The richest person alive is in the mood to sell, sell, sell. US Securities and Exchange Commission filings reveal that Amazon.com Inc. CEO and founder Jeff Bezos sold at least $1.81 billion worth of his stock over the last few days.

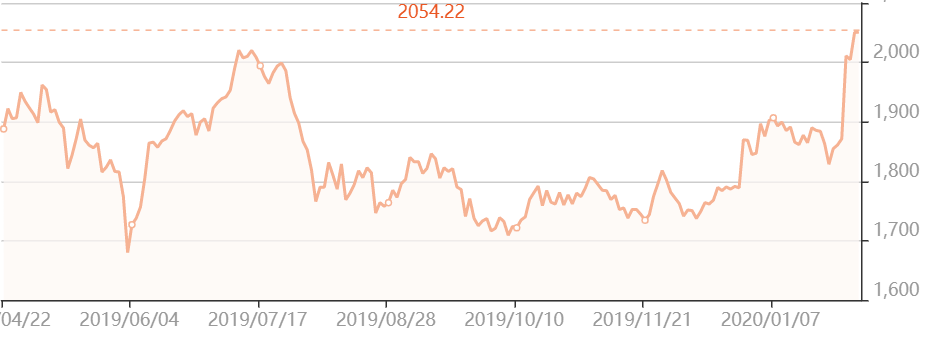

The first batch of Amazon shares were sold on Friday. Bezos sold off 310,791 shares when Amazon stock was trading between $2,003 and $2,053 per share. The second wave of sales came on Monday, consisting of 594,665 shares. At the time, Amazon stock was worth between $2,000 and $2,048 per share. All in all, a total of 905,456 shares for $1.84 billion.

Bezos shooting for outer space?

Bezos has yet to comment on his recent actions in the market, but it’s quite possible that this is actually part of a larger sale. Bezos has previously sold several thousand shares in a single day, only to follow it up with a series of big sales over the following days.

One explanation could be found in the stars. Bezos has previously admitted that he liquidates $1 billion worth of stock annually to fund Blue Origin, his space exploration company. The Kent, Washington-based Blue Origin has been expanding. The private space company aims to grow to over 2600 employees and complete a Lunar lander, known as ‘Blue Moon’, by 2024.

Bezos also sold nearly $3 billion worth of Amazon stock last August, even though the e-commerce giant was suffering its worst losing streak in 13 years. But that’s not the case now.

A good time to sell

The sales were prearranged, timed for just after Amazon reported fourth-quarter earnings on Thursday. The online retail behemoth has been going from strength to strength, far exceeding expectations when it posted net sales of $87.4 billion and net income of $3.2 billion. Amazon boasted of having quadrupled the number of packages it was able to deliver in one day.

Amazon closed the trading day on Tuesday with a market cap of more than $1 trillion for the first time. This makes it the fourth US company ever to do so, joining an exclusive club of fellow tech giants Apple Inc, Microsoft Corp. and Alphabet Inc. Overall, Amazon shares are up 24% over the past year.

Amazon.com Inc.

Bezos on top

The Bloomberg Billionaires Index ranks Bezos as the world’s richest individual, worth $127 billion. Bezos, who also owns The Washington Post, still holds on to 56.6 million Amazon shares, valued at about $116 billion as of close of trading Tuesday.

Trade on top tech firms with Libertex

Libertex clients can trade in over 200 financial instruments including stocks, shares, currencies, indices, oil and gas, metals and more all in one place. This includes all the highly valuable tech firms – not just Amazon but also Facebook, Apple, Microsoft, Amazon, Tencent, and Tesla Motors.

With Bitcoin and top cryptocurrencies also available, Libertex is the perfect platform for the modern trader who wants a diverse portfolio that combines traditional assets with new opportunities.

Available as a user-friendly smartphone app or on the web, Libertex offers a 50% commission discount for new traders, zero spreads and favorable leverage (up to 1:30 for Retail Clients and up to 1:600 for Professional Clients).

Want to benefit from Bezos’ billions? Then register with Libertex and start trading right away!