Popular Energy Stocks in 2022

Besides the list of stocks, we'll also give you some important information about the energy industry, show you how to analyse risks and give a step-by-step guide to opening your first trade.

A Brief Overview of the Energy Industry

The energy sector comprises a huge, complex network of companies that are directly and indirectly evolved in energy production, transportation and distribution.

Energy can first be classified into two primary types: renewable and non-renewable.

- Renewable: Oil and other petroleum products, gasoline, diesel fuel, nuclear energy

- Non-renewable: Biofuels, solar power, wind power, hydropower

The industry also encompasses secondary power sources — such as electricity, for instance.

The need for power is what drives the prices of energy-related companies. As an economy grows, the more power it needs: so, it buys and consumes more energy sources. This increases demand, and prices soar. The energy industry is also sensitive to geopolitical events: in times of war within energy-producing countries, supply dries up and price rises.

There's one more thing we'd like to cover before moving on to the most popular energy stocks — that is, some types of energy companies.

- Oil and gas drilling/production: These companies find, drill and produce natural gas and oil.

- Oil and gas transportation: These companies transport raw products to refineries.

- Refineries: Raw products are refined into a final, usable product.

- Mining companies: Coal mining companies fall under the energy sphere, as coal is used in power plants.

- Renewable energy: These companies deal with 'clean' energy like wind and solarpower. This sector has been gaining lots of traction in recent years.

- Chemicals: Some companies refine gas and oil into chemicals like "petrochemicals," including plastics, fertilisers and pharmaceuticals.

What Are Some of the Most Popular Energy Stocks in 2022?

When searching for energy stocks in 2022, we considered the opinions of investment analysts, YTD price changes, market value and dividend yield. We've included a wide range of company types within the energy sector. Some companies have operations that fall under multiple energy types: for instance, a company might produce and refine oil, work with some renewable energy and also have a chemicals division.

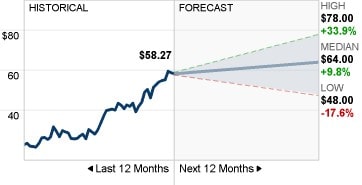

Devon Energy (NYSE:DVN)

- Market Value: $38.7B

- Price of Share: $58.27

- Annual Dividend Yield: 6.86%

- Quarterly Dividend Amount: $1.00

- Year-to-Date Price Change: +12.87%

- Analysts' Opinion: 20 Buy, 5 Outperform, 7 Hold, 1 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Devon Energy is involved in the finding and production of oil and natural gas. On December 31, 2021, Devon proved that it had 1,625,000 barrels of oil equivalent in reserve. What's more, the company owns over 2,300 producing oil wells. It also engages in some midstream activities, including transporting, processing, storing and treating hydrocarbons, as well as construction and operating pipelines.

Devon Energy offers investors a very strong dividend return: 6.86% per year. What's more, the price per share is still fairly low — it's projected to grow pretty quickly, so investors can grab stock, enjoy dividends and hold DVN until it reaches a much higher price.

Out of the 33 polled investment analysts, 20 recommend buying DVN, bringing the consensus to Buy. There are currently 31 analysts offering 12-month price forecasts for DVN. The high estimate is $78 in 12 months, the median is $64 and the low estimate is $48.

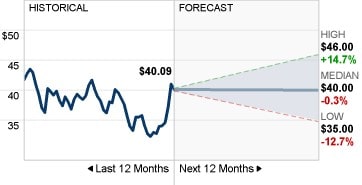

Brookfield Renewable (NYSE:BEP)

- Market Value: 13.8B CAD

- Price of Share: $40.09

- Annual Dividend Yield: N/A

- Quarterly Dividend Amount: N/A

- Year-to-Date Price Change: +11.83%

- Analysts' Opinion: 10 Buy, 1 Outperform, 4 Hold, 0 Underperform, 1 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Brookfield Renewable is a leading investor and developer of renewable power. The company deals with hydro, wind and solar power, and its transition operations distribute power to consumers. Brookfield Renewable has a strong financial position with good downside production, and the company follows strong ESG practices to create long-term value for investors.

Out of the 16 polled investment analysts, 10 recommend buying BEP, bringing the consensus to Buy. There are currently 15 analysts offering 12-month price forecasts for BEP. The high estimate is $46 in 12 months, the median is $40 and the low estimate is $35.

