Basics of Options Trading: Understanding Put vs Call Option

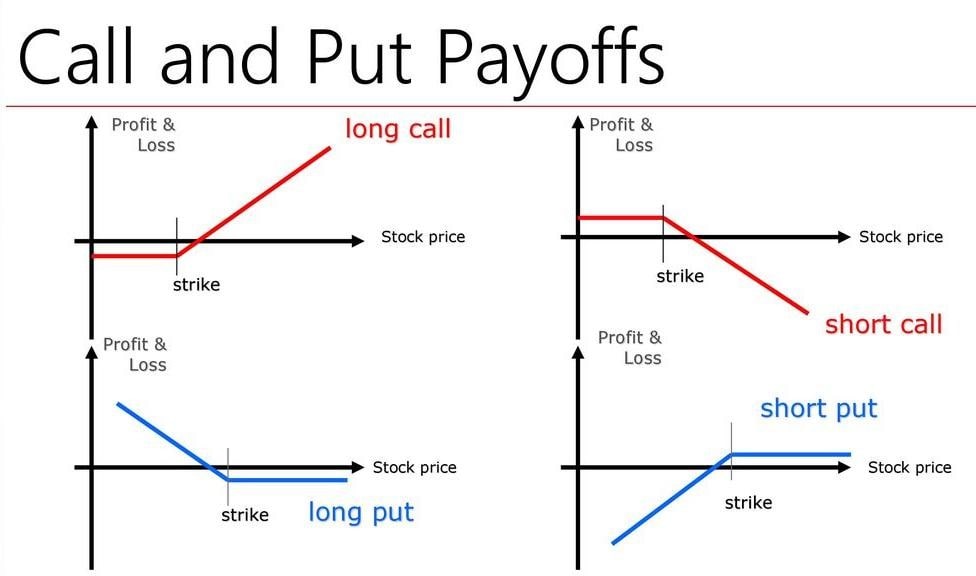

Options trading is an advanced strategy that can help investors participate in stock market activity, lower risks, and plan properly. To become an options holder, it's vital to know the difference between the two derivatives or two types of options for investment: put vs call options.

What Are Call Options, and How Do They Work?

A call option is a type of contract that gives investors the right (but not the obligation) to buy bonds, stocks, commodities and other securities at a set price or spot price. Not only does the contract have a certain price (also called "strike price"), but there is also a defined due date (referred to as "exercise date" or "expiration date"). The buyer pays a small amount of premium with the expectation that the price will rise in a certain time frame.

The call option contract is sold in 100 shares of stock, and the option ceases to exist after the exercise date. You can sell or buy call options depending on your expectation of how the price of the underlying asset will move. It's up to you to let it expire or sell the option contract before that happens.

Remember: If you're a buyer of a call option, you're not obligated to execute the option. If the stock price increases, you can sell the contract itself or execute it. If the price doesn't increase, you can opt to let the contract expire to lose only the premium you paid.

If you're the call writer or seller, you're writing a call option to receive the premium. However, if you get income, it will only be limited to the premium. There are two ways of selling call options:

- Naked call option: You sell a call option even if you don't own the underlying asset. If a buyer exercises the call option, you'll buy the asset at the market price. However, you'll lose money if the price is higher than the strike price.

- Covered call option: You sell an asset you already own. The desired situation is when a buyer exercises the option when the strike price is higher than the original amount you paid.

There are three phrases you need to know about when dealing with call options:

- In the money: The underlying price of a stock or an asset is above the call strike price.

- Out of the money: The underlying price is lower or below the strike price.

- At the money: The underlying price is the same as the strike price.

Call Option Example

To better understand how call options work, here's a simple example.

Imagine you have a house near undeveloped land. Since you'll be moving to a new place, you put the house up for sale for $100,000. Buyer A wants to buy the house but will only have $100,000 after the month. Buyer A asks you to remove the house from the market and essentially reserve it for them in exchange for $2,000.

In this story, the $100,000 is the strike price, and the $2,000 is the premium. If Buyer A buys the house, you'll get the $100,000 on top of the $2,000. If Buyer A doesn't buy the house, you'll get to keep the $2,000.

For a more fitting analogy, consider the following example for the next sections: A company's strike price in May is $100 with a premium of $10. Its expiration date is in November.

Call Option Calculation

How can you identify your call option for a profit or loss? You start with the underlying security's price and subtract the option premium, the strike price, and other transaction fees. You will then arrive at the intrinsic value.

| Underlying Security's Price – (Option Premium + Strike Price + Other Transaction Fees) = Intrinsic Value, i.e., Profit/Loss |

The company has a strike fee of $100, a premium of $10 and a transaction fee of $1. Since the call option contract covers 100 shares, the total premium cost would be $1,000.

| $10 x 100 Share = $1,000 Premium |

The breakeven point in this example would be $111. The strike price of $100 plus the $10 premium plus the $1 transaction fee. To not lose anything, the company's stock should be worth at least $111.

If the company's stock reaches a price of $130 before November, your profit will be $19 per share. Multiply $19 by 100 shares to get the full profit of $1,900.

| $130 (Underlying Security Price) – ($10 Option Premium + $100 Strike Price + $1 Transaction Fee) = $19 Profit Per Share |

| $19 Profit x 100 Shares = $1,900 Total Profit |

Pros and Cons of Call Options

|

Pros |

Cons |

|

Good choice if you expect a stock's price and value to rise significantly before the expiration date. |

If the stock market finishes below the strike price on or before the expiration date, you will lose the premium you paid. |

|

Call buyer: Small upfront cost for a significant gain until the option expires. |

Call seller: Income limited to the premium. |

|

Covered call option: Make risk-free money |

Naked call option: No limit to potential losses incurred. |

What Are Put Options, and How Do They Work?

