What is the MIB Index?

This article breaks down the index, its history and its constituent stocks. It also covers the factors that influence the index and the best way to invest in the index.

FTSE Indices

The MIB Index is owned and managed by FTSE International Limited, a leading provider of indices. The company manages over 250,000 indices in 80 countries, the best-known of which is the FTSE 100, the UK's benchmark index. FTSE publishes the FTSE Italia index series, which includes 13 indices.

The FTSE MIB explained

The FTSE MIB Index is the benchmark stock market index for the Borsa Italiana, the national stock exchange of Italy. It replaced the MIB 30 in 2004. The index consists of the 40 most valuable and liquid stocks listed in Italy. The London Stock Exchange owns both the exchange and the FTSE group.

The MIB is the most widely followed index on the Italian stock market and is used as a benchmark for investment products in Italy. A large number of derivatives and index-tracking funds track the index.

MIB Definition

The full name of the index is FTSE MIB Index. MIB stands for

Milano Indice di Borsa, and the index is owned by the FTSE Group. It is also known as the FTSE MIB 40, the IT40 and the Italy 40.

MIB History

Italy's benchmark indices have been through several iterations over the past few decades. The first major index was the COMIT 30, which was launched in 1992. Management of the index was then taken over by the Borsa Italiana and renamed the MIB 30.

In 2004, the index was expanded to 40 companies and was managed and published by Standard and Poor's. It was then renamed the MIB Index.

The London Stock Exchange bought the Borsa Italiana in 2007, and in 2009 the FTSE Group, a subsidiary of the LSE Group, took over the index. It was then renamed the FTSE MIB Index.

What is the FTSE MIB?

Like most headline indices, the MIB is weighted by market capitalisation. For stocks to be considered, they must be listed on Borsa Italiana's MTA or MIV markets. A stock's free float and liquidity are also considered before it is included in the index. The FTSE Italia Index Policy Committee reviews the index every quarter.

How is the FTSE MIB Index calculated?

The index only considers the free-float market capitalisation of each company. This means restricted shares held by related parties are excluded when the market capitalisation of a company is calculated.

Furthermore, the weight of each stock is capped at 15% of the index. If the weighting of any stock exceeds 15%, it will be adjusted at the quarterly review.

MIB Weighting and FTSE MIB Composition

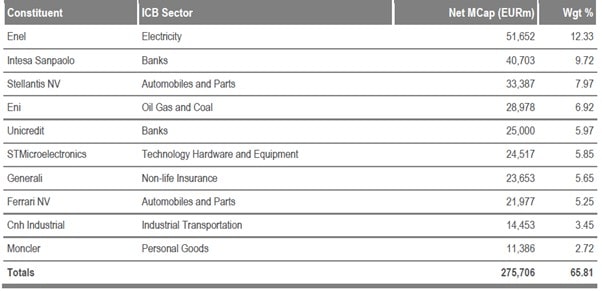

The following table shows the top 10 stocks included in the index as well as their market capitalisation and weights as of October 2021.

Some of the Best-Known FTSE MIB companies

The following 3 stocks each account for between 5% and 13% of the MIB Index. These are companies that anyone trading the index should follow.

Enel SpA, with a market value of €63 billion, is by far the most valuable listed company in Italy. Enel is a global provider of electricity and gas. The company designs, builds and manages power generation plants and distribution grids in Europe and the Americas. Enel is also involved in the natural gas industry, desalination and port infrastructure.

Intesa Sanpaolo SpA is the largest banking group in Italy and the third-largest company in the index. The merger of Banca Intesa and Sanpaolo IMI formed the group, which is involved in banking, insurance and asset management. The group operates over 3,000 branches in Italy as well as another 1,000 in Eastern Europe, the Middle East and Africa.

Eni SpA is the second-largest company in Italy with a market value of €31 billion. Eni is a global oil and gas company with operations in 79 countries and is involved in the entire oil and gas value chain from exploration to distribution. As an energy company, ENI ranks sixth in the world behind competitors like Exxon, Shell and BP. At least a third of the shares in the company is indirectly owned by the Italian government.

Ferrari NV is probably the best-known company in the MIB Index. With a market value of €35 billion, it's actually ranked second but falls to fourth place when adjusted for its free float. Besides its luxury performance sports cars, the company earns revenue by licensing its brand and from a theme park in Abu Dhabi.

The MIB Index is pretty well-diversified. Its top 5 stocks account for about 43% of the index's value, while the top 10 stocks account for 65%.

