What is a contract for difference (CFD)?

They allow customers to trade without having to actually own the underlying asset or acquire any right or obligation. The main benefit of trading CFDs is the flexibility they offer in terms of enabling you to trade against share movements without buying or selling the physical instrument.

Learn about the benefits and drawbacks of this powerful market instrument and how to use it to your potential advantage.

CFDs in detail

A CFD, or Contract for Difference, is essentially a contract between a trader and an intermediary (broker or investment bank). The intermediary bills or pays the difference between the price at which the trade is opened and the market price when the position is closed.

At the end of each day, if a position shows a profit for the day, that profit is credited to the trader's account. If the position shows a loss for the day, the loss is debited from the trader's account.

CFDs have no fixed maturity, meaning that the contract entered into between the intermediary and client has no end date. Instead, the client is able to terminate the contract whenever he or she chooses. This characteristic is one of the major benefits of this product over traditional futures.

Put simply, CFD is a financial instrument that has an underlying asset, such as a cryptocurrency, stock, etc. They enable traders to get a potential profit from price movements without requiring them to own the physical asset. The underlying asset might be an index, a commodity, a precious metal, shares, etc.

How do CFDs work?

CFDs allow you to trade both in the rise and fall of a given asset. If we make an upside trade (we open a long position), we'll make profit on the rise in the stock's price (e.g., if we open a $10 position and close it at $11, the profit would be $1 since there is positive change: $11 - $10 = $1).

If, however, we choose to complete a downside trade (we open a short position), our profit will be the difference between the contract settlement price and the closing price (e.g., if we open a $10 position and close at $9, the profit would still be $1 as there is a difference to the downside).

The calculation will always be the same: sell price - buy price. A trade will generate a profit whenever the sell price is higher than the buy price (or lower for short positions).

Note: This calculation does not include any broker commission and/or financing expenses that may be payable.

As such, CFDs can allow traders to make profit regardless of the market situation, i.e., both in up and down markets. It goes without saying that if we open a bearish position and the market behaves contrary to our predictions (i.e., it rises instead of falls), we will incur a loss. The same would apply if we open a long position and the market falls.

What are margin and leverage?

Perhaps a better question would be: what is the relationship between margin and leverage?

Margin is a good faith deposit required to maintain open positions.

Leverage is a by-product of margin and allows an individual to work with larger trade amounts.

"Leverage" and "margin" essentially refer to the same concept, only from a slightly different angle. When a trader opens a position, they are required to provide a fraction of its value as a gesture of "good faith".

Leverage allows a trader to trade CFDs worth more than the margin they have deposited. In effect,the broker is lending capital to the client so that they can trade larger positions. The minimum amount that must be charged is known as the "Margin Requirement".

CFDs are a leveraged product, which means that you only need to deposit a small percentage of the total trade value in order to open a position. In other words, you only need to put up a small amount of money to trade a much larger amount, thus enabling you to increase the potential return on your investment. But remember that this means that your loss potential will be similarly amplified, so be sure to manage this additional risk.

Example of leverage and margin in action

You want to open a long position with CFDs on stock XYZ. The stock price is $20, and the margin requirement is 10%. That means you need to deposit a margin of $2 for each CFD.

If you buy 50 CFDs your position will be worth $1000 ($20 x 50), but you will only need to deposit a margin of $100 ($2 x 50).

If the stock price rises and you sell at $25, your profit is $250 ($5 x 50). If the stock price falls and you sell at $15, your loss will be $250 ($5 x 50).

If you had instead bought the shares with the $100, you would have only been able to buy 5 shares. So, your profit or loss would have been $25 ($5 x 5).

Example of leverage and margin in action

Let's say you want to open a long position with CFDs on stock XYZ. The stock price is $20, and the margin requirement is 10%. That means you need to deposit a margin of $2 for each CFD.

If you buy 50 CFDs, your position will be worth $1000 ($20 x 50), but you will only need to deposit a margin of $100 ($2 x 50).