ConocoPhillips (NYSE:COP)

- Market Value: $129.43B

- Price of Share: $99.60

- Annual Dividend Yield: 2.35%

- Quarterly Dividend Amount: $0.59

- Year-to-Date Price Change: +35.01%

- Analysts' Opinion: 21 Buy, 4 Outperform, 4 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

ConocoPhillips largely deals with upstream oil operations — that is, exploring, drilling and producing. Therefore, because the price of West Texas crude oil is experiencing a strong price rally (over $100 per day), ConocoPhillips' revenue is growing quickly.

Out of the 29 polled investment analysts, 21 recommend buying COP, bringing the consensus to Buy. There are currently 26 analysts offering 12-month price forecasts for COP. The high estimate is $135 in 12 months, the median is $115 and the low estimate is $96.

Exxon Mobil Corp (NYSE:XOM)

- Market Value: $333.06B

- Price of Share: $78.67

- Annual Dividend Yield: 4.47%

- Quarterly Dividend Amount: $0.88

- Year-to-Date Price Change: +23.81%

- Analysts' Opinion: 11 Buy, 3 Outperform, 17 Hold, 0 Underperform, 1 Sell (source: CNN Business)

- Analysts' Consensus: Hold

Exxon Mobil is the largest energy company in the US — and the largest, non-government-owned energy company across the world. The company searches for and produces oils and natural gas; it also manufactures and distributes petroleum products. Over the last couple of years, Exxon Mobil has been pouring money into long-term energy production. This hurt the company's position for a while, but its investments are starting to pay off. If oil prices keep rising, Exxon will do better and better.

Out of the 32 polled investment analysts, 17 recommend holding XOM, bringing the consensus to Hold. There are currently 26 analysts giving 12-month price forecasts for XOM. The high estimate is $166 in 12 months, the median is $87.50 and the low estimate is $66.

Chevron Corp (NYSE:CVX)

- Market Value: $314.98B

- Price of Share: $161.73

- Annual Dividend Yield: 3.51%

- Quarterly Dividend Amount: $1.42

- Year-to-Date Price Change: +35.61%

- Analysts' Opinion: 18 Buy, 2 Outperform, 10 Hold, 0 Underperform, 1 Sell (Source: CNN Business)

- Analysts' Consensus: Buy

Chevron is the second-largest US-based energy company. Not only does it produce oil and gas, but it supplies aviation fuel and owns nearly 8,000 retail gas stations. Because the global economy has been rebounding lately and international travel is opening back up, there is increased demand for Chevron's products. So, the price has jumped recently, and it will likely keep on growing, especially as people who haven't travelled in years are itching for a vacation.

Out of the 31 polled investment analysts, 18 recommend buying CVX, bringing the consensus to Buy. There are currently 25 analysts offering 12-month price forecasts for CVX. The high estimate is $205 in 12 months, the median is $169 and the low estimate is $115.

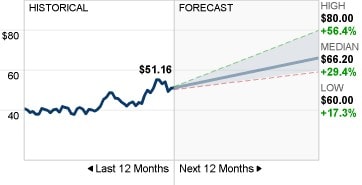

Shell PLC (NYSE:SHEL)

- Market Value: $193.35B

- Price of Share: $51.16

- Annual Dividend Yield: 3.49%

- Quarterly Dividend Amount: $0.45

- Year-to-Date Price Change: +14.61%

- Analysts' Opinion: 24 Buy, 2 Outperform, 4 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

When energy prices fell during Covid-19, Shell reduced its dividend, outraging investors. However, it used that money (and money diverted from oil and gas capital projects) to invest in renewable energy. Investing in Shell is a little riskier than other companies on this list, as the company is reinventing itself — investors can hope for success, but they need to watch the company's projects closely. Renewable energy is in-demand, so if Shell's projects are successful, it has the potential for huge growth in revenue.

Out of the 30 polled investment analysts, 24 recommend buying SHEL, bringing the consensus to Buy. There are currently 13 analysts offering 12-month price forecasts for SHEL. The high estimate is $80 in 12 months, the median is $66.20 and the low estimate is $60.

TotalEnergies SE (NYSE:TTE)

- Market Value: $131B

- Price of Share: $49.82

- Annual Dividend Yield: N/A

- Quarterly Dividend Amount: N/A

- Year-to-Date Price Change: -2.28%

- Analysts' Opinion: 16 Buy, 2 Outperform, 9 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

TotalEnergies is France's largest energy company. For decades, its core business revolved around the exploration, production and refinement of oil and gas. Last year, however, TotalEnergies announced that it would transition towards cleaner energy. Over the next four years, half of the company's capital investment budget will go toward renewable energy and natural gas.

Something to keep in mind, though: over the past couple of weeks, TotalEnergies has experienced a dip in share price. This is because they have not withdrawn from Russia yet during the Russia-Ukraine conflict. Unless it does so, we can reasonably expect the company's position to decline further, as the company is facing condemnation from French NGOs.

