Most Volatile Stocks: 10 Tickers to Track

For traders and investors alike, the concept of stock market volatility is highly important, largely affecting their decisions and strategies.

This article will explain the idea of stock volatility, its significance, and the factors driving it. And also cover the ten most volatile stocks at the moment. Finally, there's some advice for those looking for such stocks and the best strategies to deal with them.

Stock Volatility: Explanation and Significance

Stock volatility refers to the rate at which the price of a stock increases or decreases over a period of time. The higher the stock volatility, the higher the risk associated with it. Essentially, volatile stocks have no consistent price or even a consistent price trend. This concept is important because it helps traders and investors estimate the fluctuations that may happen in the future.

The volatility of a stock is calculated by the standard deviation of the stock's annualised returns over a particular time period. This results in the range in which the stock price is expected to remain when it increases or decreases. If the price fluctuates too rapidly, the stock is characterised as highly volatile. A gradual price change is classified as low volatility.

Two main commonly used types of volatility are historical and implied volatility. Historical volatility considers a series of past market prices, whereas implied volatility is calculated with future volatility using the market price of a market traded option.

Several key factors drive price volatility.

Political and Economic Factors

Politics and economy arguably sit at the centre of how stock markets operate. Governments, which play a deciding role in regulating industries, can strongly impact the economy with trade agreements, tariffs and legislation. Similarly, economic indicators are closely tied to investor confidence in stocks.

For instance, inflation data, consumer spending reports and GDP calculations can all impact stock performance and the market entirely.

Individual Company Performance

Market-wide factors don't always cause volatility in the stock price. Often, individual companies can rattle stocks. For instance, positive news, such as strong quarterlyearnings or the launch of an impressive product, can catch investors' attention, potentially causing the stock to rise.

Similarly, negative news, including data breaches or decreased profits, can make investors wary, prompting them to sell off their stock, leading to the stock price falling.

Industry Factors

Certain events can affect the stock prices across particular sectors and industries. Consider the oil sector, where a significant weather-related event in a major oil-producing region can lead to a drastic rise in oil prices. This is highly likely to raise the oil stock since investors would expect to benefit from the increasing prices.

On the contrary, with increased government regulations and restrictions across certain industries, stock prices could fall due to increased compliance or employee costs.

The Most Volatile Stocks in 2021

We've compiled a list of the ten most volatile stocks in 2021 based on two major factors: trading volume and the percentage change in the share price over the past day. Additionally, we considered beta, which measures a stock's volatility for the overall market.

Please be aware that any abrupt change in any stock worldwide can add, remove or replace names from the list below.

Note: All the statistics and figures mentioned are relative as of late November 2021.

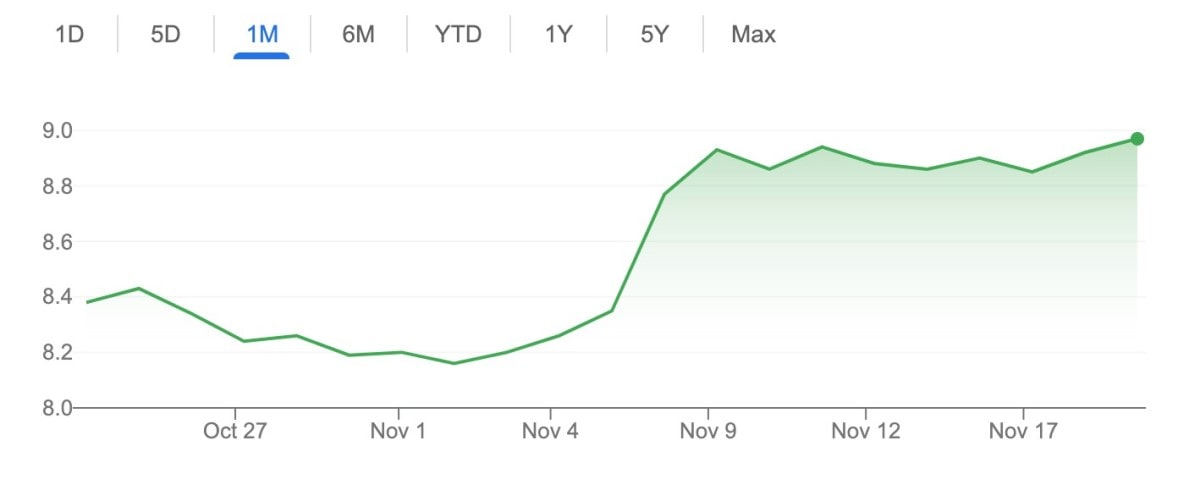

Prospect Capital (NASDAQ: PSEC)

Often listed among the most volatile stocks, Prospect Capital Corporation is a leading public business development company. The company generates current income as well as long-term capital appreciation through equity investments and debts. With a 5-year monthly beta of 0.93, it's considered moderately volatile.

