How to Buy Stocks: A Beginner’s Guide

What Are Stocks and How Do They Work?

We're going to kick things off with a rundown of what stocks are.

Stocks are securities that represent an investor's ownership of a company. When you buy stock from a certain company, you aren't lending them money. Rather, you are purchasing a percentage of the company's ownership.

In turn, that ownership gives you a claim to part of the company's assets and earnings. Some stocks may even pay annual or quarterly dividends.

You may have also heard the term "share". Shares are closely related to stocks, but they're not quite the same thing. While stocks represent the broader concept of ownership, shares represent the exact amount – one share is one ownership unit. If somebody says to you, "I own stock in Microsoft," you wouldn't know if they own three shares or 100 shares. But if they say, "I own 20 shares in Microsoft," you then know exactly how many ownership units they have.

There are several kinds of stock categorisations that you should be aware of:

Common vs Preferred Stock

- Common stock: This is the stock that most people invest in. It represents the investor's partial ownership of a corporation. If the company is dissolved, shareholders receive a proportional share of the value – but if the company doesn't have any assets leftover when it fails, common stockholders end up with empty pockets.

- Preferred stock: Shareholders with preferred stock have preference over those with common stock upon company dissolution. They also get paid dividends first.

Small-Cap vs Mid-Cap vs Large-Cap Stock

Stocks can get categorised by the worth of all shares (also called market capitalisation):

- Small-cap stock: It has a market cap below $2 billion.

- Mid-cap stock: It has a market cap between $2 billion and $10 billion.

- Large-cap stock: It has a market cap of $10 billion or more.

Growth vs Value Stocks

- Growth stock: These are stocks of businesses that seek to fulfil strong, rising demand among their customers. Competition is strong in this area, and a business' stock can plummet if a rival gets ahead. Even though the risk level is high, the potential returns are attractive to investors that want to see sales rise quickly.

- Value stock: These stocks are more conservative, comprising shares of well-known and mature companies. Such companies are already industry leaders, so there isn't much room for growth. This kind of stock is popular with investors who want inexpensive shares from companies that have stood the test of time.

Dividend vs Non-Dividend Stocks

- Dividend stocks: Often, stocks provide dividend payments to shareholders regularly, and these stocks are very attractive among investors. But payments don't have to be high – a stock that pays only one cent per share still qualifies as a dividend stock.

- Non-dividend stocks: Stocks don't have to pay dividends – in fact, many industry leaders don't pay shareholders. Even without dividend payments, these stocks can still be a smart addition to an investmentportfolio if the share's price increases over time.

There are many other classifications of stocks, but the ones above are the main ones you need to know. Keep in mind that one stock can fall under multiple classifications: for instance, you could buy a small-cap common growth stock that pays dividends.

How to Choose Which Stocks to Buy

If you're reading this guide, you're likely a new investor – with tens of thousands of stocks available to buy, you might have no idea where to start. There's no single best stock to buy – advantageous ones differ depending on your goals. So, we've created a series of steps to narrow the process down.

Step 1: Determine What Kind of Investor You Want to Be

Do you want to be an income-oriented investor (somebody who buys and holds stocks in companies that regularly pay good dividends)? These investors tend to invest in low-growth, solid companies, such as utility corporations.

Are you aiming for wealth preservation instead? Such investors don't have a high tolerance for risk. Instead, they prefer investing in stable corporations (also referred to as blue-chip). Companies that provide consumer staples are popular choices, as they perform well during good and bad economic climates.

Perhaps you are looking for capital appreciation? Investors with this goal keep an eye out for companies that are having the best early growth years. They are more willing to buy high-risk stocks if there's a chance of achieving big gains. But it also means accepting the potential of bigger losses.

Step 2: Identify Promising Companies

There are three common ways to fulfil this step. First, you can research ETFs (exchange-traded funds). In essence, an ETF bundles shares from different companies. You don't actually have to buy the ETF. Instead, use them as a way to track the performance of various industries.

To do so, head to an ETF database, such as etfdb.com. Then search for a particular industry, such as "consumer discretionary". The database will show you all relevant ETFs – you can then browse through them and see each fund's top holdings.

