What Is A Stock Split? Definitions, Types, Pros and Cons

And what if you already own shares in that company? Should you sell them off prior to the split, or should you hold off?

It can be confusing, but this article will break down stock splits. Read on to learn about the stock split, different kinds of splits, their pros and cons and how a split will affect you if you already hold stock in the company.

What Is a Stock Split?

Here's the basic split stock definition: when a company splits its stocks, it increases the number of shares it has issued, which boosts liquidity. It's important to note that the split doesn't change the company's value. Therefore, even though the number of shares outstanding increases, their total dollar value stays the same.

So, if you own shares in a company that splits its stocks, is your investment suddenly cut in half? Well, yes and no. In a basic 2-for-1 stock split (which we'll explain in more detail later), the price of one share halves. BUT, as an investor, your one share becomes two shares, so you still have the same dollar amount invested.

If you're confused, don't worry! We'll walk you through an example.

How It Works: Example

Let's take a look at a real-life stock split. In August 2020, Apple carried out a 4-for-1 stock split. Prior to the split, a share was worth about $540. Because the company did a 4-for-1 split, the share amount was divided by 4. $540 divided by 4 is $135, so that's what the new share price was.

If you held five shares of Apple before the split, it would have been worth $2,160. After the split, you still would have owned $2,160, but you would have twenty shares instead of five.

When Does a Company Decide to Split Stock?

So, if your dollar amount invested stays the same before and after a stock split, what's the point?

It's more of a benefit for the company and for investors with less capital. By splitting its stock, a company is able to make its share price more attractive to a greater number of people. In the example above, Apple's shares were originally $540 each, which would be a daunting figure to many amateur traders. But after the 4-to-1 split, the new price was $135, which was much more attainable for a wider pool of investors.

That's the driving force behind a stock split, but a company can also carry out a reverse stock split. We'll cover it in great detail later in this guide, but we'd like to give you a brief overview now. With a reverse stock split, a company does the opposite: they reduce the number of shares and increase the value of each one.

A company might choose to do a reverse stock split if they are in danger of being removed from an exchange. Stock exchanges require a minimum share price. For instance, the Nasdaq requires a minimum price of $4 per share.

Will It Influence Your Taxes and Cost Basis?

A stock split is not a taxable event. After all, the company's total market value is the same, and you're not making any gains. After you sell the stock, you'll be taxed on profit made, but this would happen regardless of the split.

Something to keep in mind, though: even though a stock split doesn't change your overall basis, your 'basis per share' will be adjusted. You'll need to calculate the new per-share basis, so you can calculate losses and gains correctly when you decide to sell your stock.

It's a pretty easy process, though. Your original per-share basis is found by dividing the amount you paid by the number of shares purchased. So, if you paid $100 to buy 10 shares of a company, your per-share basis is $10.

If the stock experienced a 2-for-1 split, you would then own 20 shares instead of 10. So, just divide $100 by 20 (or divide $10 by 2 since it was a 2-for-1 stock split), and your new per-share basis is now $5.

Types of Stock Splits

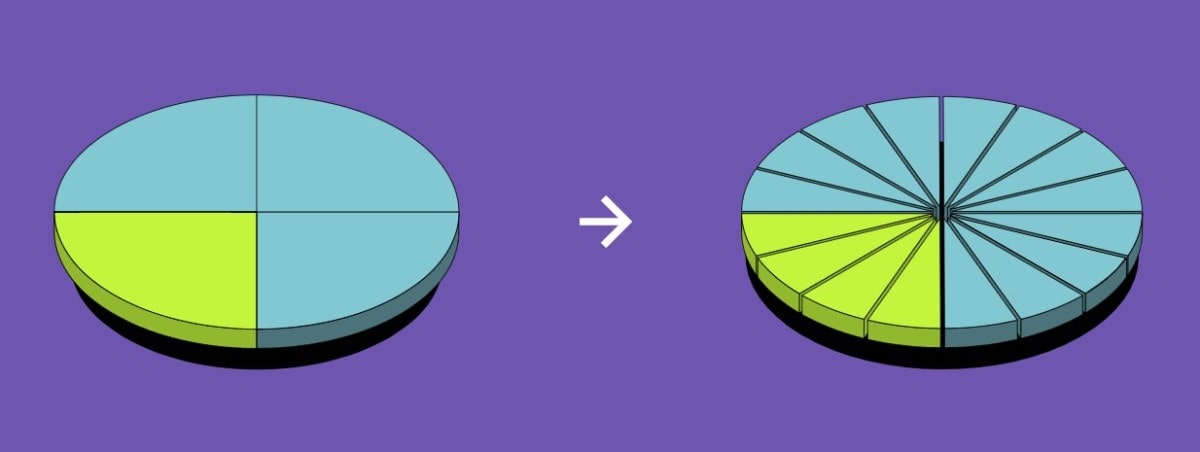

Now that you know how stock splits work in general, let's take a look at each kind. When a company undergoes a stock split, you'll see a certain number template: X-for-Y. It represents a ratio of shares, with X being the new amount and Y being the original amount.

