Best Short-Term Investments for 2022

The average interest rate for savings accounts is only 0.19%, which is fairly low. If you crunch some numbers with Bankrate's simple savings calculator, you'll see the problem for yourself. Let's say you put €10,000 into a savings account and make a monthly deposit of €300 for the next 10 years. With a 0.06% APY, you'll only earn €532.61 in interest over the entire decade.

Please note: we don't offer financial advice. Our guides are for educational purposes. We hope this article will serve as a launching point for you to do more research before, ultimately, choosing the path that's best for your individual situation.

What Are Short-Term Investments?

Short-term investments — also known as temporary investments or marketable securities — are investments that are highly liquid. This means that they can easily be converted into cash when it's needed. Some short-term investments, like a cash management account, are often used by traders who need money in 2 years or less. Others, like CDs, are better for a 3-5 year timeframe.

It may seem that 3-5 years is a long time, but it's relatively short in the world of investing. Long-term investments are typically held by individuals for 7-10 years (although there is no cut-and-dry period of time).

Check the table below to see the short-term investments covered in this article, sorted by their respective cash-out timeframes.

|

Timeframe |

Investment Types |

|

2 years or less |

|

|

2-3 years |

|

|

3-5 years |

|

Now, we'll explain each type of investment; they're sorted based on the timeframe, so head to the section that best meets your savings goal.

Short-Term Investments: 2 Years or Less

Cash Management Accounts

Cash management accounts combine the features of checking, savings and investment accounts. They can be accessed from a single, convenient platform. These accounts are offered by non-bank financial organisations like mobile trading apps, robo-advisors and online investment companies.

With a cash management account, you can carry out normal banking tasks like paying bills and receiving direct deposits, but you can also invest through the account. Depending on the institution, you may receive a debit card, chequebook or both.

Unlike traditional banks, cash management accounts usually don't charge fees for their banking services. Instead, they make money via investment fees and through add-ons like financial coaching.

Cash management accounts at a glance:

- Potential interest rate: 0.25%-0.5%

- Risk: Low

- Liquidity level: High

Pros: Many accounts don't have fees and come with FSCS insurance on up to €1 million.

Cons: Investment returns may be lower than those of high-yield savings accounts.

High-Yield Savings Accounts

We mentioned earlier that the average savings account only offers a 0.06% APY. However, you can opt for a high-yield savings account. These usually pay 20-25 times more in interest.

So, why isn't everybody putting their money into high-yield savings accounts instead of regular ones? Well, the banks that offer these accounts usually have fewer features. Many don't provide checking accounts or ATM cards, and they may require all inflows and outflows to occur via electronic bank transfer. Furthermore, they may require a certain minimum balance as well as a monthly deposit minimum. If you want to open a high-yield savings account, make sure to compare multiple banks and find one with reasonable requirements.

High-yieldsavings accounts at a glance:

- Potential interest rate: About 0.5%

- Risk: Low

- Liquidity level: High

Pros: Up to €250,000 of your savings are protected by FSCS insurance. Your money can easily be managed on the go via mobile bank apps.

Cons: While savings accounts are highly liquid, you can only withdraw or transfer money a maximum of 6 times per month. Otherwise, your account could be closed.

Treasury Bills

There are three kinds of treasuries, but for very short-term investments, we're focusing on T-bills. These are very safe, as they're backed by the US federal government, which has an AAA credit rating.

You can purchase T-bills in increments of €100, and they are offered via TreasuryDirect or through a bank or broker. Most T-bills have maturity periods of 4, 13, 26 or 52 weeks — although there are certain types that reach maturity in just a few days.

Treasury bills at a glance:

- Potential interest rate: 0.05% - 0.4%, depending on the maturity period you select.

- Risk: Low

- Liquidity level: High

Pros: Treasury bills are very short-term and are considered to have very low risk.

Cons: The shorter the maturity date, the lower the interest rate will be.

Short-Term Investments: 2-3 Years

Short-Term Corporate Bond ETFs

Major corporations may issue corporate bonds, which are used to fund their investments. Usually, these bonds pay holders at regular intervals, such as twice per year or once per fiscal quarter.

You can buy a corporate bond from a single company, or you can opt for a bond exchange-traded fund (ETF). The latter compiles corporate bonds from multiple companies, typically including organisations of different sizes and industries. The main advantage here is that you get to diversify your portfolio. If one company tanks, you won't lose as much in a bond fund as if you had put all of your money into that company's bonds. What's more, bond funds pay more often: typically, you'll get interest once per month.