If the stock price rises and you sell at $25, your profit is $250 ($5 x 50). If the stock price falls and you sell at $15, your loss will be $250 ($5 x 50).

If you use the $100 to buy the physical shares themselves, you would only be able to buy 5 shares. As such, your profit or loss would be $25 ($5 x 5).

Long and short CFD positions

Using a long or short option involves a trade on a Contract for Difference moving up or down in value. The difference between your long and short options represents your post-trade profit or loss.

When you open a long position, you purchase an asset in the hope that its value will increase. Its name comes from the phrase long term, the logic being that markets tend to rise gradually over a much longer period of time than they fall. Thus, opening a long position means buying.

A short position, on the other hand, is when you sell an asset in the hope that it will decrease in value. This name derives from the phrase short term since markets typically fall sharply in a short space of time. Therefore, opening a short position means selling.

What are the associated costs of CFDs trading?

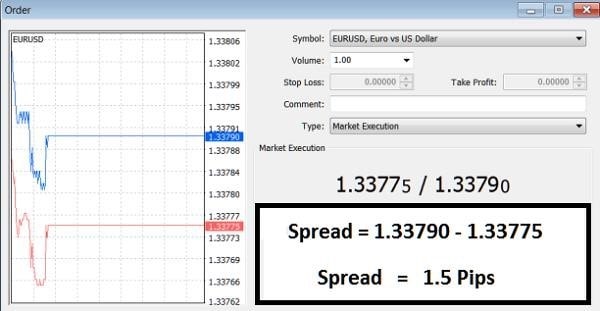

- Spread: When trading CFDs, you must pay the spread (the difference between the buy price and the sell price). When you enter the market, the price you pay is known as the buy price. The sell price is what you receive on exiting. The smaller the spread, the less the price needs to move in your favour before you start making a profit (or loss in the event that the price moves against you). At Libertex, we make sure we consistently offer our customers different spreads.

- Maintenance fees: At the end of each trading day, any open position in your account may be subject to a charge known as a maintenance fee. Maintenance fees may be positive or negative depending on the direction of your position and the applicable maintenance rate.

- Commission: You must also pay a separate commission fee when exchanging CFDs.

You can read more about Libertex's trading termshere.

Benefits and risks

CFDs offer a flexible alternative to traditional investment and therefore represent an attractive instrument for a wide variety of traders. It's possible for beginners to trade CFDs successfully, but they must first do thorough research into the benefits and risks involved before using real money.

With proper preparation, traders can take full advantage of many of the positive aspects of CFDs while simultaneously minimising the potential drawbacks.

Advantages of CFDs

We have compiled a list of the main advantages typically associated with CFD trading. Traders who use a wide variety of trading strategies will find some or all of these techniques are compatible with their methods. Once you have read our list, it will become clear why so many different types of traders use CFDs to speculate on the financial markets.

Ability to achieve potential profits in both up- and down- trending markets

A clear advantage of CFD trading is that traders do not have to limit themselves to positions in a single type of economic environment (e.g., buy positions in an up-trending market). The ability to trade in both bull and bear markets adds flexibility to your trading strategy and allows you to forecast price movements that match underlying fundamentals (which can fluctuate both up and down).

Hedging positions with CFDs

CFDs can be used to hedge positions in other asset classes. For example, if you have a long position in a stock that is losing value, you can open a short position in a CFD on the same stock. Profits on the short position can then offset the losses on the long position. If the stock price stabilises, you can then close the short position. Of course, this is a risky endeavour and could cause you to incur even greater losses if the price suddenly reverses. This is why pending orders are an absolute must.

Flexible contract sizes

Many CFD traders have a variety of trade sizes at their disposal which they can use for various trading styles or investment account types. As a general rule, beginners want to limit themselves to smaller-sized lots until they have developed a successful trading strategy that generates sustained, long-term profits. Experienced investors may opt to risk more money to avoid feeling limited in their trading structure.

