Understanding Dividends

This article offers an in-depth explanation of what dividends are, the reason why companies choose to pay their profits to shareholders, the various types of dividends and relevant dates regarding dividends. It also delves into the relationship between dividends and share prices before detailing dividend-paying companies.

If you want to get the gist of the article, scroll down to our FAQ section, which briefly covers significant details about dividends.

What Are Dividends?

Dividends are rewards, cash or otherwise, that a company pays to its investors who own its shares. When the company makes profits, it shares the profit with its shareholders in proportion to their investment in the company. This is one of the ways an investor can earn a return from the money they invest.

That being said, not all stocks pay dividends, so if you’re considering making a living off of dividends, you need to choose dividend stocks. Although dividends are usually paid four times a year, they can also be paid monthly or semi-annually. The company’s board of directors determines when a dividend is to be paid.

Although dividends, by their nature, are a regular payment to shareholders of a stock, they can be cut down during a financial crisis to preserve cash for the company.

Dividend Example

To further understand what dividends are, let’s consider an example. Suppose a public company announces a cash payment of $1 per share on its outstanding shares. The total outstanding shares of the company might be $3,000,000, for instance. This will make its dividends payable equal to $3,000,000.

Given below are the quarterly dividend payments by Apple Inc. in the year 2021. For the last three quarters of 2021, the tech giant issued cash dividends of $0.22 per share of its public stock.

|

Declared |

Record |

Payable |

Amount |

Type |

|

28 October 2021 |

8 November 2021 |

11 November 2021 |

$0.22 |

Regular Cash |

|

27 July 2021 |

9 August 2021 |

12 August 2021 |

$0.22 |

Regular Cash |

|

28 April 2021 |

10 May 2021 |

13 May 2021 |

$0.22 |

Regular Cash |

|

27 January 2021 |

8 February 2021 |

11 February 2021 |

$0.205 |

Regular Cash |

Why Do Companies Issue Dividends?

Listed companies have several options when they make profits. They can invest the capital to help their business grow further or buy back some of their shares on the open market. Why is it then that companies choose to pay dividends to their shareholders?

- Paying dividends is a way for companies to express their gratitude to their investors for their support of the business.

- Furthermore, it acts as an incentive to not only the current shareholders to continue holding stocks but also to potential investors to consider investing in a business that regularly pays dividends.

- It also improves the reputation of a company since regular dividends are a sign of a company’s financial strength and confidence in its future performance.

How Do Dividends Work?

The decisions regarding a dividend are made by a company’s board of directors. The value of a dividend is determined on a per-share basis and shareholders belonging to the same class (for example, common and preferred) are paid equally.

Generally, these are the steps companies take.

- A company generates profits and retained earnings it does not need to utilise in the near future.

- The management makes a decision regarding the excess money: whether it should be reinvested or paid as a dividend to shareholders.

- The board of directors approves the issuance of dividends and other relevant details.

- The company announces the dividend on its declaration date along with information about the dividend, such as the value per share, payment date, etc.

- The dividend is paid to the shareholder on the payment date.

Types of Dividends

While the payment of dividends is essentially the disbursement of profits, a dividend may not always be in the form of money. A company can pay various types of dividends to its shareholders. Detailed below are some of the most common types of dividends.

Cash

The most common type of dividend, a cash dividend, refers to the payment of cash to shareholders as a return on their investment. This dividend is paid regularly, and the shareholders can choose to reinvest this money to increase their investment.

Stock

A stock dividend is provided by giving the shareholders additional stock. This usually happens when a company doesn’t have enough cash to pay its shareholders or has other preferences to invest its cash. If the company issues less than 25% of the previously issued stocks, it is considered as a stock dividend. If the issuance is more than 25% of the previously outstanding shares, it is treated as a stock split.

Asset

As dividends are not always monetary, companies can ever offer assets as dividends. An asset dividend is recorded against its current market price. Since this fair value is likely to be different from the book value of the asset, the company could either record it as an incurred loss or a gained profit. This means that companies can deliberately issue asset or property stocks to alter their taxable income.

Scrip

Essentially a note payable, this type of dividend is issued when a company doesn’t have sufficient funds to pay its shareholders. Instead, it offers a promissory note to pay the dividend amount at a later date.

Liquidating

If a company decides to return the original capital invested by its shareholders, it offers a liquidating dividend. This is not a regular dividend and usually occurs when a company is about to wind up its affairs.

Special

Special dividends payout on all shares of a company’s common stock. However, these are not paid like regular dividends and are often issued to distribute profits that have accumulated over the years and which do not need to be used immediately.

Impact of Dividends on Share Prices

After the declaration of a stock dividend, the share price often increases. Once dividends are distributed, share prices usually drop. Let’s examine the impact dividends have on share prices.

