CFDs vs Options: Which Financial Derivative Does it Better?

This article will outline the distinctive features of such derivatives as options and CDFs (contracts for difference), determine their similarities and differences and shed some light on their benefits and drawbacks. Learn all about the CFD vs options debate down below.

What Are Options and How Do They Work?

Options are derivative contracts that give their holders the right (but not the obligation) to purchase or sell the underlying assets at an agreed-upon price on a preset date.

Traders make use of the options' strike prices and trade them when it's economically viable to do so. For instance, they can sell a specific group of options at a beneficial price even if the value of these options significantly decreases. It's all about the fixed price documented in the contract.

An experienced trader can successfully speculate on the execution of their options with certain tactics. Speaking of which, the most widespread tactic is buying shares below market value and then selling them once their price is driven up.

Options are sometimes mistakenly mixed up with futures. There is, however, a considerable difference between these two documents. A future contract must be executed strictly on its expiry date. An option contract provides its owner with the 'option' to choose whether to conduct the trade or not (hence the name).

There are two types of options you can engage in:

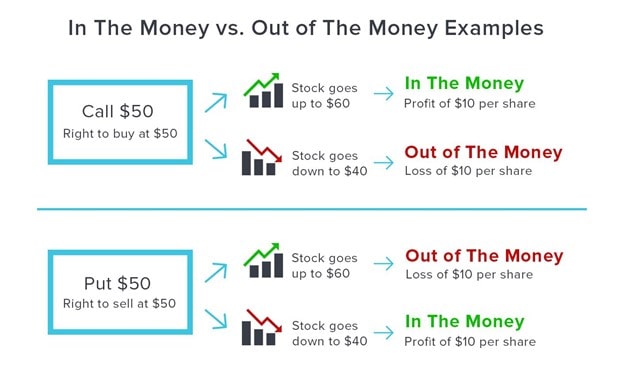

- Call options. When you buy call options, you're hoping that the underlying assets rise in value.

- Put options. When you buy put options, you're hoping to sell them at the preset price, even if the underlying assets decreased in value.

It doesn't matter what type you decide to buy; your risks will always remain fixed at the option premium. The option premium is the price for which you buy the respective option. By moving up and down, the premium reflects whether the contract is profitable to exercise before the expiry date. This fluctuation enables traders to speculate on the market without executing their options and taking possession of the underlying stock.

Apart from buying options, you can also 'write' (sell) them. Selling an option will also bring you a premium. However, beware of the risks that can be potentially unlimited in this case:

- Writing a call option enables you to open a short position. Therefore, you agree to sell the right to buy an underlying asset at the predetermined price.

- Writing a put option enables you to open a long position. Therefore, you agree to buy the underlying asset at a predetermined price if the option is exercised.

Here is an example to help you understand the nature of options better. If you have a hunch that the value of Intel's stock is going to rise from its current price of $50, you can try to follow the lead and buy an option contract that gives you the right to purchase it at $55 next month. If the value of the stock rises above $60, you can execute your option to buy Intel stock at a better price.

You will have to pay a premium to get the option that allows you to buy Intel at $55. If an option doesn't bring anything, you can let it expire, losing only the cost of the premium.

Important Features of Options

Now that you have a better understanding of how options work, let's look at some of their most notable features.

Implied Volatility

The implied volatility of options is dynamic. It changes according to the fluctuations on the market depending greatly on the expectations regarding future movements of the underlying asset's price.

Events like annual earnings reports published by companies can result in increased or decreased demand for the respective options. As such, these events influence the price of options, even if the price of the underlying asset remains unchanged.

Hedging

An option contract can serve as a great tool for hedging against possible risks in the related underlying assets. The results of hedging with options may vary. In some cases, investors can even lose money if the option's price moves against them. However, if the price turns out to be favourable, traders can wait until the option expires and make use of the beneficial market price.

No Obligations

All option contracts provide their holders with the right to purchase or sell the related underlying assets. The owners can exercise this right at any moment while the contract is still active. They are, however, not obliged to do so. If the underlying stocks were not bought or sold during the currency of the contract, the option would lapse.

Advantages and Disadvantages of Options

Like every other financial instrument, options have their own strong and weak sides that should be taken into consideration by investors. Below, you'll find the main characteristics of these investment vehicles.

|

Pros |

Cons |

|

|

|

|

|

|

What Are CFDs and How Do They Work?

A CFD (contract for differences) is another financial derivative in the form of an agreement between an investor and a CFD broker. The parties agree to exchange the difference in the value of the underlying asset that emerges during a certain period of time (from the moment the trade is opened until it's closed). CFDs can't be used to deliver physical products, and a CFD investor is not the owner of the underlying asset.

Contracts for differences are often contrasted with options, even though they're also used to speculate on the market. Buying a CFD enables you to speculate on the positive price movement while selling one protects you from the risks of losing money if the stock's price is heading downward. The underlying asset's price fluctuations determine your possible profits and losses from each trade.

