Tesla Stock Forecast: Will It Slide Deeper Into the Red?

With that said, it's impossible to deny the challenges the EV maker is facing. Last year, Tesla orders nearly halved, and there were consumer complaints about safety and poor response to criticism.

Taking into account a stellar performance and controversial news, investors are divided. If you're also wondering what might come next for the stock, continue reading for Tesla stock predictions.

Is it a Buy, Hold or Sell? Is it a worthwhile addition to an investment portfolio? Find out the answer below and the context for the ratings given.

Brief Summary of Tesla's Stock (TSLA)

Tesla, Inc. operates in the automotive and energy generation and storage segments. The company designs, develops, manufactures and sells electric vehicles, grid-scale, solar panels and solar roof tiles.

Co-founder Elon Musk, J. B. Straubel and Jason Wheeler are three key management executives. Tesla's world-famous vehicle collection includes the Model 3 (four-door sedan), Model Y (sport utility vehicle), Model S (four-door sedan) and Model X (SUV). The Powerwall and Powerpack are the most popular products in the energy storage range.

|

Market Cap |

$849.955 billion |

|

Public Float |

1.004 billion |

|

P/E Ratio |

172.72 |

|

EPS |

$4.90 |

|

Average Volume |

28.411 million |

|

Percentage of Float Shorted |

2.75% |

The company was launched in 2003, but it was only in 2010 when Tesla's stock became publicly available. Tesla Motors launched its initial public offering (IPO) on NASDAQ on 29 June 2010. It was the first American car company to do so since the Ford Motor Company's IPO in 1956. With 13.3 million shares issued at the price of $17.00 per share, the company raised $226 million.

In 2020, Tesla's market capitalisation surpassed those of BMW, Daimler and Volkswagen combined. It even surpassed Toyota's $202 billion, becoming the world's most valuable automaker by market cap.

Factors Behind Tesla's Stock Price Fluctuations

Let's leave some fundamental factors aside, such as pandemic-related changes on the global scale and the political environment, which impact the entire market. We'll focus on Tesla specifically and how it plans to resolve its unique challenges.

Manufacturing Capabilities

Tesla moved forward to expand its manufacturing capabilities with plans to build 20 million EVs per year over the next decade. The newest additions would be a manufacturing factory near Berlin and one near Austin, Texas. As manufacturing scales up, the company can increase revenue and push its stock price up.

International Sales

Recently, Tesla deliveries in China excluding exports fell by two-thirds. This might reflect a weakening demand from the overseas markets. If the issue of international sales isn't resolved, it'll have a huge impact on Tesla's earnings and stock price.

Public Image

Tesla is facing fallout from its handling of various customer service complaints. For example, the company had a response on their Chinese social media page that trended for all the wrong reasons. A massive public outcry never goes unnoticed with similar stocks.

Also, Elon Musk is heavily associated with his company in the minds of investors; the company's success is in part connected to Musk's perceived success. This turned out to be both negative and positive for the stock.

Index Inclusion

The last factor on this list is the effect from S&P Dow Jones Indices on the Tesla share price forecast. Nearly $5.4 trillion in funds are indexed on the S&P 500. So, every time someone bets on the index, they also bet on Tesla, thus increasing demand for the stock. On top of that, liquidity is broadly picking up, which is a positive change for Tesla shares.

Past Performance of Tesla's Stock

For the first few years, TSLA's price stayed at around $5 and then jumped into the $30-$40 range in 2014.

The stock has had plenty of ups and downs along the way. For example, in August 2018, Elon Musk sparked deep controversy with a now-infamous tweet about taking Tesla private at $420. Interestingly, it didn't have a major effect on the stock price, which hovered around the $50-$60 range from 2017 to 2019.

By December 2019, the share price reached $393.15 following reports that Tesla brought in $24.6 billion in revenue. As a volatile stock, TSLA suffered through the correction triggered by the COVID-19 crisis. As vehicles stopped coming off production lines, Tesla didn't have any revenue or margin.

On 31 August 2020, Tesla had a 5-for-1 stock split., followed by an increase in value from around $300 to nearly $440.

How Did Tesla Stock Perform in 2021?

TSLA started 2021 on a high note of around $880 and went through consolidation to around $600. Despite investor concerns about lacklustre results in the first half of the year, the uptrend from June to November made a statement. The highest 52-week price point was $1,243.49.

Taking a peek at 2022, we can already see a similar pattern: a rise to $1,199.78 and a setback to below $830.

Tesla reported Q4 2021 results on 3 January 2022. As expected by Tesla's supporters, the company surpassed analysts' expectations and reported its best revenue growth in 10 quarters. Even those who hyped Tesla stock plenty in the past were astounded. The ascent might have come from the infusion of trillions of dollars of new money into the US economy and future earnings expectations.