In the last 30 days, the prices of PSEC have experienced high fluctuation, ranging from as high as $9.22 to as low as $7.62. At $8.14 currently, it's experiencing an increasing price trend.

LTC Properties (NYSE: LTC)

LTC Properties Inc. is a self-administered real estate investment trust with an impressive portfolio of leases and mortgages. A market cap of $1.35 billion and a 5-year monthly beta at 0.95 makes for a moderately volatile stock.

The current price of $34.24 has continuously dipped and surged over the past month. On 29 October 2021, it was at $31.86, the lowest in the last 3-day period. Whereas the stocks for this investment firm peaked on 11 November 2021, standing at $34.60.

Realty Income (NYSE: O)

Among the stocks with high volatility, a popular one is Realty Income, The Monthly Dividend Company. It provides dividends to its shareholders and investors along with a yearly bonus. Its 5-year monthly beta is 0.72, making it a moderately volatile stock like many on this list.

Just over the past month, O has seen multiple crests and troughs in its price, signifying a volatile nature. The stocks ranged from $71.97 to $68.62. While the difference in these figures might seem minimal, it's mention-worthy that this company has a market capitalisation of $40.12 billion.

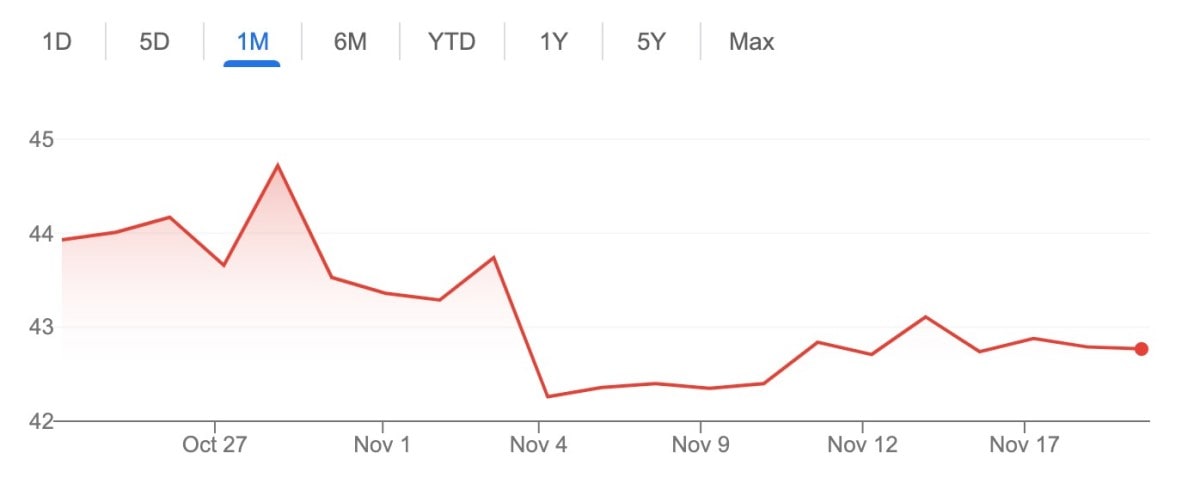

STAG Industrial (NYSE: STAG)

STAG Industrial Inc. also has some of the most volatile stocks in the market, with a 5-year month beta of 0.92. This company operates by acquiring single-tenant industrial properties. It has a market cap of $7.26 billion and a price day range of $42.53-$43.00.

While this is undoubtedly a volatile stock, it has a pattern. When observing the last 5, 10, 30 or even 365 days, we can see that the value stays consistently low or high for some period of time once a drop or surge has been experienced. This also explains why a volume chart of STAG seems more stable than many other names listed here. That said, there are still sudden drops and gains in the price.

