Stop Loss vs Stop Limit

Similarly, a stop order buys or sells a stock once the price of the stock hits the specified amount. There are two types of stop orders: stop loss order and stop limit order. Continue reading to learn the difference between the two and the benefits and risks of both.

Stop Loss Orders

A stop loss order is used to limit losses. This ensures that the trade is executed at the current market price, which means that slippage can occur. Keep this in mind when trading. This type of stop loss is further categorised into orders for buying and selling.

Sell Stop Orders

A sell stop order protects a long position, a term that describes an investor's purchase when they buy a security and expect it to rise in value over time. Sell stop orders trigger a market sell order if the price drops below a certain level. This is based on the assumption that it is highly likely to fall further if the market price has fallen this far. By selling the stock at this set price, you can avoid a loss.

Buy Stop Orders

A buy stop order protects a short position, the concept of a trader selling a security with the intention of repurchasing it later at a lower price. Buy stop orders work just like sell stop orders, except they trigger a market buy order if the price rises about the set level. This way, instead of letting the price rise further, a buy stop loss order is executed to close to the short position automatically.

Stop Limit Orders

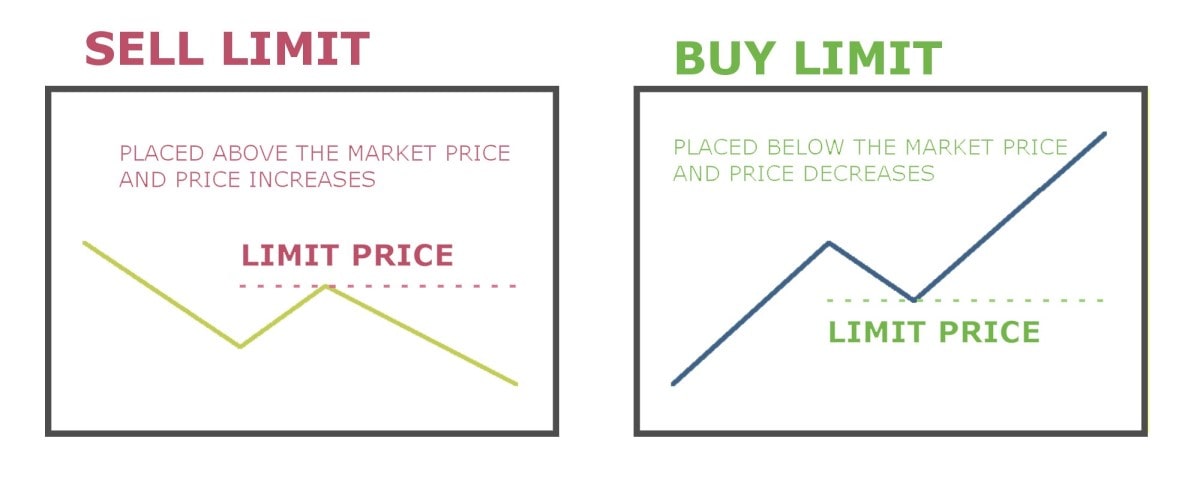

A limit order is meant to take advantage of a certain price target. This order type executes a trade when the stock price hits a predetermined level. If this price is unavailable due to low liquidity, the trade is not executed. Hence, there is no slippage from the specific price that has been set in advance. Thus, it resolves the issue of the stop loss order triggering at an unfavourable time.

A stop limit order comes with a limit on the price at which the trade will be executed. This means that it has two prices specified: the stop price that converts the order to a sell order and the limit price. Thus, rather than the order becoming an order to sell, the sell order becomes a limit order that executes only at the limit price or better.

A limit order is further categorised into two types for buying and selling.

Sell Stop Limit

A sell stop limit is a limit order to sell if the security's price falls down to, or even further than, the stop price. In this case, the limit is the lowest price per share that one is willing to accept from a buyer. Placing a sell stop limit order means telling the market marker to sell your shares if the price drops to a certain limit or lower. However, this is only done if you can earn a certain amount or more per share.

Buy Stop Limit

With a buy stop limit order, if the price increases to or exceeds the stop price, the buy order is triggered. The limit here is the maximum price you're willing to pay per share. Placing a buy stop limit order means telling the market marker to buy shares if the price reaches a certain limit or higher. However, this is only done if you can buy each share for a certain amount or less.

Stop Loss vs Stop Limit Comparison

Below are the most prominent differences between a stop loss order and a stop limit order.

Instruction

In a stop limit order, the trade is executed at a price equal to or better than a set price. This means that buy orders are bought at $X or lower. Similarly, sell orders are sold at $X or higher.

In a stop loss order, the trade is executed if the price goes beyond the set target. This means that sell orders are sold if the price falls below $X, whereas buy orders are bought above the price of $X.

Intent

A stop loss order is meant to limit losses. If the price of a stock is heading in the opposite direction than intended by the investor, the stop order caps their potential losses. A stop limit order, on the contrary, is meant to lock in the desired price since it's always executed.

Guarantee

In a stop loss order, the trade's execution is guaranteed but not the price at which it executes. In a stop limit order, the execution is not guaranteed, but the price is.

How Limit and Stop Orders Work

Consider the following scenario to better understand how limit and stop loss orders work.

An investor wants to buy a stock that is currently trading at $100. If they place a limit order, they would wait for the right buying opportunity and buy the stock if the price is available for $90 or less. With a stop order, even though they're waiting for the right buying opportunity, they'll buy the stock even if that opportunity doesn't come. So, if the stock keeps rising, they might buy it for $110 to limit their loss.

If an investor is looking to sell the same stock with a limit order, they would wait for the right selling opportunity. When the price gets to, say, $110 or higher, they would sell the stock and make a profit on it. However, for a stop order, they would wait for the right selling opportunity, but if the price keeps falling, they would still sell the stock but try to minimise their loss by selling at, say, $90.

Benefits of Stop Loss and Stop Limit Orders

Stop limit orders are beneficial because they guarantee a trade at a certain price. Short-term volatile movements in the market can also trigger these orders.

Stop loss orders avoid potential losses, particularly in bearish movements, and can even help make profits by placing the stop order at a price above the stock's purchasing price.

Risks of Stop Loss and Stop Limit Orders

Stop limit orders may never be executed if the limit price is not met. These orders can also be triggered by short-term volatile movements in the market. Moreover, brokers are also likely to charge a high commission fee for them.

In stop loss orders, slippage often occurs. This is the condition when there is a difference in the expected and the actual price of a trade.

Conclusion

A stop loss order and a stop limit order can offer different types of protection for long and short positions. You can start with a Libertex demo account to practice your trading strategy with these orders in a risk-free environment and learn how to navigate the volatility of the current market.

FAQ

What Is the Difference Between a Limit Order and a Stop Loss?

A limit order executes a trade at a price equal to or better than a set price, whereas a stop loss executes a trade if the price goes beyond the set value.

Is a Stop Loss the Same as a Stop Order?

Yes, a stop loss is actually a stop order.

Can You Set a Stop Loss and Limit Sell at the Same Time?

Yes, it is possible to set stop and limit sell orders simultaneously. You can set a limit order to sell at a good price at the same time as you set a stop loss to sell the same security at a bad price.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.