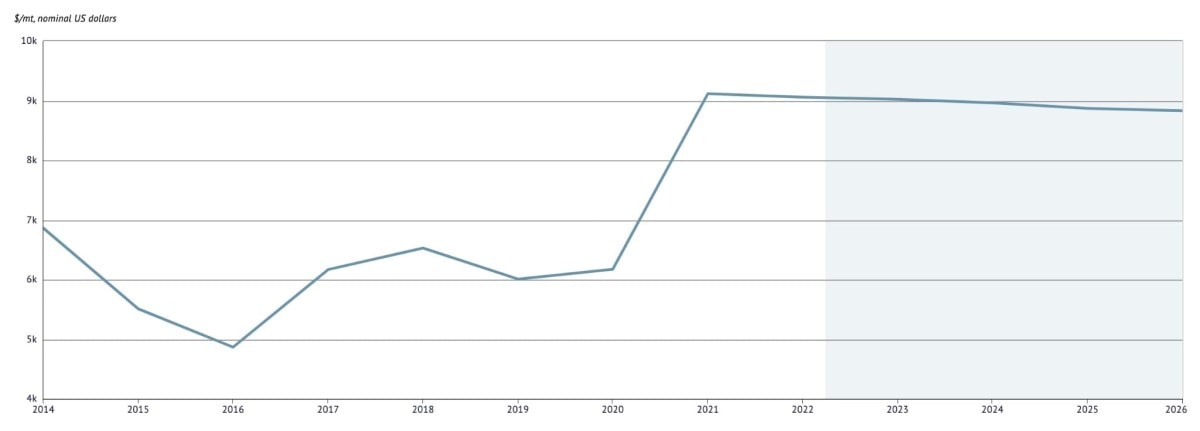

Copper Price Forecast: What to Expect From One of the Most Consumed and Versatile Metals?

