Popular Fintech Stock in 2022

However, to those who are new to investing, the prospect of purchasing fintech stock may seem quite daunting. If you're one such potential investor, you may find yourself intimidated by the sheer number of fintech companies out there.

This article will hopefully make that decision a bit easier for you. Not only will we give you a broad sense of what fintech is and what different kinds of stock are available in this industry, but we'll also give you a breakdown of some of the most popular fintech stocks in 2022. If this interests you, then read on to find out more!

What Is Fintech?

Fintech is short for "financial technology", a term to describe the different kinds of new technology used by financial companies. Businesses that develop methods of digital payment are considered fintech, for instance. Basically, any company that develops software or hardware to facilitate payment processing in order to make it more streamlined and accessible can be described as a fintech company.

Types of Fintech Stock

Financial technology has a wide range of applications, some of which you may very well make use of every day without even thinking about it.

Some examples of the uses of fintech include:

- Online crowdfunding websites

- Online banking

- Mobile phone payments

- Blockchain technology and cryptocurrency

- Peer-to-peer payment applications, e.g., Venmo, Cash App, etc.

- Contactless card payments

This list of examples is not exhaustive, but it should give you an idea about the wide applicability of fintech in society. Financial technology is so interwoven into our way of life that it's difficult to imagine what things would look like without these fantastic innovations.

If you plan to invest in fintech stock, you'll find that you have no shortage of options. This article will now take you through some of the fintech stock investment options today.

12 Fintech Stocks in 2022

In this section, we'll break down twelve of the most popular fintech stocks in 2022. The financial technology industry is one with great long-term potential and shows no signs of slowing down anytime soon. On the contrary, thanks to the popularity of smartphones, cloud computing and e-commerce, the industry is only expected to grow larger moving forward.

Block (NYSE: SQ)

- Market capitalisation: $80.07 billion

- Price of share: $133.62

- Annual dividend yield: 0%

- Year-to-date price change: -41.78%

- Analysts' opinion: 32 Buy, 3 Outperform, 9 Hold, 0 Underperform, 2 Sell (source: CNN Business)

- Analysts' consensus: Buy

Block, Inc, formerly known as Square, Inc, is a fintech company based in California in the United States. Its best-known product, Cash App, is a peer-to-peer payment application available on mobile that lets its users transfer money without fees. Block also owns Square Point-of-Sale (POS), a free-to-use application that allows traders to take payments using a smartphone.

Block has even more to offer besides Cash App and Square POS. Among its other products and services, the company owns Square Capital, a lending platform for small businesses that is beginning to see more usage with bigger companies, as well as its small-business demographic.

With its Cash App users almost doubling year after year, and with the increased traction of services like Square Capital, Block is an interesting investment option for any would-be investors.

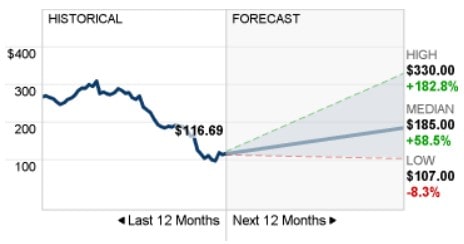

PayPal (NASDAQ: PYPL)

- Market capitalisation: $139.25 billion

- Price of share: $116.67

- Annual dividend yield: 0%

- Year-to-date price change: -52.87%

- Analysts' opinion: 32 Buy, 5 Outperform, 11 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' consensus: Buy

PayPal Holdings, Inc is an internationally known fintech company also based in California. With over 425 million active accounts by the end of last year and a growing list of partnerships and business acquisitions, the company has established itself as the leader in the online payment service.

In 2012, PayPal purchased Venmo, a peer-to-peer payment service designed for family and friends to split bill payments. Since then, Venmo has only climbed in popularity, establishing itself as a leader in the industry with a rapidly expanding user base. Over the course of the COVID-19 pandemic, with the introduction of restrictions and with more and more people shopping online and sending money to people digitally, the app only grew further.

Additionally, PayPal has recently moved to support Bitcoin on its platform. This has only helped its stock, making PayPal a particularly interesting investment option at this time.