Short-term corporate bond ETFs at a glance:

- Potential interest rate: 2% or more

- Risk: Medium

- Liquidity level: High

Pros: Diversify your portfolio and get paid interest more frequently.

Cons: It's not insured by the government, so you could lose money.

Short-Term Government Bond ETFs

Government bonds work similarly to corporate bonds, but the US government and its agencies issue them. You can purchase individual government bonds or instead go with a government bond ETF: these will contain T-bills, T-notes, T-bonds and mortgage-backed securities.

Short-term US government bond ETFs at a glance:

- Potential interest rate: 0.05%-2%

- Risk: Low

- Liquidity level: High

Pros: Government bonds are backed by the US government and are considered very safe.

Cons: There aren't as many ETFs to choose from. There are 43 government bond ETFs compared to 86 corporate bond ETFs.

Money Market Mutual Funds

A money market mutual fund invests in bank debt securities, treasuries, municipal and corporate debt and other short-term securities. Investors can purchase shares of the fund either directly from the mutual fund company or via a broker.

Because this is a mutual fund, you'll have to pay an expense ratio to cover administrative and operating expenses. This fee is typically calculated as a percentage of the money you invest in the fund. For instance, if you invest €1,000 into a money market mutual fund in one year, and there was an annual expense ratio of 0.75%, you would need to pay €7.50. However, you won't get a bill in the mail for the expense ratio; rather, when you buy a fund, the money will be deducted from your returns.

Money market mutual funds at a glance:

- Potential interest rate: 1%-2%

- Risk: Medium

- Liquidity level: High

Pros: Some funds hold municipal securities that you won't have to pay state or federal taxes on.

Cons: Investors will have to pay an expense ratio, which reduces the rate of return. They are also not FSCS-backed.

Short-Term Investments: 3-5 Years

Bank Certificates of Deposit

A bank certificate of deposit (CD) is a product that credit unions and banks offer. If you agree to make a deposit and leave it untouched for a certain amount of time, you'll earn a premium interest rate on the money. Banks offer a wide range of CD rates, so shop around and find one with the best terms.

Bank certificates of deposit at a glance:

- Potential interest rate: 0.8%

- Risk: Low

- Liquidity level: Medium

Pros: Because CDs offer a guaranteed interest rate, this is an extremely low-risk short-term investment method.

Cons: If you withdraw money before the CD ends, you'll be penalised. Typically, the penalty ranges from 3-6 months of interest.

Is the Stock Market a Good Place for Short-Term Investing?

You may have noticed that we didn't include stock trading in our list of the best short-term investing methods. That's because trying to time the stock market can have devastating results. Some people dedicate decades to learning about short-term stocks and day trading — some are successful, while others lose it all.

During times of low interest rates, you may be tempted to try your hand at stocks to boost short-term returns. But unless you're a professional trader with years of education and experience, long-term investments in the stock market are more likely to be successful. Here's why.

- Withstand the highs and lows: Stocks are fairly volatile; it's not unusual for them to drop 10%+ in value over a short period of time. But more often than not, the prices recover. By investing in stock for the long-term, you'll get to ride out the highs and lows across many years and generate better returns. When you look at data from the 1920s until now, individuals have rarely lost money when investing in stocks for a 20-year time period. It can pay off to play it safe.

- Higher return rate: According to a study by Dalbar, the S&P 500 had a 6% APY for the time period of 31 December 2001-2021. But during that timeframe, the average investor experienced only a 2.5% APY. If they had held their stocks for the full 20 years, they would have experienced a 3.5% higher APY.

- Avoid emotional decisions: Emotional buying and selling are detrimental for traders. If you read up on trader psychology, you'll see how fear and greed sway people to buy high and sell low, thereby crippling their returns.

- Lower taxes: If you sell a security within one calendar year of purchasing it, the gains will be considered 'short-term capital gains', and they'll be taxed. The max tax rate for these gains is 37%. But if you hold the securities for over 1 year, the maximum you could be taxed is 20%. If you're in a lower tax bracket, you may even qualify for a 0% tax rate.

- More cost-effective: Besides your tax liability, there are other ways that short-term stock trades can cost you. The longer you hold stocks, the fewer fees you'll have to pay. But if you're constantly buying and selling stocks, you'll be charged transaction fees and commission.

