All You Need to Know About Buy to Open vs Buy to Close Options

Many believe that trading options is not for everyone, mainly because the risks involved can exceed the rewards. However, with a proper introduction to and understanding of the topic, investors like you will be better positioned to use options to their advantage to earn on the fluctuation of stock market prices instead of losing funds.

If you're interested in stock market and options trading, you've probably come across these terms: buy to open vs buy to close. But just how will these terms help you in trading? In this article, we'll discuss and explain how you can incorporate buy to open vs buy to close options in your strategy.

What Is Options Trading?

To fully understand the difference between buy to open vs buy to close, we need to look into options trading first.

Options are contracts between two parties that give investors the right to buy an underlying asset at a fixed or pre-set price (strike price) within a given period of time (expiration date). They are also derivatives and are traded on Exchange-Traded Funds (ETFs), stocks, indices and commodity futures. They are sold in batches of 100 shares of stock.

Options trading allows traders or investors to buy a security based on market movement. If they believe that a particular stock price will change, they can secure profit by using options.

What makes options trading popular is that it's less expensive than the underlying security price itself. It also offers more choices when opening or closing a trade compared to securities. Buy to open vs buy to closetransaction orders are designed to operate in both upward and downward trends.

Options are used as a hedge by investors against a stock falling in price or to limit their risk on the market's impliedvolatility. They're derived from stocks but don't represent ownership. They can be less risky than stocks because traders can withdraw anytime.

The two main types of options include:

1. Call Options

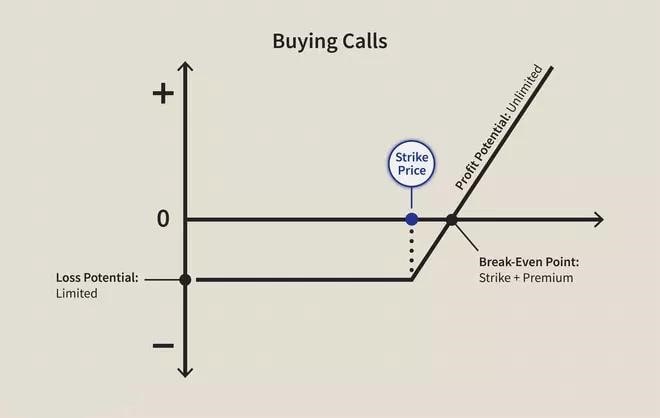

Call options investors pay a small premium with the expectation that the price will increase in a certain period before the expiration date.

Call optionbuyers bet that the underlying asset's price will be higher in the open market than the strike price. They buy the asset from the option seller at the strike price and resell it.

A call option seller gets the premium and bets that the asset's market price will not be higher than the price specified in the options contract.

2. Put Options

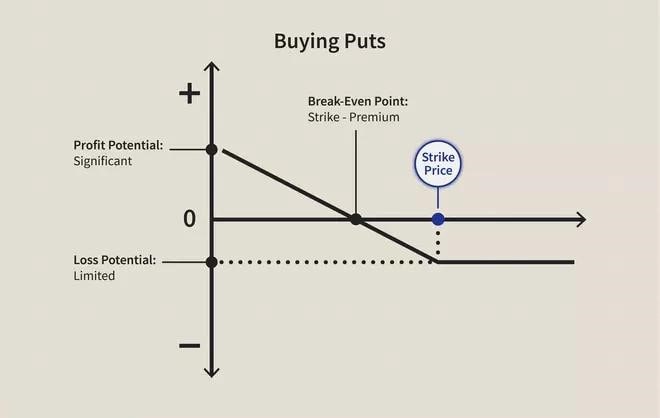

The investor of put option contracts expects that the price of the underlying shares of stocks will drop lower than the strike price.

A put buyer bets on the market price falling lower than the strike price, so they can sell it to the option seller who is obligated to buy the contract at a higher or agreed-upon strike price.

A put seller or writer, on the other hand, is betting that the market price will not fall below the specified price.

Ways to Trade Options

There are four basic ways to trade in the options market. Whether you buy or sell call options or buy or sell put options, you're making a bet on the direction of the underlying asset's price with different strategies.