As mentioned earlier, regular payment of dividends signals the good financial health of a company and improves its goodwill and brand value. This is why as soon as a dividend is declared and its payable date is announced, investors are interested in buying the stocks. Hence, the prices of the shares increase since many want to buy them and are willing to pay high prices in order to get the dividends later on.

Conversely, after the ex-dividend date, the interest in a company’s stocks decreases because even if someone buys shares at that point, they would not be eligible for the dividend. Therefore, no one is willing to buy the shares at high prices since they wouldn’t be able to benefit from them. Thus, share prices usually fall after the ex-dividend date and even the payment date.

What Is Dividend Yield?

The dividend yield is a financial ratio, expressed as a percentage, which calculates how much a company pays out in dividends relative to its current stock price each year. Thus, a dividend yield is an annual rate. The dividend yield is calculated according to the following formula.

| Dividend Yield = (Annual Dividends per Share / Current Share Price) * 100 |

If a company has declared the dividend per share of $1 and its current stock price is $25, its dividend yield will be equal to (1/25 = 0.04 or) 4%.

This formula also makes it clear that dividend yield can vary a lot over a certain period of time. Given that the dividend is kept constant, if the value of a stock rises, the dividend yield will fall. Conversely, if the value of a stock sharply decreases, the dividend yield will drastically rise.

What Are Qualified Dividends?

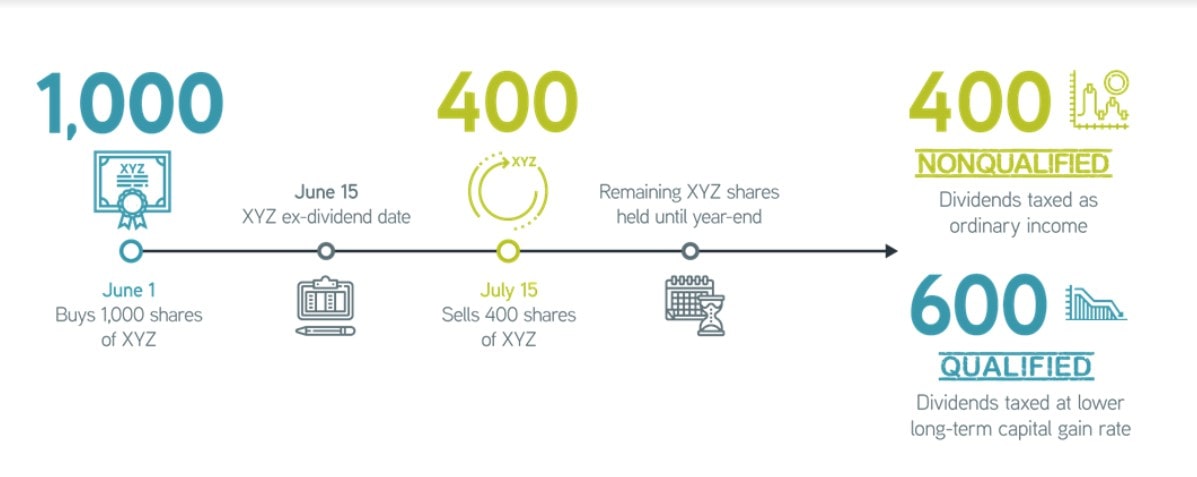

As the name suggests, qualified dividends have to meet certain requirements and conditions put in place by the Internal Revenue Service. Qualified dividends are taxable at the capital gains tax rate, whereas regular dividends are taxed at standard federal income tax rates. These are generally from shares in either domestic companies or qualifying foreign corporations and have to be held for a specific minimum period, which is termed the holding period.

Since the tax rates on qualified and ordinary dividends often vary a lot, it can make a significant difference to an investor when receiving one type of dividend over the other.

Which Companies Pay Dividends?

The highest dividend-paying companies are usually large, established corporations with predictable profits and expected growth in the future. Such companies aim to maximise their shareholders’ profits. Although a company from any industry or sector can regularly pay dividends, many companies from the following sectors have been noted to be regular dividend payers.

- Oil and gas

- Healthcare

- Financial institutions

- Utilities

- Basic materials

In addition to this, companies that are structured as Master Limited Partnerships (MLPs) and Real Estate Investment Trusts (REITs) are also top dividend-paying companies since they are required to distribute their profits among their shareholders. Conversely, startups and other companies in their nascent stages might not be able to pay regular dividends owing to their high initial costs of running and expanding their business.

Dividend Dates to Look Out For

A company can decide to pay its dividends monthly, quarterly or even yearly. When it comes to dividend payment, the following three dates are important.

