What is the IPC Mexico Index?

This article describes the index, its history and the way it is calculated. Also discussed are the largest companies in the index, the factors that affect its performance and how you can invest in the index or trade it.

S&P Dow Jones Indices

The IPC Index is now managed and published by S&P Dow Jones Indices. S&P Dow Jones is a joint venture between S&P Global, the CME Group and News Corp.

It's one of the largest index providers in the world and manages two of the best-known stock indices: the S&P500 and the Dow Jones Industrial Average.

Mexican Stock Exchange (Mex Bolsa)

The Bolsa Mexicana de Valores (BMV), or Mexican Bolsa, is the primary stock exchange in Mexico. The exchange was founded in 1933 and has since merged with several smaller exchanges. It became a fully electronic exchange in 1999. The exchange itself is listed and forms part of the IPC index.

The IPC explained

The IPC index is a benchmark index for the Mexican stock market. The index includes 35 blue-chip stocks listed on the Bolsa Mexicana de Valores. It is viewed as a gauge for the economy of Mexico and for investor sentiment in the country. The IPC is also one of the oldest stock indices around.

IPC Definition

The index name IPC is an abbreviation of Índice de Precios y Cotizaciones. The full name is the S&P/BMV IPC index, which reflects the joint management of the index by S&P and BMV.

The index is also known as the MX35, the MEXBOL and the Mex Bolsa index.

IPC History

The IPC index was launched in 1978 with 42 stocks and was initially managed by the exchange. In 2000, the number of index members was reduced to 35, and the index methodology was standardised.

A special division of the BMV was established in 2005 to manage the exchange's indices. In 2012, the methodology was updated so that restricted shares were excluded from the calculation. S&P Dow Jones Indices took over the management of the index in 2017. The index is now jointly managed by BMV and S&P Dow Jones.

Understanding the IPC

The IPC is a modified market-cap-weighted index. For stocks to be included, they must be listed on the BMV and must have an investable weight factor of 0.1. This means at least 10% of the company's outstanding shares must be available for investment.

To be included in the index, stocks must also comply with other requirements related to liquidity and size.

How is the IPC index calculated?

When calculating the index, only the free-float market capitalisation of each company is considered. This means restricted shares held by related parties are excluded when the value of a company is calculated.

Furthermore, the weight of each stock is capped at 25% of the index. If the weighting of any stock exceeds 25%, it will be recalculated during the quarterly review.

IPC Weighting and IPC Composition

The following table ranks the member companies by size as of April 2020. The table also includes the price and weight of each stock within the index.