Narrative aside, Tesla needs to justify such outsized enthusiasm. With the price trading under $850 at the start of February, there's still room for Tesla to prove its potential.

Short-Term Tesla Stock Prediction for 2022

Wall Street is turning bullish when it comes to Tesla in the short term. The fear of higher interest rates is still prevalent, but that doesn't stop analysts from increasing their price targets.

Wallet Investor predicts a consistent uptrend through 2022. Although the forecast starts from March, it's enough to gauge the overall movement and its intensity.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

|

March 2022 |

909.912 |

930.696 |

908.624 |

930.696 |

|

April 2022 |

930.853 |

967.150 |

930.853 |

967.762 |

|

May 2022 |

969.179 |

990.595 |

968.222 |

990.595 |

|

June 2022 |

992.157 |

1032.030 |

992.157 |

1032.03 |

|

July 2022 |

1032.770 |

1064.600 |

1032.770 |

1064.60 |

|

August 2022 |

1069.740 |

1111.980 |

1069.740 |

1111.98 |

|

September 2022 |

1112.840 |

1142.500 |

1112.840 |

1142.77 |

|

October 2022 |

1146.470 |

1197.740 |

1146.470 |

1197.74 |

|

November 2022 |

1199.310 |

1236.600 |

1199.310 |

1236.60 |

|

December 2022 |

1237.070 |

1272.240 |

1236.840 |

1272.24 |

Long-Term Tesla Stock Forecast for 2025 and Beyond

Jumping to 2025, we have another positive forecast from Wallet Investor. In a few years, Tesla's stock might jump above $2,000. Over the year, the stock price might further increase from $2,100 to $2,500.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

|

January 2025 |

2116.11 |

2147.73 |

2116.11 |

2147.73 |

|

February 2025 |

2152.43 |

2163.90 |

2152.43 |

2165.72 |

|

March 2025 |

2165.07 |

2186.44 |

2164.53 |

2186.44 |

|

April 2025 |

2187.75 |

2224.31 |

2187.75 |

2224.31 |

|

May 2025 |

2224.13 |

2243.45 |

2223.24 |

2243.45 |

|

June 2025 |

2248.90 |

2287.92 |

2248.90 |

2287.92 |

|

July 2025 |

2289.80 |

2323.79 |

2289.80 |

2323.79 |

|

August 2025 |

2324.12 |

2363.59 |

2324.12 |

2363.59 |

|

September 2025 |

2368.60 |

2399.30 |

2368.60 |

2399.30 |

|

October 2025 |

2400.30 |

2452.15 |

2400.30 |

2452.15 |

|

November 2025 |

2457.59 |

2488.66 |

2457.59 |

2488.66 |

|

December 2025 |

2492.72 |

2531.78 |

2492.72 |

2531.78 |

For a second opinion, here is the Tesla stock forecast for 2025 provided by Gov Capital.

|

Month |

Average price ($) |

Minimum price ($) |

Maximum price($) |

|

January 2025 |

2244.033 |

1907.42805 |

2580.63795 |

|

February 2025 |

2281.319 |

1939.12115 |

2623.51685 |

|

March 2025 |

2242.198 |

1905.8683 |

2578.5277 |

|

April 2025 |

2232.333 |

1897.48305 |

2567.18295 |

|

May 2025 |

2279.477 |

1937.55545 |

2621.39855 |

|

June 2025 |

2272.295 |

1931.45075 |

2613.13925 |

|

July 2025 |

2330.543 |

1980.96155 |

2680.12445 |

|

August 2025 |

2377.085 |

2020.52225 |

2733.64775 |

|

September 2025 |

2484.488 |

2111.8148 |

2857.1612 |

|

October 2025 |

2505.739 |

2129.87815 |

2881.59985 |

|

November 2025 |

2690.114 |

2286.5969 |

3093.6311 |

|

December 2025 |

2759.718 |

2345.7603 |

3173.6757 |

Supporting the bull case, some experts see Tesla delivering 8 million vehicles per year by 2030 compared to 499,550 vehicles in 2020. On top of that, in the next decade, the company will become more than just a car producer. Only taking into account the value of EV sales overlooks all other businesses embedded in Tesla.

Tesla might also make a profound business model shift in the next few years. Sectors like software and connected services should start contributing significantly to their earnings.

With all that said, Tesla must be able to withstand growing competition with the following companies in 2025-2030:

- Xpeng Motors

- Volkswagen Group

- BMW

- Mercedes Benz

- General Motors

Technical Analysis of Tesla Stock

Looking at the chart, Tesla's stock has reached its pre-pandemic levels. However, it rapidly went down throughout 2021 and is still yet to catch up to its early 2022 performance.

