Which Social Media Stocks May Blow Up in 2022?

If you're interested in investing, you may recognise this social media boom as a potential opportunity, and investment analysts agree. We're in an interesting position: the share price of almost every social media company is declining.

It isn't because social media is dying — rather, it's that people are going back to work after the Covid-19 restrictions subsided, and unemployment is falling. When 90% of the world was spending more time on social media for a couple of years, that meant more eyes were on ads (which is where social platforms get most of their revenue). Now, those eyes are busy at work, so revenue isn't growing at ridiculously high rates anymore.

But investment analysts don't think that social media shares will keep dropping. They'll even out to pre-pandemic levels and then experience stable growth from here on out.

However, this doesn't mean that investors should buy the stock of every social media company out there. Instead, one must conduct careful research. This includes reviewing price trends and the opinions of investment analysts.

In this article, we'll show you the social media stocks in 2022, backed up by the opinions of expert investors. Let's go!

What Do the Experts Say About Social Media Stocks to Invest In?

Bumble (NASDAQ:BMBL)

- Market Value: $5.70B

- Price of Share: $28.17

- Dividend: N/A

- Year-to-Date Price Change: -19.81%

- Analysts' Opinion: 10 Buy, 1 Outperform, 5 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Bumble was first created as a dating app back in 2014, but it's now used for networking, making friends, and more. Even though the company has gone down in price since the beginning of 2022, Bumble has been doing really well over the last few weeks. In early March, Bumble released information on its Q4 earnings, which showed smaller net losses and solid revenue growth of 25.7%. 2021 was Bumble's first year being publicly traded, so we can expect some growing pains. But analysts think that now is a great time to get in while the social media market shares are still low.

Out of 16 investment analysts, 10 recommend buying BMBL, bringing the consensus to Buy. There are currently 16 analysts offering 12-month price forecasts for BMBL. The high estimate is $34.50 in 12 months, the median is $48 and the low estimate is $20.

Match Group (MTCH)

- Market Value: $30.43B

- Price of Share: $106.73

- Dividend: N/A

- Year-to-Date Price Change: -20.49%

- Analysts' Opinion: 17 Buy, 0 Outperform, 4 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

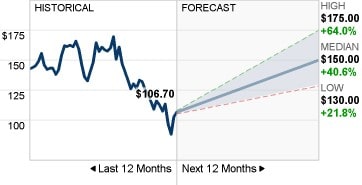

Match Group is an American tech company that owns some of the most popular dating platforms — Tinder, OkCupid, Hinge and PlentyOfFish. Despite pouring money into expanding its offerings, the company has experienced excellent profitability, with an adjusted operating income of 19% in 2021. Like pretty much every other social media platform, early 2022 hasn't been kind to its share price, but analysts are confident that the situation will turn around.

Out of 21 investment analysts, 17 recommend buying MTCH, bringing the consensus to Buy. There are currently 20 analysts offering 12-month price forecasts for MTCH. The high estimate is $175 in 12 months, the median is $150 and the low estimate is $130.

Meta Platforms (FB)

- Market Value: $603.78B

- Price of Share: $221.82

- Dividend: N/A

- Year-to-Date Price Change: -34.48%

- Analysts' Opinion: 33 Buy, 5 Outperform, 17 Hold, 0 Underperform, 1 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Previously known as Facebook, Meta Platforms is a social media conglomerate that owns Facebook, Instagram, Oculus, and WhatsApp, among others. There has been a lot of negative press coverage regarding Meta lately, which is why the company's YTD price change is worse than others on this list. However, because the company owns so many incredibly popular platforms, the price will likely turn around as Meta keeps adding to its user base.

Out of 56 investment analysts, 33 recommend buying FB, bringing the consensus to Buy. There are currently 48 analysts offering 12-month price forecasts for FB. The high estimate is $425 in 12 months, the median is $322.50, and the low estimate is $220.

Alphabet (NASDAQ:GOOG)

- Market Value: $1.87T

- Price of Share: $2,830.43

- Dividend: N/A

- Year-to-Date Price Change: -2.45%

- Analysts' Opinion: 41 Buy, 6 Outperform, 1 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

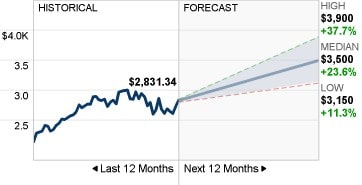

You might have noticed that Alphabet (Google) has experienced the least severe drop in price for 2022. That's because the company deals with so much more than social media. While there's still an overall tech bear market, Google's offers are diverse enough to mitigate risks. For instance, the company's cloud revenue growth was 45% in 2021.

Out of the 48 investment analysts, 41 recommend buying GOOG, bringing the consensus to Buy. There are currently 44 analysts offering 12-month price forecasts for GOOG. The high estimate is $3,900, the median is $3,500 and the low estimate is $3,150.

Tencent Holdings (OTC:TCHEY)

- Market Value: 3.43T HKD (4.38B USD)

- Price of Share: $45.68

- Year-to-Date Price Change: -21.57%

- Dividend: None

- Analysts' Opinion: 39 Buy, 7 Outperform, 5 Hold, 0 Underperform, 3 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Tencent Holdings is a Chinese tech company that was founded in 1998. It doesn't just deal with social media; it also is a big contender in music, comics, cinema, video streaming, and even health tech. To get an idea of its potential, you have to examine the company as a whole, including all of its projects and acquisitions. Right now, the stock is down after a recent announcement of strict Chinese gaming regulations, so the dip isn't even related to its social media sector. But analysts expect the price to pick back up, especially considering Tencent's excellent market position, great balance sheet, and diversified revenue stream.