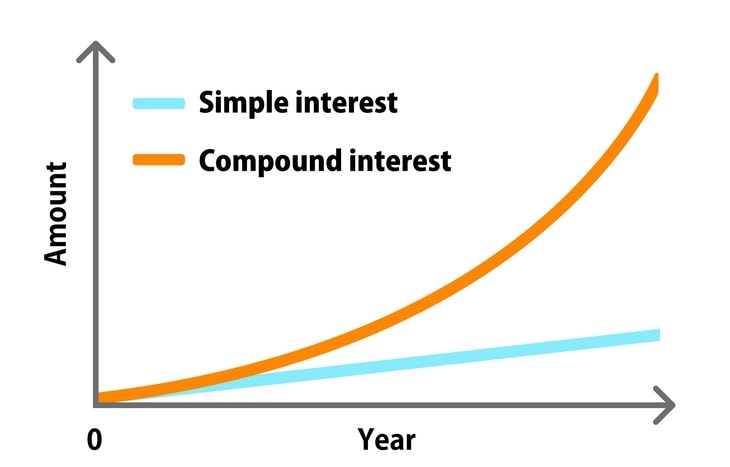

- Take advantage of compounding: Some companies offer dividend stocks, in which holders are paid regular dividends on a regular basis — usually, once per quarter. You might be tempted to cash them out each quarter to boost your short-term returns, but it is usually more fiscally wise to hold off. Why? Because of compound interest! When you add your dividends to your stock portfolio, they'll start generating compound interest. This means that any interest you earn is added to your portfolio, and then your interest starts earning its own interest. It's one big snowball effect.

Investing Money Based on Timeframe

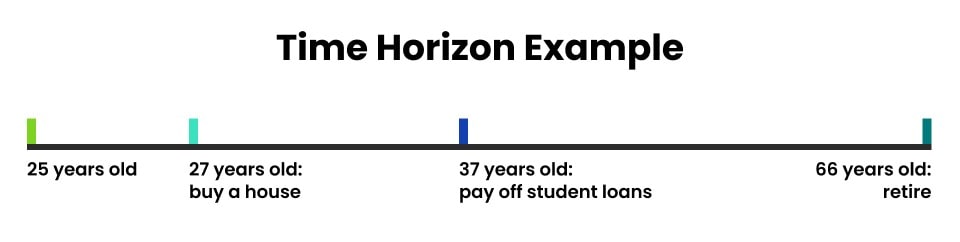

When deciding what investments to make, you'll need to decide upon a time horizon.

Time horizon: The period of time you expect to hold the investment before needing the money back.

A short-term time horizon refers to investments that will last for 5 years or less. This is a common choice among people who need a certain sum of cash in the foreseeable future or who are getting close to retirement.

The medium-term time horizon refers to investments that are held for 3 to 10 years. This is popular among people who are saving up to buy their first home.

Lastly, the long-term time horizon refers to investments that are held for 10 or more years. The most common investments within this category are retirement savings.

Here are a few questions to help you determine your time horizon:

- What age-based financial events will you experience, and how far away are they? When are you planning to buy a home, fund a wedding, pay tuition for a child, etc.? If there are several years between now and your next big funding, then a medium-term or even long-term horizon could work. But if you're saving for a wedding that's in 2 years, it might be best to choose short-term investments.

- What does your income look like now? How about 5 years from now? Maybe 10 years down the road? What is going to change? You can think of your financial goals as a final destination, and your investments are part of the engine that drives you there. But your income is the fuel that powers that engine. If you're planning on switching career paths or climbing the corporate ladder, your income situation will change. Not only does this affect the size of your financial targets, but it can also speed up or slow down your timeframe.

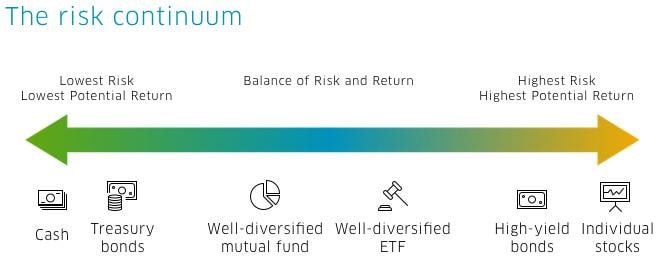

- How much risk are you willing to accept? Short-term investments can earn you a lot more than long-term ones, but they can also lose you a lot more.

