Strike Prices for Trading Options Explained

What Is a Strike Price in Options Trading, and How Does It Work?

Options are financial derivatives that allow but do not oblige traders and investors to buy or sell various stocks indicated in the contracts at a specific price. This specific price is the strike price.

The strike price is the stock's price at which you can set a call or put option. It's a future price set by the seller (also known as the writer) for each option for when the contract is to be traded at a specified date.

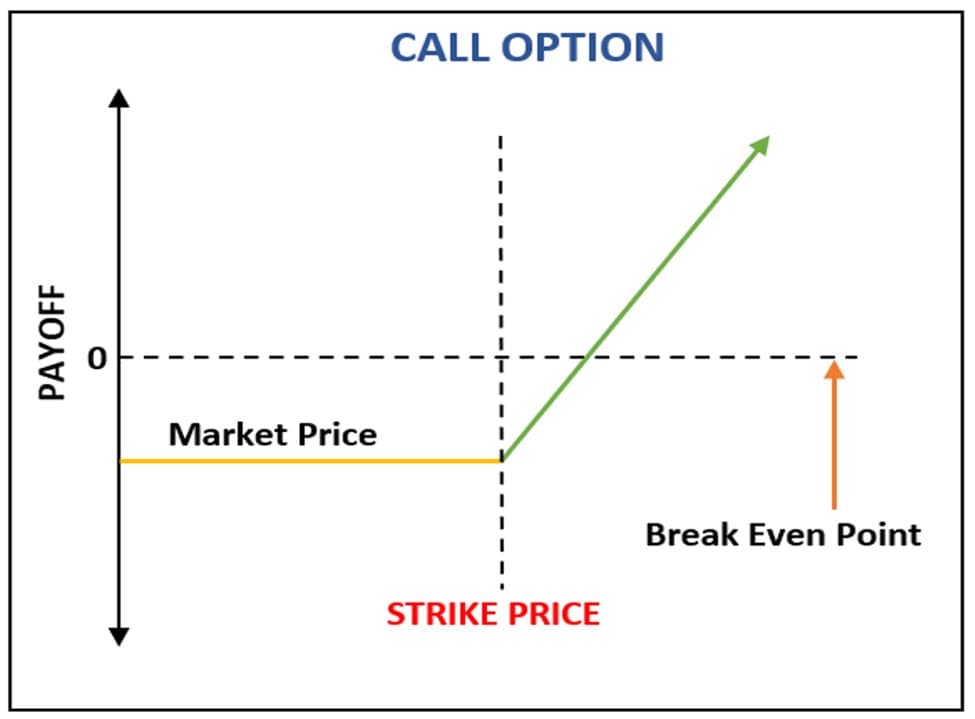

Strike Price in a Call Option

When traders enter into an agreement with the writer and buy a call option, they get the right to buy a particular number of shares of the stock at the strike price. On the other hand, the writer, or seller, will receive the premium the trader will pay in exchange if the buyer exercises their options.

Take note that options are only available for a certain period of time. They have an expiration date that is specified in the contract. The buyer can exercise their right at any time before the option's expiry.

There are two possible outcomes from this: 'in the money' and 'out of the money'. If an option is 'in the money' before it expires, it means that the stock's market price is more than the strike price indicated in the option. When this happens, the buyer can trade the stock at a better price compared to the market price.

You can buy stocks at a much lower price before the option completely expires because of the strike price. The writer will have to sell you the stock at the strike price.

But when the option is 'out of the money' before it expires, the stock's price dropped and is less than the specified strike price. Most traders don't exercise their rights during an out-of-the-money situation, instead letting the option completely expire. As such, the writer receives the premium you paid for opening the option.