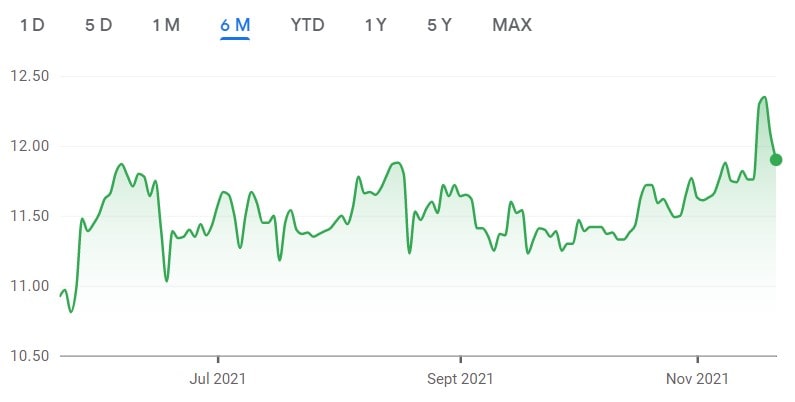

Gladstone Investment Corporation (NASDAQ: GLAD)

Gladstone Investment Corporation, which acquires and operates net-leased office and industrial properties, also has stocks with high volatility. With a 5-year month beta of 1.45, it's a highly volatile stock. Considering that it has a market capitalisation of $408.22 million, this stock may be a good addition if traded wisely.

According to data of the last six months, no consistency is observed in the prices of GLAD, reflecting its extreme volatility. The stocks keep rising and plummeting, having gone from $10.81 to $12.35.

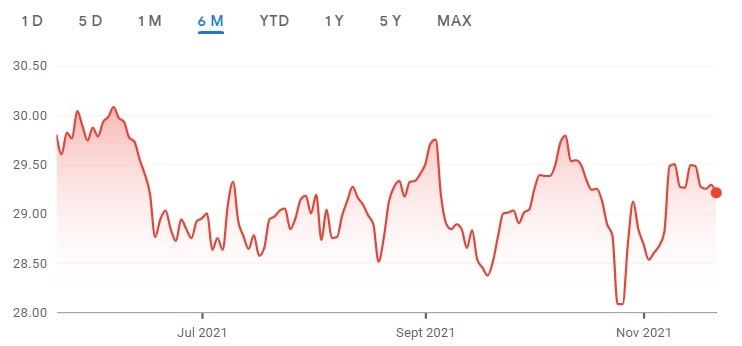

Shaw Communications (NYSE: SJR)

A familiar name in the most volatile stocks, Shaw Communications is a leading telecommunications company, telephone, television, Internet and mobile services in Canada. Its 5-year month beta is 0.44, which seems highly significant against the market cap of $14.57 billion.

A look at the half-year summary of how this stock performed in the market reveals high fluctuations in price. The year range of this stock is currently at $17.06-$30.41.

Simon Property Group (NYSE: SPG)

Along with being the largest mall operator in the United States, Simon Property Group is also the largest real estate investment trust. The high volatility of its stock at the moment is largely owing to the COVID-19 pandemic since commercial and residential real estate faces difficulties.

Since the advent of COVID-19, SPG has lost almost 66%. However, it rebounded, and its remarkable recovery led to trading as high as $121.

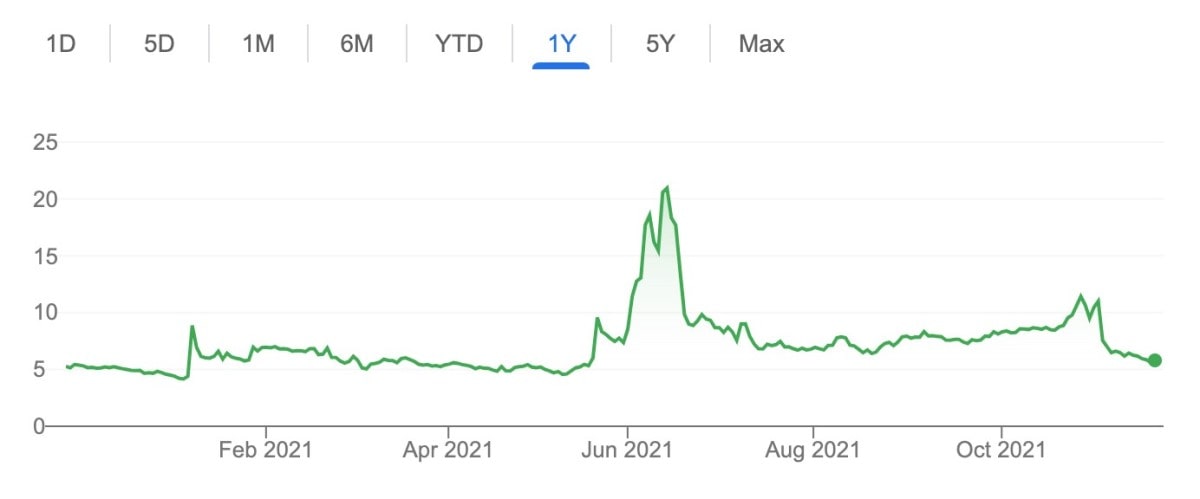

Urban One (NASDAQ: UONE)

Urban One, the American media conglomerate, is known for stocks with high volatility as it has a 5-year monthly beta of 1.02, making it very volatile. Its stocks have gone from $1 to $2 penny stock to a $54 high. This can be attributed to the protests and civil unrest lately, the effects of which trickle into the media sector very quickly.