Source: Knoema

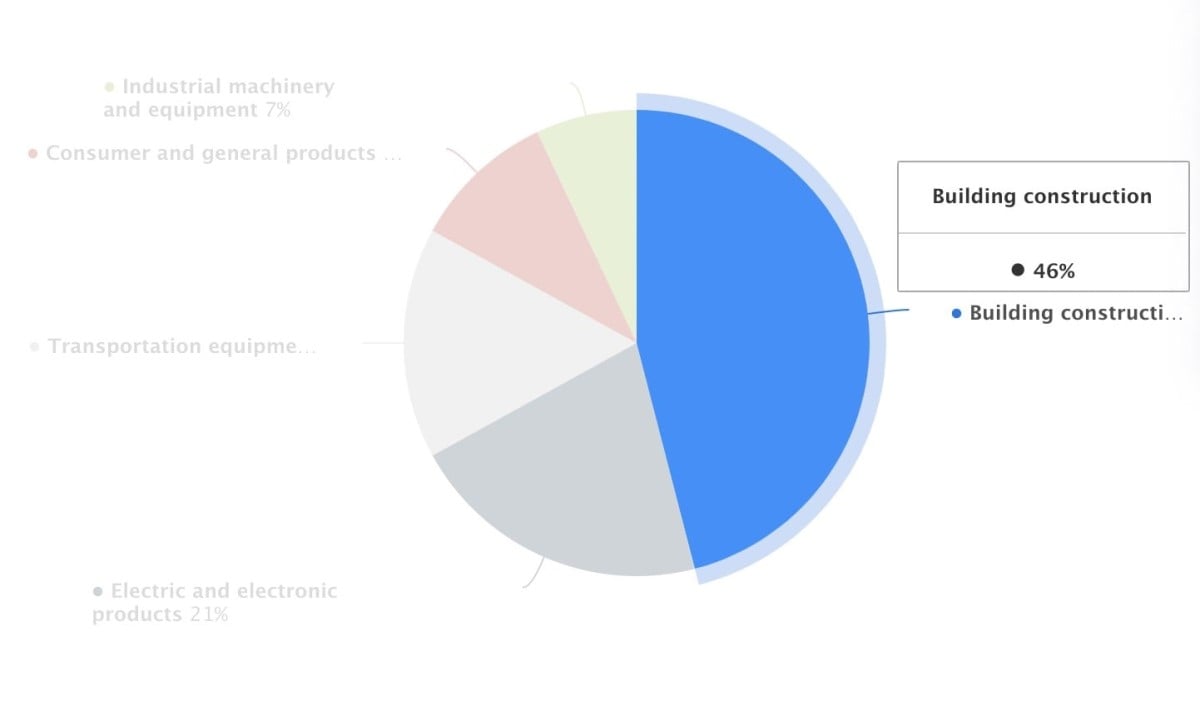

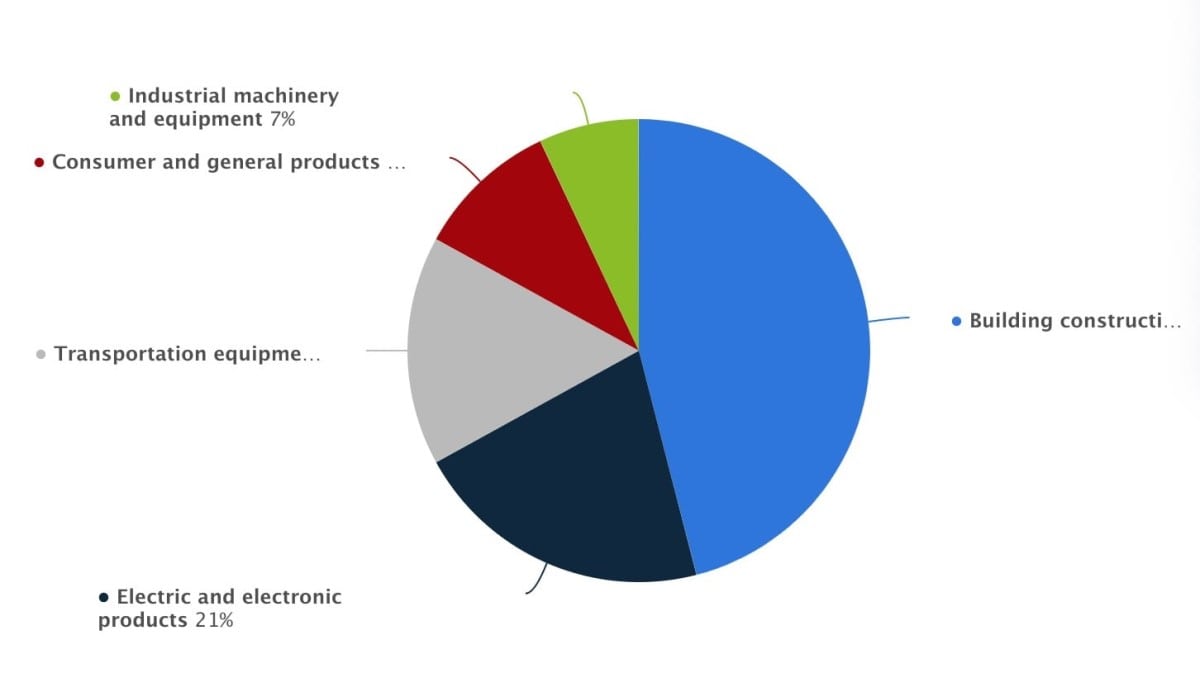

Common Applications of Copper: Demand by Industry

Copper is one of the most widely used industrial metals due to its high ductility, malleability, thermal and electrical conductivity and corrosion resistance. Examples of common uses:

- Electrical wires and cables

- Construction materials, plumbing and industrial machinery

- Emerging and green technologies (electric vehicles and solar cells)

- Decorative elements, jewellery.

The building construction industry currently shows the highest demand for copper. The charts below are based on averaged data but take into account that the uses of copper may vary slightly depending on the country.

Electric and electronic products, transportation equipment and consumer products together account for 46% of copper demand.

Copper can be alloyed with different metals, which expands its possible uses. Some of the most commonly used alloys are:

- Bronze (copper + tin) - structural and design elements, musical instruments, electrical contacts, ship propellers

- Brass (copper + zinc) - pipes and tubes, weather-stripping pieces, screws, musical instruments, cartridge casings for firearms

- Cupronickel (copper + nickel) - numerous uses in marine engineering, coinage

- Sterling silver (copper + nickel) - jewellery and other metalwork

What Factors Determine Copper Prices?

Here are some of the factors that affect and contribute to copper's overall price (to a greater or lesser degree):

- Demand. When economies are booming and expanding, the rising demand provides a nice boost to the price.

- Supply. Price usually soars when there's a shortage of readily available copper.

- Stockpiles. Governments can use existing stockpiles as a short-term solution to pricing pressures. This helps keep prices at bay as long as the copper supply catches up eventually.

- International relations. Financial crises, economic downturns, armed conflicts, sanctions and monetary policies can all have a significant effect if these events take place in major exporting countries.

- Technological innovation. Copper has an indispensable role in modern technologies, ensuring copper stays valuable.