Out of 54 investment analysts, 39 recommend buying TCEHY, bringing the consensus to Buy. There are currently 47 analysts offering 12-month price forecasts for TCEHY. The high estimate is $87.37 in 12 months, the median is $66.98 and the low estimate is $33.87.

Snap Inc. (NYSE:SNAP)

- Market Value: $57.5B

- Price of Share: $35.40

- Dividend: N/A

- Year-to-Date Price Change: -24.02%

- Analysts' Opinion: 26 Buy, 4 Outperform, 11 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Snap Inc. is the company that owns Snapchat, a popular social media app used to send temporary pictures to friends and followers. Snap introduced AR to social media users way before other companies hopped on board; however, rather than dealing with a 'metaverse', Snapchat lets users overlay AR over their worldview. In other words, rather than existing in a virtual world, you view the real world through an AR lens via photos and videos. Snap is considered a hot growth stock, as it experienced 64% revenue growth in 2021.

Out of 41 investment analysts, 26 recommend buying SNAP, bringing the consensus to Buy. There are currently 34 analysts offering 12-month price forecasts for SNAP. The high estimate is $93 in 12 months, the median is $52 and the low estimate is $39.

Kuaishou Technology (HK:1024)

- Market Value: HKD 301.38B ($38.5B)

- Price of Share: HKD 70.75 ($9.04)

- Dividend: N/A

- Year-to-Date Price Change: -5.16%

- Analysts' Opinion: 29 Buy, 4 Outperform, 2 Hold, 1 Underperform, 1 Sell (source: Wall Street Journal)

- Analysts' Consensus: Buy

Kuaishou is an investment holding company that owns a video-sharing app of the same name. It's considered to be China's biggest rival to TikTok. The company was named a new long idea by Hedgeye, an independent investment research firm. Hedgeye states that Kuaishou has a potential upside return of 30%-35%.

Out of 37 investment analysts, 29 recommend buying 1024.HK, bringing the consensus to Buy. According to MarketWatch, there are currently 37 analysts weighing in on the target price; the average 12-month target price is $16.83.

Etsy (NASDAQ:ETSY)

- Market Value: $16.81B

- Price of Share: $132.32

- Dividend: N/A

- Year-to-Date Price Change: -36.97%

- Analysts' Opinion: 12 Buy, 2 Outperform, 6 Hold, 0 Underperform, 0 Sell (source: CNN Business)

- Analysts' Consensus: Buy

Etsy is a global online marketplace in which vendors sell handmade goods, arts, crafts, and vintage items. The company recently announced that it would be increasing its fees for sellers, an unpopular choice reflected by a drop in share price, but this move will be good for the company in the long term.

Out of 20 investment analysts, 12 recommend buying ETSY, bringing the consensus to Buy. There are currently 17 analysts offering 12-month price forecasts for ETSY. The high estimate is $280 in 12 months, the median is $200 and the low estimate is $145.

Looking for Penny Stocks to Invest In?

If you don't have enough capital to invest in companies with high share prices, you still have plenty of options to choose from. You may want to consider investing in penny stocks. Despite the name, these stocks trade for $5 or less — not for pennies. Still, this means that they're more affordable than bigger companies (for instance, it could be difficult to pony up over $2,000 needed for Alphabet stock). These are some of the most promising penny stocks. While they aren't social-media related, they may still be a welcome addition to an investor's portfolio.

|

Company |

Market Cap |

Description |

|

Denison Mines Corp (NYSE American: DNN) |

$1.37B |

A uranium mining company that experienced an incredible EPS growth of 560% between February and April. |

|

ARC Document Solutions (NYSE: ARC) |

$166.3M |

A one-stop shop for document services: copying, printing, scanning, data archival and equipment installation. The company's gross margin is quite good, standing at 32%. |

|

Mind CTD Ltd. (NASDAQ: MNDO) |

$58.36M |

Works with customer care, real-time billings, and communication analytics. Compared to most other penny stocks, MNDO has a very strong balance sheet and an excellent price-to-earnings ratio. |

Conclusion

Whether you're investing in social media stocks or penny stocks from various industries, make sure to conduct thorough research. Reading this article was just the beginning! Investors often find it helpful to conduct fundamental analysis — and if you plan on trading CFDs rather than investing, then short-term technical analyses are something you should learn to do. Regardless of the method you choose, you can sign up at Libertex for a demo account and practice your strategies.

FAQ

What stock is TikTok?

TikTok is a product by the company ByteDance. Currently, ByteDance is privately held. Therefore, its shares aren't available on social media stock index listings.

Which social media companies are publicly owned?

Etsy, Alphabet, Snap, Tencent Holdings, Kuaishou Technology and many other social media companies are publicly owned.

What's the next social media platform in 2022?

In late 2021, the Octi social media app was released. The app is an AR platform that mixes the features of Instagram, Facebook and TikTok. The launch was very successful, as the app debuted as #1 on the App Store. However, Octi isn't yet publicly traded. New social media apps need time to gain steam.

What is a SPAC stock?

It stands for "special purpose acquisition company" — it's a company that doesn't have any commercial operations. Such a company is formed either to raise capital via an IPO or to acquire/merge with an existing company.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.