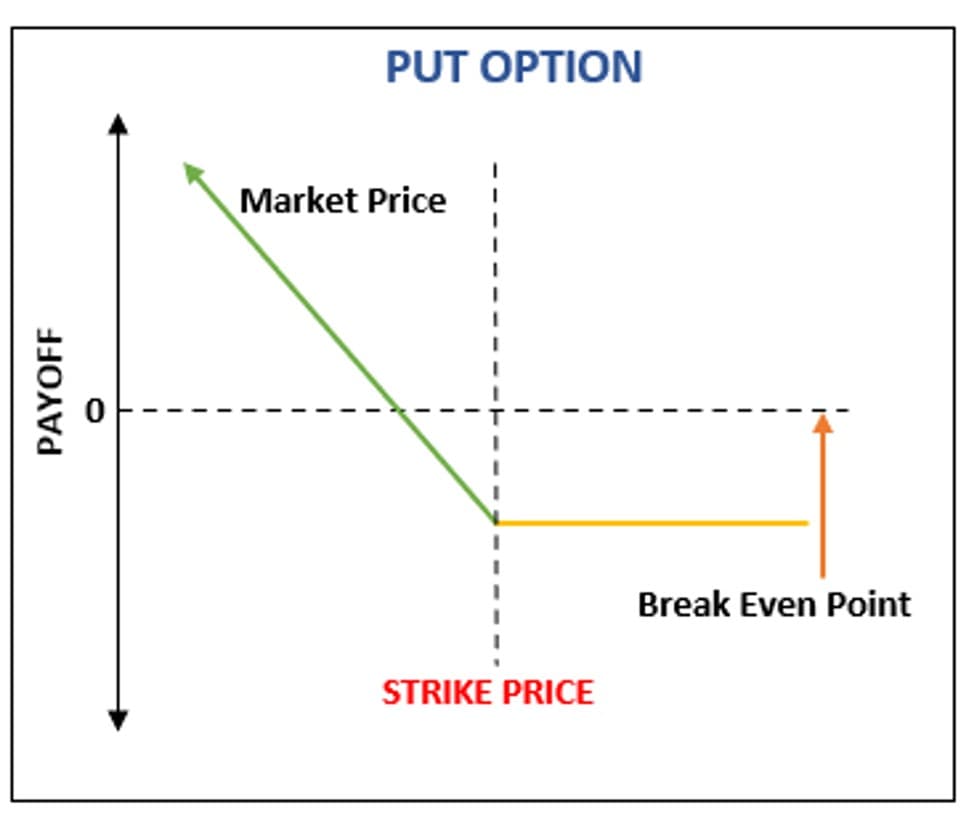

Strike Price in a Put Option

A put option allows the buyer to sell the stock or any underlying asset by paying for the premium. In this agreement, the buyer can exercise the option and sell the stock at the specified strike price before the indicated expiration date.

'In the money' and 'out of the money' also happens with this type of option. Since the buyer of the option can exercise their right or not until the expiry, the stock's price movement in the market will significantly affect their decision.

With an in-the-money situation, the buyer's prediction is correct, and the stock's market price declines. Because of the put option, the buyer can sell the stock at the strike price before the option expires, even if the market price continues to decline. By doing this, you can prevent yourself from incurring bigger losses when selling the stock at a much lower price.

On the other hand, in an out-of-the-money situation, the stock's market price doesn't decrease, going up instead, more than the strike price until the option expires. In situations like these, traders usually let their options expire. The writer will then receive the premium.

Examples of Strike Price Selections

We prepared some examples to help you understand how to select strike prices in various situations, both for a call option and a put option. Let's say we have two traders, Nico and Robin. Here's how they select their strike prices.

Example 1: Buying a Call Option

Nico and Robin both want to buy FB stock that currently costs $350.50. They expect the market price will soon increase, so they each buy a call option from a certain writer (seller). Let's suppose that these are the choices of strike prices the writer offers:

- $352

- $351

- $350

- $349

- $348

Since both Nico and Robin predict that the price will go up, they choose a strike price higher than the current stock price. Nico is a bit conservative, so he chooses $351 and buys the call option for a premium. Robin, on the other hand, loves a little risk, so he chooses $352 and pays for the option's premium.

Both options have an expiry of 5 September 2021 and were purchased on 30 August 2021. Over the one-week duration, the price does increase but only to $351.50 a day before the expiration.

Nico decides to exercise his right and buys the stock at his chosen strike price. He's able to purchase the stock for a lower price. However, Robin can't buy the stock at his chosen strike price since the market price is lower, so he lets the option expire. Although neither incurred significant losses besides the premium, Nico was able to buy FB stock while Robin wasn't.

Example 2: Buying a Put Option

Considering both Nico and Robin own an FB stock that costs $350.50, they predict the price to drop. So they buy a put option instead to sell their stock before the market price completely declines. With the same strike prices offered:

- $352

- $351

- $350

- $349

- $348

This time Robin expects that the price won't decrease much, so he chooses $349. He bought the put option and paid for the premium. On the other hand, Nico predicts that there'll be a big drop in the market price, so he chooses $348 and buys the option.

Let's consider the same dates. They bought their options on 30 August 2021, and the contract will last until 5 September 2021. During this one week, the market price didn't decline by much. Before the options' expiry, FB's market price dropped to only $348.50.

Robin decides to sell his stock since he still expects the price to drop after the expiration date. He avoided significant losses and was able to sell his stock before the market price continued to dip. Nico, however, let the option expire since his strike price was way lower than the market price for the whole duration.

In this scenario, Nico lost his entire premium and couldn't sell his stock while Robin could.

Example 3: Buying Both Call and Put Options

Nico and Robin own FB stock that they both want to trade. Let's say that the current price is $350.50 and the list of strike prices is the same.

Nico expects the price to drop in the following days, so he buys a put option with a strike price of $348. However, he also wants to buy more shares if the price goes up so he can sell them later. So he also buys a call option at $352.

On the other hand, Robin expects the price to increase, so he first buys a call option at $351. Taking precautions, he also buys a put option at $350 in case the price goes the other way.

During the same duration as before, the market price continued to move up and down. But, before the expiration, FB reached $351. Since the price is still lower for Nico's call option and higher for his sell option, he decides to let both options expire. Robin, however, buys additional shares at $351 and lets his put option expire.

In this scenario, Nico saw more losses since he lost two premiums and wasn't able to trade, while Robin gained more stock and lost only one premium.