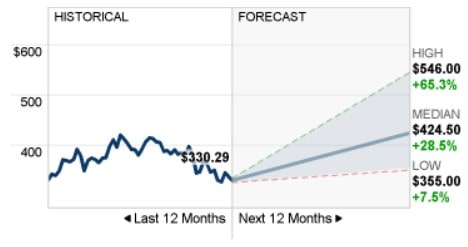

Goldman Sachs (NYSE: GS)

- Market capitalisation: $111.58 billion

- Price of share: $330.22

- Annual dividend yield: 2.2%

- Year-to-date price change: 0.79%

- Analysts' opinion: 14 Buy, 4 Outperform, 11 Hold, 0 Underperform, 1 Sell (source: CNN Business)

- Analysts' consensus: Buy

Goldman Sachs may not be the first option to come to mind when considering fintech stock investments, but they are worth considering! The New York-based investment bank has always had a reputation of being old-fashioned and traditional in its approach to investing. You might call it "quintessentially Wall Street". But since 2016, Goldman Sachs has been transitioning into a new era.

Beginning with its Marcus personal loans and savings platform, the company has slowly been making the transition from investment banker for America's richest 1% to a retail bank. When it issued the Apple credit card back in 2019, this marked its expansion into the credit card industry, and more new features are on the horizon. Goldman Sachs reportedly has plans to launch checking accounts as well as its own investment platform.

Green Dot (NYSE: GDOT)

- Market capitalisation: $1.52 billion

- Price of share: $27.82

- Annual dividend yield: 0%

- Year-to-date price change: -40.80%

- Analysts' opinion: 5 Buy, 1 Outperform, 5 Hold, 0 Underperform, 0 Sell (source: CNN business)

- Analysts' consensus: Buy

The Green Dot Corporation is one of the older fintech companies on our list. Over twenty years ago, the business developed and produced the first prepaid debit card. To this day, Green Dot is perhaps best known for this feat of ingenuity.

As a banking-as-a-service platform (or, BaaS platform), the company shows massive potential. Simply put, it allows other companies to use its well-established banking framework to offer their own services. It is likely that, as a BaaS, Green Dot will see significant growth in the industry going forward.

Green Dot may have seen a decline in its stock in recent years, but it is still performing quite well. In 2021, the company regularly surpassed the predicted quarterly earnings, bringing in more revenue than was expected. As such, it is still worth some consideration when investigating potential investment opportunities.

Shopify (NYSE: SHOP)

- Market capitalisation: $87.44 billion

- Price of share: $693.00

- Annual dividend yield: 0%

- Year-to-date price change: -40.02%

- Analysts' opinion: 19 Buy, 1 Outperform, 1 Hold, 1 Underperform, 0 Sell (source: CNN Business)

- Analysts' consensus: Buy

Shopify is an e-commerce platform based in Canada that rose in popularity throughout the course of the COVID-19 pandemic, as it helped thousands of companies survive during the tumultuous months of lockdowns and quarantines. Perhaps due in part to this spike in its performance, many analysts rate Shopify quite highly.

The website's revenue increased dramatically between January 2018 and March 2021, rising from $1.1 billion to $3.5 billion over those 27 months. This represents a growth of more than 200%. No doubt part of the reason for this increase in earnings is due to Shopify investing in its partners. For instance, in 2021, Shopify invested $350 million in its payments processor, Stripe.

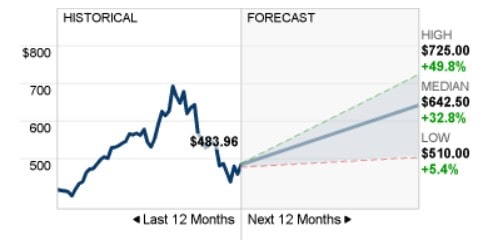

Intuit (NASDAQ: INTU)

- Market capitalisation: $136.86 billion

- Price of share: $483.93

- Annual dividend yield: 0.54%

- Year-to-date price change: 22.44%

- Analysts' opinion: 17Buy, 3 Outperform, 3 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' consensus: Buy

Intuit Inc is a financial software company based in California. The business was founded in 1983 and was made public a decade later. While it is perhaps best known for its TurboTax and QuickBooks services, Intuit holds promise not just as a software-as-a-service platform but also as a growing fintech company.