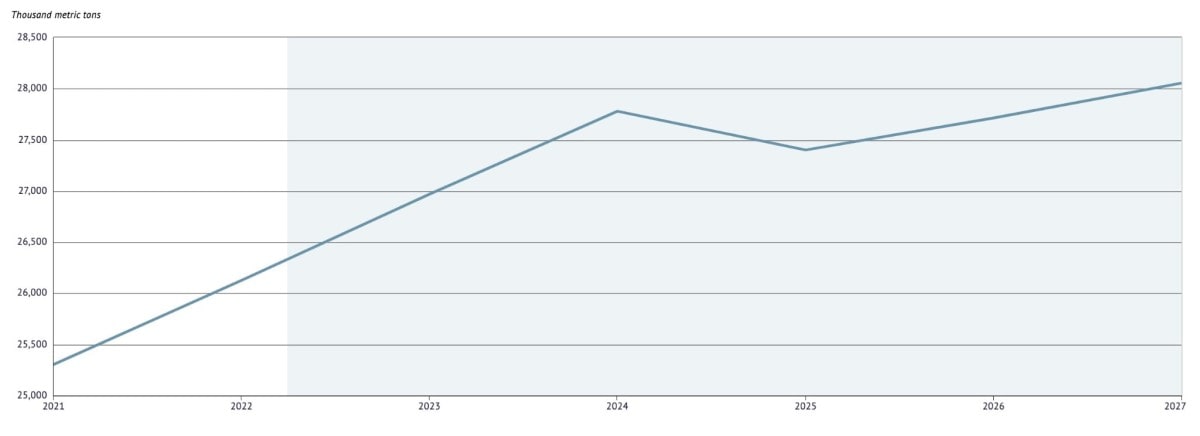

Copper Demand Forecast by Sectors

Source: Knoema

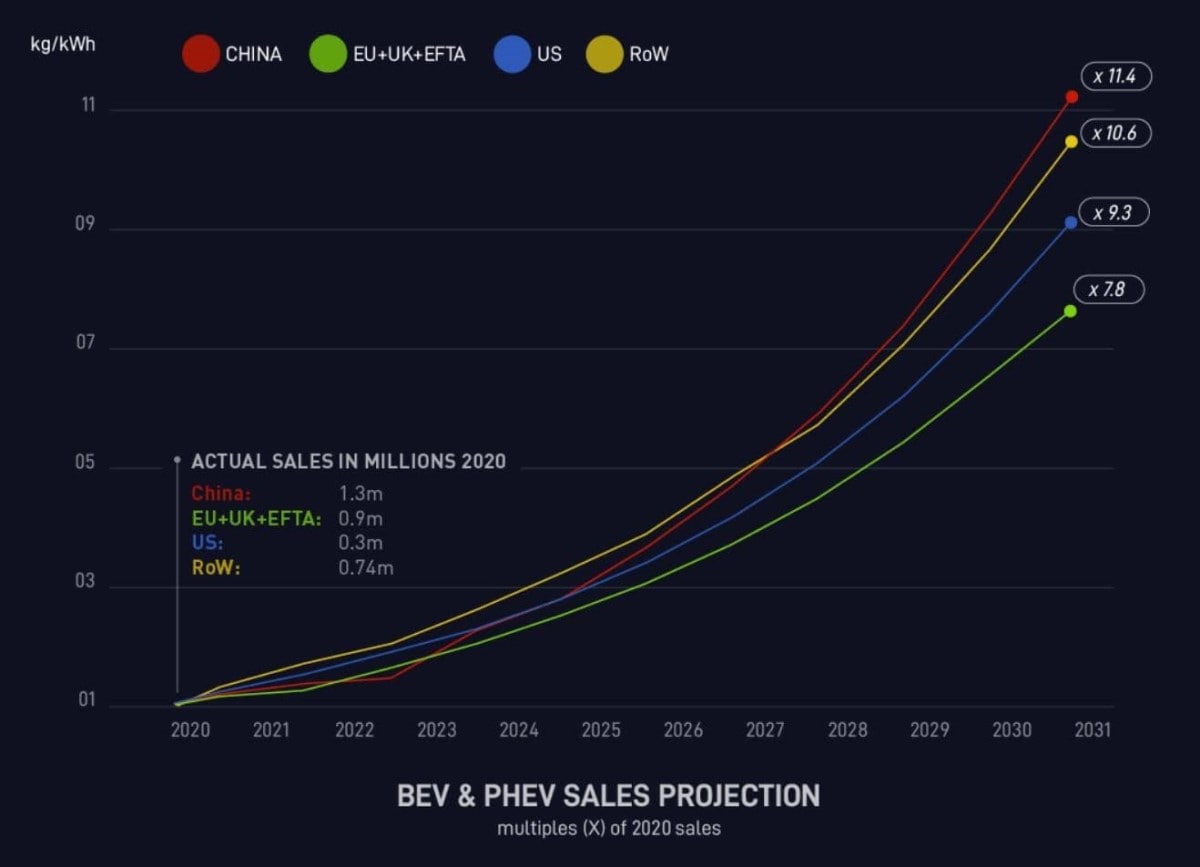

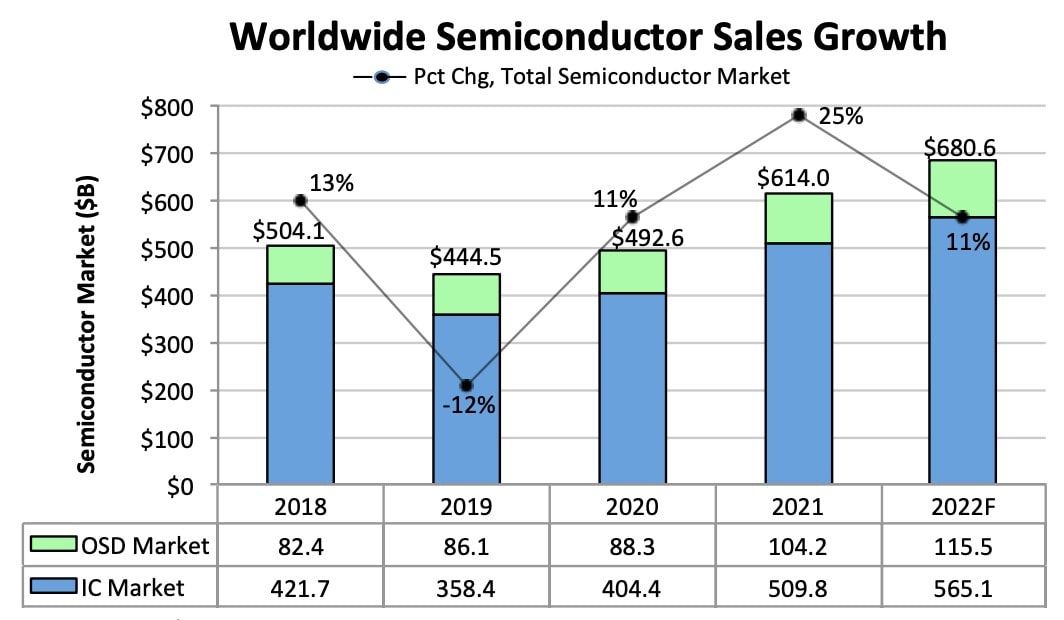

The copper demand is expected to rise further because of growing concerns over low copper inventories. Demand can rise due to copper's vital role in a number of rapidly growing industrial sectors: Electric vehicle batteries and semiconductor wiring. Here are market projections for these two sectors to have a general idea of how much the consumption might grow.

