8 Popular Oil Stocks in 2022

But first, before investing in oil company stocks, it's important that you understand the oil industry as a whole.

Overview of the Oil Industry

Oil is part of the larger Oil and Gas industry — which is one of the world's largest sectors. Oil contributes to the global economy as it is the world's primary source of energy, but its largest producers benefit the most: Saudi Arabia, the US, Canada, Russia and China.

Types of Oil Companies

There are three types of companies within the oil industry:

- Upstream: These are companies that search and produce oil. They are also known as E&P, which stands for exploration and production. This segment comes with high investment capital and high risks. Almost the entirety of an E&Ps cash flow comes from oil and gas production — and since it takes time to locate new sources of oil, there's the possibility of earnings drying up.

- Midstream: These are businesses that focus on transporting raw materials to refineries. The success of this sector is dependent upon the success of upstream companies — if upstream companies aren't finding oil, then there's no need for product transportation.

- Downstream: These are the refineries that are responsible for converting raw materials into final products. Downstream companies depend on both upstream and midstream categories: not only does oil need to be found, but it also must be transported to the refineries.

There are also companies that offer a combination of upstream, midstream and downstream services. By diversifying their solutions, they can mitigate some losses if one sector flounders.

What Influences the Price of Oil?

One of the biggest factors of an oil company's stock price (particularly that of an upstream oil company) is the price per barrel of crude oil.

But what influences oil price? Economic growth. Growing economies have a greater need for energy. When a nation has a need for transportation fuels, chemicals, plastics, asphalt and electricity generation, they need oil to make it happen. While there are certainly alternative sources of energy, oil is still the king of the sector.

So, it makes sense that in times of economic turmoil, the price of oil may suffer — take, for instance, when whole countries shut down at the start of the COVID pandemic. The price of oil tanked, even reaching the negatives. While there were more factors in play, the pandemic-induced recession was a leading cause of the price drop.

Another thing to consider: the onset of war can drive up the price of oil, especially if the conflict involves a country that produces crude oil.

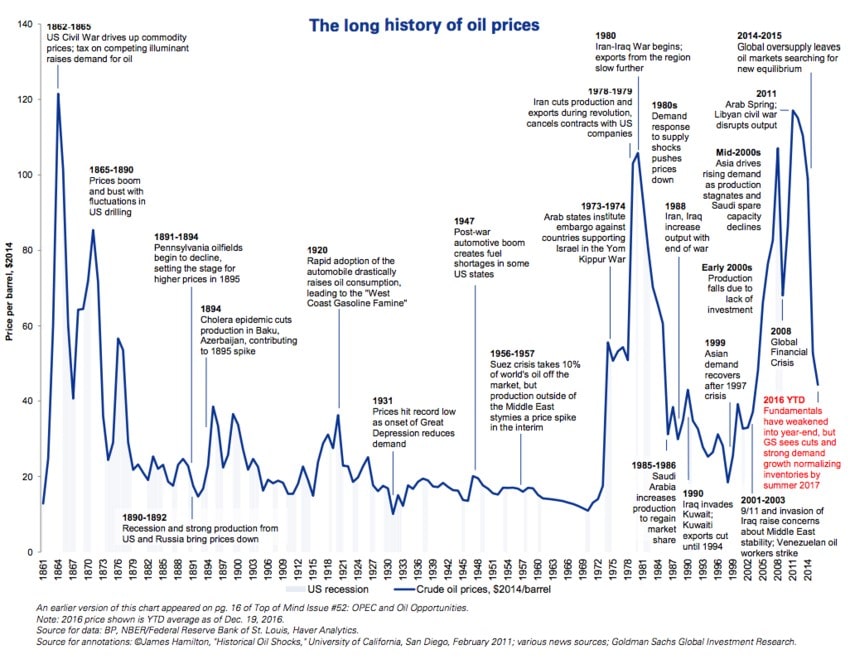

Take a look at this oil price timeline from Goldman Sachs: the low prices took place in times of economic turmoil, while the high points were caused by war and technological advancements.

Investing in Oil vs an Oil Company

While the scope of this article focuses on oil-related stocks, it is also possible to invest in oil itself. Because oil is a finite resource, changes in supply and demand can cause significant price fluctuations. This is why oil is very popular among traders: they can take advantage of price changes via CFDs, oil futures, or options contracts.

That said, investing in a commodity like oil comes with great risk — if you are a beginner, it may be better to start by purchasing stocks from oil-related companies. So now, let's take a look at the list of oil stocks that may outperform in 2022!

