AMC Stock Forecast

As the largest movie theatre chain in the world, AMC has been popular as a global investment option, offering its shareholders the opportunity to benefit from the $18 billion US theatre industry.

Learn what makes AMC stand out among its competitors, how its stock price is defined, AMC's past performance on the New York Stock Exchange and the price target consensus for 2022 by experts. After that, we'll provide an analysis of AMC's future.

About AMC Stock

Founded in 1920, AMC Entertainment Holdings, Inc. is an American multinational movie theatre chain and the largest movie theatre chain worldwide. Headquartered in Leawood, Kansas, in the United States, it has the largest share of the US movie theatre market.

The company is involved in the cinema industry, which it conducts through its subsidiaries. It does so by owning, operating and having interests in theatres. AMC operates through two segments:

- United States Markets, which focuses its operations specifically in New York, Washington D.C., Los Angeles, Chicago and Atlanta.

- International Markets, which involves activity in countries that include Germany, the United Kingdom, Ireland, Estonia, Spain, Sweden, Denmark, Finland, Lithuania and more.

AMC's stock ticker on the NYSE is AMC. As of 24 December 2021, its current share price is $20.57. It has an impressive market capitalisation of approximately $10 billion and has a volume of $49.59 million. The year range for the cost of one AMC share is $2.27 to $62.55. This extreme difference is partly due to the impact of the COVID-19 pandemic on the entertainment industry. Apart from this, the stock experienced a massive rally in mid-2021 as speculative trading began intensely owing to Reddit users.

What Affects AMC Stock Price?

The performance of AMC on the stock exchange depends on certain factors. While some of these have impacted AMC's stock price for decades, others are relatively and surprisingly new.

The regular factors include financing movies, producing films, legal and regulatory rules pertaining to theatre operations, supply chain issues and more.

At present, the ongoing COVID-19 pandemic is a major factor that can vastly move the price of AMC stock up or down. Since March 2020, when COVID-19 was declared a pandemic, the share prices have gone through many surges and dips. Thus, the revenue AMC can potentially bring in largely depends upon whether the situation with the virus will ease in the upcoming few months, allowing cinemas and theatres worldwide to operate at their full capacity. Similarly, growing trust in vaccination and approval of vaccines for children will also play a key role in this situation since movies for children can then be shown, as well.

These price indicators and other general economic factors are considered when analysts and industry experts create an AMC stock forecast.

AMC Stock Price in the Past

For most of its history, AMC's stock price has remained in the $15 to $35 bracket, as shown in the chart below.

- The lowest recorded price is $2.27, which occurred in April 2020 due to the complete closing down of cinemas and theatres worldwide owing to the COVID-19 pandemic.

- The highest recorded price is $62.55, which occurred in June 2021. This was after the cinemas were reopened after lockdowns were lifted across many parts of the world. It's interesting to note that although the virus brought the stock's price down drastically, the way it has increased since reopening has been astonishing, considering it has significantly soared past its previous high.

- An interesting and highly notable surge in the price of AMC stock was recorded in May 2021 when enthusiastic Reddit users encouraged doubling down on the stock. In fact, this wild movement even helped AMC surpass GameStop as the most popular stock among Reddit WallStreetBets forums.

As a result, shares of AMC saw a gain of 1,100% in 2021 alone.

While it helps to know how AMC has performed in the last few years, this information can't be used on its own for accurate AMC price prediction.

AMC Stock Technical Analysis

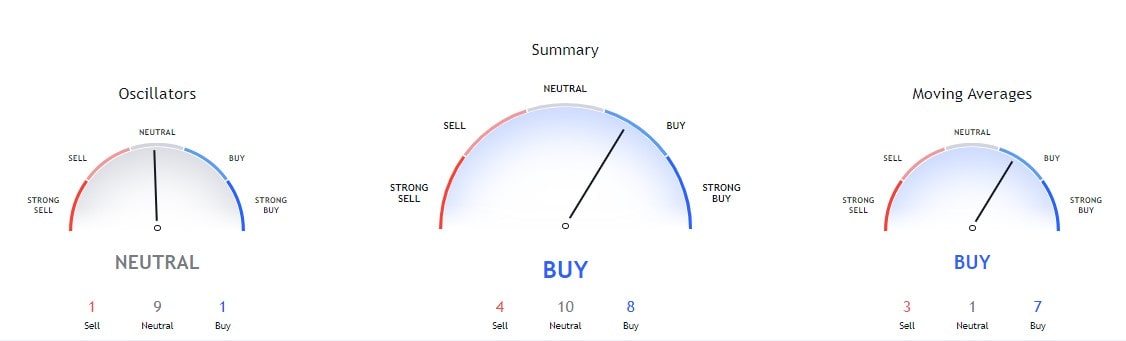

When making any AMC stock forecast, the most useful metrics are technical indicators. The technical analysis reveals whether the stock should be bought, sold or held at any given moment or during a certain period. The charts below summarise the technical analysis for AMC stock for the upcoming month.