Source: ACC

Source: IC Insights

ACC also reports an expected 15.3-fold increase in copper demand for battery pack materials in 2031 compared to 2020.

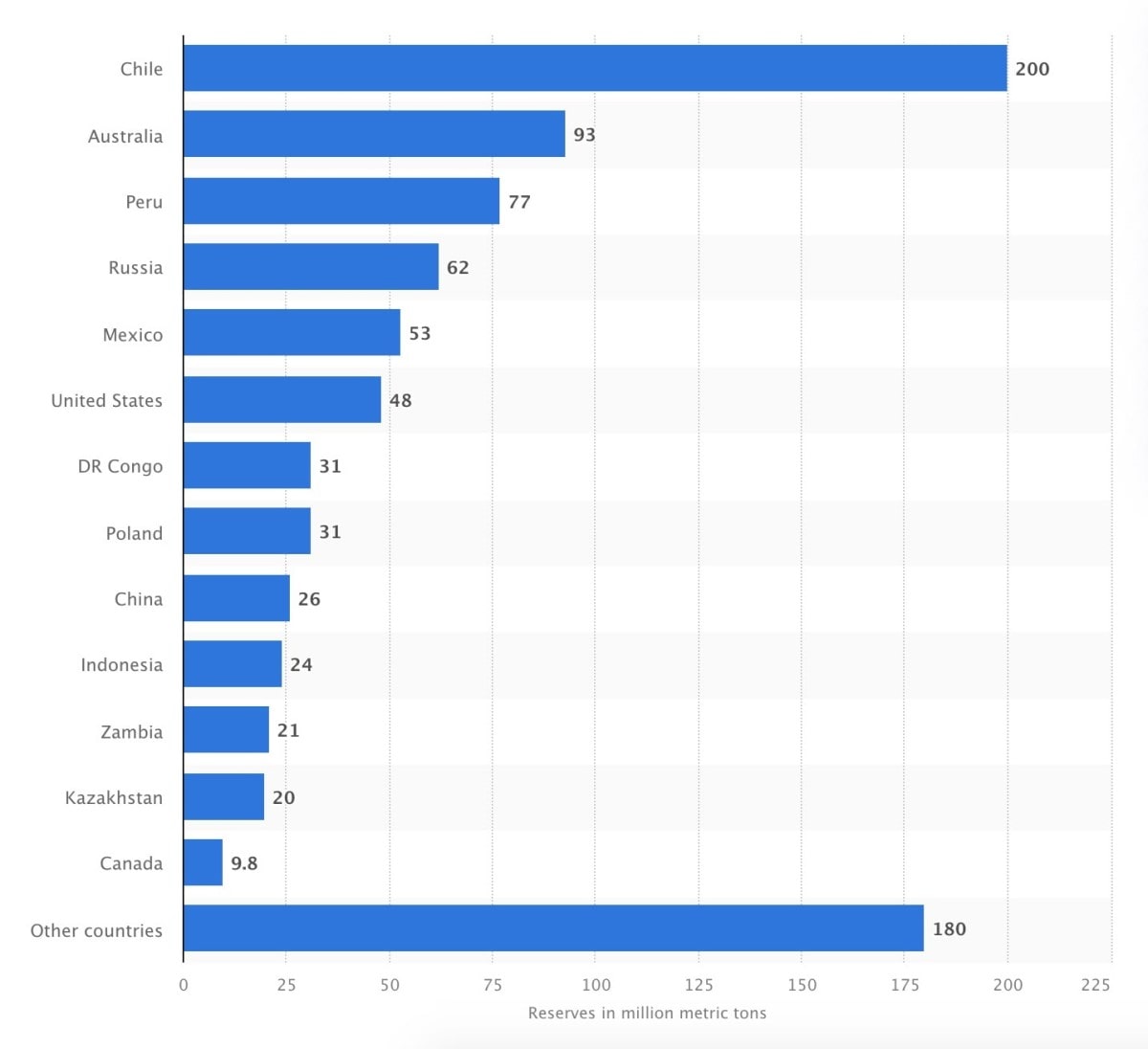

To support the ever-rising demand, there needs to be plenty of supply and effective export capabilities in producing countries. The region around Chile and Peru accounts for almost 40% of the world's copper production, with Australia also being in the top 3. Here are the last estimated reserves worldwide.