|

Company |

Ticker |

Price |

Weight |

|

AMERICA MOVIL |

AMXL |

14.6 |

15.3% |

|

WALMART DE MEXICO |

WALMEX |

57.97 |

13.2% |

|

FOMENTO ECONÓMICO MEXICANO |

FEMSAUBD |

155.77 |

13.0% |

|

GRUPO MÉXICO |

GMEXICOB |

51.4 |

7.4% |

|

GPO FINANCE BANORTE |

GFNORTEO |

65.91 |

7.3% |

|

GRUPO ELEKTRA |

ELEKTRA |

1,385.07 |

3.6% |

|

CEMEX CPO |

CEMEXCPO |

5.07 |

3.4% |

|

GRUPO TELEVISA |

TLEVISACPO |

25.61 |

2.9% |

|

GRUPO AEROPORTUARIO DEL PACIFICO |

GAPB |

150.6 |

2.5% |

|

GRUPO BIMBO |

BIMBOA |

35.59 |

2.4% |

|

GRUMA |

GRUMAB |

228.79 |

2.3% |

|

COCA-COLA FEMSA CLASS UBL UNITS |

KOFUBL |

97.1 |

2.3% |

|

GRUPO AEROPORTUARIO DEL SURESTE |

ASURB |

241.39 |

2.2% |

|

KIMBERLY-CLARK DE MEXICO CLASS |

KIMBERA |

34.04 |

2.2% |

|

ARCA CONTINENTAL |

AC |

92.83 |

1.8% |

|

INFRAESTRUCTURA ENERGETICA NOVA |

IENOVA |

74.74 |

1.7% |

|

PROMOTORA Y OPERADORA DE INFRAESTR |

PINFRA |

167.43 |

1.7% |

|

GRUPO FINANCIERO INBURSA |

GFINBURO |

14.5 |

1.4% |

|

GRUPO AEROPORTUARIO DEL CENTRO NOR |

OMAB |

87.8 |

1.4% |

|

ORBIA ADVANCE CORP SA |

ORBIA |

28.44 |

1.3% |

|

ALFA |

ALFAA |

9.86 |

1.3% |

|

INDUST PENOLES |

PE&OLES |

186.08 |

1.0% |

|

GRUPO CARSO |

GCARSOA1 |

48.25 |

1.0% |

|

BOLSA MEXICANA DE VALORES |

BOLSAA |

43.78 |

0.9% |

|

BECLE SA DE CV |

CUERVO |

36.97 |

0.9% |

|

CORPORACIÓN INMOBILIARIA VESTA |

VESTA |

33.03 |

0.8% |

|

MEGACABLE HOLDINGS CPO |

MEGACPO |

60.07 |

0.8% |

|

QUALITAS CONTROLADORA |

Q |

99.36 |

0.8% |

|

GENOMMA LAB INTERNATIONAL |

LABB |

19.41 |

0.7% |

|

BANCO DEL BAJÍO INSTITUCIÓN DE BAN |

BBAJIOO |

19 |

0.6% |

|

EL PUERTO DE LIVERPOOL |

LIVEPOLC.1 |

60.71 |

0.5% |

|

ALSEA DE CV |

ALSEA |

19.87 |

0.5% |

|

GENTERA SAB DE CV |

GENTERA |

9.58 |

0.4% |

|

BANCO SANTANDER |

BSMXB |

13.42 |

0.3% |

|

REGIONAL SAB DE CV |

RA |

59.07 |

0.3% |

Source: S&P Dow Jones Indices

The IPC index is very concentrated amongst its top members. The largest two stocks account for 25% of the index, while the largest 5 stocks account for 56% of the index. This means the smallest 30 companies account for just 45% of the index.

Largest 5 IPC companies

The following are the 5 largest companies in the IPC index which together account for 56% of the index. These are the most important stocks for investors trading the IPC index to track.

America Movil is the largest component of the IPC index, with a weighting of around 15%. The company, which is worth $39 billion, provides telecommunication services throughout Latin America, as well as the US, the Caribbean and Europe.

Walmart de Mexico is a partially owned subsidiary of Walmart and accounts for 13% of the index. It is the largest division of Walmart outside of the US and operates over 2,500 stores throughout Mexico.

Fomento Económico Mexicano, known as Femsa, is a beverage and retail company. The company produces and markets Coca Cola products in Latin America and also operates retail chain stores. The company is worth $27 billion and accounts for 13% of the IPC index.

Grupo Mexico is a conglomerate involved in mining, transportation and infrastructure. The mining division is primarily involved in copper production, as well as silver, gold and zinc. The transport division provides freight and passenger rail services. The infrastructure division serves the energy industry. Grupo Mexico has a market value of $16 billion and has a weighting of 7.4% in the index.

GPO Finance Banorte is the largest financial services group in Mexico. The group owns the Banorte and Ixe commercial banks and is also involved in insurance, pensions and broking.

Banorte has a market value of $7 billion and an index weight of 7%.

Sector composition of the Índice de Precios y Cotizaciones

Because Walmart and Femsa account for a large percentage of the index, the IPC has unusually high exposure to the consumer staples sector at 38%. The communication services, financial and materials sectors account for between 13 and 19% each.

The remaining sectors together account for less than 15% of the index.

IPC price performance

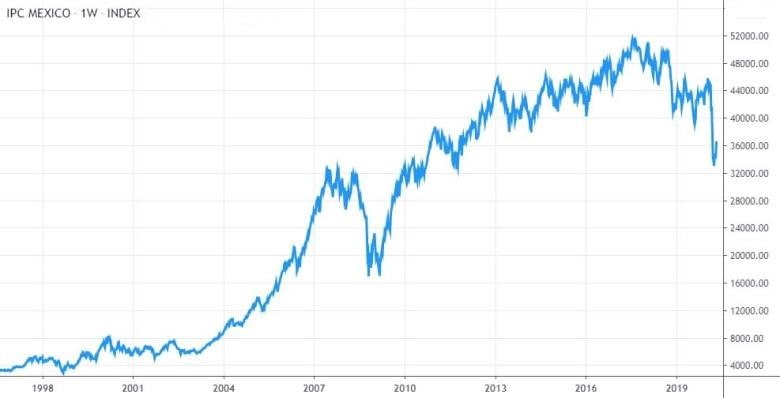

The following chart illustrates the index performance since 1998.

Since the index modernised in 1992, its value has grown from below 2,000 to over 36,000, with a record level of 51,772. This growth has resulted from the increased value of companies as well as the devaluation of the Mexican Peso. The USD/MXN exchange rate has gone from under 4 to over 25.

A structurally weak currency will often lead to a rising index for two reasons. Firstly, as the currency weakens, the value of exports increases. Secondly, stocks become cheaper when measured in USD. When measured in USD, the IPC's performance is less impressive.

Most of the IPC's growth occurred before the Global Financial Crisis. During the crisis, it fell 47% but quickly recovered in 2009 and 2010. Since 2013, it has traded in a broad range between 37,000 and 51,500. It recorded its highest ever level in September 2017.

