Netflix Stock Price Prediction: Should You Buy, Sell or Hold NFLX?

Is this positive sentiment reflected in the Netflix stock price forecast? Let's find out.

NFLX: Company Profile

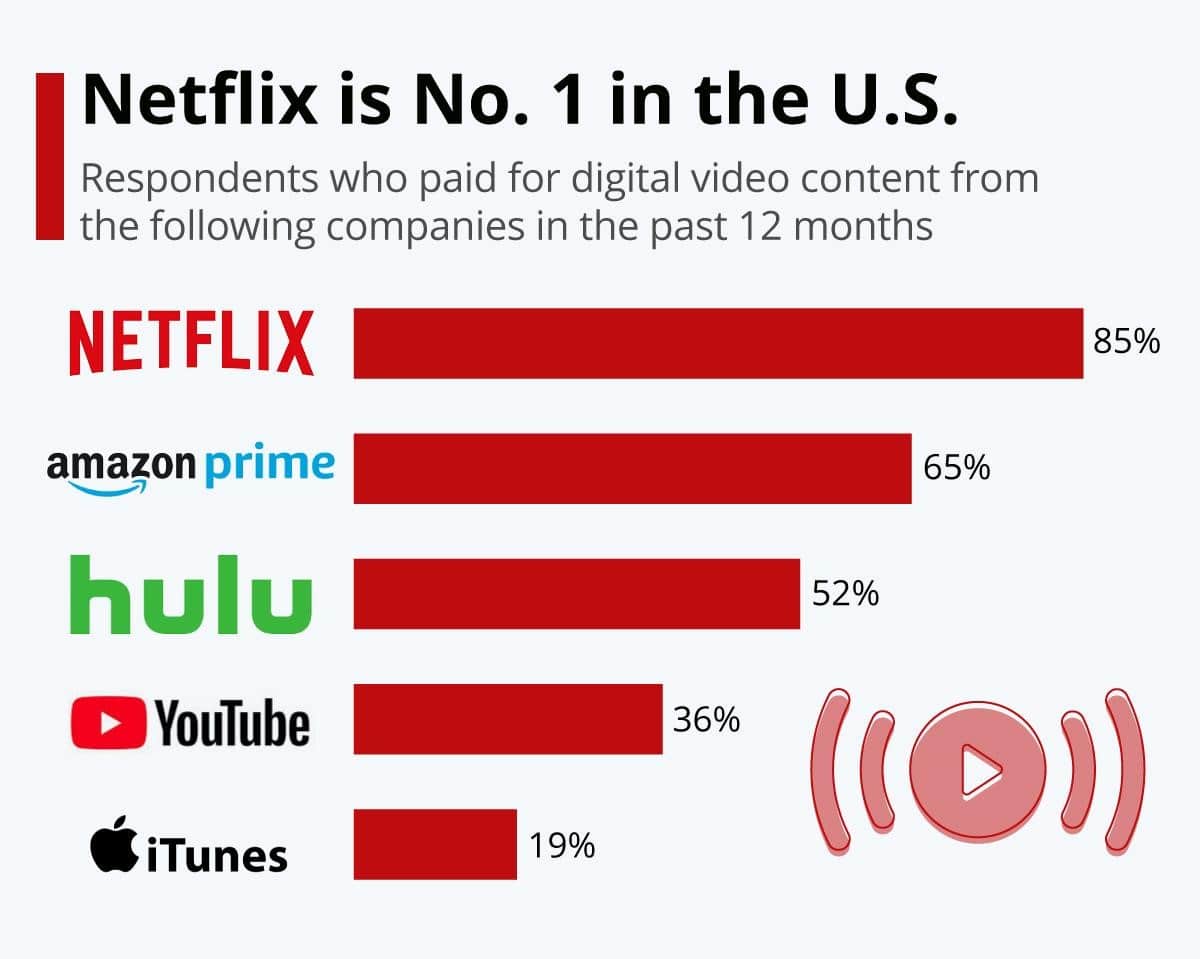

Netflix Inc is a streaming entertainment service company. It distributes films and TV shows in various genres and languages to more than 200 million paid members. It's by far the biggest company in its niche in the US market.

Stock summary as of 25 April 2023:

- Market cap: $143.39 billion

- Beta (5Y monthly): 1.27

- PE ratio: 34.65

- Earnings per share: 9.31

- Volume: 5,426,642

- Average volume: 6,752,642

The averaged Netflix stock value for the last 52 weeks is $162.71 - $379.43. It's a member of such indices as the Nasdaq 100, Russell 1000, Nasdaq Composite, S&P 500 Communication Services Sector, Russell 3000, S&P 100m and S&P 500.