Source: Statista

In the latest commodity outlook, Australian mining giant BHP said that in-development projects in the 2022-2024 window could move copper prices higher.

Reuters reported copper price analysis forecasts for 2022, sharing that Commerzbank analysts expected the price per tonne to average at $9,400, while Bank of America said copper would average $9,813. ED&F has a similarly optimistic outlook, putting copper prices between $9,315 and $9,880 by the end of the year.

But not everyone has the same view. Wallet Investor expects a lower closing price of $5,034 at the end of the year.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

May 2022 |

4,713 |

4,706 |

4,706 |

4,716 |

-0.15% |

|

June 2022 |

4,707 |

4,749 |

4,702 |

4,749 |

0.9% |

|

July 2022 |

4,750 |

4,844 |

4,750 |

4,846 |

1.94% |

|

August 2022 |

4,843 |

4,872 |

4,820 |

4,872 |

0.58% |

|

September 2022 |

4,880 |

4,839 |

4,839 |

4,905 |

-0.84% |

|

October 2022 |

4,837 |

4,888 |

4,836 |

4,897 |

1.04% |

|

November 2022 |

4,884 |

4,933 |

4,872 |

4,933 |

0.99% |

|

December 2022 |

4,940 |

5,034 |

4,940 |

5,034 |

1.87% |

Another copper price prediction for 2022 comes from Gov Capital, where the year-end price is expected to be in the $4,440-$6,007 range.

|

Month |

Average price ($) |

Minimum price ($) |

Maximum price ($) |

|

May 2022 |

4,886 |

4,153 |

5,618 |

|

June 2022 |

4,889 |

4,155 |

5,622 |

|

July 2022 |

4,993 |

4,244 |

5,741 |

|

August 2022 |

4,959 |

4,215 |

5,702 |

|

September 2022 |

4,888 |

4,154 |

5,621 |

|

October 2022 |

4,995 |

4,245 |

5,744 |

|

November 2022 |

5,116 |

4,348 |

5,883 |

|

December 2022 |

5,224 |

4,440 |

6,007 |

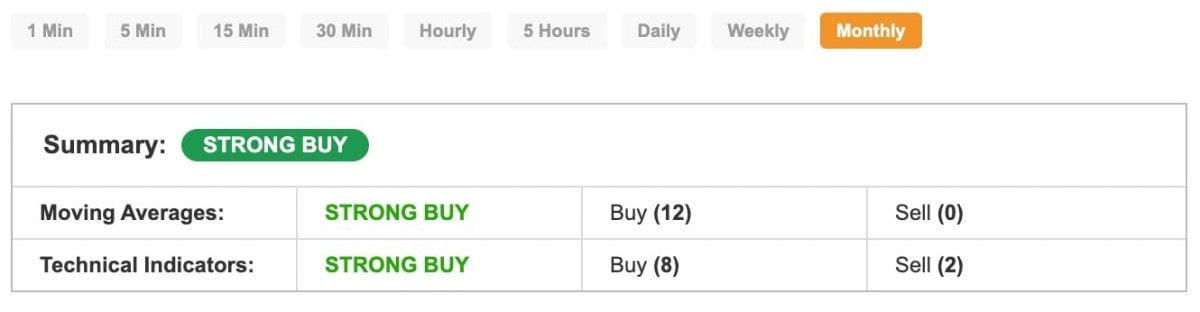

Technical Analysis of Copper Prices

There are three key steps to conducting technical analysis:

Step 1. Identify the prevailing trend, which you can do by looking at the price chart on your chosen timeframe.

Step 2. Mark support and resistance levels (drawn on 11 April 2022):

- S3: 4,457

- S2: 4,565

- S1: 4,645

- Pivot Point: 4,752

- R1: 4.832

- R2: 4,940

- R3: 5,020

Step 3. Establish entry and exit points. For this, look at technical indicators and determine an adequate moment for a move.

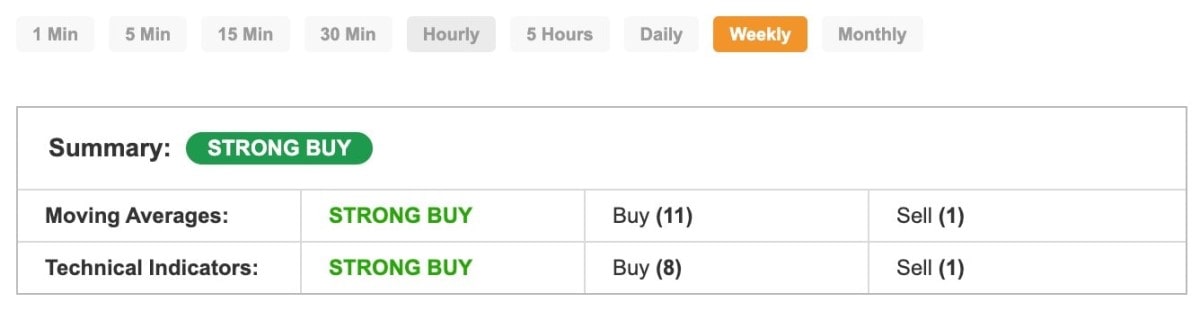

Source: Investing.com

Let's look at the signals picked up by technical indicators (as of 11 April 2022):