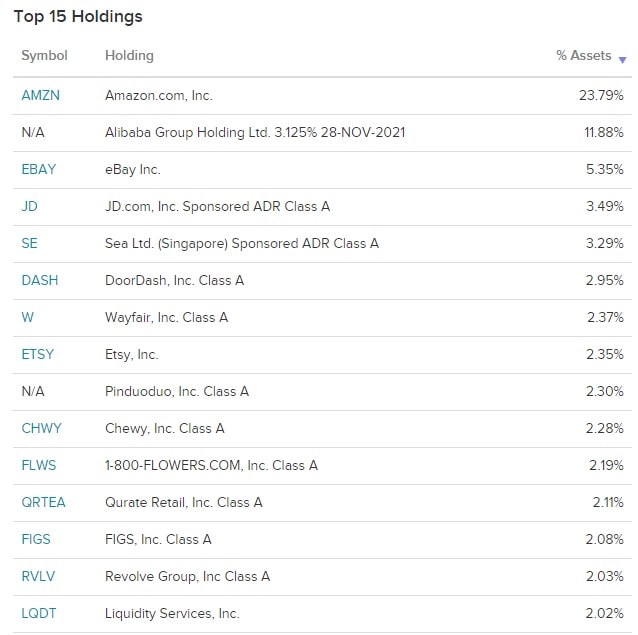

We did exactly this on ETFDB and chose to view ProShares Online Retail ETF's top holdings, which can be seen below:

You don't have to buy stock in these companies, but this strategy gives you an idea of where to start researching.

Pros and Cons of Investing in Stocks

Investing in stocks might not be the right move for everybody. To make an informed decision, make sure to carefully review the advantages and disadvantages of buying stocks.

Advantages |

Disadvantages |

|

Stocks can offer better ROI than bonds, with an average annual return of 10.34% |

Stocks are subject to higher risk. |

|

Stocks give you a piece of ownership in a company. |

You have to do lots of research and analysis to find a stock that could potentially generate returns. |

|

There are plenty of online platforms that let you buy and sell stocks, with some even offering commission-free transactions. |

Stockholders are usually paid last (preferred stockholders are only paid first if a company goes bankrupt). |

|

Shares are classified as "liquid", meaning you can turn them into cash if you need money. |

Prices rise and fall rapidly, which can have a negative effect on trading psychology. |

What Is the Best Place to Buy Stocks?

There are two categories of places that offer stocks: stock exchanges and over-the-counter markets.

Stock Exchanges

An Exchange is a centralised system that offers stocks of well-established companies. Exchanges operate on an intricate network and are not open 24/7 - for instance, the New York Stock Exchange (NYSE) is open from 9:30 a.m. - 4 p.m. EST on Mondays through Fridays. Most exchanges are closed on the weekends and on holidays.

Here's something really important to keep in mind: you can't just call up a stock exchange and request to purchase stocks. Instead, you'll need to work with a stockbroker – they are the ones who can place your orders on an exchange.

Over-the-Counter (OTC) Market

In this kind of market, securities aren't traded on a centralised exchange. Instead, trades are made through a broker-dealer network. This market offers securities of companies that don't meet the requirements to be listed on the NYSE and other exchanges. This method provides access to financial instruments that, otherwise, you wouldn't be able to trade.

However, because there is a lower entry barrier, OTC markets have an increased risk of fraud. To take advantage of this market without falling prey to fraud, you would need to use the services of a dealer or broker that specialises in OTC markets.

Regardless of whether you want to buy stock from an exchange or an OTC market, you'll need to select a reputable broker to work with: and this is where things can get tricky. There are hundreds – perhaps even thousands – of brokerage websites. With so many to choose from, how do you select a trustworthy place with good terms? Here's a quick checklist for you to work through when comparing an online stock broker:

- Is the broker regulated?

- Do they offer protection against fraud?

- Does their website offer 2FA?

- What kind of fees do they charge? Is there a monthly maintenance fee or an annual account fee?

- Is there a minimum deposit amount?

- Can you trade during pre-market and after-hour time periods?

- What kind of charts and tools are available?

How to Buy Stocks Online With a Broker

After you've assessed various online brokers and selected the one that best meets your needs, it's time to create an account and start buying stocks. Here's how to buy stocks!

1. Open an Account to Buy Stocks

Opening an account with an online broker isn't too complicated. Nowadays, most of these services don't require an account minimum. All you'll need to do is provide some KYC (know-your-customer) info for identity verification and give some basic financial info. But there is a chance that the service will ask for KYC documents first and then inform you about a minimum amount to invest.