4-for-1

The company's shares are split into 4. Let's say a company has 100 million shares outstanding, and each share is worth $100. After the split, they will have 400 million shares outstanding, and the share price will be $25.

2-for-1

The company's shares are split into 2. Following the example above, the company's 100 million shares will be split into 200 million shares. And the share price would decline from $100 to $50 per share.

10-for-1

It's the same thing here! The company's shares are split into 10. Instead of 100 million shares, they now have 1 billion shares. And in this 10-to-1 stock split, the share would drop from $100 to $10.

3-for-2

So, a company announces a 3-for-2 stock split, meaning shares will increase by 1.5x. So, the 100 million shares increase to 150 million. To get the share price, you'd divide the original one by 1.5. $100 divided by 1.5 is $66.66, which would be the new share price.

What Is a Reverse Stock Split?

A reverse stock split works very similarly to a forward split. The one exception, of course, is that it moves in the opposite direction: the number of shares decreases while the price increases.

We previously mentioned that a company might do a reverse stock split if they need to increase the price per share to stay listed on an exchange. There are also a couple of other reasons: perhaps they want a higher price to gain more attention from analysts or to boost their company's image. In general, a company's reasons for reverse splits are related to improving its reputation.

What Does a Reverse Stock Split Mean for Shareholders?

As with a stock split, the company's market capitalisation will be the same afterwards unless they decide to pay fractional shares out as cash. To illustrate this, let's say you own 10 shares in a company that does a 1-to-3reverse split. After the reverse split, rather than ending up with 3.33 shares, you'll have 3 shares and receive the cash equivalent for the remaining 0.33.

This scenario does have tax implications; the cash paid out will be subject to capital gains or losses, dependent on your holding period and cost basis.

Is a Reverse Stock Split Good or Bad?

There's no clear-cut answer here, as every company's situation is different. It helps to know, however, that reverse stock splits have a negative connotation, as companies that use this scheme are often in distress.

However, if the company makes operational changes along with the reverse split, they stand a decent chance of turning things around. So, an upcoming stock reverse split isn't always a signal to sell. If you hold stock in a company that's announced a reverse split, do some research before selling your shares in a panic. Read press releases, compare earnings reports, get up to speed on new initiatives within the corporation and carefully review recommendations from investment analysts.

To prove this point, let's look at some reverse splits that have turned out really well for their companies:

- Laboratory Corporation of America (NYSE: LH) turned to a 1-for-10 split in 2000. The company experienced great success after the split and ended up doing a forward split two years later. The company has not needed to perform a split again since 2002.

- Priceline.com (now Booking Holdings Inc) performed a 1-for-6 reverse split in 2003. Unlike LH, Priceline did not do a forward split later. However, the company has excelled over the last two decades, and its share price has grown from a mere $20 to over $2,000!

Forward Stock Splits vs Reverse: Pros and Cons

Before we close out this article, let's take a look at the pros and cons of forward and reverse stock splits.

Forward Split

|

Pros |

Cons |

|

Makes the price per share more affordable for investors |

Splits cost the company money; they have to hire a bank to plan and then execute the stock. Some investors believe this money is better used elsewhere |

|

Increases liquidity, which leads to heightened stability and transparency |

The company doesn't become more valuable after the split |

|

Sends positive signals to investors that management is confident about the future |

Reverse Split

|

Pros |

Cons |

|

Prevents the company from being delisted from an exchange |

Comes with a negative connotation and may prompt a mass sell-off |

|

The higher price may look attractive to potential long-term investors |

May occur if the company has poor finances or is suffering reputational losses |

Conclusion

A stock split — forward or reverse — doesn't change the market capitalisation of a company. It does, however, alter public perception, make share prices more affordable or more expensive and (in the case of fractional shares in a reverse split) may come with tax implications.

Generally, a forward split is seen as a positive sign, while reverse splits indicate poor financial health.

However, this isn't always the case: there are companies that have flourished after reversals and companies that have struggled after forwards. Before buying or selling shares from a company that's splitting stock, make sure to study the reasons behind this choice. Is the company exceeding or falling short of revenue projections? What is the market sentiment? Just make sure to do plenty of research!

FAQ

How does it affect short sellers?

A forward split makes a company's stock more attractive to short-sellers, as the lower share price is more affordable. What's more, this kind of split has a positive connotation and is often followed by a positive price trend, so short sellers take advantage of a forward split to buy low and sell higher in a short timeframe.

Are stock splits announced before they happen?

Yes, companies typically make formal announcements to let their shareholders know about splits. These announcements will contain a record date and an ex-date. For your shares to be eligible for the split, you must hold the stock at the end of the trading day on the record date. Then, on the ex-date, your number of shares will be adjusted accordingly.

What happens if I own shares that undergo a stock split?

With a forward split, nothing really happens to your portfolio. You will own more shares in the company, but the total amount remains the same.

Should you invest after a stock split?

There's no definitive 'yes' or 'no' answer to this because every scenario is different. If the company seems to be in good financial health, then this could be a sign that prices will go up after the split.

Does a stock split make a company more or less valuable?

Neither. A stock split does not change the value of a company, just the number of shares it has outstanding.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.