- RSI - Buy

- STOCH - Neutral

- STOCHRSI - Sell

- MACD - Buy

- ADX - Buy

- Williams %R - Buy

- CCI - Buy

- ATR - High Volatility

- Highs/Lows - Neutral

- Ultimate Oscillator - Buy

- ROC - Buy

- Bull/Bear Power - Buy

Summary: Strong Buy

Here are signals from moving averages (as of 11 April 2022):

- MA5: Simple - Sell; Exponential - Buy

- MA10: Simple - Buy; Exponential - Buy

- MA20: Simple - Buy; Exponential - Buy

- MA50: Simple - Buy; Exponential - Buy

- MA100: Simple - Buy; Exponential - Buy

- MA200: Simple - Buy; Exponential - Buy

Summary: Strong Buy

Copper Price Prediction for 2023-2024

The next stop is Wallet Investor's prediction for 2023. The mid-year closing price might be $5,347, and the end-year closing price might be $5,629.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2023 |

5,047 |

5,078 |

5,047 |

5,082 |

0.61% |

|

February 2023 |

5,081 |

5,213 |

5,081 |

5,213 |

2.52% |

|

March 2023 |

5,219 |

5,281 |

5,219 |

5,281 |

1.18% |

|

April 2023 |

5,291 |

5,318 |

5,291 |

5,328 |

0.52% |

|

May 2023 |

5,315 |

5,309 |

5,308 |

5,317 |

-0.12% |

|

June 2023 |

5,3114 |

5,347 |

5,303 |

5,347 |

0.67% |

|

July 2023 |

5,357 |

5,445 |

5,357 |

5,446 |

1.62% |

|

August 2023 |

5,444 |

5,475 |

5,422 |

5,475 |

0.57% |

|

September 2023 |

5,477 |

5,443 |

5,443 |

5,505 |

-0.62% |

|

October 2023 |

5,438 |

5,488 |

5,437 |

5,499 |

0.91% |

|

November 2023 |

5,488 |

5,536 |

5,474 |

5,536 |

0.88% |

|

December 2023 |

5,537 |

5,629 |

5,537 |

5,629 |

1.64% |

Gov Capital expects the average price in the middle of the year to be $7,139-$7,300, and reach $7,560 by the end of the year.

|

Month |

Average price ($) |

Minimum price ($) |

Maximum price ($) |

|

January 2023 |

5,101 |

4,335 |

5,866 |

|

February 2023 |

5,343 |

4,541 |

6,144 |

|

March 2023 |

5,280 |

4,488 |

6,072 |

|

April 2023 |

7,084 |

6,021 |

8,146 |

|

May 2023 |

7,165 |

6,090 |

8,239 |

|

June 2023 |

7,139 |

6,068 |

8,209 |

|

July 2023 |

7,300 |

6,205 |

8,395 |

|

August 2023 |

7,294 |

6,199 |

8,388 |

|

September 2023 |

7,188 |

6,109 |

8,266 |

|

October 2023 |

7,308 |

6,211 |

8,404 |

|

November 2023 |

7,469 |

6,348 |

8,589 |

|

December 2023 |

7,560 |

6,426 |

8,694 |

Moving on to 2024, Wallet Investor predicts the price to rise to around $5,907-$5,944 by the middle of the year and $6,144-$6,242 by the end of the year.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2024 |

5,643 |

5,681 |

5,643 |

5,683 |

0.67% |

|

February 2024 |

5,685 |

5,822 |

5,684 |

5,822 |

2.35% |

|

March 2024 |

5,822 |

5,878 |

5,822 |

5,878 |

0.94% |

|

April 2024 |

5,888 |

5,915 |

5,888 |

5,929 |

0.47% |

|

May 2024 |

5,916 |

5,909 |

5,909 |

5,918 |

-0.12% |

|

June 2024 |

5,907 |

5,944 |

5,905 |

5,944 |

0.62% |

|

July 2024 |

5,954 |

6,047 |

5,954 |

6,047 |

1.54% |

|

August 2024 |

6,049 |

6,071 |

6,024 |

6,071 |

0.37% |

|

September 2024 |

6,086 |

6,041 |

6,041 |

6,108 |

-0.75% |

|

October 2024 |

6,038 |

6,093 |

6,038 |

6,100 |

0.89% |

|

November 2024 |

6,087 |

6,134 |

6,075 |

6,134 |

0.75% |

|

December 2024 |

6,144 |

6,242 |

6,144 |

6,242 |

1.56% |

Gov Capital expects copper to break above $10,000 in April 2024 and close the year with an average price of $10,442.

