8 Most Popular Gaming Stocks for 2022

There are approximately 3.1 billion gamers across the world, meaning that around 40% of the globe's population regularly play video games on their consoles, desktops or mobile devices. The market stood at $203.12 billion in 2020, and it's predicted to reach $545.98 billion by 2028, experiencing a CAGR of 13.20%.

So, gaming is only going to get even more widespread. Now, if you're interested in investing, you're likely wondering if video game stocks will be a good addition to your portfolio. The market data above looks promising, but let's examine some top video game stocks and see what investment analysts have to say. In case you're new to the finance world, we'll also show you a few different ways to invest in game company stocks.

Investing in Video Game Stocks

Even if you've never invested in stock before, there's nothing to be afraid of. Investing isn't just for people who work on Wall Street. Nowadays, there are many platforms to choose from. Some offer demo accounts and educational materials. So, you can take your time, practice and learn about various stocks before buying a single share.

Once you've carefully analysed a video game company and feel confident in its stock, you can invest in one of the following ways:

Spread betting

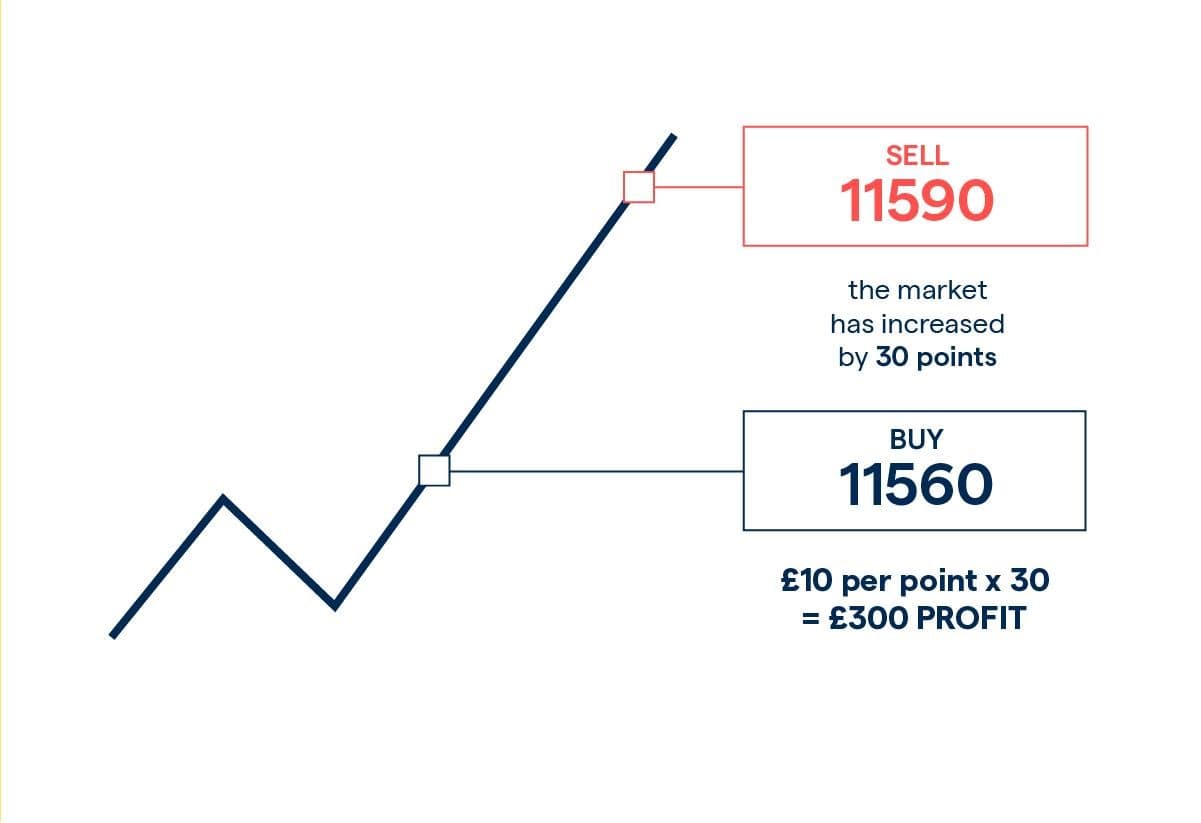

Essentially, you're speculating on whether the stock's price will rise or fall. In some countries, it's a commission-free and tax-free activity. Investors often go with this method, as it allows them to speculate in bear and bull markets. The profit of a spread bet is equal to:

Your per-point stake x (Closing Market Price - Opening Buy/Sell Price)

For instance, in the scenario below, a trader set £10 per point at a sell price of £11,560. They closed the trade when the price hit £11,590. There were 30 points of movement, so the trader's profit was £10 x 30 = £300.