Mint and Credit Karma are Intuit's two biggest developments in that sector. The former is a mobile app and website that allows individuals to manage their finances. It was established in 2006. A year later, Credit Karma came onto the scene and has since established itself as a popular multinational retail finance company.

These two products alone saw Intuit's annual revenue go from $6.78 billion in 2019 to $10.3 billion the following year, representing a growth of more than $3 billion.

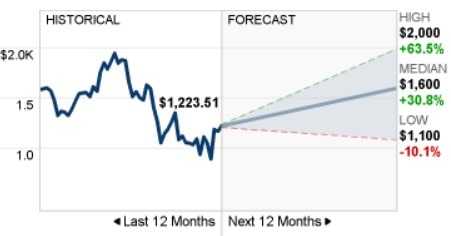

MercadoLibre (NASDAQ: MELI)

- Market capitalisation: $61.71 billion

- Price of share: $1,224

- Annual dividend yield: 0%

- Year-to-date price change: -18.96%

- Analysts' opinion: 19 Buy, 2 Outperform, 2 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' consensus: Buy

MercadoLibre, Inc is the largest and fastest-growing payments processing and e-commerce company in the whole of Latin America. Because of the range of financial services it provides, including everything from investments and banking to insurance, as well as the sheer size of the company, MercadoLibre has a promising future. It's likely that the company will see substantial growth in the coming years.

MercadoLibre's revenue also is regularly increasing, which is a good sign for its future prospects. In 2021, the company saw more than $7 billion USD in revenue, a 78% increase from the revenue of the previous year, when MercadoLibre brought in just $4 billion.

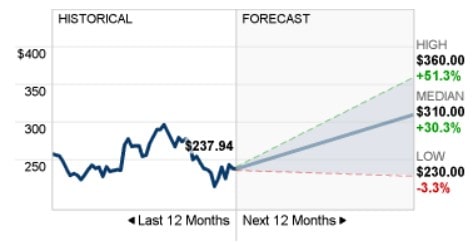

Workday (NASDAQ: WDAY)

- Market capitalisation: $59.72 billion

- Price of share: $237.93

- Annual dividend yield: 0%

- Year-to-date price change: -0.64%

- Analysts' opinion: 27 Buy, 4 Outperform, 3 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' consensus: Buy

Workday, Inc is an American software company that provides companies with cloud applications. These applications include human resources, analytics, and financial management services, just to name a few of their many applications. Because of its versatility in the workplace, Workday is becoming extremely popular among businesses.

As these companies continue to flourish, they gather more and more data, which means that Workday's services are in more and more demand. This demand sees Workday continuing to grow as a company. In 2021, the company expected revenue of $4.43 billion; in the end, they surpassed this by more than half a million dollars.

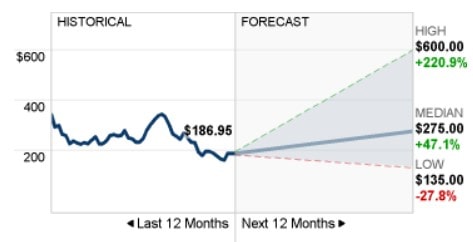

Coinbase Global (NASDAQ: COIN)

- Market capitalisation: $48.96 billion

- Price of share: $186.96

- Annual dividend yield: 0%

- Year-to-date price change: N/A

- Analysts' opinion: 16 Buy, 3 Outperform, 5 Hold, 0 Underperform, 2 Sell (source: CNN Business)

- Analysts' consensus: Buy

Coinbase Global is one of the more recent fintech companies to make this list, having been founded just ten years ago in 2012 and having only been public since April 2021. As the largest and most popular cryptocurrency exchange in the United States, with more than 73 million registered users, the exchange helps investors from all over America invest in Bitcoin.

In the coming years, it's projected that Coinbase will grow beyond trading and come to encompass blockchain technology as well, for example, decentralised finance (DeFi). Such a move would mark a great increase in Coinbase's value.