Even though CFDs are often included in advanced trading strategies, they can still be used by both aspiring and experienced traders.

Traders' revenue is influenced by the price changes of the related stock. That means that a CFD investor doesn't buy oil but speculates on its price fluctuations instead. Investors also use CFDs to make assumptions about whether the stock's price will rise or fall.

Here's an example. If you think that the value of Apple stock is going to increase, you can buy an Apple CFD at the current price of $280. If you do and then close your position when Apple is above $300, you'll receive the difference in the price from when you opened the position to when you closed it. However, if you were wrong and the value of the stock decreased, you'd have to pay the difference to your CFD provider.

A CFD isn't limited to stocks only. It can also be used to buy and sell currencies, commodities (like gold or oil), indices and much more.

Important Features of CFDs

Understanding such complicated financial instruments as CFDs can be a bit overwhelming. You can learn more from the list below and then apply it while trading.

Margin Trading

Unlike traditional trading, CFD margin trading allows traders to borrow funds from the brokerage, thus increasing the leverage. However, a broker must have enough traders to keep the necessary balances on their accounts in order to process these transactions.

Hedging

Many risk-averse investors can utilise CFDs to hedge their investments since they provide a great opportunity to protect share portfolios. Stock prices are by nature volatile and can go up or down significantly if market conditions dictate so. CFD hedging can be a useful tool if you know how to use it wisely and want to keep your shares safe.

No Expiries

In the CFDs vs option discussion, CFDs have one huge advantage: they don't have expiry dates. Even though CFDs are used to speculate on the price movements of other derivatives, e.g., futures, they're not futures themselves. They do, however, trade like other securities and have 'buy' and 'sell' prices.

Advantages and Disadvantages of CDFs

CDFs do have a lot in common with options, as some of their benefits and drawbacks overlap with those attributed to other derivatives. Below, you'll find the most significant traits worth remembering:

|

Pros |

Cons |

|

|

|

|

|

|

CFDs vs Options: Key Differences

Both CFDs and options are effective trading tools if you know how to use them properly. Your choice ultimately depends on your end goal. Figure out what your priorities are and what you want to achieve:

- CFDs are designed to be traded with brokers, while options are traded on exchanges.

- CFDs are agreements that are concluded to speculate on the related asset's price fluctuations between the date the contract was opened and the date it was closed. Options can be considered a form of assets, but they only grant you the right to buy an asset at a predetermined price in the future.

- CFDs are easier to manage and are traded on a wider set of markets. Options, in their turn, can be traded directly, thus providing the holder with a chance to experience better gains.

- CFDs have a more transparent system of trading than options, as their price always changes in strict accordance with the price movement of the underlying asset.

- You can successfully roll into CFD trading even if you only have a basic understanding of how financial markets operate. Options trading, on the other hand, requires more knowledge of many financial processes.

Conclusion

Having read all the information on the CFDs vs options battle, you can decide which investment strategy is preferable for you.

Let's say you're now more interested in instruments like CFDs. Where do you start? We suggest opening a demo account on a trusted brokerage like Libertex. Here, you can make bold decisions and learn all the specifics of newly discovered assets in a risk-free environment.

CFDs vs Options: FAQ

What Does CFD Stand For?

CFD stands for "contract for difference." It's a financial contract concluded between two parties that agree to exchange the difference (hence the name) in the value of the underlying asset that emerges during a certain period of time. CFDs can be used to buy stocks, indices, commodities, currencies and many other assets.

What Are Options?

Options are derivatives that provide their owners with the right (but not the obligation) to purchase or sell the underlying assets at a predetermined price on the preset date. Options are advanced financial tools that can be implemented in many different investment strategies, providing that their holder has sufficient knowledge on how to speculate on the market.

Is Options Trading the Same as CFDs?

In the CFD market, buyers and sellers don't own any options contracts, but they have a chance to speculate on the price if it changes from the moment the related options contract was opened. A CFD isn't limited to stocks or options only; it can also be used to buy and sell currencies and commodities (like gold or oil).

What's the Difference between CFDs and Options?

Here are the major differences between a CFD and an option:

- CFDs are traded through a brokerage, while options are traded on exchanges.

- CFDs are financial agreements concluded to speculate on the price fluctuations between the opening and closing dates. Options provide their holders with the right to buy assets within a specified time period at the predetermined price in the future.

- CFDs are more straightforward and can be traded in a broader set of markets. Options are significantly more complex in terms of their management. However, they can be traded directly, thus maximising possible yields.

What to Choose: CFDs vs Options?

The choice should depend on what you want to achieve through trading. However, if you're an aspiring trader, it's better to stick with CFD trading for a while, as it has a more transparent system suitable for entry-level investors. Once you gain more financial knowledge, you can try to work with options as well, but for now, you can get started by opening a demo account on Libertex.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.