Factors That Drive Netflix Stock Prices

When the shares of a company showcase such a great performance, it's bound to receive questions over whether such growth is sustainable. We'll try to investigate what factors favour the company and how they impact the Netflix share price forecast.

Number's Game

As with any company, the higher key metrics are, the stronger the stock performs. According to its Q1 2023 report, Netflix is doing better than expected in some aspects and worse in others:

- Revenue of $8.162 billion, up 4% growth.

- Earnings per share are at $2.88 per share, which is in-line with the company’s guidance of $2.82.

- Global Streaming Paid Memberships are at 232.50 million which is a 4.9% increase or 1.75 million new subscribers if compared with the previous year.

If the company continues to outperform expectations, Netflix will be well-placed to reap its share of streaming market profit, and, subsequently, the stock will rise.

Differentiation

It's not enough to just be a streaming service these days because the platform needs to offer something consumers can't get anywhere else.

In 2022 Netflix Inc. spent $16.84 billion on content, most of which was for producing originals. The company should be on track to have originals be the majority of viewing in every category. This means that some of the content libraries will be unavailable on any other streaming platform, bringing more viewers.

The NFLX stock price is likely to change along with the public's interest in original content.

Competitor Results

The biggest competitive threat to Netflix is Amazon Prime. Other prominent competitors are Disney+, HBO Max and Hulu (although they have much fewer subscribers).

While it may seem counterintuitive to see positive results for Netflix's competitors as positive, there is some truth to that. It signals the ongoing shift from live TV to on-demand streaming. There's room for multiple winners in the current landscape, so Netflix needs to pay close attention to consumer behaviours. This will allow the company to adapt and earn more subscriptions.

Overview of NFLX's Price History

As context for any Netflix share price prediction, let's look at some of the most notable numbers in the stock's performance:

- $15-$60: One of the biggest jumps that happened between 2002 and 2011

- $64: Spike in subscribers after new content deals in 2014

- $118: Netflix premiered its first original film in 2015

- $184: Uptick in international segment and record-breaking revenue in 2017

- $411: New shows and almost non-existent competition in 2018

- $256: Massive decline in subscriptions

- $435: Increased demand for streaming services during the outbreak of the COVID-19 pandemic

