Stock investors are worried about something scheduled to happen this time next year and according to a recent report by MSN, they are hedging their bets against these mysterious events. The reason for this fear and why these players are holding their cards close to their chest is likely to be related to the outcome of the next US presidential election.

MSN cites Julian Emanuel, head of equity and derivatives strategy at BTIG, as their source for this interpretation. What it means, in practical terms, is that the price of buying downside puts (a negative bet on the S&P 500) is at a historical level when compared to the price for upside calls, or an opposite bet in the options market for a higher price.

Downside protection is meant to provide a safety net if an investment starts to fall in value. So, what exactly are investors afraid of?

Election fever

By this time next year, the Nov 3rd election will have been decided and the next US presidential administration will have been in power for just over a month.

According to Emanuel: “We have predicted either a less business-friendly attitude or a civilizational conflict with China after the election”. It’s not clear which fate investors are actually hedging against. “The left, the right, and the center are all worried about highly unstable electoral outcomes”.

Business-unfriendly democrats or Trumpist belligerence?

The increase in downsides could be the result of investors fearing that a Democrat like Sen. Elizabeth Warren or Sen. Bernie Sanders winning the election could result in a business-unfriendly administration.

But what if President Donald Trump successfully wins another term? The fear then would be that Trump’s trade war with China will drag out and even escalate after the election.

Be prepared for anything with Libertex

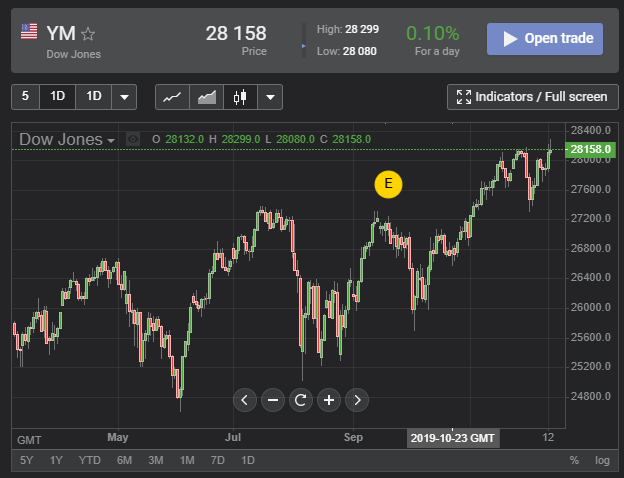

Regardless of the outcome of the next US presidential election, with the right set of tools, a savvy trader can make a trade effectively no matter what the political climate is. For traders who are interested in building a diverse, flexible portfolio through the ups and downs of the market, Libertex offers the one best platform for making investments and acquiring trading assets.

Libertex is a fast, user-friendly trading platform that lets you trade on the financial market 24/7 using your smartphone or the web. With over 20 years of financial market and online-trading experience, Libertex offers in-app signals and training materials from experts who have weathered the market throughout all kinds of political and economic change.

Libertex offers over 200 financial assets including stocks, shares in top companies, currencies, crypto, indices, oil and gas, precious metals, and more. It even incorporates training materials to make new traders into experts in a short amount of time. Looking for one the best ways to trade? Then register with Libertex and start trading now!