Out of the 27 polled investment analysts, 16 recommend buying TTE, bringing the consensus to Buy. There are currently 23 analysts offering 12-month price forecasts for TTE. The high estimate is $81 in 12 months, the median is $65.55 and the low estimate is $54.78.

BP PLC (NYSE:BP)

- Market Value: $92.20B

- Price of Share: $28.74

- Annual Dividend Yield: 4.56%

- Quarterly Dividend Amount: $0.33

- Year-to-Date Price Change: +5.01%

- Analysts' Opinion: 15 Buy, 4 Outperform, 9 Hold, 0 Underperform, 1 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Interestingly enough, BP is kind of in the opposite situation of TotalEnergies: the company left Russia almost immediately after the conflict began. BP, along with Shell, led the movement that swayed other energy companies to withdraw from the company. But, BP's performance this month hasn't been great — withdrawing from Russia cost the company $25 million.

So, the question is: what makes an energy company suffer more — leaving a country and losing billions in revenue OR staying in the country and losing the support of many huge investors.

One indicator that could help answer this: Shell and BP both left Russia and have still experienced a positive YTD price change. TotalEnergies, on the other hand, has experienced a negative YTD price change.

Out of the 29 polled investment analysts, 15 recommend buying BP, just barely bringing the consensus to Buy. Only one analyst, though, recommends selling. There are currently 25 analysts offering 12-month price forecasts for BP. The high estimate is $56.35 in 12 months, the median is $37 and the low estimate is $29.

How to Invest in Energy Stocks

Now that you've gotten an overview of the most popular energy companies, how do you buy their stock? Let's dive in.

Step 1: Research the energy sector

While we've given you a quick overview of the energy sector and price factors, it can be wise to conduct more research on your own. Investopedia is a great place to get started! When you choose a platform to invest, they may also offer educational materials, so be sure to check those out.

Step 2: Determine what moves the price of energy types

Remember we mentioned that times of economic growth would cause the price of oil, gas and other energy forms to rise. Furthermore, wars can increase the scarcity of energy sources, which can also cause the price to increase.

Step 3: Decide on a platform

It's time to select a platform. Many beginners prefer to start with a platform that offers plenty of educational materials, as well as a free demo account, so they can practice. If you like the sound of such a platform, check out Libertex!

Step 4: Open a trading account

This step may differ depending on the trading platform you register with. You can expect to create a username and password — then, you'll carry out some identity verification activities. Before creating the account, make sure the platform supports users from your country so that you don't waste time.

Step 5: Find a good time to buy

Now it's time to watch the market and conduct technical/fundamental analyses.

Step 6: Make your first investment

Based on your money management plan, risk tolerance, and investing goals, decide how much of your capital you want to spend on one asset and use the platform to make an investment. If you’re a beginner, it’s better to start small.

Step 7. Monitor your position

If you choose a platform like Libertex, it will have plenty of monitoring tools, which you can use to closely follow price movements.

Step 8: Sell your assets

Sell when your investment reaches your profit target or if your account suffers a certain amount of loss.

How to Analyse the Risks of Energy Sector Stocks

Before buying the stock of an energy company, it can help to conduct technical and fundamental analysis. With technical analysis, you're looking at short-term price movements — sometimes, these involve timeframes as short as one minute!

Conversely, with fundamental analysis, you're looking at the overall market sentiment, the company's quarterly earnings and new projects, the global economy and many other factors. While you can create your own technical analysis charts, it will help to read fundamental analyses from investment experts, as they take an enormous amount of information into account.

While you can use both kinds of analysis, technical analysis is better for trading over short timeframes. Fundamental analysis, on the other hand, is ideal for long-term holdings.

Conclusion

Whether you want to buy stock from a company that provides renewable or non-renewable energy (or both), you need to study the industry's price factors. Keep an eye on when oil prices are high: not just oil-related companies will benefit from this period. High oil prices indicate a strong economy and global conflict — both factors contribute to the growth of the energy sector as a whole. So, keep an eye on these companies but always remember to conduct thorough analyses!

FAQ

What are energy stocks?

Energy stocks belong to companies that produce, refine, transport and distribute energy.

How to buy energy stocks?

Create an account on a platform of your choice. Fund the account and make an investment. Then, you can sell the stock. You can also buy energy penny stocks if you don't have a lot of capital to spend.

What is the future of energy stocks?

There is strong demand for oil and gas, and it will likely remain this way for decades. However, there is also increasing interest in renewable energy sources.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.