The indicators point towards buying the stock. Only four of them suggest selling, while twice that amount recommend buying. The rest of the indicators are at a neutral position for this 30-day period.

The individual analysis by the oscillators and moving averages is different, however. The moving averages say that AMC stock is a Buy. For oscillators, except Momentum (10) and MACD Level (12, 26), all technical indicators are pointing towards neutral.

Therefore, according to this technical analysis, it appears that the next few weeks are good for buying AMC stock or perhaps even holding it. However, this doesn't seem like an appropriate time at all for selling any shares you own. That being said, technical analysis depends on multiple indicators whose values keep changing regularly. Thus, before finalising any decision, make sure you consider the latest technical analysis.

AMC Stock Forecast for 2022 by Experts

What a senior analyst or an industry expert thinks about future performance can largely affect investor confidence in AMC stock. Mentioned below are some experts and how they predict 2022 will turn out for the international theatre giant. For 2022, most experts don't believe that AMC will make a remarkable recovery from its pandemic-induced loss. Therefore, there are many sell ratings among Wall Street analysts.

Chad Beynon

Chad Beynon, an analyst at the investment banking company Macquarie Group, downgraded AMC in September 2021, expecting the company to exhibit bearish performance on the stock exchange in 2022. The price quoted by Beynon was also shocking for some; at $6, his prediction brings down the value of AMC stock nearly four and half times from its current price. Beynon justified this decision by the fact that the film industry hasn't been able to recover to the pre-pandemic levels at a pace that can help AMC bring in notable revenue.

Michael Pachter

Michael Pachter, an analyst at the privately held investment firm Wedbush Securities, also downgraded the stock price for AMC in 2022 and changed his rating from 'neutral' to 'underperform'. Patcher gave a target price of $7.50, a drastically lower value than the current price inching closer to $30.

Note that forecasts and expert predictions can be wrong and aren't a substitute for proper research and due diligence on your end.

Short-Term AMC Price Prediction for 2022

Despite significant volatility lingering in this industry due to the pandemic, various artificial intelligence-based models and statistical tools have led to some reliable AMC price predictions for 2022.

Coin Price Forecast

According to estimates by Coin Price Forecast, AMC is expected to recover very well from the bearish movements in 2020 and early 2021. The forecasted price for mid-year is $34.52, whereas the year-end price is quoted to be $41.22. This is an extremely positive outlook that suggests confidence in AMC and the fact that the global entertainment industry is set to move past the obstacles brought on by the virus.

Long Forecast

Another optimistic outlook for 2022 comes from Long Forecast. It has released a bullish outlook for the company, with share prices increasing in most months to eventually reach a possible maximum value of $41.50 in December. This also reinforces the growing confidence among investors and traders alike regarding the comeback of cinemas and theatres.

|

Month |

Rate Forecast ($) |

Min Rate ($) |

Max Rate ($) |

Volatility, % |

|

January 2022 |

28.93 |

32.63 |

30.78 |

7.74% |

|

February 2022 |

27.49 |

30.99 |

29.24 |

2.35% |

|

March 2022 |

26.49 |

29.87 |

28.18 |

-1.37% |

|

April 2022 |

27.81 |

31.37 |

29.59 |

3.57% |

|

May 2022 |

29.21 |

32.93 |

31.07 |

8.75% |

|

June 2022 |

30.66 |

34.58 |

32.62 |

14.18% |

|

July 2022 |

32.20 |

36.31 |

34.25 |

19.88% |

|

August 2022 |

33.80 |

38.12 |

35.96 |

25.87% |

|

September 2022 |

34.24 |

38.62 |

36.43 |

27.51% |

|

October 2022 |

35.68 |

40.24 |

37.96 |

32.87% |

|

November 2022 |

36.60 |

41.28 |

38.94 |

36.30% |

|

December 2022 |

36.80 |

41.50 |

39.15 |

37.03% |

While experts have rather bleak expectations about AMC stocks in 2022, predictions from statistics and models are revealing a very promising picture for the future of this entertainment leader. Take this as yet another reason not to stand by any prediction or rating, and always do your own homework before using your money for AMC stock.

