Although Bitcoin has been around for over a decade now, it really only gained mass recognition about three years ago. After much sideward trading and slight incremental gains, the then-obscure digital asset made headlines after shooting up almost 2000% in less than 12 months. Along with the huge price rises, its daily trading volumes similarly took off, rising from $30-40M in early 2017 to nearly $5B at the end of that same year. As we know, the Bitcoin rocket eventually ran out of fuel and crashed back to Earth in spectacular fashion. Nevertheless, the aftereffects of this first great crypto boom were groundbreaking: a new breed of asset class was born, and an entire industry sprouted up around it.

After two years of relative quiet on the crypto markets, the pandemic saw BTC blast off once again. This run has dwarfed the last, and you could be forgiven for thinking an even bigger bust is just around the corner. However, this time things are very different. Retail investors and millennial enthusiasts aren’t driving this current growth; it’s big institutions finally adding a serious yet previously neglected asset class to their holdings. Indeed, regardless of the significantly higher price achieved in this boom, average daily trading volumes are actually quite a bit lower. That would suggest that this isn’t speculative bubble inflation, but rather sound and considered investment.

Should I sell it all and buy Bitcoin, then?

While it’s highly likely that we will see BTC up many multiples yet, it’s never wise to put all your eggs in one basket. The overwhelming consensus on Wall Street is that, yes, Bitcoin has been performing phenomenally of late and will likely continue to do so for years to come. However, it’s not some sort of magic instrument that is immune from the market’s ups and downs. When John Pierpont Morgan was asked how the market would perform over the years ahead, his immortal reply was as follows: “It will fluctuate”. When it comes to Bitcoin, this adage is especially true. And while it’s never wise to put all your money in a notoriously volatile asset, having exposure for the potential massive upside is a must.

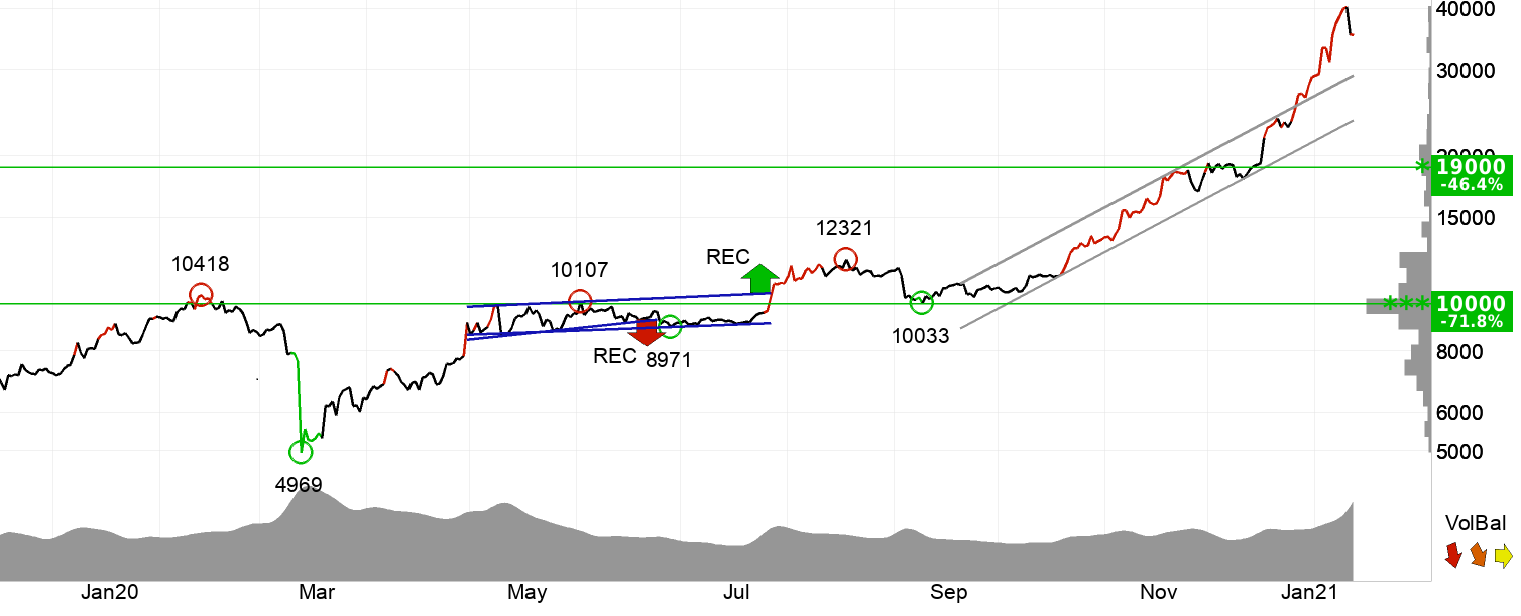

Luckily for us, just this past month, Bitcoin has undergone a 10% correction and thus represents excellent value for new entrants to the market. Recent technical analysis predicted this kind of correction as a prelude to even more vigorous growth in the long term. As the chart below shows, BTC has broken its rising medium-to-long term uptrend and, with this recent retracement, the stage is set for even higher highs. What’s more, many experts believe that Bitcoin could soon replace gold as an anti-inflationary safe-haven asset. With the rampant money printing going on right now, we might well see a sharp increase in BTC demand and, consequently, the coin’s value.

Trading Bitcoin with Libertex

You no longer need to rely on unregulated cryptocurrency brokers or shady p2p exchanges to trade Bitcoin. Now that Libertex is offering BTC, you can buy the flagship digital currency with confidence and enjoy all of the security and convenience of trading with an established financial broker with over 20 years of experience.

With Libertex, you can create a balanced, diversified portfolio on an award-winning platform, with all of your various instruments conveniently accessible in one place. Register an account today and enjoy up to 50% off trading commission on transactions for Bitcoin and a whole host of other supported cryptocurrencies!