To further calculate the amount you need to earn relative to your expenses, you need to determine the break-even point at which you neither gain nor lose money.

Below are the basic trading terms and concepts used to refer to a person buying or selling options:

- Buy to open: The trader or buyer of the option is looking to buy a call or put option. The term "open" means you're opening or creating a position when you enter a trade. You'll pay the premium price now to safeguard your position and have the chance to get a return before the expiration date.

- Sell to open: Sell to open means you're selling the contract to a buyer to collect a premium. Some investors get returns from selling put or call options and then buying them right back when the premium price has dropped before the expiration date.

- Buy to close:You're trading a previously created contract or ordering an option when you want to close the position instead of creating a new one.

- Sell to close: You're selling a contract back to the market. This option is used to exit or withdraw a position taken with a buy to open order.

Options trading can sound abstract and hard to understand, so a real-life scenario can help you better understand the four option trading strategies.

You noticed that the stock price of Tesla is rising considerably, from $100 in March 2020 to $400 in September 2020 and then $600 in March 2021. You believe the stock price will continue to increase as it follows the trend, and you speculate that it will reach $1,000 by December 2021.

Below are the steps you can take to earn money in this scenario:

- Buy to open: You'll create or open an option contract by buying ten shares of Tesla at the ongoing or current price with a strike price of $1,000 to secure your position to sell them at $1,000 each even if the actual price doesn't reach $1,000 on or before December 2021.

- Sell to open: Before the expiration date, Tesla's stock price reaches $1,500. You can now sell your ten shares at $1,000 each to someone else at that moment to stay in the game with the hope that their price will significantly drop before the contract's expiration date so you can exercise the right to buy them at the lower price. However, if the price doesn't drop, you're still obliged to buy the stocks at a higher amount.

- Buy to close: If the expiration date, December 2021, comes and the price is still higher than $1,000, you can choose to end your contract obligation by buying the ten shares back with the current price to close the contract. This will help you limit your losses in case the price continues to increase.

- Sell to close: If the share price is lower than $1,000 in December 2021, you'll still have the right to sell the shares at the same price to close the contract.

What Is Buy to Open, and When Can It Be Used?

Using a buy to open option means you want to buy a new long put or long call. Doing so sends a signal to other participants that you see potential in the market, especially if you place a large order. If you're only making a small order, it could mean that you're only using the buy to open order for hedging or spreading. You can either sell the contract back to the market or let it expire.

Buy to open orders are used for strategies like bear put spreads, bull call spreads, long strangles and long straddles.

There are three possible scenarios when you buy to open:

- If the underlying asset's price doesn't reach the strike price before the expiration date, the contract is worthless.

- When the strike price is reached, the option contract holder can exercise the option and buy the underlying asset.

- The investor can close the contract by selling. This is also called a sell to close order.

Below is an example:

John is an options trader. He thinks that Company A's stock price will increase over a few weeks or months. He'll then purchase a call option on Company A's stock to open a long call option position, believing that he'll generate revenue from it.

What Is Buy to Close and When to Use It?

Buy to close means that the investor wants to sell an existing option or close a short position. In short, you're closing a position you've made before or buying back a contract that you already sold. However, in this case, you won't be assigned the previous contract you initially sold.

For example, a buy to close order is required to close the position when a sell to open order is placed. When a put or call option is sold, it places the trader in a short position. The investor can get a return from the premium created, such as the option premium.

If, after some time, the position delivers a profit or loss, the trader can choose to close the position before it expires. To do this, the trader will need to buy back the sold options (buy to close order). The original buyer of the option will pay for someone who will take over the position.

Here's an example of buy to close:

Imagine Paul is an experienced options trader. He thinks he can earn money by selling some put options on Company B's stock. He'll then sell a put option contract on the market. However, before the option contract's expiration, he no longer wants to remain obligated under the contract. He wants to close his put option position, so he buys put options to close his position.