Trading margin

Margin trades are usually allowed for CFDs, which means that traders are only required to deposit a portion of the actual transaction size for each trade. This allows you to increase your buying power in the market to generate potentially higher returns. Trading on margin is inherently risky, however, and care should be taken to ensure your potential losses are properly managed.

One account, multiple asset classes

CFDs allow you to trade forex, shares, indices, commodities and cryptocurrencies with one account and one platform. If you trade the underlying assets, you will need to open a different account for each asset class.

Risks involved in CFD trading

Like anything in life, CFD trading is not without its risks. Most of these potential negative effects can be reduced with proper research and by following a structured trading plan. But you must remember that there is no way to completely eliminate all risks, although there are a few ways to minimise the possible negative effects.

-

Over-leveraging of positions

Far and away the biggest mistake that new traders can make is risking too much on a given position. One of the reasons "over-leveraging" occurs so frequently with inexperienced traders is that many of them look at CFD trading as a new career and a path to wealth. When given a chance to place leveraged trades (with the potential for improved earnings), many new traders abuse this opportunity and incur significant losses (or even completely wipe out their trading accounts) in the process.

All you need is an appropriate risk management strategy: use stop orders to limit the size of your losses and risk only a manageable proportion of your trading capital.

Traders must remember to be prudent at all times as they aim to create a base of CFDs that generate steady, long-term profits instead of trying to hit a perfect "hole-in-one" at every opportunity.

-

CFDs confer no voting rights

Unlike shares, a CFD does not give you the right to vote at a company's annual general meeting. This is a minor drawback as a shareholder's vote is only meaningful if they have a very large position.

CFD Instruments

The underlying assets available to trade as CFDs vary from broker to broker. Liquid assets are better suited to CFD trading, so most brokers stick to large-cap stocks and popular forex pairs.

Libertex offers CFDs on stocks listed around the world, cryptocurrencies, currency pairs, as well as several stock indexes, metals, energy products, soft commodities and ETFs.

Choosing CFD Underlying Assets to Trade

It can be tempting to try to trade too many types of underlying assets. Instead, you should stick to a few types of assets that you understand and find interesting. Most of the best traders specialise in one or two markets.

The timeframe you trade on, the hours you trade and your style of trading may also be better suited to particular underlying assets. If you trade on very short timeframes, cryptocurrencies and very liquid currency pairs may be for you.

Commodities and indices are well suited to medium-term timeframes with a holding period of one to five days. Shares and exotic currency pairs are suited to longer timeframes unless there is a lot of short-term volatility. When trading CFDs on shares, day traders stick to the companies that are in the news. However, CFDs on shares can also be traded over the medium to long term.

Commodities and emerging market currencies are also well suited to long term trend following due to their cyclical nature.

How to find CFD trading ideas

There are lots of ways to generate trading ideas. You can analyse an instrument's fundamentals, you can trade based on the news, or you can use chart patterns and indicators. Most traders develop their own strategy based on a combination of methods.

Broadly speaking, there are two approaches to trading. Either you trade in the direction of the trend and momentum if you believe a price will continue moving in that direction. Alternately, you can trade against the direction the price is moving if you believe the price will revert to the mean or a major reversal will occur.

Trading with trend and momentum

For a trade in the direction of the trend to be profitable, the price needs to continue moving in the same direction. The probability of that is higher when one or more of the following happens:

- Volume is high

- Major technical levels have been breached

- The news flow continues to support the direction of the price

The same factors apply to long and short positions. To find good trading ideas, you need to look for instruments where these factors are present.

Trading against the trend

When prices move too far in one direction, they will often reverse course. This can occur on any timeframe, and the price will often move back to the middle of the trading range and possibly to the opposite side of the trading range.

On shorter timeframes, prices revert to the mean when:

- They reach a support or resistance level

- The price becomes overbought or oversold

- Volume falls, signalling there are few remaining buyers or sellers

On longer timeframes, prices reverse direction when:

- The valuation becomes too low or too high

- An economic cycle turns

- The fundamentals behind the instrument change

How to choose a CFD broker

When choosing a CFD broker, you'll need to consider the following:

Are they regulated?