Urban One offers two different classes of shares: UONE are Class A shares, and UONEK are Class D shares. These two differ based on voting rights.

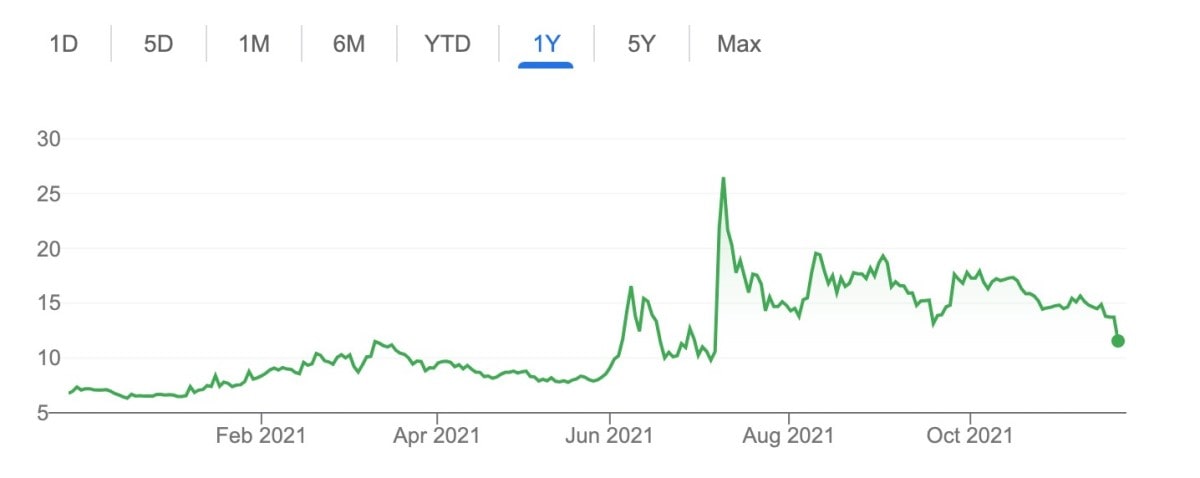

Carver Bancorp Inc. (NASDAQ: CARV)

Carver Bancorp Inc., a bank holding group, is also among some of the most volatile stocks, with a 5-year monthly beta of 1.41, making it extremely volatile. Couple this with the fact that it has a market cap of $40.53 million, and CARV will be right for those whose expertise is in volatile stocks.

The bank was severely hit due to the COVID-19 pandemic, losing half of its value when it was in the penny stock range before the virus. However, investors did their best to boost its price to around ten times.

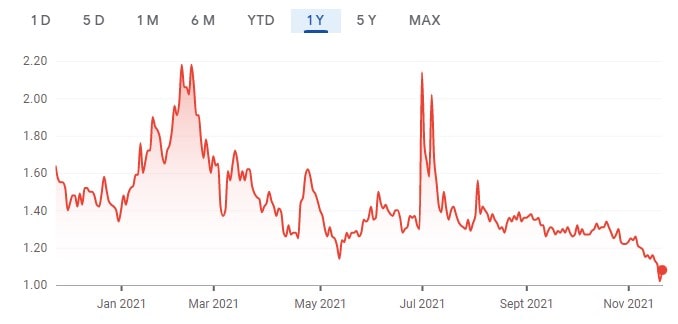

Alterity Therapeutics (NASDAQ: ATHE)

A biotech company based in Australia, Alterity Therapeutics develops remedies for neurodegenerative diseases. It has a market capitalisation of $51.85 million and a 5-year monthly beta of 0.8, making Alterity Therapeutics a moderately volatile stock. With a 52-week low of $0.28 and a 52-week high of $5.15, ATHE stocks reflect very high liquidity.

ATHE yearly performance analysis can easily tell how common changes are in this stock's price.

Moreover, it needs to be mentioned that the COVID-19 pandemic and the subsequent race for vaccines have greatly impacted the shares of such biotech companies.