List of the 8 Most Popilar Oil Stocks in 2022

1. Exxon Mobil Corp (NYSE:XOM)

- Market Value: $367.80B

- Price of Share: $78.98

- Annual Dividend Yield: 4.46%

- Quarterly Dividend Amount: $0.88

- Year-to-Date Price Change: +29.04%

- Analysts' Opinion: 11 Buy, 3 Outperform, 17 Hold, 0 Underperform, 1 Sell (source: CNN Business)

- Analysts' Consensus: Hold

Exxon Mobil is the largest energy company in the US, so it's only fitting that it's included first on the list. On the upstream side of things, Exxon Mobil searches for and produces conventional, unconventional and heavy oil, as well as liquified natural gas. On the downstream side, the company manufactures and distributes products made from raw oil — they sell 5.4 million barrels of petroleum products per day.

Out of the 32 polled investment analysts, 17 recommend holding Exxon, bringing the consensus to Hold. There are currently 26 analysts offering 12-month price forecasts for XOM; the high estimate is $166 in 12 months, and the low estimate is $66 for the same timeframe.

2. Phillips 66 (NYSE:PSX)

- Market Value: $42.28B

- Price of Share: $77.55

- Annual Dividend Yield: 4.75%

- Quarterly Dividend Amount: $0.92

- Year-to-Date Price Change: +6.98%

- Analysts' Opinion: 13 Buy, 1 Outperform, 4 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Phillips 66 is an energy manufacturing and logistics company. Their portfolio of specialities is very diverse, allowing them to generate revenue even if the price of oil falls. Phillips 66 owns 13 refineries across the US and Europe, with a total capacity of 2.2 million barrels of oil per day.

They also have midstream solutions, including transporting and storing crude oil, refined products and natural gas liquids.

Furthermore, Phillips 66 owns 50% equity in CPChem, which produces within the automotive, industrial, pharmaceutical, energy and agriculture industries. In fact, in Q4 2021, Phillips 66 reported a 208% YoY increase in their chemicals segment, bringing in nearly $2B in adjusted earnings.

Out of the 18 polled investment analysts, 13 recommend buying PSX stock, bringing the consensus to Buy. There are 15 analysts who offer 12-month price forecasts for the stock. The high estimate for 12 months from now is $114, the median is $101 and the low is $85.

3. ConocoPhillips (NYSE:COP)

- Market Value: $128.43B

- Price of Share: $98.83

- Annual Dividend Yield: 2.37%

- Quarterly Dividend Amount: $0.59

- Year-to-Date Price Change: +36.94%

- Analysts' Opinion: 21 Buy, 4 Outperform, 4 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

The price of West Texas crude oil is largely working in ConocoPhillips' favour: a barrel is trading at over $100 — this is largely due to the current geopolitical situation between Russia and Ukraine. ConocoPhillips mainly deals in upstream operations, so they are capitalising heavily on the crude oil's price rally.

In 2022, the company expects to produce approximately 1.8 million barrels of oil per day.

Out of the 29 investment analysts polled, 21 recommended buying COP stock, bringing the consensus to a Buy. There are 26 analysts who offer a 12-month forecast: the high projected price is $135, the median is $114 and the low is $93.

4. Denbury (NYSE:DEN)

- Market Value: $3.73B

- Price of Share: $74.21

- Annual Dividend Yield: N/A

- Quarterly Dividend Amount: N/A

- Year-to-Date Price Change: -3.11

- Analysts' Opinion: 7 Buy, 1 Outperform, 1 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Denbury is not as strong of a contender as the previous three companies on our list; yet, investment analysts still recommend buying this stock; we'll examine the reasons in a moment.

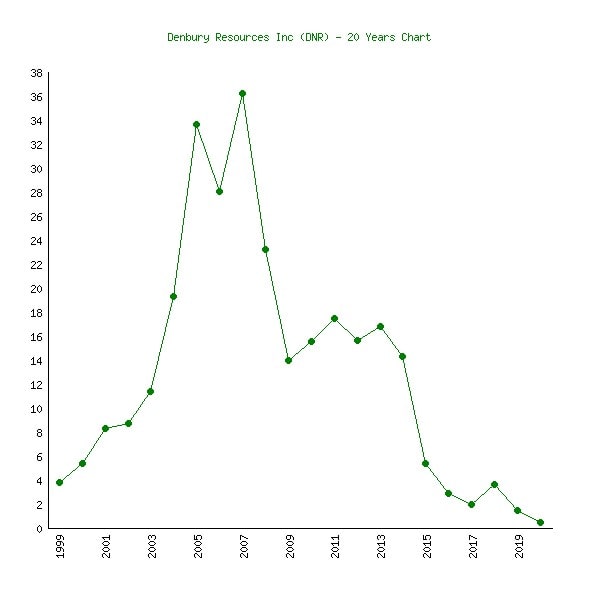

In 2015, Denbury's stock price took a nosedive, which you can see in the chart below (it was listed as DNR on NYSE at that time). Denbury even ended up announcing it would no longer pay dividends starting from that year.