Gaming share basket

This is a type of order that contains shares from multiple video game companies. Typically, market analysts will pick out the shares within a basket. This can give investors exposure to several assets simultaneously.

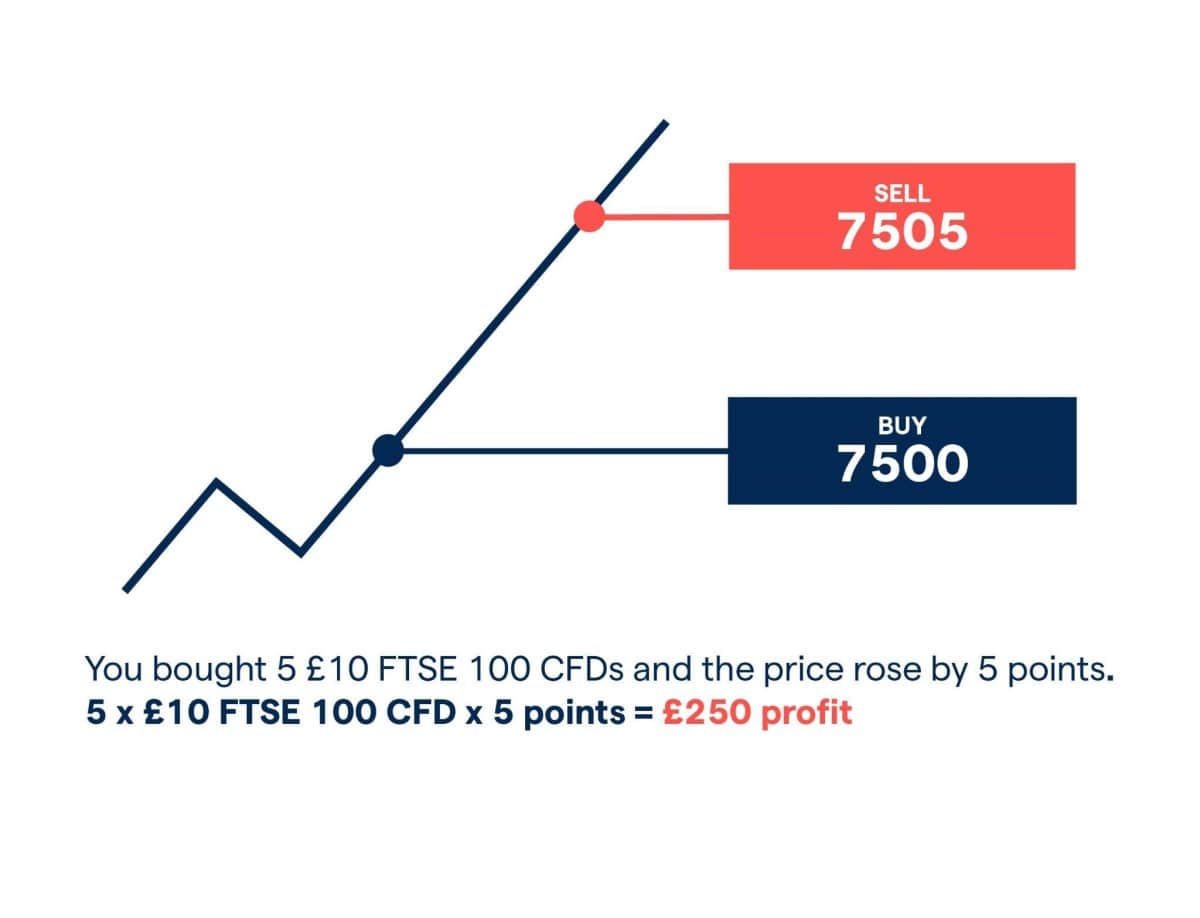

CFD trading

Like spread betting, CFDs allow you to invest without actually owning an underlying asset. However, you aren't placing a stake per point of price movement with this method. Rather, a FTSE contract is equivalent to £10. So, you buy a certain number of contracts. For each point of upward movement, you'll make £10 x the number of contracts you purchased.