Perhaps you've decided that longer-term investments are a better fit for your lifestyle and goals. However, this guide is all about short-term investments, so, below, we've compiled some strategies for trading on timeframes of 5 years or less.

What to Know When Investing Money for Less Than 5 Years

When you make short-term investments, you'll need to do things pretty differently than with decades-long investments. Here are a few tips:

Focus on minimising risk

With short-term investments, there's not as much time for prices to recover after a crash. Let's say you put a huge chunk of money in stocks, and you're planning on buying a house in 2 years. However, there's a huge market crash, and you don't recover all of your money when the 2 years are up. You'd be in a really bad position. That's why it's important to focus on low-risk methods that are backed by the government or the FSCS. The shorter the time frame is, the less risk you should take on. Bank CDs are one of the best choices for safe short-term investments in 5 years or less because the interest rate is guaranteed, as long as you don't touch the money.

Recognise that not all short-term investments have the same risk and return

While bank products are backed by the FSCS, market-based products could end up declining over a short time frame. So, a high-yield savings account has much less risk than, say, short-term corporate bond ETFs.

Know what to look for in a short-term investment

When selecting a short-term investment, consider these factors:

- Risk: As mentioned above, when you need the money back soon, you can't take on much risk.

- Liquidity: Some short-term investments like CDs charge penalties if you withdraw money early. Your high-yield savings account might be shut down if you make more than six withdrawals in one month. So, ask yourself: how quickly will you need to access money? Is it important that you are able to withdraw it early if needed?

- Stability: If you're on the longer end of the short-term timeframe (3-5 years), you can afford a little bit more volatility in your investment choices. But if you need to get your money back in the next 6-12 months, stability needs to be a big priority.

- Costs: Some high-yield savings accounts charge monthly maintenance fees. With a money market mutual fund, you'll have to pay an expense ratio. Are these costs worth it to you? In the long run, they might be, but what about when compared to smaller short-term returns?

Synchronise assets that could potentially meet your goals

If you have narrowed down your specific time horizon to six months, for instance, look for products that offer returns in that period of time. Government bonds and AAA corporate debt bonds are both popular choices for the 6-month timeframe. If your timeframe is up to a year, you could look for products that have varying durations of 6-12 months. In this scenario, laddered CDs are a common choice.

Model short-term portfolios + risk levels

|

Risk Tolerance |

Investment Percentage |

|

High Risk |

10% cash 30% bonds 60% equities |

|

Moderate Risk |

10% cash 40% bonds 40% equities |

|

Low Risk |

35% cash 40% bonds 25% equities |

Conclusion

If you want to invest money in the short term, there isn't a lot of room for error. To ensure that your portfolio performs well before you hit the 1-, 3- or 5-year mark (or whichever time frame you decide on), it's best to go with less risky FSCS- or government-backed assets. Liquidity, low risk and stability are the most important qualities to evaluate when it comes to short-term investments.

Depending on your potential goals and exact timeframe, you can tweak the ratio of those factors. But, overall, high-yield savings accounts, bond funds, Treasuries and cash management accounts are popular options for short-term traders.

For more educational information on financial topics, check out the other posts on our blog! At Libertex, we regularly publish guides for investors learn about their options. From cryptocurrency predictions from famous analysts to CFD explanations, our online trading platform has an extensive resource library. Please keep in mind that crypto CFDs are not available for retail clients

FAQ

How should I invest my €10K in the short term?

First, narrow down what you mean by 'short term'. 6 months? 2 years? 4 years? For 2 years or less, consider a high-yield savings account, cash management account, or treasuries. For the upper end of the time range, CDs and money market mutual funds may be better short-term investment options.

Is a 6% rate of return good?

For a short-term ROI, yes, 6% is good. For long-term investments, though, 10% and upwards is considered 'good'.

What stocks bring in high returns?

There's no right answer to this question because the stock market is highly volatile. Investors can make money, but they can also lose significant funds overnight. Trading stocks is risky, and you need to conduct plenty of research before choosing which companies to invest in.

How much money do I need to invest?

Bear in mind that any information given on this page should not be construed as investment advice. This is a commonly used approach, which may not be suitable for everyone. But generally, the investment amount depends on the method you choose.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.