2. Research Which Stocks You’d Like to Buy

It's research time! Some online broker websites have educational sections, so make sure to watch whatever videos and read any guides they offer. They will give you some great strategies for selecting promising stocks.

When you find a company that you want to buy stock in, do even more research – before investing money into it, you'll need to have a full understanding of the company, the products it offers, its balance sheet, and the industry it's a part of. To get this info, you can read through the company's filings that are posted on the Securities and Exchange Commission.

Some other research methods include using a stock screener, speaking to the management teams of smaller companies, and subscribing to investment newsletters.

After you've gathered sufficient research, you can either choose to ignore this company's stock or, if it seems promising, develop an investment thesis – in other words, a data-based argument for a particular investment. Putting your analysis of a particular stock into writing can help you determine what steps to take if the price experiences a steep decline.

When a significant price change happens in the future, you would measure the new factors against the original thesis and see if your analysis still holds true. If so, you can keep holding the stock or even buy more shares. But if the thesis has broken and the company isn't poised to outperform in the coming years anymore, it may be a good idea to sell the investment.

3. Place a Investment

After you've selected a company to buy stock in and created an investment thesis, it's finally time to place your investment! You'll use the stock's ticker symbol (usually a three or four-letter code) to enter an order on the online broker website.

When you placing an investment, you'll have to specify which kind you'd like to place:

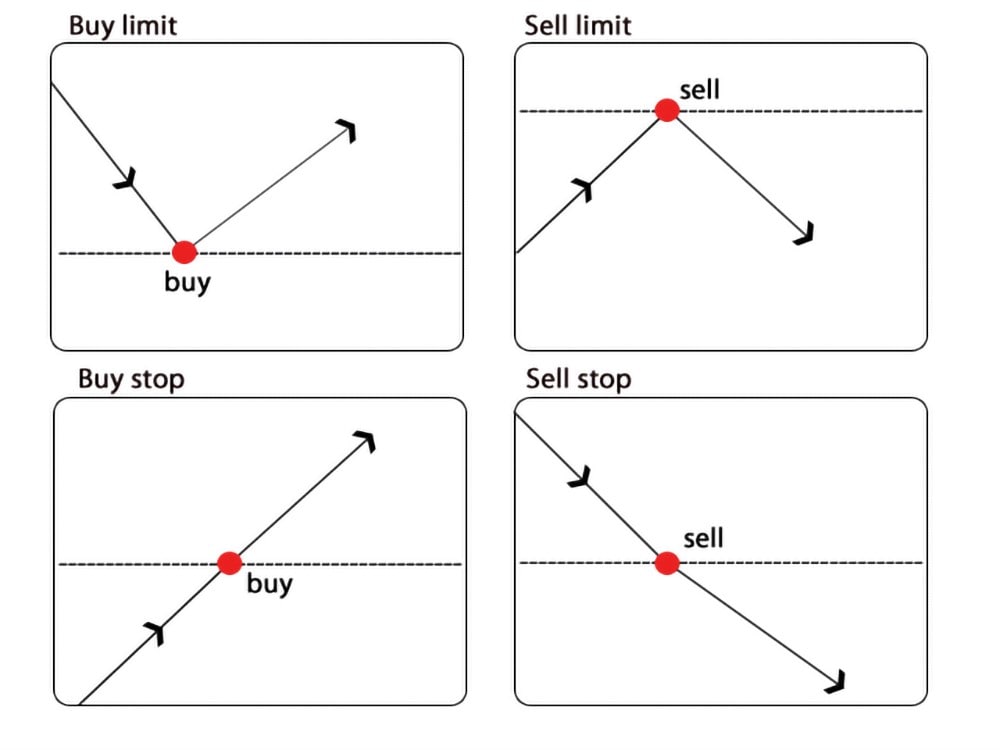

- Limit order: You'll specify a price, and the order will only execute at that price or better. In most cases, the limit order will be valid for three months.

- Market order: You don't have any control over the price. Instead, the transaction will occur at the best price that was available when you sent the order.

- Buy stop order: When a security reaches a pre-specified price, the buy stop transforms into a limit or market order, which is carried out at the next available price.

- Buy stop limit order: It combines the stop order and limit order features. Once the stop price is reached, the order transforms into a limit order. It will be executed at the specified price (or a better price, if available).

Once the trade executes, you now own stock in the company.

What Taxes Do You Have to Pay?

Before diving into the wide world of stocks, it's important to understand how they could affect your tax bill.