But CFDs don't just involve upward movement! If you're expecting a price to decrease, then you wouldn't buy the contracts; instead, you would sell an opening position.

Most Popular Video Game Stocks (as of 25.03.2022)

Capcom (OTC: CCOEY)

- Market Value: JPY814.03B ($6.68B)

- Price of Share: $12.44

- Semi-Annual Dividend Yield: 1.27%

- Semi-Annual Dividend Amount: $0.16

- Year-to-Date Price Change: +6.42%

- Analysts' Opinion: 6 Buy, 2 Outperform, 5 Hold, 0 Underperform, 0 Sell (source: MarketWatch )

- Analysts' Consensus: Buy

Capcom is a Japanese gaming firm that was founded in 1979. It's globally recognised for series like Monster Hunter, Street Fighter and Resident Evil. The company is currently doing really well in the video game market, especially because of this year's release of Monster Hunter Rise: Sunbreak. What's more, it's launching an upcoming DLC for Resident Evil Village.

Out of 13 investment analysts, 6 recommend buying CCOEY. Because of the 2 analysts giving an Outperform rating, the consensus tips over to Buy. Industry analysts predict that in 2023, CCOEY will report an earnings-per-share figure of 1.60 (high estimate), 1.30 (average estimate) or 1.04 (low estimate).

Take-Two Interactive (NASDAQ: TTWO)

- Market Value: $17.37B

- Price of Share: $150.50

- Year-to-Date Price Change: -15.74%

- Dividend: None

- Analysts' Opinion: 15 Buy, 3 Outperform, 6 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Take-Two Interactive is an American company founded in 1993. It's known for some super popular game franchises — most notably, Grand Theft Auto. So far this year, the company has experienced a 15% price drop, making it a good time to buy low. This price drop followed the company's announcement that it would acquire Zynga; a price dip is typical during acquisitions. The deal, though, may have a positive long-term effect, as it'll give Take-Two Interactive a strong foothold in the mobile gaming industry.

Out of 24 investment analysts, 15 recommend buying TTWO, bringing the consensus to Buy. There are currently 21 analysts offering 12-month price forecasts for TTWO. The high estimate is $232 in 12 months, the median is $210 and the low estimate is $102.

Microsoft (NASDAQ: MSFT)

- Market Value: $2.28T

- Price of Share: $304.10

- Annual Dividend Yield: 0.82%

- Quarterly Dividend Amount: $0.62

- Year-to-Date Price Change: -9.16%

- Analysts' Opinion: 34 Buy, 6 Outperform, 3 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

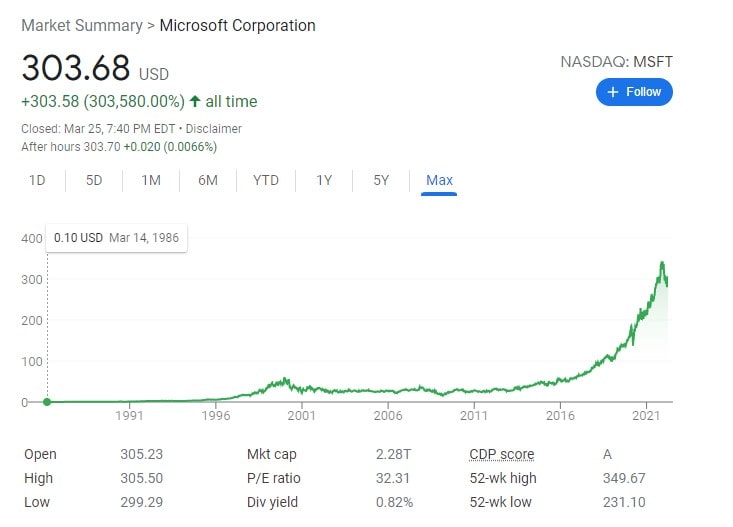

While Microsoft's success is attributed to much more than its gaming sector, the company makes plenty of profit from the Xbox console and its games. One of Microsoft's most successful games is Minecraft, which the company actually bought back in 2011. Since then, Minecraft has gone on to be the highest-selling game of all time, at 238 million sales.