|

Month |

Average price ($) |

Minimum price ($) |

Maximum price ($) |

|

January 2024 |

7,490 |

6,366 |

8,613 |

|

February 2024 |

7,847 |

6,669 |

9,024 |

|

March 2024 |

7,836 |

6,660 |

9,011 |

|

April 2024 |

10,192 |

8,663 |

11,720 |

|

May 2024 |

10,284 |

8,741 |

11,826 |

|

June 2024 |

10,141 |

8,619 |

11,662 |

|

July 2024 |

10,299 |

8,754 |

11,843 |

|

August 2024 |

10,246 |

8,709 |

11,782 |

|

September 2024 |

10,110 |

8,593 |

11,626 |

|

October 2024 |

10,261 |

8,721 |

11,800 |

|

November 2024 |

10,341 |

8,789 |

11,892 |

|

December 2024 |

10,442 |

8,875 |

12,008 |

Long-Term Copper Price Forecast for 2025-2030

CNBC reported the outlook of Bank of America, which expects prices to hit $20,000 per metric ton by 2025 due to widening supply and demand deficits.

And once again, Wallet Investor is much more reserved in its outlook.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2025 |

6,248 |

6,283 |

6,248 |

6,285 |

0.56% |

|

February 2025 |

6,289 |

6,4192 |

6,289 |

6,419 |

2.02% |

|

March 2025 |

6,430 |

6,485 |

6,430 |

6,485 |

0.85% |

|

April 2025 |

6,487 |

6,519 |

6,487 |

6,530 |

0.49% |

|

May 2025 |

6,521 |

6,512 |

6,512 |

6,521 |

-0.14% |

|

June 2025 |

6,509 |

6,551 |

6,506 |

6,551 |

0.63% |

|

July 2025 |

6,553 |

6,651 |

6,553 |

6,651 |

1.47% |

|

August 2025 |

6,647 |

6,666 |

6,626 |

6,666 |

0.28% |

|

September 2025 |

6,682 |

6,641 |

6,641 |

6,711 |

-0.61% |

|

October 2025 |

6,642 |

6,691 |

6,641 |

6,701 |

0.74% |

|

November 2025 |

6,685 |

6,730 |

6,675 |

6,730 |

0.67% |

|

December 2025 |

6,741 |

6,843 |

6,741 |

6,843 |

1.49% |

Gov Capital expects a more eventful year for copper. In April, it may surpass $13,000, and in December, it may rise close to $14,000.

|

Month |

Average price ($) |

Minimum price ($) |

Maximum price ($) |

|

January 2025 |

10,344 |

8,792 |

11,895 |

|

February 22025 |

10,589 |

9,000 |

12,177 |

|

March 2025 |

10,651 |

9,053 |

12,248 |

|

April 2025 |

13,624 |

11,580 |

15,667 |

|

May 2025 |

13,687 |

11,633 |

15,740 |

|

June 2025 |

13,627 |

11,582 |

15,671 |

|

July 2025 |

13,768 |

11,702 |

15,833 |

|

August 2025 |

13,736 |

11,675 |

15,796 |

|

September 2025 |

13,635 |

11,589 |

15,680 |

|

October 2025 |

13,763 |

11,698 |

15,827 |

|

November 2025 |

13,877 |

11,795 |

15,958 |

|

December 2025 |

13,976 |

11,879 |

16,072 |

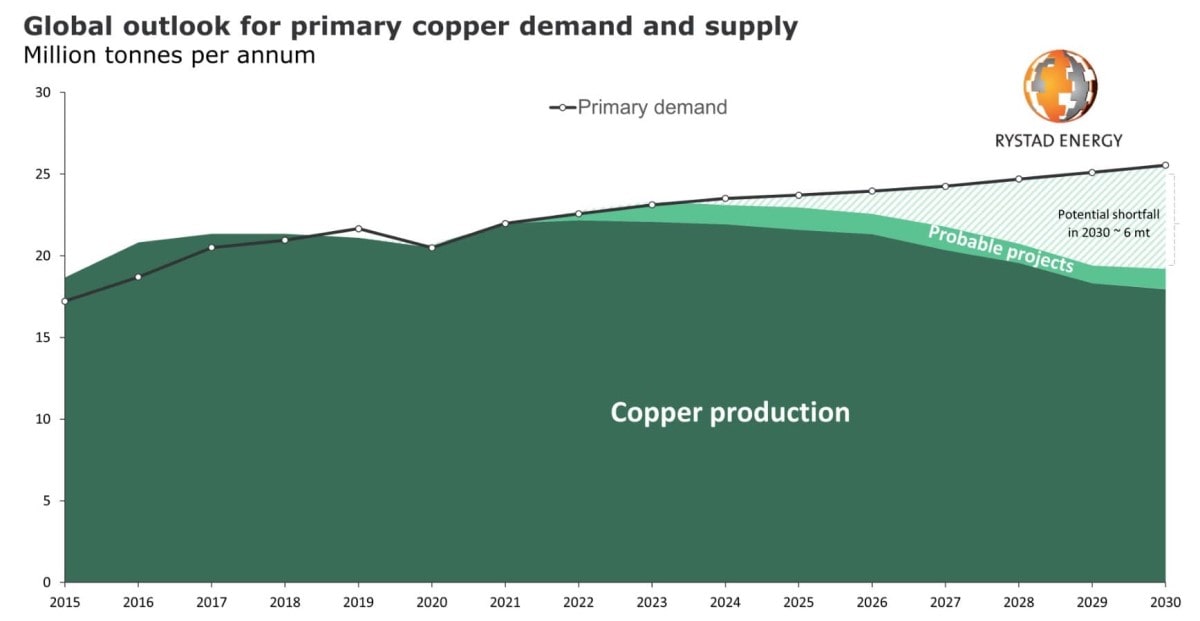

In the base scenario by Oroco Resource Corp, the forecasted price of copper in 2030 will be $10,756. In the bullish scenario, it's $14,341. The bullish assumption is supported by Rystad Energy, which believes global demand for copper will outstrip supply by more than six million tonnes by 2030.

