Understanding Stop-Limit Order: With Strategies and Examples

There are three main types of orders:

- Market order: This is used to purchase or sell an asset at its market price.

- Limit order: This places a ‘limit' on an asset's buy or sell price.

- Stop order: A stop order is used to buy or sell an asset once it has reached or passed the 'stop price.' A stop-limit and stop-loss are the main types of stop orders.

This article will provide an in-depth answer to the question 'what is a stop-limit order?' by covering its definition, reasons to use it, the best strategies, dangerous mistakes to avoid, its pros and cons and how it differs from a stop-loss order.

Let's get started!

What Is a Stop-Limit Order, and How Does It Work?

A stop-limit order is a technique used to limit losses and risk exposure. It's a combination of two orders, i.e., a stop order and a limit order. After a particular stop price is reached, a stop-limit order becomes a limit order, and the asset is purchased or sold at a specified price.

It can be confusing at first, and that's why we'll look at a real-world example of a stop-limit order below using Affirm Holdings Inc. (AFRM) stock.

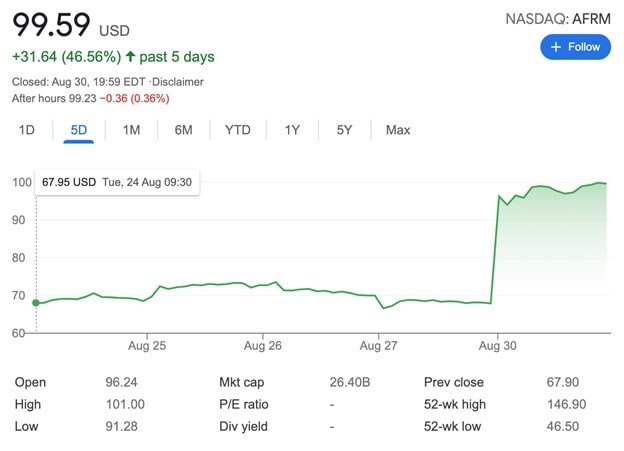

The image above shows AFRM trading at $99.59 with a clear uptrend. Seeing the market momentum, you want to buy the stock and put a stop-limit order on it. You set the stop price at $110 and the limit price at $115.

For the order to be triggered and turn into a limit order, AFRM's price will have to rise above the stop price, i.e., $110. If the order is filled under the limit price of $115, the trade is filled. However, the order won't be filled if AFRM skips over $115.

The market price is $99.59. You would place a buy stop-limit order above the market price and a sell stop-limit order below it.

Why Should I Use a Stop-Limit Order?

The primary reason you should use a stop-limit order is to keep a close watch on your portfolio without doing it manually. The stop order will assist you in staying updated on market developments by giving an automatictrigger to the order once an asset hits a specified price.

Now let's learn about the types of limits, why you should use them and what factors influence their execution.

Buy Stop-Limit Order

Once you've determined the acceptable highest per-share price, a buy stop-limit order will assist in managing the amount you pay. Suppose the stock price rises and reaches or rises above the stop price. This will trigger a buy order.

Apart from the stop price discussed, a buy stop-limit order contains the limit price, which defines the maximum per-share price you're willing to pay.

Let's look at an example of a buy stop-limit order.

Suppose you want to buy Affirm Holdings stock (AFRM), which, as seen in the example above, is valued at $99.59, and upward momentum is also expected during the day. Therefore, you place a stop price at $105.

Once AFRM's price rises to $105, the trade executes, and it becomes a market order. If you place the limit price at $110, the order will be processed after rising to $105, and if it goes above $110, it won't be filled.

Sell Stop-Limit Order

A sell stop-limit is a limit order to sell the asset once the price drops to or below the stop price. It consists of the limit price, the minimum price per share you're willing to sell at, and the stop price, which triggers the limit order to sell.

For instance, if the current price per share of AFRM is $110, you can place the stop price at $105. The limit order can be placed at $103. Once the price decreases to $105, the order is triggered. However, if it goes below the limit price of $103, the order won't be executed.