As you can see, the stock price pretty much hit rock bottom. In 2020, though, Denbury filed for bankruptcy and agreed to a restructuring scheme. Now, the company is listed as DEN and is performing much better. The pre-bankruptcy price was less than $2/share, and the current price is around $74.

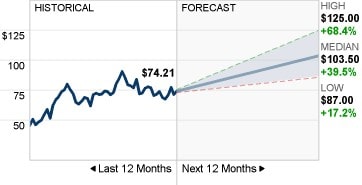

Expert analysts seem to be happy with Denbury's potential. Out of the 9 polled investment analysts, 7 recommended buying DEN, bringing the consensus to Buy. 10 analysts offer 12-month price forecasts: the high value is $125, the median is $103.50 and the low is $87.

5. Magnolia Oil & Gas (NYSE:MGY)

- Market Value: $5.22B

- Price of Share: $23.27

- Annual Dividend Yield: 1.72%

- Quarterly Dividend Amount: $0.10

- Year-to-Date Price Change: +23.37%

- Analysts' Opinion: 7 Buy, 1 Outperform, 7 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Magnolia Oil & Gas is largely an oil and gas exploration/production company — but they place a much heavier emphasis on generating value for shareholders than the other companies on this list. When you visit their website, before it goes into explaining the actual operations and products, it gives an explanation of how the company maximises shareholder returns.

While the company is pretty new (it was formed in the summer of 2018), things are looking very promising. Back in 2019, West Texas Oil was trading at about $60 per barrel, and Magnolia Oil had a $100 million net income before tax. Now that West Texas is trading above $100 per barrel, we can expect even better financial reports throughout 2022.

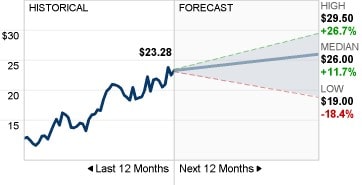

Out of the 15 polled analysts, 7 recommend buying and 7 recommend holding — only one analyst stated overperform (AKA, a moderate buy). The moderate buy just swings things over into Buy's favour for the consensus.

As far as the 12-month price projection, 13 analysts weighed in; the highest projection was $29.50, the median was $25 and the lowest was $19.

6. Baker Hughes (NYSE:BKR)

- Market Value: $35.94B

- Price of Share: $34.98

- Annual Dividend Yield: 2.06%

- Quarterly Dividend Amount: $0.18

- Year-to-Date Price Change: +9.94%

- Analysts' Opinion: 18 Buy, 3 Outperform, 8 Hold, 0 Underperform, 0 Sell Buy (source: CNN Business)

- Analysts' Consensus: Buy

Baker Hughes is an energy technology company that focuses on making the globe's power safer, more efficient and cleaner. The company doesn't produce oil; rather, it creates oil & gas equipment, placing the company in the midstream sector.

Baker Hughes was purchased by General Electric (GE) in 2017 — and then, just a couple of years later, GE completely divested its stock in BKR. This doesn't mean that Baker Hughes did anything wrong on its end — rather, General Electric was already trapped under a mountain of debt before the purchase and quickly decided to try to get its money back.

Because of this whirlwind of events, it took some time for Baker Hughes to recover, but now, things are on the upswing.

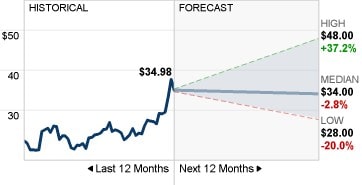

Out of the 29 investment analysts polled, 18 recommend buying BKR, making the consensus a Buy. There are 24 analysts that offer 12-month price forecasts of this stock; the high projection is $48, the median is $34 and the low is $28.