Why Are Volatile Stocks Popular?

High-volatility stocks are popular with traders because they can sometimes bring great results within a few hours, minutes or even seconds. It's essential to note that volatility isn't necessarily a bad thing in the market. In fact, many prefer it. Investors who are regularly engaged in volatile stock trading are often the drivers of the said volatility.

Consider a simple scenario. If the stock price falls due to a bearish movement but is expected to rise dramatically eventually, it can be bought for low and then sold at a high price. Or one can even sell their shares close to the peak in a bullish movement.

How to Find the Most Volatile Stocks?

To make the most of these stocks, utilise the most effective strategies to find the most volatile stocks at the right time. Timing plays a crucial role in benefitting from them as what might be favourable at one moment might lead to a loss in the next.

Stock Screeners

One of the simplest and most common ways to find volatile stocks is using an analysis tool, such as a stock screener. Free applications are providing these services.

Stock screeners can be used in multiple ways by applying filters. Thus, stocks can be filtered according to the ones that experience a lot of volatility on high trading volume, ones that show high volatility during a particular time of the day, or ones that will most probably be volatile yet highly traded during a certain period.

This allows narrowing down the search and finding the most suitable volatile stocks to consider. Stock screening applications can also be used to monitor intraday volatility.

Earning Calendars

Another strategy to find volatile stocks can be to regularly check whether any popular stocks have earning releases due. There are many earning calendars online that list the companies scheduled to release their financial results on any given day. This can be helpful because announcements regarding a company's financials can often cause large price movements in the stock market.

However, this strategy demands high punctuality and diligence because the most volatility occurs as soon as the news is announced. That's the most favourable time to trade.

Volatility Indices

The Chicago Board Options Exchange's (CBOE) Volatility Index, with the ticker symbol VIX, measures the stock market's volatility expectations for the upcoming 30 days. This information is based on the S&P 500 index options. Such indices can also offer reliable estimates of stocks expected to plummet or skyrocket soon.

Technical Indicators

Apart from these strategies, technical indicators, including oscillators and channels, can also reflect the stock's volatility.

The Average True Range (ATR) is considered a solid volatility indicator. It computes the 'true' range of a stock's price, establishing it as a 14-day exponential moving average of that range. This indicator is directly proportional to the volatility and, hence, the risk factor associated with a stock. This means that the larger the ATR, the higher the volatility, and vice versa.

Strategies for Volatile Assets

Once you've found your desired stocks with high volatility and decided to trade or invest them, here are a few tips for more informed and calculated decisions with your stock, Forex or cryptocurrency trading journey.

- Even during bearish movements, don't lose perspective. Downturns are normal, and as per history, stocks have dipped every six years. That being said, they have recovered and delivered decent long-term performance.

- Strictly focus on time in the market. By missing even a few of the best days, your performance can reduce significantly.

- By investing consistently, even during bad times, one can build the discipline to buy stocks at their lowest prices.

- Remember to place a limit order with your brokerage on your trading platform. This is a set limit at which you must sell or buy to avoid unexpected shocks, which are quite common with volatile stocks.

Conclusion

While it can't be denied that volatility has negative connotations in the market, volatile stocks can be a great pick if played right. However, it's for this very reason that one should be more careful when trading volatile stocks than regular stocks. The widely fluctuating nature of these means that both a bearish or bullish movement is possible.

That being said, stock markets keep moving up and down, and volatility shouldn't be the sole factor when deciding whether or not to exit your investment.

FAQ

What Are the 10 Most Volatile Stocks?

At the time of writing, the following stocks were considered the most volatile:

- Prospect Capital (NASDAQ: PSEC)

- LTC Properties (NYSE: LTC)

- Realty Income (NYSE: O)

- STAG Industrial (NYSE: STAG)

- Gladstone Investment Corporation (NASDAQ: GLAD)

- Shaw Communications (NYSE: SJR)

- Simon Property Group (NYSE: SPG)

- Urban One (NASDAQ: UONE)

- Carver Bancorp Inc. (NASDAQ: CARV)

- Alterity Therapeutics (NASDAQ: ATHE)

Which Stock Is Best for Intraday Trading?

The answer to this varies from day to day, and stock that might be suitable for intraday trading today might not even be considered at all by traders tomorrow.

How Do You Find Stocks That Will Go Up?

Stocks whose volatility is expected to tilt towards a bull market or where a sudden upward trend is expected can be found using stock screeners, CBOE's Volatility Index (VIX) or by following earning calendars.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.