Stocks opened higher across the board on Wednesday as the major indices make an attempt to reverse a four-day free-fall. Crude oil fell below $50 per barrel and the 10-year treasury yield (^TNX) just pulled back from record lows.

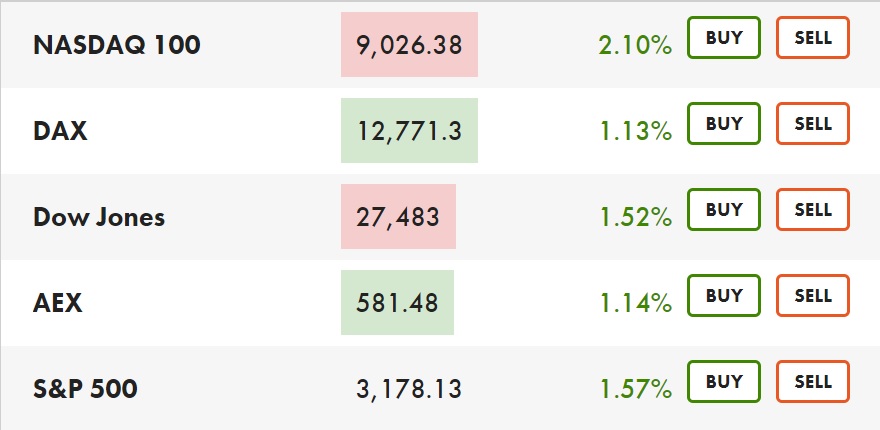

Indices at the time of writing

Indices at the time of writing

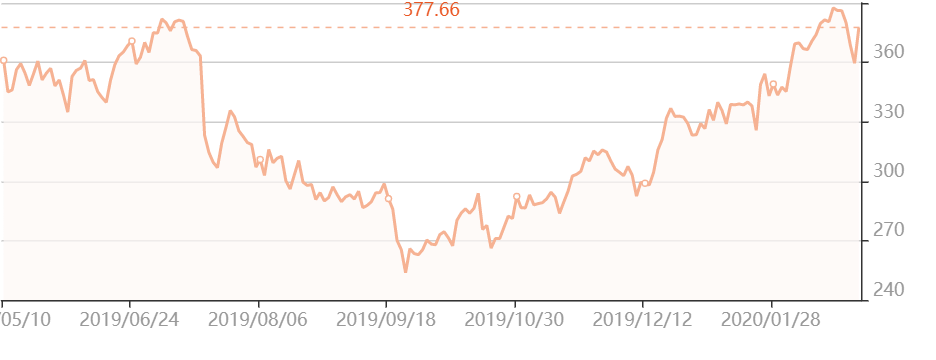

The technology sector is also bouncing back. Netflix investors has special reason to celebrate as the streaming giant’s stock jumped a satisfying 4%. Facebook, Amazon, Apple, and Google also joined in on the recovery.

Netflix stock performance at the time of writing

The rally will be a welcome sign, but it remains to be seen whether this can counteract the growing trend of pessimism. It’s been nothing short of a massacre on Wall Street this week as stocks closed lower for four consecutive days. This is largely chalked up to fears of the coronavirus as reports of the disease spreading across the globe continue to roll in, scaring away investors.

The results so far have been grim: The Dow lost 1,900 points in just two days, while the S&P 500 has been haemorrhaging, losing $810 billion on Tuesday for a total of $2.14 trillion in a week. It’s been the worst continuous market decline in five years. Asian markets have also taken a tumble as analysts waver on whether to trust Beijing’s containment efforts.

Coronavirus continues to take human and financial toll

As of the time of writing,more than 81,000 cases of coronavirus have been confirmed worldwide, with roughly 2,770 of them confirmed fatalities. Europe has not escaped the outbreak, with 2 confirmed deaths in France, and 12 in Italy. Greece, Austria, Spain, Croatia and Switzerland have also confirmed their first cases.

The coronavirus continues to slow economic activity and disrupt supply lines. China, the world’s second largest economy and a big buyer of products and services from other countries, has shut down huge swaths of its manufacturing sector to try and control the spread of the disease. This has exposed the vulnerability of US technology companies such as Apple Inc., which depend on Chinese supplies.

US Election uncertainty keeps investors cautious

Eyes are also on the US, and not just because of its reaction to the coronavirus. The US is in an election year. The outcome of the contest could lead to major disruption in the international markets. A left-leaning Democrat such as the current frontrunner Bernie Sanders, could regulate businesses more strictly. Alternatively, a nothing-to-lose Trump administration could escalate the kind of belligerence that aggravated the US-China trade war in recent years.

How traders can profit from the stock market rally

Regardless of the dramatic events of the week so far, there are bound to be more fluctuations in the coming months. The smart trader needs to stay informed on world events and keep a cool head to weather the volatility of the market. Not to mention the importance of a versatile portfolio to be prepared for anything. That’s where Libertex comes in.

Libertex is a fast, user-friendly trading platform that lets you trade on the financial market 24/7 on the web or your smartphone. With over 20 years of financial market and online-trading experience, Libertex also provides live updates on market trends, trading advice and extensive training materials to keep users up to speed in a fast-paced world of global finance.

In the ever-sensitive international stock exchange, it’s essential to keep a diverse and flexible portfolio. That’s why Libertex is ideal, since it offers over 200 financial assets including stocks, shares, currencies, crypto, indices, oil and gas, metals and more. Want to be ready for anything the market brings? Then register with Libertex and start trading now!