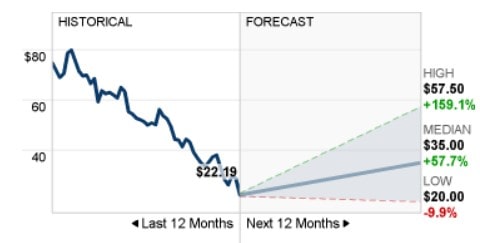

UiPath (NYSE: PATH)

- Market capitalisation: $11.64 billion

- Price of share: $22.18

- Annual dividend yield: 0%

- Year-to-date price change: N/A

- Analysts' opinion: 13 Buy, 2 Outperform, 6 Hold, 0 Underperform, 1 Sell (source: CNN Business)

- Analysts' consensus: Buy

Romania-based company UiPath is a top developer of robotic process automation software, otherwise known as RPA. UiPath is a growing company, but that growth is steadily declining. That, in addition to a decrease in profit margins and a somewhat pessimistic valuation, means that it is difficult to know how well the business will do going forward.

That said, demand for UiPath's services is sure to increase over time. It could be interesting to see where the company goes in the future.

StoneCo (NASDAQ: STNE)

- Market capitalisation: $3.75 billion

- Price of share: $12.14

- Annual dividend yield: 0%

- Year-to-date price change: -81.10%

- Analysts' opinion: 5 Buy, 0 Outperform, 10 Hold, 0 Underperform, 1 Sell (Source: CNN Business)

- Analysts' consensus: Hold

Brazilian fintech company StoneCo was founded to help small businesses process payments. Through StoneCo, companies can take payments in-store, online or by mobile, meaning that the company offers a useful degree of flexibility and efficiency.

Despite the COVID-19 pandemic's negative impact on Brazil's economy, StoneCo managed not just to maintain revenue but, in fact, grow it. This is a sign that StoneCo is a company with a prosperous future ahead of it, perhaps of interest to investors.

DraftKings (NASDAQ: DKNG)

- Market capitalisation: $7.78 billion

- Price of share: $19.05

- Annual dividend yield: 0%

- Year-to-date price change: -69.70%

- Analysts' opinion: 15 Buy, 1 Outperform, 15 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' consensus: Buy

DraftKings is one of the largest online sports betting companies in America. When it comes right down to it, online betting and other kinds of gaming are very reliant on fintech, as, without that technology, they would not be able to grow so rapidly or to the same scale.

Over the past few years, DraftKings has shown a consistent increase in revenue. Because of this and the site's popularity with online gamblers, DraftKings has a fair bit of potential going forward. A relative lack of earnings is perhaps a little troubling, but overall the company is an intriguing prospect for potential investors.

More Fintech Companies Are Going Public in 2022

In 2021, a number of large fintech companies went public, making for quite an exciting year. However, at this early juncture, it's uncertain whether 2022 will match that rather impressive performance. That said, there are some fintech companies that may very well go public after all.

Some fintech companies that might go public this year include:

- Shawbrook Bank

- Klarna

- Zopa

- Checkout.com

Which Fintech Exchange-Traded Funds Are Popular Investments?

Exchange-traded funds (ETFs) are funds that enable investors to purchase lots of different stocks grouped together in one bundle. Usually, ETFs are easier to sell and purchase than mutual funds and also expose the investor to a wider variety of assets. Because of this, they're a great way to diversify your portfolio.

With fintech's rising popularity, there are, of course, many fintech ETFs out there. According to analysts, however, there are a few top picks for fintech ETF investments in 2022:

- FINX – Global X Fintech ETF: As the oldest fund out of our top three picks, FINX is also the most well-established. With more than $1 billion in assets and stocks in blockchain, wealth management, and insurance, FINX may be an interesting purchase for some investors.

- IPAY – ETFMG Prime Mobile Payments ETF: IPAY's scope isn't as broad as FINX. This ETF focuses on stocks in mobile payments. However, due to how popular this sector of fintech is, the fund has more than $1 billion in assets. IPAY is an intriguing option, to be sure; however, investors may be put off by its 0.75% fee.

- ARKF – ARK Fintech Innovation ETF: After launching in 2019 and seeing an extremely prosperous year in 2020, ARKF has an impressive performance, amassing assets that amount to more than $4 billion. Like IPAY, ARKF has a 0.75% fee, but its shares of PayPal, Shopify, and Pinterest make it an interesting prospect.