Factors influencing the IPC index price

The IPC index is affected by several factors. As one of the prominent developing market indices, it is affected by sentiment toward other developing and emerging markets. Emerging markets are highly correlated, so the IPC often tracks other emerging markets like Brazil, South Africa and Turkey. The index is also affected by sentiment toward other Latin American markets as well as North American markets.

The Mexican Peso plays a large role in the performance of the index. When the USD is strong, it makes exports from Mexico more competitive. When it's weak, exports become less competitive. Thus, the index is often affected by factors not directly related to the Mexican economy.

IPC Index Trading

The IPC is an interesting index as it represents one of the most liquid developing markets. It can be used to trade emerging market sentiment and take advantage of when risk appetite in global markets rises and falls.

Advantages and disadvantages of IPC trading?

Advantages of trading the IPC Index

- The IPC index represents a very liquid emerging market and is a useful proxy for emerging market sentiment.

- The IPC index trading day overlaps the US trading session but is affected by different factors. This makes it a good alternative to US indices like the S&P 500.

Disadvantages of trading the IPC Index

- The index is weighted toward consumer staples and telecoms, which are not high growth sectors.

IPC CFD Trading

An index itself is not tradeable because it is merely a calculation based on the prices of the constituent stocks. However, you can trade exchange-traded funds (ETFs), futures contracts and contracts for difference (CFDs) on the index.

ETFs are best suited to long term investors as they are typically not leveraged. Futures contracts are suitable for active trading but require a large trading account. CFDs are best suited to active traders with trading accounts of all sizes.

What is CFD Trading?

CFDs are a type of derivative instrument, similar to futures contracts. They allow traders to open both long and short positions using leverage. CFDs can be traded on any liquid assets, including indices, stocks, currencies, cryptocurrencies and commodities.

They offer more flexibility than other types of derivatives. You can start trading CFDs with any account size, and you can trade several asset classes using a trading platform like the Libertex platform.

Because CFDs are traded using margin, only a small percentage of the value of a position needs to be deposited before making a trade.

Pros and cons of using CFDs to trade the IPC Index

As with all trading activities and instruments, there are advantages and drawbacks to consider when trading IPC CFDs.

Pros

- You can start trading IPC CFDs with as little as €100.

- CFDs allow you to profit whether the index is rising or falling.

- CFD trading accommodates smaller trades than futures trading, which has a very high minimum trade size.

Cons

- Like any index, the IPC can be unpredictable at times.

- Sometimes, the index is affected by factors that have little to do with Mexico. This means you will have to follow global markets closely to trade IPC index CFDs.

IPC Trading Strategies

The IPC index moves between periods of consolidation and volatility. In order to trade the index effectively, it's important to use the right strategy at the right time. With CFDs, you can open long or short positions depending on whether you expect the price to rise or fall. Please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital.

Range trading

When the index is consolidating, you can use support and resistance levels or technical oscillators to trade the trading range. You can vary the timeframe to suit the size of the range. Daily and 4-hour charts are best suited to a very wide trading range, while hourly and 15-minute timeframes can be used for narrower trading ranges.

Trend following and momentum trading

When the IPC index breaks out of a trading range, a trend may develop. This is when momentum and trend following trades perform well. You can use moving averages or trend lines to follow the trend. You can also wait for a pullback and then open a position in the direction of the trend if it resumes.

Risk on/risk off trading

Because Mexico is a developing market, the IPC index is viewed as a riskier asset. Riskier assets perform well when risk tolerance is high and perform poorly when risk tolerance is low. IPC index CFDs can be used to trade based on global market sentiment. Trading on margin or without stop losses is not advisable with such risky instruments as it can lead to unchecked capital losses.

Conclusion

The IPC is an important benchmark for the Mexican stock market and for emerging markets in general. It offers a useful alternative to US index CFDs as it is affected by different factors, most notably by the exchange rate.

You can trade CFDs on the index with Libertex. But please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital. If you want to get started, you can open a risk-free demo account today. This will allow you to get used to the trading platform and learn more about trading the IPC index with no risk or cost.

Libertexis a broker and trading platform that offers CFDs stocks commodities, indices, ETFs and cryptocurrencies. The platform offers free trading tutorials and state of the art trading tools.

Frequently Asked Questions

What is the IPC index?

The IPC index is the benchmark index for blue-chip stocks listed in Mexico.

What moves the IPC?

The IPC index is most sensitive to the USD/MXN exchange rate and to emerging market sentiment.

How can I invest in the IPC?

For long-term investors, IPC ETFs may be a good option.

How can I trade the IPC index?

The IPC is one of the best emerging market indices for trading. Most traders use CFDs to trade the index.

How important is the IPC index to traders?

The IPC is one of the major emerging market indices tracked by investors and traders.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.