7. Marathon Petroleum (NYSE:MPC)

- Market Value: $43.09B

- Price of Share: $77.15

- Annual Dividend Yield: 3.01%

- Quarterly Dividend Amount: $0.58

- Year-to-Date Price Change: +17.50%

- Analysts' Opinion: 14 Buy, 1 Outperform, 4 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Marathon Petroleum has a strong midstream division; its midstream services have predictable and guaranteed cash flows that aren't directly tied to the price of oil. 2020 was catastrophic for the oil industry, yet the company still managed to bring in $70B of revenue. They experienced a net income loss of $10B that year — while a significant figure, it was still much lower than what other oil-related companies lost.

Out of the 19 investment analysts polled, 14 recommend buying MPC, bringing the consensus to a Buy. A 12-month price projection was provided for the stock by 17 analysts. The highest projection is $113, the median is $87 and the lowest is $70.

8. EOG Resources (NYSE:EOG)

- Market Value: $69B

- Price of Share: $117.87

- Annual Dividend Yield: 2.55%

- Quarterly Dividend Amount: $0.75

- Year-to-Date Price Change: +29.30%

- Analysts' Opinion: 19 Buy, 6 Outperform, 1 Underperform (source: CNN Business)

- Analysts' Consensus: Buy

EOG Resources is an American energy company that finds, produces, develops and markets oil and gas. The company heavily engages in exploration drilling and has turned its focus toward drilling wells. EOG Resources stated in 2021 that drilling wells offer a 60% return rate and that, when coupled with other exploration tactics, can even reach 80% or higher.

EOG's exploration tactics are certainly paying off, as the company has experienced 29.30% growth so far this year — and 71.07% YoY growth.

Out of the 33 polled analysts, 19 recommend buying the stock, bringing the consensus to a Buy. There are 31 analysts that offer 12-month price forecasts of this stock; the high projection is $160, the median is $130 and the low is $102.

How to Buy Oil Company Stocks

Now that you know companies in the oil and gas sector, how do you take the next step and buy their stock? We'll walk you through the process.

Step 1: Research what oil trading is

While we've given you a quick overview of the oil industry and price factors, consider doing even more research before you make your first purchase. Investopedia is a great place to get started!

Step 2: Determine what moves oil's price

Remember that we mentioned that times of economic growth would cause oil's price to rise, while recessions and depressions lead to falls. Furthermore, wars can increase the scarcity of oil when they involve production companies, so that can cause the price of oil to increase.

Step 3: Decide which platform to use

It's time to select a platform. Many beginners prefer to start with a platform that offers a free demo account, so they can hone their strategies. If this is something that appeals to you, check out Libertex!

Step 4: Create a brokerage account

This step may differ depending on which platform you choose. Generally, you will set up a username and password and then verify your identity. When you make a account, make sure the platform is accepted in your country.

Step 5: Find a good time to buy

Now it's time to watch the market. Look at the long-term perspective (fundamental analysis), as well as the short-term (technical analysis). We'll show you how to do this later.

Step 6: Open your first oil position

Use the platform to open an oil position! You have some choices here, but many investors choose to buy stock for oil-related companies (like the ones on this list).

Step 7. Monitor your position closely

Your platform should have built-in monitoring tools, which you can use to closely follow price movements.

Step 8: Sell your assets

If things are going your way and the price is moving toward your reward target, exit your position once the target is reached. If the price is moving in the opposite direction, exit when you reach a pre-determined level of loss.

How to Analyse Oil Stocks

Above, we mentioned that you could conduct fundamental and technical analyses of stocks. For fundamental analysis, you're looking at the stock's intrinsic value. You'll examine the market as a whole, as well as the company's latest financial reports, innovations, competition and so on.

Remember how we showed the 12-month price forecasts from investment analysts? They used fundamental analysis to come to those conclusions. You can follow the advice of analysts, or you can do your own research.

Technical analysis is better for trading over a short timeframe. You can analyse the price movements of a stock even down to 1-minute time increments! Your platform of choice will likely have technical analysis tools that allow you to predict short-term movements and close at a favourable price point.

Conclusion

Whether you want to buy crude oil or company stock, it's important to understand the factors that drive prices up and down. When oil prices are high, the companies listed above will likely perform very well — but when they plummet due to an economic slump (such as in 2020), oil-related companies will suffer. So, keep an eye on these promising companies but always remember to carefully analyse the overall market!

FAQ

What are oil stocks?

Oil stocks are the stocks of companies that belong in the Oil and Gas industry.

What is the future of oil stocks?

It depends on the direction that the energy sector takes. If the globe shifts towards renewable energy, then the price of crude oil will decline.

Is crude oil a good long-term investment?

Crude oil is highly volatile, but it does trend positively over time, making it attractive to long-term investors and day traders.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.