Is Investing in Penny Fintech Stocks Risky?

Penny stocks — stocks with shares that trade for $5 or even less — can sometimes prove to be highly rewarding, but this comes at high risk. This remains true of penny fintech stocks. While the high growth of the fintech sector makes investing in penny stocks an intriguing prospect, one should always exercise caution when making such investments. There are lots of penny stock scams out there that you could fall prey to if you don't do your research.

Fintech Stocks for Dividends

One problem with fintech companies is that many of them do not pay dividends. You can see this yourself from our fintech stock picks displayed above.

However, there are a few companies that do. Some of the top fintech stocks offering dividends are banks and credit card providers. Below, you'll find a list of the top four fintech stocks paying dividends and their dividend yield.

|

Company |

Share Price |

Annual Dividend Yield |

|

Visa (NYSE: V) |

$226.36 |

0.66% |

|

Mastercard (NYSE: MA) |

$363.97 |

0.54% |

|

Bank of America (NYSE: BAC) |

$40.90 |

2.05% |

|

American Express (NYSE: AXP) |

$187.17 |

1.11% |

What Is the IBD Investment System?

IBD, Investor's Business Daily, is a financial news organisation based in the United States. Founded as a printed newspaper in 1984 by stockbroker William O'Neil, IBD remains a popular and reliable source of finance and investment news.

Over 50 years of intensive research, IBD has developed its own seven-part investment system based on the seven traits stocks were observed to display before making their biggest earnings. This investment system is known as CAN SLIM, standing for:

- Current Quarterly Earnings

- Annual Earnings Growth

- New Product, Service, Management or Price High

- Supply and Demand

- Leader or Laggard

- Institutional Sponsorship

- Market Direction

By thoroughly investigating each of these seven traits in relation to stock before committing to making an investment, you are less likely to make poor decisions.

When Is the Right Time to Buy Fintech Stocks?

Due to the volatile nature of the stock market, there is no such thing as a "right time" to purchase fintech shares. It is extremely difficult to predict how companies will grow. The market is changing all the time, so it's impossible to say with complete certainty whether stock prices will fall or rise. Sitting around and waiting for shares to reach a better price is therefore not a great strategy.

The best thing to do is invest in companies that are growing and making constant innovations. That way, you at least know that the business has a chance of lasting into the future, as they still are progressing and making changes in the sector.

Future Fintech Stock May Be Connected With Blockchain

Given the popularity of cryptocurrency right now and the potential blockchain has to grow as an industry, it seems likely that the future of blockchain fintech companies is looking bright. More and more uses are being found for blockchain all the time. The technology isn't only useful in banking but also has applications in everything from voting to medicine.

The more uses are found for blockchain, the more it seems that fintech stocks may be an interesting investment decision in the future.

Conclusion

The fintech industry is only likely to get bigger and bigger. Between the growth of blockchain and our increased reliance on digital payments, the various applications of financial technology are always increasing. Because of this, fintech is an especially interesting sector for investors to buy stocks in. Invest wisely!

FAQ

What is the number 1 fintech company?

In terms of market capitalisation, Visa is the biggest fintech company out there. Visa is the 11th most-profitable company in the world, with a market value of $490.19 billion. The company is also growing; its year-to-date price change currently sits at +4.38%.

Are fintech stocks safe?

By its very nature, all investment comes with a certain level of risk. It's impossible to predict peak fintech stock prices with 100% certainty, and, as such, you cannot know for sure how your investments will perform. However, you can take steps to reduce risk and make sure you're making wise investments.

Who is the biggest fintech company?

Over the past few years, rapid growth has been seen in the fintech world. Some companies have seen particularly high revenue growth and show signs of continuing to grow in the future. One of the fastest-growing fintech companies is OpenSea, a popular NFT marketplace based in America. Based on estimated revenue growth, employee growth, the quantity of funding, as well as other growth triggers, analysts expect OpenSea to do well in the future.

Why is fintech the future?

We have yet to uncover the full potential of fintech. As the financial technology industry grows and develops, we are finding more and more ways to innovate and make use of blockchain, digital assets, and digital methods of payment. As our culture becomes increasingly based online, it seems likely that fintech will only grow in importance.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.