The technicals on the daily chart look bad, but the summary for the monthly chart is better.

Oscillators:

- Relative Strength Index (14) - 61.18 - Neutral

- Stochastic %K (14, 3, 3) - 70.08 - Neutral

- Average Directional Index (14) - 48.24 - Neutral

- Awesome Oscillator - 544.99 - Neutral

- Momentum (10) - 178.42 - Sell

- MACD Level (12, 26) - 201.03 - Buy

Moving averages:

- Exponential Moving Average (50) - 431.98 - Buy

- Simple Moving Average (50) - 315.51 - Buy

- Exponential Moving Average (100) - 265.20 - Buy

- Simple Moving Average (100) - 181.66 - Buy

The chart above shows values from EMAs and the MACD indicator, which help identify key levels and price targets. This particular combination suggests two sell targets, $999 and $1,240 (although the stock can be held longer for potentially bigger returns) and two buy targets, $515 and $759.

Analysts' Ratings and Price Targets for Tesla Stock

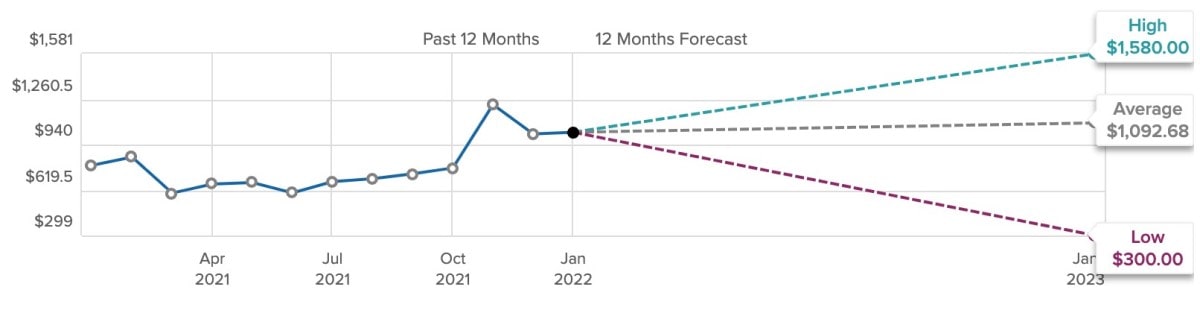

Based on 12-month Tesla stock predictions by 31 Wall Street analysts, the stock has a Hold rating. It's an average of 7 Sell ratings, 8 Hold ratings and 16 Buy ratings. The price target range is very wide, so we'll need to look at a few specific firms and their recent release notes.

Mark Delaney, Goldman Sachs

Robert W. Baird reissued their Buy rating on Tesla shares. The current price target from the firm is $1,200, which, at the time of issuing, had a medium effect on the share price.

Wells Fargo & Company

Morgan Stanley analyst Adam Jonas continues stock coverage with a Buy rating. The price target is currently at $1,300 a share (up from $1,200). Jonas also predicts that Tesla will continue being a stronger player as the EV marathon wears on.

Philippe Houchois, Jefferies

Jefferies has a Buy-equivalent rating on Tesla and a price target of $1,400. Analyst Philippe Houchois lifted his target price from the previous $950.

What Is Best for Tesla Stock: Trade vs Invest

Tesla's wild stock rally attracted many investors' attention. While some analysts are still sceptical about rapidly growing valuation and occasional dips. So far, investors that took the risk a few years prior have enjoyed hefty profits. On top of that, analysts and price predictions describe a rather positive set of events.

With that in mind, past performance doesn't guarantee future results. Tesla's stock can be volatile, and it can be hard to predict where Elon Musk will steer the company in the future.

While the company grows rapidly, the fastest way to potentially gain some profit might be through trading. This way, you can capitalise on price movements without making long-term investment commitments. Please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital. You can hold a long position, speculating that the TSLA price will rise, or a short position, speculating that it'll fall. In any case, you start learning about new tools and markets in a practice environment with a free Libertex demo account.

FAQ

Is Tesla Stock a Good Investment in 2022?

In the short term, Tesla's stock might go through a turbulent period, testing new support and resistance levels. But its ability to sell cars, solar panels and batteries and then sell services and software to its customers can potentially bring the company forward.

Is Tesla Worth Buying?

After the company's first full year of profitability, Tesla seems like a good option. There are risks, as with any company, but both fundamentals and technicals look strong.

Will Tesla Stock Crash?

Tesla's stock crash can't be overruled due to competition. But the company survived the 2020 stock market crash, so it's already a good sign. In the long run, big and famous companies, including Tesla, are likely to survive even a major market crash in the future.

What Will Tesla Stock Be Worth in 2025?

Based on historical probability, Tesla's projected prices could reach $2,500-$3,000 in 2025.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.