Regulated brokers must comply with certain requirements designed to protect their customers. Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC).

What instruments do they offer?

You don't necessarily need a CFD broker that has the widest choice of underlying assets. However, the broker that's right for you should offer a good variety of assets that you would like to trade.

Competitive fees

It's tempting to choose the broker with the lowest fees. The fees you pay should be competitive but shouldn't be the only consideration.

Available platforms

Most brokers have their own platforms, but you may also want to use a third-party platform like MetaTrader. These platforms have powerful features, so you may want to check that a broker offers them.

Account size

Each broker has its own minimum account size and minimum trade size. You will need to check that the available options suit your budget.

How to become a CFD trader in ten steps

- Your first step is to choose a broker and the instruments you wish to trade.

- Once you have chosen a broker, open a demo account. No matter how many mistakes you make in a demo account, you won't lose any real money. Try to learn something from every mistake you make.

- Get to know the platform and add a handful of instruments to your watchlist.

- Track the prices on your watchlist closely. Keep an eye on the chart of these instruments, as well as any news about them. Look for patterns in the way they trade.

- While you are tracking those prices, learn as much as you can about trading. There are lots of free resources on the web - you can start with this free tutorial.

- When you are ready, start opening a few positions with clearly defined targets at which you will exit.

- Use a stop loss to limit your risk on each trade. You should never lose so much on a single trade that you don't have enough capital to carry on trading.

- Learn from your mistakes and develop a trading strategy that you have confidence in. Develop a set of rules for entries and exits.

- Keep a trading journal and a record of each trade.

- Once you are confident of your strategy and are consistently successful and profitable in your demo account, you are ready to open a live trading account to generate potential profits.

Conclusion

CFD trading is ideal for traders looking to improve their yields.

Nevertheless, it entails significant capital risks and is not suitable for everyone. You can start trading with a demo account before trying with your own money.

CFD trading may be ideal for the following categories of potential traders:

- Those looking for short-term potential opportunities

CFDs are generally kept open no longer than a few days or weeks.

- Those who want to make their own trading decisions

Libertex provides brokerage services only. We will not advise you on what options to trade, and we will not trade on your behalf.

- Those looking to diversify their portfolio

Libertex's trading offering includes numerous assets from global markets and comprises real stocks, and currencies, indices, cryptos etc on CFD’s.

- Those who wish to trade as little or as much as they want

You can trade as often or as infrequently as you like.

Libertex's CFD offering covers a wide range of asset classes. Find more information on CFD trading fees here. CFDs are flexible investment vehicles. As contracts with no maturity date, you decide exactly when you want to close your position and realise your profit or loss.

We hope this article has been of use to you. You may open a free demo account anytime you feel ready to try and trade CFDs on your own. Please understand that trading CFDs is not easy and carries a risk of you losing all the capital in your trading account.

FAQ

Do I have to pay tax on CFD trades?

The taxes payable on CFD trading vary from one country to the next. In many cases, capital gains tax may be payable on your profits. CFDs are usually exempt from stamp duty which is payable on share trades.

Is CFD trading the same as forex trading?

Forex, or foreign (currency) exchange, is an asset class, whereas CFDs are a type of trading instrument. You can trade forex directly, or you can trade CFDs on a forex pair.

How much can I lose?

CFD trading is risky, and you can lose money. The amount you can lose will depend on the size of your trades. With prudent risk management, losses can be managed and minimised. However, losses on short positions and leveraged trades can be significantly higher, which is why such trades ought not to be entered into lightly.

Do I need a lot of money to start trading CFDs?

No, you can start trading CFDs on Libertex with as little as €100. You can also practice on a demo account for free.

Why are CFDs not available in the US?

Trading over-the-counter trading instruments like CFDs is currently not allowed under US securities regulations. The law applies to US citizens and anyone paying taxes in the US.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.