How to Choose the Right Strike Price

Choosing a strike price may sound simple, but there's more to it than that. For a better strike price selection procedure when trading options, you can take the following steps:

Step 1 - Determine Which Market to Trade

There are numerous markets where you can trade options, such as the stock market, commodities, forex and indices. In line with this, decide the timeframe for your contract, as well. You can trade daily, weekly or monthly. Just make sure that the trading platform offers these timeframes.

Step 2 - Plan Out Your Strategy

It's best if you have a strategy when trading. This may include the price you'll trade your option and how you'll trade it. You have to understand the fundamentals of options trading for this so you can generate a good strategy.

Step 3 - Take Note of Volatility

Don't forget to consider your risk profile because this can have an impact on the strike price when trading. Volatility is one of the major factors that affect the market's price and the option's price, as well.

The option is susceptible to implied volatility. With implied volatility, you can gain precise insights on the expected volatility of the option based on the current price movement in the market.

It also has an impact on an option's premium price. The higher the implied volatility is, the higher the premium you'll need to pay.

Step 4 - Analyse the Market

Perform both technical and fundamental analysis on the market you choose. This can help obtain data and details behind the current market price. You can also use the results as implications if your option has the chance to be successful.

Step 5 - Pick Your Preferred Strike Price

When choosing your strike price, you have to consider the value of your option. In line with this, you have to understand the intrinsic value and time value.

The intrinsic value is an inherent value of the contract. It's the difference between the asset's current price and the strike price indicated in the option. It means that the market price will move past the strike price.

On the other hand, time value is the additional cost the buyer can pay over the intrinsic value. Most traders are willing to pay for this if they expect the option's value to increase before it expires. It's the difference between the premium and the intrinsic value.

Take all of these, along with the volatility, into consideration when choosing your strike price. If you have low risk tolerance, you can choose a strike price close to the market price value. But if you have a high tolerance, you can choose a strike price that's further away from the market price.

Step 6 - Start Trading

After completing all the steps above, you can now create a trading account, log into it, and place an options trade.

Top Mistakes to Avoid When Choosing a Strike Price

There are still traders who poorly select their strike prices. Here are some mistakes you must avoid when choosing an appropriate strike price.

Setting Aside Risk Tolerance

Risk tolerance is an essential factor you must always consider when determining your strike price. Your risk tolerance will help you decide on which type of option you can purchase: 'in the money', 'at the money' or 'out of the money' options.

If you have a low risk tolerance, you should consider only 'in the money' and 'at the money' contracts. But if you have a high tolerance, you can opt for an 'out of the money' option.

Choosing Rarely Traded Options

Consider an option's liquidity. Only choose options that are heavily traded with small bid-ask spreads. That way, you can reduce your trading costs.

Trading Out of Budget

Most traders like to maintain a budget when trading. With that being said, some traders don't consider moneyness. It's best to pay with an amount you can afford to lose. 'In the money' options are more expensive than 'out of the money' ones.

Conclusion

The strike price is the price of an option that the buyer decides to pay. It serves as a baseline of the success of your call or put option. Since options are popular financial derivatives like CFDs, you must choose your strike price properly. If you want to try CFD trading for a change, you can open a trading demo account.

FAQ

What Is a Strike Price for an Option?

An option's strike price is the amount that gives the trader the right to buy or sell the underlying asset. It allows investors and traders to exercise their call or put option. With a strike price, traders can observe how the price movement will play out in the market before trading.

What Happens When an Option Hits the Strike Price?

When this happens, the option contract becomes worthless on the expiration date. Since the strike price and the market price are the same, you can simply purchase the asset openly in the market. There's no need for a trader to exercise their option.

How Do You Calculate Strike Price?

An option contract essentially allows a trader to buy 100 shares of stock from the writer before the option expires at the specified strike price. The strike price of a stock option is commonly equal to the fair market value (FMV) of the stock on the day the option was granted. Most writers of options usually base their strike price by looking at the current situation of the stock in the market.

What Happens If a Put Option Doesn't Hit the Strike Price?

When you buy a put option, it means that you expect the market price to drop, so you choose a strike price at which you want to sell your stock. However, if the option doesn't reach the strike price, it's 'out of the money'. There's no intrinsic value with the put option, and you can opt to let it expire.

What's the Difference Between the Strike Price and the Exercise Price?

There's no difference between the two. The strike price of an option is the same as its exercise price. Both equate to the price at which the option can be exercised.

Is the Strike Price Break-Even?

No, it's not. The strike price is the amount of money at which you can buy or sell stocks. However, the break-even price or point is the price that will make any potential profit on the trade zero.

What Is a High Strike Price?

There are two directions the market price can go in: up or down. The strike price stands in between. So when you say a high strike price, it means you're choosing a strike price that's way higher than the stock's current market price. Most traders buy call options with higher strike prices because they tend to cost less.

How to Choose an Option's Strike Price

You need to consider the volatility, intrinsic value, time value and the current status of the stock's market price before choosing the strike price. Based on your market analysis, you can gain insights into whether to buy a call or put option and whether how the price will move in the future. Also, choose an amount you can afford to buy or sell.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.