When investing in Microsoft, don't just consider its video game projects and acquisitions. You have to look at the company as a whole. The company has its hands in many pots, including operating systems, mobile devices, cloud servers and productivity solutions.

The stock price has dropped by about 9% this year, mainly due to the overall tech bear market. However, if you look at the company's historical price, you can see that it has a strong positive trend.

Out of 43 investment analysts, 34 recommend buying MSFT, bringing the consensus to Buy. There are currently 37 analysts offering 12-month price forecasts for MSFT. The high estimate is $425 in 12 months, the median is $370 and the low estimate is $306.55.

Electronic Arts Inc. (NASDAQ: EA)

- Market Value: $35.31B

- Price of Share: $125.57

- Annual Dividend Yield: 0.54%

- Quarterly Dividend Amount: $0.17

- Year-to-Date Price Change: -6.95%

- Analysts' Opinion: 19 Buy, 5 Outperform, 7 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Electronic Arts, better known as EA, has been around since 1982 and has published smash gaming hits like The Sims and FIFA. While EA has demonstrated excellent growth in stock price over the last couple of decades, it floundered in late 2021 and late 2022 — this was a combination of a disappointing game release (Battlefield 2042) and the overall market's risk-off tone. But, considering EA's excellent EPS growth, high CAGR and low capital requirements, analysts believe the company will bounce back.

Out of 31 investment analysts, 19 recommend buying EA, bringing the consensus to Buy. There are currently 28 analysts offering 12-month price forecasts for EA. The high estimate is $188 in 12 months, the median is $167.80 and the low estimate is $127.

Nintendo (OTC: NTDOY)

- Market Value: JPY 8.55T ($70.17B)

- Price of Share: $66.22

- Year-to-Date Price Change: +13.25%

- Dividend: None

- Analysts' Opinion: 13 Buy, 0 Outperform, 3 Hold, 0 Underperform, 2 Sell (source: CNN Business )

- Analysts' Consensus: Buy

Interestingly enough, Nintendo was founded back in 1889 as a playing card company — but, of course, it eventually transitioned to the world-renowned video gamingcompany responsible for hits like Animal Crossing and Mario.

Nintendo's share price has grown by 13% so far this year — but it might be worth buying now instead of waiting for a low. That's because Nintendo is notorious for releasing new consoles every couple of years, and it's approaching that point of the cycle. Every time a new Nintendo console is released (or even just announced), revenue skyrockets. The new consoles then generate demand for games, and revenue drives even higher.

Out of 18 investment analysts, 13 recommend buying NTDOY, bringing the consensus to Buy. There are currently 16 analysts offering 12-month price forecasts for NTDOY. The high estimate is $102.69 in 12 months, the median is $74.68 and the low estimate is $32.40.

Bilibili (NASDAQ: BILI)

- Market Value: $11.63B

- Price of Share: $30.31

- Year-to-Date Price Change: -34.72%

- Dividend: None

- Analysts' Opinion: 27 Buy, 4 Outperform, 6 Hold, 0 Underperform, 2 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Bilibili is a Shanghai-based video-sharing website; it focuses on several aspects, including gaming, anime and comics. The company is showing incredible growth, with China's Gen-Z population being the main user base. What's more, China is a fairly low-inflation environment, which could both draw global equity investors to Bilibili and allow the company to sustain consumer demand.

Out of 39 investment analysts, 27 recommend buying BILI, bringing the consensus to Buy. There are currently 37 analysts offering 12-month price forecasts for BILI. The high estimate is $121.38 in 12 months, the median is $46.50 and the low estimate is $14.88.

Tencent Holdings (OTC: TCHEY)

- Market Value: HKD 3.74T ($4.78B)

- Price of Share: $46.21

- Year-to-Date Price Change: -20.65%

- Dividend: None

- Analysts' Opinion: Buy, Outperform, Hold, Underperform, Sell (source: CNN Business )

- Analysts' Consensus: Buy

Tencent Holdings is a Chinese technology and entertainment company that was founded in 1998. Like Microsoft, the company doesn't just deal in video games; it has a part in music, comics, video streaming, cinema, social media and even the medical industry. So, this is another company where you have to examine all of its projects and acquisitions. Right now, the stock is down after a recent announcement of strict Chinese gaming regulations. But analysts expect the price to rebound, especially considering Tencent's dominant market position, diversified revenue stream, and strong balance sheet.

