The bears are growling on Wall Street this week, as veteran investors cast doubt on the recent stock market rebound.

Superstar investors Stan Druckenmiller and David Tepper were the latest to voice their pessimism over share prices. On Tuesday, Druckenmiller poured cold water over the ‘fantasy’ of a V-shaped recovery. The following day, Tepper claimed that equities were the most overvalued they’ve been since 1999.

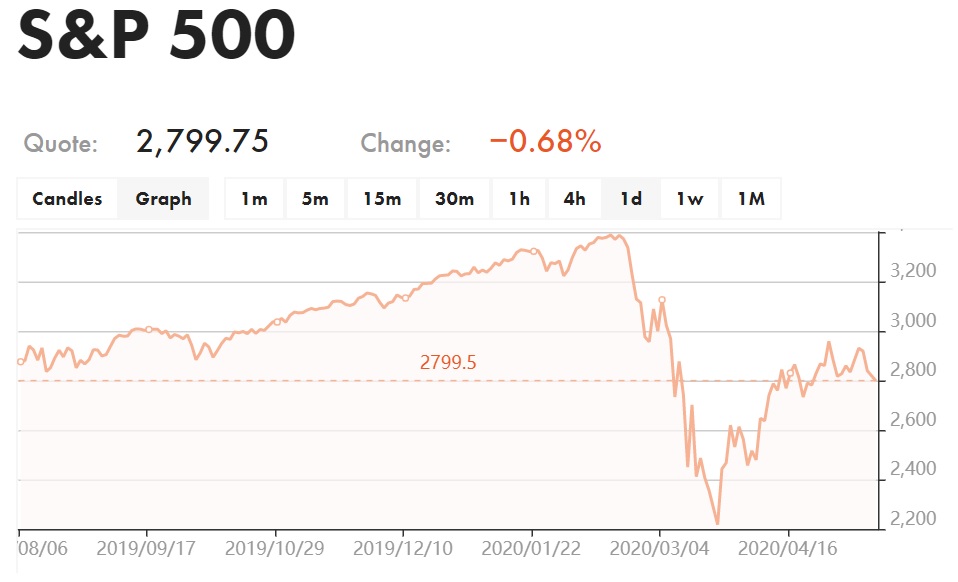

The gloomy mood on Wall Street is spreading, as investors point to soaring unemployment and a wave of bankruptcies in the US as evidence that the Federal Reserve’s emergency measures, as well as the $3 trillion in the Treasury stimulus package, just aren’t doing enough to prop up the economy. The S&P 500 Index recently rallied up 26% from its lowest point in March, only to drop by 3.8% this week. With no end in sight to the COVID-19 pandemic, economists do not see a return to business as usual. Even the most optimistic estimations for a vaccine are projecting a date well into next year.

The grim forecast from the US has had aftershocks in Europe, as the Stoxx Europe 600 SXXP fell by 1.79%. The German DAX dropped by 1.79%, the French CAC 40 fell by 1.99% and the UK FTSE 100 slid down 2.3%.

Trump hits out at ‘so-called rich guys’, Fed urges lawmakers to do more

US President Donald Trump, who faces the unenviable challenge of re-election during an unprecedented economic crisis, turned on ‘so-called rich guys’ in a tweet on Wednesday.

‘You must always remember that some are betting big against it, and make a lot of money if it goes down,’ Trump wrote. But his own team has a different view. Federal Reserve Chair Jerome Powell, selected by Trump to head the Fed, urged lawmakers to do more to prevent lasting damage to the economy.

Similarly, Billionaire Mark Cuban, who was picked by Trump last month to help advise on reopening the economy, agreed with the bearish mood on Wall Street about equities and stressed the need for more government action. ‘Stocks are overvalued and the risk-reward isn’t there until we see a cohesive plan for testing from the government,’ Cuban said in an email.

Libertex: trading tools for long-term success

The savvy trader knows not to take the gloomy mood on Wall Street as any reason to panic. The stock market is always subject to shifting fortunes, but a wise investor will have a long-term strategy for profit. Even a slumping market is an opportunity to benefit further down the line. What’s important is having the right tools and knowledge to make good investments and capitalize on them at the right time.

Designed to give you opportunities in both rising and falling markets, Libertex is a fast, user-friendly trading platform that lets you trade 24/7 on the web or from your smartphone. With over 20 years of financial market and online-trading experience, Libertex’s award-winning app also provides live updates on market trends, trading tips, and an extensive educational program to keep users up to speed in a fast-paced international market.

With the stock exchange always sensitive to global events, it’s essential to keep a diverse and flexible portfolio. That’s why Libertex offers over 240 financial assets including stocks, shares, currencies, crypto, indices, oil and gas, metals and more. Want the best tools for long-term trading success? Then register with Libertex and start trading now!