AMC Stock Forecast for 2023-2025

The farther a time period is from the present, the less reliable predictions for it get. That being said, knowing a price target for AMC stock in the upcoming few years can help mitigate risks associated with investing and trading and facilitate the development of a trading or investment strategy.

Wallet Investor has given shockingly high estimates for the price of AMC from 2023 to 2025. Starting from $46.464 in January 2023, it expects the stock to have a bullish movement. This constant increase in the value is forecasted to lead AMC stock to close at $99.177 in December 2025.

Analysts usually refrain from giving out estimates so far ahead in time, and statistical models usually come up with very near-sighted estimates. Therefore, the least risky manner of making any decision regarding AMC stock is to study the details yourself or consult a professional.

Long-Term AMC Stock Price Prediction for 2026-2030

Wall Street analysts don't offer any predictions for the long-term status of stocks, but they can be made using artificial intelligence-based models. Below are AMC price predictions for 2026-2030 by various reliable sources.

Coin Price Forecast

Coin Price Forecast predicts that the price of AMC will follow an uptrend from 2026 onwards. Although these estimates don't depict any significant surge in price, those who are planning to hold their existing shares for the long term might be able to benefit from the expected gradual increase.

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End,% |

|

2026 |

76.23 |

77.37 |

+170% |

|

2027 |

83.17 |

86.38 |

+201% |

|

2028 |

88.16 |

90.02 |

+214% |

|

2029 |

91.96 |

93.98 |

+228% |

|

2030 |

96.09 |

98.30 |

+243% |

Wallet Investor

Wallet Investor has shown far more confidence in the future performance and earnings of AMC, as per its predictions. While many estimates have quoted a price over $100 only in 2029 or 2030, Wallet Investor has forecasted AMC's stock status to reach around $116.191 by just the end of 2026.

Conclusion

At present, the most important factor investors and traders are analysing to determine if they should buy, sell or hold AMC stock is the future state of the leisure and entertainment industry in the US and across the world. This, in turn, depends upon the circumstances surrounding the pandemic, vaccination efficacy and speed of administration and government regulations. If unforeseen circumstances don't appear, the share price is expected to grow slowly.

Before making any trading decision, you can test your strategies and learn useful tricks in a controlled environment, such as the one provided by Libertex. Create a demo account and practice trading CFDs on numerous underlying assets from all over the world.

Disclaimer: While the data and information presented in this article have been collected from authoritative and highly reliable sources, this piece is only meant to provide information and not guidance or recommendation. Don't solely rely on AMC stock forecasts; conduct your own research and assess any associated risks before putting your money in AMC stocks.

To get the gist of this article, check out the answers to frequently asked questions.

FAQ

Is AMC a buy or sell?

As for the technical indicators — and moving averages, in particular — AMC is currently a buy.

Will AMC stock split soon?

As for now, the company isn't expected to split its stock soon.

Is AMC a good long-term investment?

There's too much fluctuation in the stock price and the predictions by experts and computer models to believe a single AMC stock forecast to determine whether it's a good long-term investment. The answer to this also largely depends upon the future of the COVID-19 pandemic, which remains unclear at the moment.

Is now a good time to buy AMC stocks?

Although the technical indicators suggest buying AMC stocks, before deciding to trade or invest, be mindful of the fact that there's too much pandemic-related uncertainty looming over this particular market segment at the moment.

Does AMC stock pay dividends?

AMC Entertainment doesn't pay a dividend.

How much will AMC be worth in 2022?

There's significant variation in the predictions, with experts expecting downside movement and setting the forecasted price of AMC in the $5 to $8 range, while models and statistics are predicting uptrends, taking the price to nearly $45.

How much will AMC be worth in 2025?

According to some AMC stock forecast insights, the share price could be anywhere between $45 and $100.

How much will AMC be worth in 2030?

Most forecasts estimate AMC stock to cross the $100 mark once again by 2030.

Is AMC a Buy, Sell or Hold?

As per the technical analysis for AMC, the stock is in a neutral position. However, for the start of January 2022, AMC stock is predicted to be a Buy.

Is AMC overvalued?

AMC stock is believed to be overvalued due to rising competition and an increase in streaming services.

Why is AMC stock so low?

AMC stock is experiencing extreme volatility at present due to changing rules, guidelines and information regarding the pandemic and vaccination. Thus, it can't be referred to as low or high currently.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.