“2020 is my favourite year,” said no one ever. But for millennials, this year has been yet another blow in what’s been a generational rough patch of economic disruption that made itself felt most keenly in the 2008 financial crash. After entering the job market during the Great Recession and saddled with college debt, suffering low wages and a rising cost of living, the younger generation now has to reckon with a COVID-19-induced economic downturn without the safety net that previous, wealthier generations had built for themselves.

It’s no wonder that millennials and Gen Y were shy about stocks. To the average person, investing is only something to consider after padding one’s savings, paying off college debt, and saving up for real estate, something that is still in the distant future for many younger people. Brokers, for their part, continue to use their arcane jargon and dwell in the image of the greedy 1980s. They’re about as uncool as you can get to the socially conscious, digital-native, avocado-toast generation.

But these turbulent times could actually hold a silver lining for younger people. COVID-19 feels like a significant historical event that has made governments, banks, and individuals all reflect on people’s relationships to the economy. As tech-savvy youth increasingly become aware that their potential to save cash just isn’t going to cut it, they’re more willing to step out of their comfort zone and start trading. It’s clear that the current economic system isn’t going to get better anytime soon. The oldest millennials are nearly 40, with retirement becoming an increasingly pressing concern.

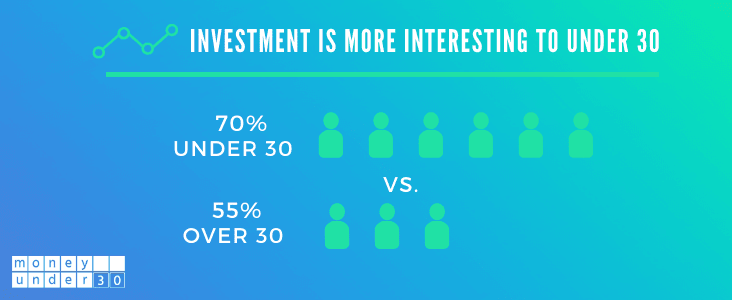

A recent survey from Money Under 30 revealed that 61% of millennials think now is a good time to invest, with a higher 70% interested in learning more about the stock market. Where did they get the capital to invest?

Credit: Money Under 30 (2020)

Well, if you’re among the lucky one in three (33.5%) millennials who just started working from home, the coronavirus may have actually increased your savings. Of the millennials working from home, 78% reported that their total expenses decreased, with money saved on transportation and eating out more than making up for increased home utility costs.

Curiously enough, one in five (20%) of under-30s surveyed confirmed that they are planning to start investing precisely because of the pandemic, with 72% of women interested in learning more about investing (or doubling down on existing investments), compared to 82% of men. And it’s about time they do because one of the most respected financial players has rolled out a trading platform that’s tailor-made to younger investors that are eager to learn the ropes.

“Trade for More”: playing the stock market for a better future

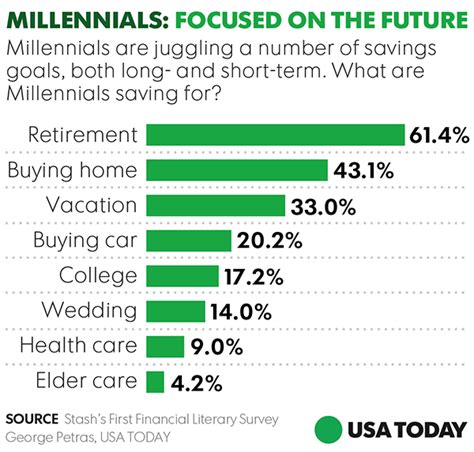

‘‘Younger people are increasingly aware that to build wealth, they need to take the initiative into their own hands. That’s the whole philosophy behind ‘Trade for More’,” said Libertex CMO Marios Chialis. “We asked ourselves, ‘are users really signing up to trade? Or are they looking to invest so that they can achieve what they want in life?’ Whether it’s saving for retirement, raising a family, getting on the property ladder or planning future travels, we empower new users with the tools and skills they need to get what they want out of life”.

What do millennials want out of life? Retirement and homeownership a looming concern. Credit: USA Today, 2018

The ongoing COVID-19 pandemic may be driving young people to stake their claim in the financial market, but it’s also led to a downturn in the world of sport and entertainment. All sports around the world, from hockey to football to ice-skating have been affected by the economic shock of cancelled games, postponed fixtures and empty stadiums without ticket sales.

The global sports juggernaut that is association football has suffered along with the rest. By 19 March, almost all 55 UEFA member associations had suspended activity, save for the Belarusian Premier League.

Even as the Bundesliga, La Liga, the Premier League, Serie A and the UEFA Champions League all returned over the summer, football continues to struggle, with a reduced number of matches, under-staffed teams taking the field, sanctions against teams that violate COVID-19 safety rules, and of course, empty seats and plummeting revenues. These days, clubs are looking for new ways to monetise — and by partnering with trading platforms, they’re seizing a unique opportunity to join their fans in chasing financial returns.

To channel the spirit of perseverance through adversity, Libertex — in addition to being Valencia CF sponsors — has teamed up with Tottenham Hostpur FC, the English Premier League superstar that boasts the motto Audere et facere, meaning ‘To dare is to do’. Through this partnership, Libertex clients can win various perks and goodies associated with the club.

Libertex’s mission to win over the young isn’t just about football perks, however. It takes training to play the game, and the finance company aims to woo millennials by offering what they need to get over their fears of indices and candle charts — education.

Ignorance fuels Gen Y’s fear of the stock market, making education more critical than ever

A lack of education has been a significant barrier between younger people and investing. It seems that millennials react to the stock market just as they would to an unexpected call to a landline phone (if they have one): with terror. Around 66% of American millennials surveyed by Ally Invest in 2018 claimed the stock market was intimidating and expressed concern about their ability to understand how to invest.

Credit: Ally Invest (2018)

Gen Z (defined in the survey as ages 18-23) were even more fearful, with 69% reporting that they’re intimidated by financial markets. The reigning fear was that they would make a bad call and lose their investment. Almost three-quarters of the millennials who are afraid of losing money when they invest are women compared to about two-thirds of men.

The true terror affecting millennials was a lack of education. Although a generation with high levels of college education, ignorance of the stock market is holding them back. One-third (34%) of respondents had no trusted source of advice. Over one-quarter (27%) cited their biggest fear came from simply not knowing how to get started, and 19% are scared about the time it takes to learn how to invest properly.

But the coronavirus pandemic, and the stock market’s relative resilience compared to the regular economy, may have convinced millennials that the financial markets aren’t the scariest thing out there. From the survey results, as attitudes change, the online trading platforms that stand to win out will be the ones that emphasise education. In other words, the trading platforms that can inform young investors about the stock market in a straightforward, trustworthy, and time-effective way.

The best investment starts with knowledge

Even as the market rebounds at the prospect of a coronavirus vaccine, millennials with money on their mind should take 2020 as a wake-up call to seize the opportunities that trading affords. But before going all in, young traders would do well to consider starting with the platforms that offer a full suite of educational materials, demo accounts, and training media such as webinars and tutorials. After all, the first and most important thing to invest in is yourself.