Pros and Cons of a Stop-Limit Order

|

Pros |

Cons |

|

It doesn't need to be monitored. |

Order execution is not guaranteed. |

|

It helps lock in profits. |

Risk of a partial fill or partial execution. |

|

It protects against incoming low prices. |

Higher broker's commission if the order is filled in multiple parts. |

What's the Difference Between a Stop-Limit Order and a Stop-Loss Order?

There are two main types of stop orders: stop-loss and stop-limit orders. Many times, traders mix them up. Let's learn about what sets both order types apart.

Stop-Loss Order

A stop-loss is an order to buy or sell a stock once it reaches a specific price.

For instance, you have Apple stock (AAPL) selling at $150, but its value has been falling recently. So, you go ahead and place a stop-loss order for $145. This means that if AAPL falls to $145, it will convert to a market order, thereby activating a sale. By the time you sell AAPL, it goes down by another $0.50. So, your share sales will be at $144.50.

Or AAPL reaches $145 and then $147. Your shares will be sold at $147.

Stop-Limit Order

A stop-limit order reduces the uncertainty of a stop-loss order. The greatest issue with stop-loss orders, as previously stated, is that they turn into market orders when executed. This indicates that the trade will be executed at an unpredictably high price. The above AAPL's sale will be activated at $145, but you have no influence over the actual sale price.

A stop-limit order addresses this issue. When AAPL reaches $145, the order will be triggered. However, instead of converting to a market order, it'll convert to a limit order. For instance, suppose the stop is at $145, and the limit price is $140. When AAPL falls to $145 or lower, it'll convert to the limit price of $140. The stock is then sold for $140 or higher.

Therefore, as seen with the examples above, the major difference between stop-loss and stop-limit orders is that the latter protects against a volatile market by enabling you to sell the stock based on a personalised limit.

However, a stop-loss order ensures that the sale is made. On the contrary, if the stock opens at a price lower than both the stop price and limit price, say $135, then, even though it'll convert to limit order, it won't be executed. Suppose AAPL falls further to $125. Your chance of selling the shares at $135 has also been wasted.

What Are the Key Mistakes to Avoid?

There are several mistakes that beginner traders make when using a stop-limit order. Below are some of the top mistakes you should avoid.

Deciding a Stop Position On the Spot

Before opening a trade, you should decide where the stop will be placed. The advantage of determining your stop before opening a trade is that it eliminates emotion from the decision-making process because you haven't risked any of your money yet. It's just a chart that you're viewing.

Therefore, instead of trying out a stop position after the trade has opened, you should decide on your stop placement mistake before opening the trade.

Positioning a Tight Stop-Limit

One of the most common mistakes that traders make is placing stops and limits very tight on trades. We know that the stock market is highly volatile, and the prices are constantly fluctuating.

So, when you place spots and limits on trades that are too tight, the price won't have enough space to fluctuate, and as a result, it may go way beyond the stop or limit placements resulting in the order not getting executed.

Positioning a Wide Stop-Limit

Sometimes, a trader may place their stops too far, hoping the price will reach the positions at some time. Similar to placing the stops too tight, placing them too wide is a drastic decision. Placing stops like this is almost like not placing them at all.

Positioning Stops Directly on the Levels

The levels here refer to the support and resistance levels. A solution to not placing stops too tight or too wide should not be placing them on the support and resistance levels. The reason for this is that after the price reaches that level, it may still turn and move in your way.

Positioning Stops on Arbitrary Numbers

Financial markets do not run on random numbers. Placing your stops based on a random percentage calculation is one of the most dangerous mistakes you could make when using a stop-limit order. This is because, instead of working your way into the market structure, you're trying to bring the market into your structure.

Though it would have been convenient to have a percentage as a deciding factor, this is not the case. As a result, while determining where to set your stop-loss, the smart way is to base the placement on technical analysis.

What Are the Best Stop-Limit Order Strategies to Apply?