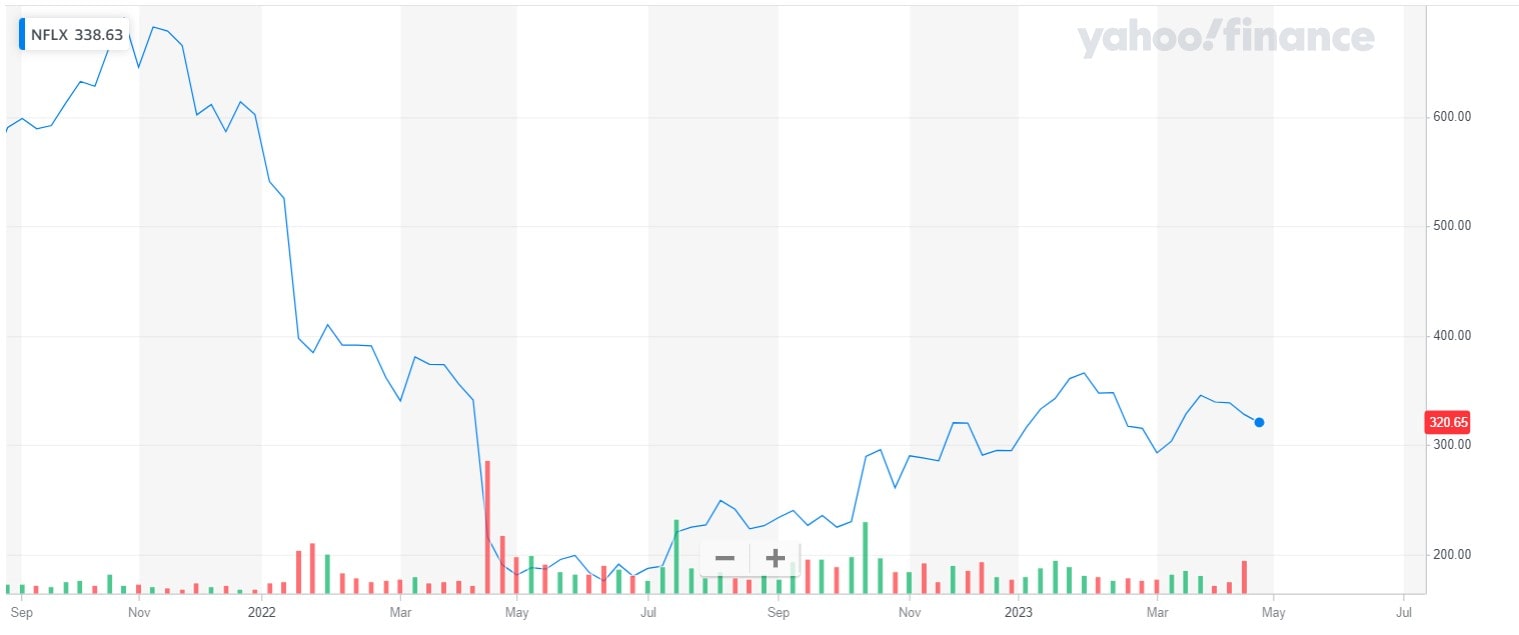

- $597: The start of 2022.

- $174: In February 2022 NFLX stock started to plummet and dropped significantly by July 2022. The company quietly admitted that streaming competition was getting too tough.

- $294: By the end of 2022 Netflix stock recovered and continued growing in 2023.

How Are NFLX Shares Performing Now?

2022 was a tough year for Netflix company. However, at the beginning of 2023, NFLX started to recover. In February its price was around $322.13 and continues to fluctuate at this level up to now.

Short-Term Netflix Stock Price Predictions for 2023

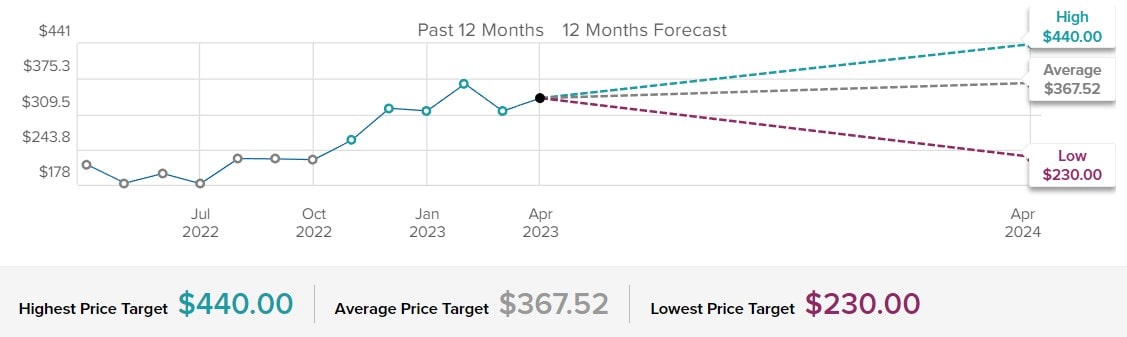

Based on the data provided by Tip Ranks, there are a few scenarios of how the situation can play out. There's a positive scenario of $440 per share, neutral of about $367.52 and negative of around $230. But it's important to mention that the consensus leans toward positive or at least moderately positive projections.

Let's take a closer look at month-by-month numbers. Long Forecast shared where Netflix share prices might move in 2022.

|

Month |

Minimum Value ($) |

Maximum Value ($) |

Closing price($) |

|

May 2023 |

293 |

331 |

312 |

|

Jun 2023 |

308 |

348 |

328 |

|

Jul 2023 |

293 |

331 |

312 |

|

Aug 2023 |

308 |

348 |

328 |

|

Sep 2023 |

315 |

355 |

335 |

|

Oct 2023 |

331 |

373 |

352 |

|

Nov 2023 |

348 |

392 |

370 |

|

Dec 2023 |

356 |

402 |

379 |

Coin price forecast predicts comes with the following short-term stock price forecast for 2023.

|

Month |

Value |

|

May 2023 |

$331 |

|

June 2023 |

$349 |

|

July 2023 |

$359 |

|

August 2023 |

$363 |

|

September 2023 |

$367 |

|

October 2023 |

$370 |

Netflix Stock Price Prediction 2025

The Netflix stock forecast for 2025 is based on a few assumptions. The biggest factor in the future price growth is the number of subscribers Netflix will generate. Historically, this metric has been growing very fast. Since last year, the growth rate has actually been accelerating even more. This implies a subscriber base of around 335 million people at the end of 2025.

Analysts also see revenue more than doubling to $51.5 billion in 2025. With that, earnings per share might more than quadruple. Check out where these projections put the stock price.

|

Month |

Min |

Max |

Close |

Total% |

|

January 2025 |

559 |

631 |

595 |

72.46% |

|

February 2025 |

564 |

636 |

600 |

73.91% |

|

March 2025 |

592 |

668 |

630 |

82.61% |

|

April 2025 |

597 |

673 |

635 |

84.06% |

If you're interested in the price dynamics inNetflix stock price prediction from 2025 to 2029, Coin Price Forecast posted a year-by-year table.