Declaration Date

This is the date when a company’s board or management team announces that a dividend will be paid. This is also called the "announcement date" and is not considered as important by investors as the other dividend dates.

Ex-Dividend Date

This refers to the date by which you must own a dividend-paying stock in order to be paid the dividend. This is usually one business day before a company decides whom to pay dividends to by checking its stockholder roster. If shares are bought on or after the ex-dividend date, the shareholder will not be eligible for the dividend. On the other hand, if shares are bought on or after this date, the dividend payment is still received.

Record Date

Shareholders are supposed to properly register their ownership of stocks by the record date in order to be eligible for the dividend. In most countries, the registration is automatic for shares purchased before the ex-dividend date.

Payment Date

This is the day when shareholders who held a dividend-paying stock on a company’s ex-dividend date receive their dividend payment. The dividend checks are mailed to shareholders or credited to brokerage accounts.

What Is the Difference Between a Dividend and a Buyback?

Now that we know what dividends are, let’s compare them to another financial term that comes into context when a company makes profits: buybacks. Also known as a "share repurchase", a buyback is when a company purchases its own outstanding shares in order to reduce its shares available in the stock market.

Dividends and buybacks have significant differences, as outlined in the table below.

|

Dividend |

Buyback |

|

Part of profits distributed among shareholders |

Part of cash revenue used to buy own shares in the open market |

|

Usually a regular payment |

Not necessarily regular |

|

Shares have to be bought to get the dividend |

Shares have to be sold to get the dividend |

|

Taxes are paid by the shareholders |

Taxes are paid by the company |

Do Dividends Affect the Valuation of a Company?

Since dividends are not included in most of the metrics for valuing a company, they do not directly impact its valuation. However, that is not to say that it does not affect the valuation at all.

A company’s dividend activity and dividend yield move its stock price and affect investor sentiment, consequently impacting the company’s valuation. For instance, a high dividend might be taken as a positive signal that the company expects to grow and perform well, eventually increasing the valuation. Similarly, a dividend cut can be interpreted as a sign that the company is underperforming, which is likely to decrease its valuation.

Conclusion

Dividends are far more than just a reward from a company to its shareholders for their trust. Dividends can, at times, be a very steady stream of income for investors. However, to ensure this, one needs to exhaustively research the kind of stocks that offer regular dividends.

Dividends do not come without disadvantages and are not completely free money. Therefore, it is important to evaluate all of your options and be completely knowledgeable about dividends before putting your money into dividend-paying stocks.

FAQ

What are dividends?

A dividend is a payment made by a public company to its shareholders when the company makes profits. It allows investors to earn a steady stream of income while retaining their shares in the company.

How do you get dividends?

You need to buy the stock of a public, dividend-paying company before its ex-dividend date in order to receive its dividend.

Are dividends good or bad?

Dividends are not inherently good or bad since they come with their own set of pros and cons. It is important to conduct thorough research regarding the dividend-paying stock you are considering to invest.

How does a company pay dividends?

A company can pay dividends in multiple ways. It can mail checks to shareholders, deposit money into brokerage accounts, give assets, or issue additional shares of stock as payment of a dividend.

Is a dividend paid monthly?

Dividends are usually paid quarterly, but some companies also pay them monthly or semi-annually. Apart from these, they can also be paid on special occasions when a company has excess cash it does not need to invest.

Which stock has the highest dividend?

Some of the dividend-paying stocks with the highest yields for 2022 are listed below:

- Annaly Capital Management In.c (NLY)

- AGNC Investment Corp. (AGNC)

- New Residential Investment Corp. (NRZ)

- TFS Financial Group (TFSL)

What are the important dividend dates?

The four major dates to consider for dividends are declaration date, ex-dividend date, record date and payment date.

Why do stocks pay dividends?

Companies offer dividend-paying stocks to incentivise shareholders to continue holding their stocks.

Are dividends free money?

Although it might appear so, dividends are not free money. Dividends are always tied to the performance of a company, and while they can be beneficial in many cases, they are not free money.

Are dividend stocks expensive?

There is a wide range of dividend-paying stocks which means that the prices of these stocks also vary largely. That being said, dividend-centred investments are usually more expensive than other, more-diversified investments.

What is a good dividend payout ratio?

While there is no specific number that investors or traders agree upon, generally, a dividend payout ratio of 30% to 55% is considered healthy, while a very high payout ratio is often seen as unsustainable.

What should I look for when investing in dividends?

When selecting dividend-paying stocks to invest in, look for companies that have a history of long-term expected earnings growth between 5% and 15%, strong cash flows, and low debt-equity ratios. These are the companies expected to grow further and make enough profits to offer dividends regularly.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.