Source: Rystad Energy

Please bear in mind the copper price forecast for the long term is based on historical performance, which provides only approximate estimations.

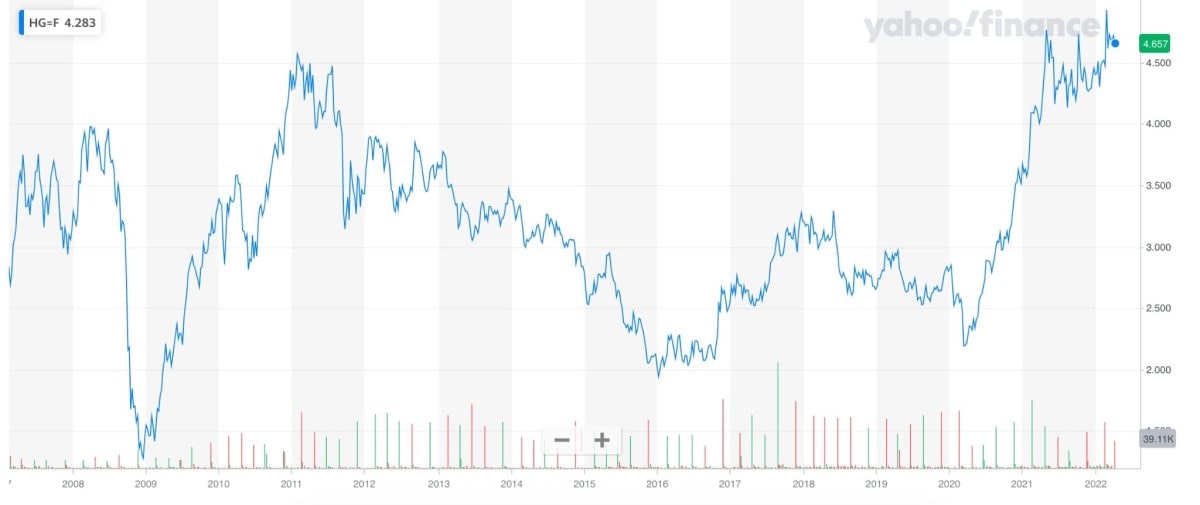

Copper Price History Over the Past 15 Years

The biggest dip in recent copper price history happened in late 2008. In a matter of 6 months, the price dropped from $3,963 to $1,305 per tonne. After that, the copper market went into a long uptrend until mid-2010, when the long-term trend declined until 2016.

Another big dip took place in March 2020, which correlated with the stock market crash and the beginning of the COVID-19 recession. In 2022, copper prices went up over fears of supply chain disruptions.

Source: Yahoo! Finance (prices per kilogram)

Are Copper Companies' Stocks a Buy or a Sell Now?

Leading publicly-traded copper miners worldwide by production output are:

- Glencore (LON: GLEN): Buy - 7

- Freeport-McMoRan (NYSE: FCX): Buy - 1, Overweight - 1, Hold - 6, Sell - 1

- BHP (NYSE: BHP): Buy - 8, Overweight - 2, Hold - 13, Underweight - 2, Sell - 1

As you can see, some analysts see potential in mining companies, and some are undecided. But these are just examples of the biggest producers. There are many more that you can analyse and view as a potential investment. Make sure to do thorough research on each one you're considering.

If you're ready to begin your journey into the stock market (or some other markets as well), do it the proper way! Practice on a demo account with Libertex and improve your skills before making trades in a live account.

Disclaimer: This article contains information gathered from multiple data sources and does not guarantee its accuracy or completeness. Before making any trading/investing decision, do your own research and consider your personal circumstances, investment experience, and current financial situation.

FAQ

Are copper prices expected to rise?

According to platforms that this article drew copper price forecasts from, yes. Some sources (e.g., Wallet Investors) predict a mild uptrend, while others (e.g., Gov Capital) expect a much sharper price rise

Is copper a good investment for 2022?

It's believed that copper demand will stay strong in the long term, which has the potential to drive the price upwards and possibly make it a good investment.

What is the best way to invest in copper?

The most common ways are exchange-traded funds (ETFs) focused on copper or copper-mining companies, copper futures and shares in copper-mining companies.

What is the highest price copper has ever been?

At the time of writing (11 April 2022), the highest trading price of copper per tonne was $4,929 on 27 February 2022.

Will copper be valuable in the future?

Most likely, yes. Currently, most copper is used to produce electrical equipment, such as wiring and motors. However, renewables and EV markets can push copper demand even further, and it's likely to remain one of the most widely used metals in the world.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.