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End,% |

|

2025 |

$565 |

$596 |

+86% |

|

2026 |

$673 |

$749 |

+133% |

|

2027 |

$824 |

$898 |

+180% |

|

2028 |

$971 |

$1,009 |

+214% |

|

2029 |

$1,048 |

$1,070 |

+233% |

Netflix Stock 5-Year Forecast 2030

Please be mindful of the fact that Netflix stock predictions for 2030 may not be very accurate. These figures may prove conservative, especially if Netflix takes advantage of acquisitions or enters new related markets. At the same time, there's a risk of positive forecasts not getting it right either.

However, let’s have a look at the netflix stock forecast 2030 from some experts in the sphere. Coin price forecast expects NFLX shares to hit around $1,117 by the end of 2030. Fintechguruji has similar forecast. According to this source, Netflix stock price could reach $1,250.

Technical Analysis of NFLX Stock

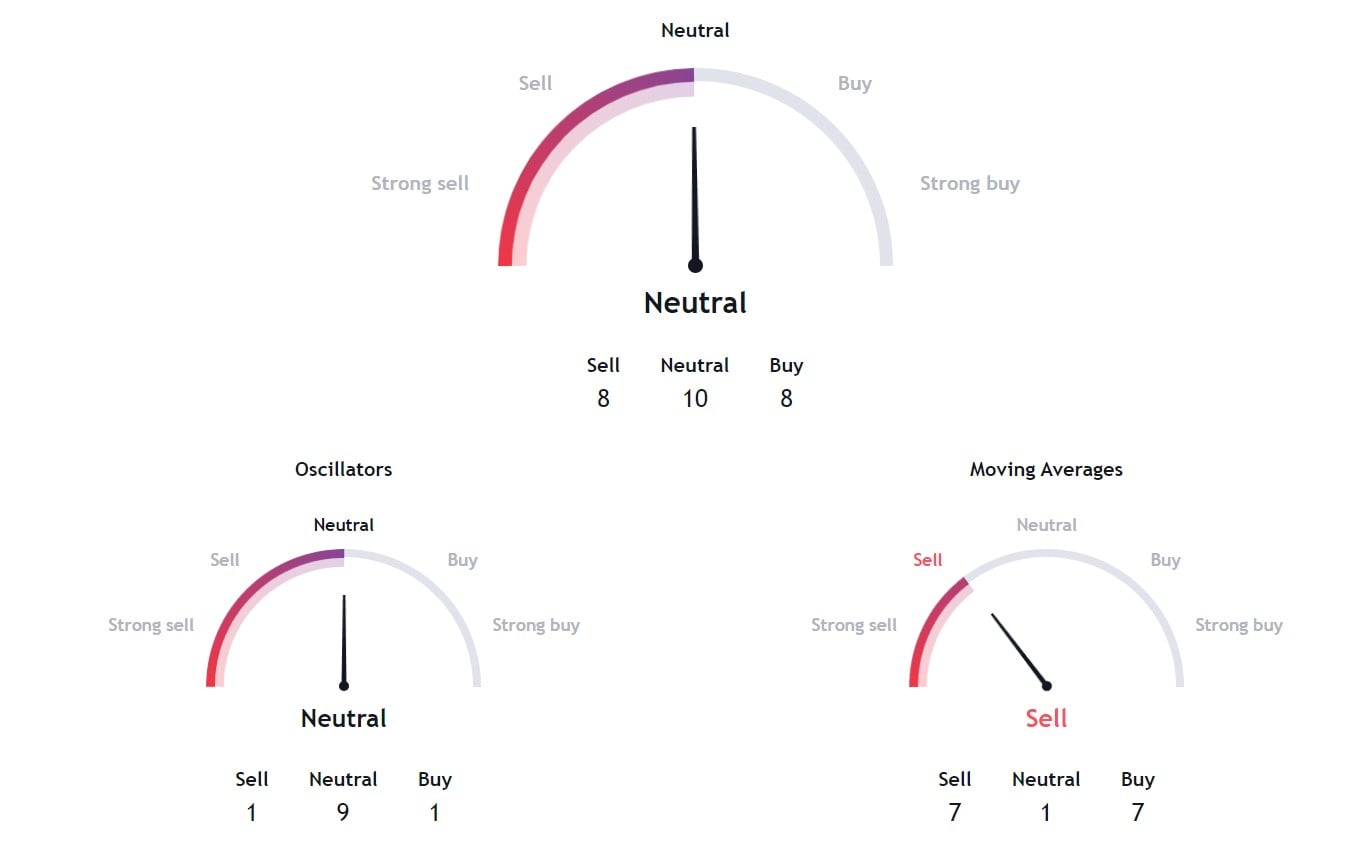

In technical analysis, you first need to identify the trend. We have already covered this step and determined that NFLX stock is in an uptrend. Then, we need to look at what technical indicators are pointing to.