Below are the top stop-limit order strategies you can use.

Analysis of Stock Charts

An important strategy is to place stop-limit orders at prices where you anticipate that other traders will buy and sell. The most common levels are support and resistance levels and prior swing highs and lows. This analysis can be conducted using stock charts. The charting platform's horizontal line feature allows you to search for turn-around places in the market.

Once you've spotted these levels, place your order around them. Liquidity also tends to increase as the price approaches them.

Checking the Stock's Volatility

Selecting the correct limit price for a stop-limit order is of utmost importance. If you set the limit price too loosely, you can end up paying a bad price. And if the limit price is too constricted, the likelihood of filling the order decreases. This might cost you money in the form of larger losses or smaller earnings. Considering the stock's volatility is a crucial step because the higher the volatility is, the wider the limit you'll want to set.

Analysis of the Stock's Liquidity and Trading Volume

While deciding whether to use a stop-limit order, it's vital to analyse its trading volume. This can also assist in determining where to place your limit.

When conducting liquidity analysis, check the stock's historical liquidity. If it's been highly liquid, you'd want to use a stop-order with a limit. And if the stock is highly illiquid, you'd want to reduce the position size. As a result, you'll be able to manage your risk better.

Conclusion

Different types of orders are available to traders. Some have an instant transaction, some transact according to the set time and price and still others are a conditional trade.

A stop-limit guarantees the trade price but not execution, which differs from a stop-loss order. A stop-limit order is used to buy and sell financial instruments at a price the trader sets, representing the amount they're willing to give if the asset is being bought and the amount they're willing to accept if the asset is being sold.

Some mistakes may prove dangerous if not paid heed to, such as placing the stops too tight or too wide, not using technical analysis and more.

The top stop-limit strategies include checking the volatility and analyses of charts, trading volume and liquidity. To learn, practise, and get a better grasp on stop-limit orders, open a Libertex demo account today! It'll help you get familiar with the concept before venturing into the real market.

FAQ

How Does a Stop-Limit Order Work?

A stop-limit order consists of two prices: the stop price and the limit price. For your order to activate, the asset price must reach the stop price. The limit price reveals the amount you're willing to give and accept for the asset.

What Is a Stop-Limit Order Example?

Suppose Facebook stock (FB) shows a continuous upward momentum and has been predicted to show an uptrend during the trading day. You decide to buy the stock at $50, so you set the stop price at $55 and the limit price at $60.

The price reaches $55, and the trade execution begins. Similarly, when selling a stock, you place the prices below the market price. If the market price goes below the limit price, the execution will take place. Otherwise, the trade won't be filled.

What Are the Reasons to Use a Stop-Limit Order?

A stop-limit order is used for two main reasons: to buy stop-limit orders and sell stop-limit orders. In a buy stop-limit order, the trader buys the asset at a price he/she is willing to pay. In a sell stop-limit order, the asset is sold by the trader at a price he/she is willing to accept.

How Do I Sell a Stop-Limit Order?

To sell a stop-limit order, place the stop price and the limit price below the market price. The limit price should be lower than the stop price. Once the price falls to the stop price, it converts to the market price, triggering a sale. If the price doesn't fall below the limit price during the sale execution, the asset is sold at the new market price. If the price goes below the limit price, the order won't be filled.

What Is the Difference Between a Limit Order and a Market Order?

A market order is an immediate purchase or sale of financial instruments. This order form ensures that the order will be executed, but it doesn't guarantee the price at which it's executed. On the other hand, a limit order is a purchase or sale of an asset at a set price or higher.

How Does a Stop-Limit Order Differ From a Stop-Loss Order?

In a stop-loss order, trade execution is guaranteed. A stop-limit order guarantees the price. So, even if the price is below or above the stop price, the stop-loss execution will continue with the sale. On the contrary, in a stop-limit order, the limit price will ensure that no trade execution occurs if the price falls below or rises above the limit price. The asset will be sold or bought if the price remains within the limit price.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.