A put option is a contract where an investor has the right to sell a stock at a specific price at or until the expiration date. An investor in the put option expects the underlying price per share of stock to drop lower than the strike price. With put options, the strike price is the fixed and predetermined price that a put buyer can sell the underlying asset.

The value of put options increases if the stock price goes down. So, if the price of stocks becomes low, you can sell your put option. However, if the stock price doesn't come down, you can let your contract expire.

Remember: The breakeven point of a point option is the difference between the strike price and the premium.

Put Option Example

To give you an example of a put option, imagine XYZ stocks trading at $400 per share. If you think it is overvalued, you'll buy a put option with a strike price of $350 and an expiration date of three months. The premium costs $10 per share, which is $1,000 if multiplied by 100 shares.

Put Option Calculation

Here's how to calculate the intrinsic value of the example above:

| $350 Strike Price - $10 Premium = $340 Breakeven Point |

The breakeven point is $340. If XYZ plummets to $300, your profit could be $40 per share or $4,000 in total on your put option. However, if the stocks don't drop to $350, you can let the premium expire.

Pros and Cons of Put Options

|

Pros |

Cons |

|

Decent returns if market prices go below the strike price. |

You might lose the premium paid if the stock price goes up or stays the same. |

|

It can safeguard you against falling prices in a volatile stock market. |

You'll need to pay a bigger premium than call profit. |

Put vs Call Options

Trading strategies in options can be risky. To further understandput vs call options, read the chart below for comparison:

|

Put Option |

Call Option |

|

|

Buyer of options has the right to: |

Sell the underlying security at the strike price on the expiration day. |

Purchase or buy the underlying security at the strike price on the expiration day. |

|

The investor gets profit when: |

The price or amount of underlying security is lower than the strike price. |

The price of the underlying security is higher than the strike price. |

|

The investor loses when: |

The price of the underlying security is higher than the strike price. |

The price of the underlying security is lower than the strike price. |

Conclusion

Overall, your best move when investing in put vs call options is to be a buyer. This way, the most you can lose in options trading is the premium you paid for the option. The results will vary depending on the stock market. Selling a put vs call option can have the most risk but can also generate output that is worth your investment. Make sure to weigh all circumstances before taking a decision.

If you're already a buyer of a stock, options can be one of the investment vehicles to build, hedge and protect your financial product portfolio. However, it will require serious effort on your part so you can fully understand and utilise these tools to your advantage. When options trading is done right, options will be a highly valuable addition to your investment portfolios.

FAQ

What Is the Difference Between Put vs Call Options

Call options are contracts that give investors the right (but not the obligation) to buy shares, usually 100, by the expiration date. It's bought if the stock call option buyer thinks the security or stock will increase in value.

On the other hand, put options are contracts that allow the investors to sell a certain number of shares before the expiration date. It's bought if the investors are hoping for a higher strike price to gain profit.

Which Is Better? Put vs Call Options

Put and call options have their pros and cons. What's better depends on your investment strategy and your prediction of the future of the stock market and strike price.

Market price movement affects losses or profits. If the market price increases, selling calls and buying puts will be the right move. If the market price falls, selling puts and buying calls will also be advisable.

Put vs Call Options With an Example

A put option is selling a number of shares for a higher strike price. For example, imagine XYZ trades at $400 per share and a premium amount of $10. You'll buy it for a $350 strike price. If their trade decreases to $300, you will gain $40 per share ($350 - $310 = $40).

In a call option, investors buy in the hope that stocks will increase in value. For example, you will buy a $100 strike price for XYZ with a $10 premium per share. If the strike price increases to $130, you will gain $20 per share ($130 - $110 = $20).

Are Puts Riskier Than Calls?

Puts have been riskier because stocks rise over time. The naked call option, on the other hand, is riskier than put options. The investor on a naked call option must purchase the stocks at the market price to deliver the call. Since market prices are volatile and have no upper limit, the investor's risk of loss is unlimited.

What Happens if I Buy a Call Option Below the Current Price?

The goal of call options is to buy at a lower strike price hoping that stocks or security will increase. If you buy a call option below the current price, you hope that the stock market will rise before the expiration date.

Can You Sell a Call Option Before It Hits the Strike Price?

Yes, you can because options are tradeable, and you can sell them any time before the expiration date. The decision to hold or sell the call option depends on whether you believe that the stock will increase sufficiently before the expiration date. However, it's not recommended if you, for example, pay $100 per share and the stocks in the open market are $70.

Are Call Options Safer?

Both call and put options are risky, the same as with any other form of investment. However, buying a call option with unlimited profit and limited risk is better than selling a put option with limited profit and unlimited risks.

Do Calls or Puts Make More Money?

Options are personalised because you will choose the right option depending on the stock. Call option or put option profit depends on your options trading strategy. But if you catch the right side of options trading, it can be lucrative.

What Happens If You Sell a Call Option Before Expiration?

Investors can sell call options before the expiration date if they think that they'll become worthless on the expiration date itself. If you sell call options before it becomes worthless, you can still save the premium you paid.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.