Out of 50 investment analysts, 35 recommend buying TCEHY, bringing the consensus to Buy. There are currently 46 analysts offering 12-month price forecasts for TCEHY. The high estimate is $67.74 in 12 months, the median is $87.37 and the low estimate is $33.87.

Activision Blizzard (NASDAQ: ATVI)

- Market Value: $62.03B

- Price of Share: $79.62

- Year-to-Date Price Change: +18.10%

- Annual Dividend Yield: 0.59%

- Quarterly Dividend Amount: $0.12

- Analysts' Opinion: 10 Buy, 2 Outperform, 16 Hold, 0 Underperform, 0 Sell (source: CNN Business )

- Analysts' Consensus: Hold

Activision Blizzard is an American video game company that was founded in 2008. The company has published some incredibly successful games — including Overwatch, Call of Duty (CoD) and World of Warcraft. Now could be a good time to get ATVI shares; their annual CoD release is usually in early November. That time of year almost always leads to a surge in share price for the company.

Out of 28 investment analysts, 16 recommend holding ATVI, bringing the consensus to Hold. There are currently 24 analysts offering 12-month price forecasts for ATVI. The high estimate is $100 in 12 months, the median is $95 and the low estimate is $79.

Best Value Video Game Stocks

Out of all the video game stocks mentioned above, these are the ones offering the best value. We've selected ones with lower 12-month trailing P/Es (price-to-earnings ratio). Generally, ratios of 15 and below are considered cheap, while those over 18 are considered pricey. Actually, none of the most promising gaming industry stocks can be considered cheap per se, but these ones offer the most bang for your buck.

|

Price ($) |

Market Cap ($B) |

Trailing P/E |

|

|

Nintendo |

$66.22 |

$70.17B |

15.27 |

|

Capcom |

$12.44 |

$6.68B |

18.02 |

|

Electronic Arts Inc. |

$125.57 |

$35.31B |

18.39 |

Fastest-Growing Video Game Stocks

Out of the top gaming sector stocks, these are the ones experiencing the best YoY revenue growth. This percentage indicates how much a company's revenue has increased over the course of one year. The higher the percentage, the more promising the company's stock will be. Generally, revenue growth of 10%-15% is considered good, so the companies in the table below are going above and beyond expectations.

|

Price ($) |

Market Cap (billion $) |

Revenue Growth (%) |

|

|

Microsoft |

304.10 |

2,280 |

20.63 |

|

Capcom |

12.44 |

6.68 |

26.78 |

|

Bilibili |

30.31 |

11.63 |

61.54 |

Video Game Stocks With the Most Momentum

These video game stocks are exhibiting the most momentum, which is measured by their 12-month trailing total return on equity. Return on equity (RoE) is calculated by dividing a company's net income by the average shareholder's equity.

Net income = total income, net expenses, and taxes that the business generates in a time span (for a trailing 12-month metric, it would be over the last full fiscal year).

Shareholder equity = The total amount of money that would go to shareholders if the company liquidates (after all debts are paid).

A higher RoE means that the company efficiently uses equity to generate income, and anything over 14% is considered acceptable. So, once again, these companies are doing well above average.

|

Price ($) |

Market Cap (billion $) |

12-Month Trailing Total Return on Equity (%) |

|

|

Nintendo |

66.22 |

70.17 |

25.74 |

|

Capcom |

12.44 |

6.68 |

27.20 |

|

Microsoft |

304.10 |

2,280 |

49.05 |

Conclusion

The video game industry is only going to keep growing, especially as consoles get faster and offer higher resolution. Do you want to get in on it and add some gaming company stocks to your portfolio? Investment analysts expect the stocks in this article to perform well over the next 12 months. But before investing or trading, make sure to conduct your own research!

FAQ

How to invest in video gaming stocks?

To invest in gaming stocks, you'll need to create an account on a platform of your choice. One example is Libertex; this platform offers a free demo account so that you can practice strategies.

Which gaming stocks to invest in?

It depends on whether you want a gaming stock with momentum or fast revenue growth.

Why are gaming stocks down?

Not all gaming stocks are down. However, some companies experience price declines if a released game isn't satisfactory or if they announce an unpopular policy. For instance, while Tencent Holdings is estimated to do well in the long run, it's experiencing a short-term price decrease after an age restriction announcement.

Which game companies are public?

All of the game companies included in this article are publicly available for investors and traders.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.