As you can see from the charts based on the technical analysis of Netflix stock on the 1M chart, there is no clear trend in the momentum of the stock's price movement, but there is selling pressure indicated by the moving averages. Traders should consider this information when making investment decisions and align it with fundamental analysis results.

Netflix Stock Price Targets by Experts

Over the last three months, a group of 32 Wall Street analysts has provided their insights on Netflix stock expected performance over the next year. Their consensus is that the company's stock average price target represents $367.52. However, their stock forecast vary widely, with a high stock price forecast of $440.00 and a low forecast of $230.00. For more information on the recent Netflix share price forecast reports, read on.

Credit Suisse Group

Similar to some other analysts, Credit Suisse revised their recommendation for Netflix by lowering their price target for the NFLX stock, down from $740 to $450. This indicates a diminished expectation of the company's future performance and growth prospects.

Wells Fargo & Company

The current price target set by Wells Fargo analyst Steven Cahall is $400. He has recently upgraded NFLX Netflix from “Equal Weight” to “Overweight” which is a positive sign for the company.

Jefferies Financial Group

The expert analysts at Jefferies Financial Group have revised their initial estimates upwards, predicting a stronger financial performance from Netflix stock during the second quarter of 2023. This is a promising development for the streaming service, as it indicates a potential growth in revenue and profit margins. According to them, NFLX stock price is supposed to reach $405.

Truist Securities

Amidst boosted price targets, Truist Securities analysts don’t rush to increase their expectations on Netflix stock performance and hold the NFLX price target from at $339.

Morgan Stanley

The last on our list is Morgan Stanley is also bullish about Netflix stock price in the future. The analysts here also believe that the NFLX stock will recover and start growing in the long term.

Is NFLX a Buy, Sell, or Hold?

Based on Netflix stock projections for the near and long-term future, NFLX is worth buying. Firstly, technical indicators (on daily, weekly, and monthly charts) signal that now is a good time to open a long position.

Secondly, the fundamentals are strong. Netflix's ability to raise prices while maintaining subscription growth shouldn't be underestimated. Also, a consumer survey showed that 92% had no complaints or questions about the value of the price. Respondents gave Netflix the highest satisfaction ratings of any streaming service.

This all points to NFLX potentially being a good investment opportunity. But what about trading? An active trading strategy is the fastest way of raising capital, which is a possibility with this asset. Trading is more intense, but the potential for profits in all market conditions and in higher percentages makes up for it.

If that sounds appealing, the best starting ground for the trading activity will be a Libertex demo account. Here, you get the chance to gain experience without risking real capital. And when you master the tools, you can start trading under live market conditions with more confidence. But please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital.

FAQ

How High Can NFLX Go?

The projected price for longer-term forecasts puts Netflix shares as high as $1,117 - 1,200 by 2030. This growth is based on promising earnings and revenue estimates.

What Was Netflix's Original Stock Price?

Netflix's stock first began trading on the Nasdaq exchange in 2002 at the price of $15 per share. Since then, the initial public offering price has grown by more than 35 times.

How to Buy Netflix Stock?

There a generally several steps you need to take regardless of the trading platform you use:

- Find a reputable broker online and set up a brokerage account on their website.

- Fund your account through an available payment method.

- Navigate to the NFLX stock, enter the number of shares (or how much you want to invest with fractional shares), and select your preferred order type (market, limit, etc.).

- Execute the trade.

- Evaluate your position regularly.

Will Netflix Keep Growing?

Netflix shares slightly lag behind the market, but bulls see good prospects. Most predictions are upbeat, especially with long-term forecasters. Numbers-wise, Netflix's operating margin (aside from content spending) is expected to grow from 60% in 2020 to 70% in 2030.

Why Is Netflix's Stock Price Likely to Increase?

Even though the streaming wars continue to heat up, Netlfix's subscriber growth drives significant business value. Increased revenue will also be rooted in raised prices for the standard and premium tiers of its subscription video-on-demand service. Overall, the stock-buying strategy for NFLX shares relies on the company's growing revenue, which is higher than ever.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.