First of all, you have to consider the capital gains tax. This tax may occur if you use a regular brokerage account to hold shares and then sell them for a profit. There are two kinds of capital gains taxes, short-term and long-term.

- Short-term capital gains tax: This is a tax on profits that occurs when you sell an asset that was held for a year or less. The tax rate is the same as your federal tax bracket.

- Long-term capital gains tax: This is a tax on profits that occurs when you sell an asset that was held for more than a year. Depending on your filing status and taxable income, you can expect to pay a tax of 0%, 15% or 20%.

Typically, long-term capital gain taxes will be lower than short-term ones.

You also need to consider dividend taxes, as dividends are normally considered taxable income. Once again, there are two kinds of dividend taxes – these ones are qualified and non-qualified.

- Qualified dividend tax: The rate is 0%, 15%, or 20%, and it depends on your filing status and taxable income.

- Non-qualified dividend tax: The rate is the same as your federal income tax bracket.

And what makes a dividend qualified? The payee must have owned the stock for at least a certain amount of time. Typically, it would be 90 days for preferred stock and 60 days for common stock. Furthermore, the dividend must either be a US corporation or have ties to the US.

How to Sell Shares

Before selling shares, make sure to refer back to your original investment thesis and see if your analysis remains true. After reviewing the situation, if it seems prudent to sell all your stock in a company (or even just a few shares), you can do so through your online broker.

Rather than selecting the "Buy" option on the website, you would select "Sell".

As with buying stocks, you will have to select the type of order: market, limit, stop, or stop-limit.

Common Mistakes to Avoid

Some people can get too excited at the prospect of making money. Diving into the stock market without preparing yourself can have devastating financial consequences. One way to prepare yourself is to learn about common mistakes and take steps to avoid making them yourself.

Here are some examples:

- Investing without understanding the company. Before buying stock in a company, research its business model and products – and even go beyond that: research the industry that the company is a part of.

- Losing patience. Lots of beginners have overly ambitious expectations when it comes to the timeline for returns and portfolio growth. Remember, buying stocks is typically done with a long-term investment mind frame. If you want shorter-term results, it might be more suitable to trade CFDs through a platform like Libertex (real shares are also available).

- High investment turnover. If your online broker charges commission rates and high transaction costs, jumping in and out of positions can eat up your returns. What's more, you'll likely have to pay higher tax rates for short-term investments.

Conclusion

Buying stocks is much more complicated than just picking a company that looks cool on paper. Some investors strike it lucky, but in most cases, you'll have to put in copious amounts of research and have plenty of patience. But, with the guidance of this article, learning how to buy stocks will take less time.

Remember, buying stocks isn't your only option! If you aren't a fan of the long-term nature of share investments, you trade CFDs on Libertex. By doing so, you can speculate on the market's price in either direction – so possible returns aren't limited to a company's good performance. Libertex offers shares as well as CFDs, so the choice is up to you. But please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital.

FAQ

How to buy stocks as a beginner?

The most common way is to sign up with an online brokerage website. You just have to create an account and then place a buy order.

How to buy shares directly?

Only brokers can buy stocks directly from exchanges. Instead, you will have to work with a broker, who will then place stock orders for you. Online brokerage websites provide an entryway for regular people.

Who gets the money when you buy a stock?

The money goes to the investor that sold the stock to you rather than to the company that issued the shares.

How to buy shares with little money?

Through micro-investing, you can buy fractional shares with just a few dollars.

How to buy shares without a broker?

Working with an online brokerage website means that you don't have to interact with a broker directly. Everything is automated, so it feels like you are buying shares on your own. However, if you truly want to place orders without a broker, you would need to invest in a Direct Stock Purchase Plan. Even then, you would need to work with a transfer agent.

How do you know when to buy a stock?

Have you done the research and feel confident that the price of the stock will rise in the long term? If so, it may be time to buy the stock.

Do I owe money if my stock goes down?

A stock’s price can’t go below zero. So, even if your stock’s price declines, you won’t owe money on it.

Is investing in stocks a good idea?

We can't advise one way or another: some people have experienced huge returns, while others have lost their money. It is riskier than some investment methods, but the higher ROI makes it worth it to some investors. The answer is different for everybody, so make sure to think about it carefully before beginning to buy stocks.

Can I withdraw money from stocks?

You can sell your stocks and withdraw money from the online brokerage account. Keep in mind that there may be some fees involved.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.