Buy to Open vs Buy to Close Tips

Options trading can be complex, so here are some tips on how and when to use them:

Buy to open tips:

- If you want to earn money through the change in an underlying asset's price by buying a call or put option, taking a buy to open position can help hedge or offset risks in your financial portfolio.

- It's more effective if you use a buy to open for a put option that's out of the money at the same time as buying the underlying stock.

- If the strike price of a call option increases before the expiration date, you can sell to close. The option premium is debited from your account.

Buy to close tips:

- Time decay is good for option sellers. If the price of an underlying asset increases, you can buy to close to access returns earlier. For example, you sell at-the-money puts that will expire after 12 months. After four months, the price of the underlying asset increases by 20%. This is a good opportunity to buy to close and access the majority of your returns immediately.

- Buying to close can reduce your potential losses. If the price on the underlying asset decreases, you can opt to buy to close at that moment to avoid bigger or greater losses that can even increase if you wait longer.

Other tips to know when to buy to open or buy to close a call or put options:

- Buy to open a call: You'll pay the premium of 100 shares at the strike price and earn if the value of stocks rises.

- Sell to open a call: You can sell 100 shares at the strike price if the value of the shares drops or stays the same.

- Buy to open a put: You'll pay the premium of 100 shares at the strike price and earn if the value of the shares drops.

- Sell to open a put: You'll buy 100 shares at the strike price and collect the premium if the value of the shares rises or stays the same.

- You can either buy a contract to earn when it reaches its strike price or sell the contract to earn the premium (deposit used to lock in the contract option) when you open a position. The options seller collects the premium paid.

Mistakes to Avoid With Options

Options trading can be volatile and unpredictable on the expiration day. To protect your account, here are some tips to avoid options trading mistakes.

If you have a profit, you might be tempted to keep the trade open on expiration day to get more money, or if you have a loss, you may want to try to get some of your money back. However, the closer the expiration date, the faster options lose their value. So, to protect your capital, you can opt to close your option trades and get your profit before your options expire.

It's counterproductive to buy call options with the goal of owning the stock because you can end up paying a higher price to purchase the stock than the amount you'd pay if you just bought the stock outright. So, to avoid unnecessary costs and fees, buy the stocks directly.

Some traders forget European-style options, which expire on the third Thursday instead of the third Friday as American options do. If your options expire before you realise it, it could result in heavy financial losses. To avoid this, whenever you enter options trade, always remember to close out your European option trades on the third Thursday before they expire on Friday. It can be helpful to create a reminder or note to help you remember expiration dates.

Conclusion

Terms in options trading can sound daunting and complex and aren't necessarily suitable for all investors. Whether you're a bearish or bullish investor, it's useful to know the basics of buy to open vs buy to closebefore you start investing in options trading. You also need to consider investment objectives and risks because of their speculative nature.

There are trusted online brokers who can help you understand options trading. You'll always have the potential to earn money when you understand your investments. However, a favourable investment outcome is not always guaranteed.

FAQ

What Does Buy to Open vs Buy to Close Mean?

Buy to open is used by brokerages to represent buying a call or put options to open a position or open a trade. By paying the premium price, you're securing your position and have the chance to get a return before the expiration date.

On the other hand, buying to close means you're trading a previously created contract instead of opening a new one. It's like you're selling a put option on a company's stock because you think you can earn money. However, if the price is not in your favour, you can buy put options back to close your position.

Is It Better to Buy a Stock at Open or Close?

The better strategy to reach your goal depends on your personal preference and what you think the stock market price will do. You can either choose a buy to open option now to secure your position and get a return before the expiration or a buy to close option to reduce your potential loss.

Can You Buy to Close at Any Time?

The purpose of buy to close is to exit or close out any short option positions that require traders to sell to open to initiate or start the trade. Option prices can change quickly, so you can buy to close anytime for a quick sale. If you sell a call option, you have to 'buy to close' the same call to close your position. If you sold a put option, you have to 'buy to close' the contract with the same strike price and expiration.

Can You Buy to Open at Any Time?

Yes, you can buy to open anytime. You can buy to open now and close to exit the next day. It all depends on your strategy and how you want your options trading experience to work.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.