as supply recovers and platinum demand rises due to more stringent car emission regulations. In the second scenario, the supply crunch will continue to shake the market.

Is it a good time to invest in palladium?

All physical metals are considered to have good potential as an investment. They act as a hedge against inflation, maintain their intrinsic value and have a high level of liquidity. However, palladium's price is unlikely to rise in the same manner as well-performing stocks or indices, meaning palladium is not likely to grow continuously unless there are supply chain issues and/or heightened demand.

Is there a demand for palladium?

Yes. The demand for palladium is kept up by various industries and activities, such as auto manufacturing, electronics, dentistry, medicine, hydrogen purification, chemical applications, groundwater treatment and jewellery. The biggest demand is currently coming from the auto sector.

Why is palladium suddenly so valuable?

Supply is relatively scarce, which generally drives the price up. But due to disruptions in major supplying countries and the use of palladium as a key component in emissions-reducing devices, the value rises even higher than usual.

Why are palladium prices dropping?

After its price skyrocketed in late February-early March 2022, palladium lost close to 20% of its trading value. This was due to a rebound in Russian production and an increase in output from Africa.

Is palladium a good investment in 2022?

It depends on which scenario will play out: bearish or bullish. In either case, it's important to note that palladium is unlikely to lose a significant percentage of its value even if supply and demand balance out. Palladium is the most expensive of the four major precious metals, and its intrinsic value will always be there.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.