FTSE MIB Price Performance

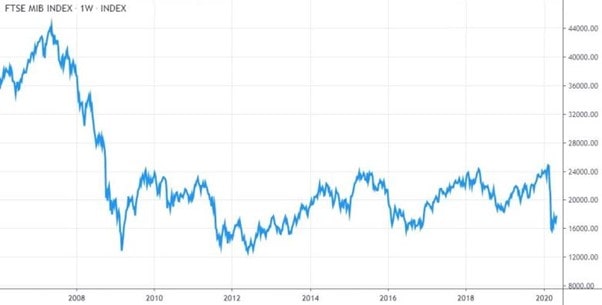

Since its launch, the MIB Index has experienced some large price swings. During the 1990s, the index included technology and media companies that followed the Dotcom bubble higher. In March 2000, the index traded above 52,000, its highest level ever. In the aftermath of the bubble, it fell by more than 50%.

The index had almost recovered its previous record-high when the Global Financial Crisis began in 2007, causing it to fall by some 70%. Since 2009, the MIB Index has traded in a range between 12,000 and 24,000 as economic factors have capped growth.

One of the reasons the index has not regained the levels seen in the 1990s and early 2000s is that growth companies now play a smaller role in the index. Nevertheless, the index does still experience large price swings and medium-term trends.

Factors Influencing the MIB Index's Price

The MIB Index differs from the benchmark indices of many other countries in that it's not very exposed to growth sectors. Over 30% of the index is made up of financial companies, while another 25% is made up of utilities. The high level of exposure to financial companies means the index is quite sensitive to interest rates. The exposure to utility companies makes the index a little more defensive and less volatile than similar indices.

The consumer discretionary and technology sectors, which are typically growth sectors, make up just 13% and 6% of the index, respectively. This means the index is less exposed to consumer spending than similar indices in other countries.

Energy companies account for 10% of the index, which is higher than most headline indices. That means energy prices do have some effect on the index. With two automakers, Ferrari and Fiat Chrysler, in the index, there is some sensitivity to the global auto market.

When compared to other headline indices, the MIB is less exposed to the global economy and more exposed to the local economy in Italy.

Other FTSE Italia Indices

While the FTSE MIB is the best-known of the FTSE Italia indices, there are 12 others. The All-Share and All-Share Capped indices include all listed companies. The Mid-Cap and Small-Cap indices include smaller companies. Other indices are sector-specific and include banks and consumer brands.

MIB Index Trading

The MIB Index stands out for the fact that it's not as exposed to global growth as others are. It is, however, sensitive to interest rates, energy prices, economic factors in Europe and European Central Bank activity. For this reason, it can provide unique trading opportunities.

Advantages and Disadvantages of Trading the MIB

Advantages of Trading the MIB Index

- The MIB Index may offer opportunities when other indices don't.

- The MIB Index is a good index to trade based on ECB policies and interest rates.

- The MIB Index can be used for relative value trades and hedging.

Disadvantages of Trading the MIB Index

- The MIB Index tends to underperform other indices over longer time periods. As such, it's better suited to short-term trading.

MIB CFD Trading

An index itself is not tradeable because it's merely a calculation based on the prices of its constituent stocks. However, you can trade exchange-traded funds (ETFs), futures contracts and contracts for difference (CFDs) on an index.

ETFs are best suited to long-term investors because they're typically not leveraged. Futures contracts are suitable for active trading but require a large trading account. CFDs are best suited to active traders with trading accounts of all sizes.

What is CFD Trading?

CFDs are a type of derivative instrument similar to futures contracts. They allow traders to easily open both long and short positions using leverage. CFDs can be traded on any liquid assets, including indices, stocks, currencies, cryptocurrencies and commodities.

They offer more flexibility than other types of derivatives. For instance, you can start trading CFDs with any account size, and you can trade several asset classes using one trading platform, such as Libertex.

Because CFDs are traded using margin, only a small percentage of the value of a position needs to be deposited before making a trade. CFDs are also easier to short sell than other instruments.

Pros and Cons of Using CFDs to Trade the MIB Index

As with all trading activities and instruments, there are advantages and drawbacks to consider when trading MIB CFDs.

Pros

- You can start trading MIB CFDs with as little as €100.

- CFDs allow you to profit whether the index is rising or falling.

- CFD trading accommodates smaller trades than futures trading, which has a very high minimum trade size.

- CFDs are ideally suited to long and short trades. You can open a long and short position using CFDs on two different stock indices. This allows you to profit from the difference in performance between the two indices.

Cons

- Like any index, the MIB can be unpredictable at times.

- There are sometimes periods when the MIB Index offers few opportunities.

MIB Trading Strategies

Most traders develop their own trading strategies, but below are some of the more popular approaches for trading the MIB Index with CFDs.

The FTSE MIB Index is best suited to short- and medium-term trading strategies using CFDs.

Long/Short Trading

MIB Index CFDs can be used with other index CFDs, like the DAX or UK100 (FTSE 100), to create long and short trades. Other indices are more sensitive to economic growth, while the MIB is sensitive to interest rates. You can open a long and short position on two different indices based on your view on growth or interest rates. These trades will have minimal market exposure but allow you to capture changes in sentiment around growth or economic indicators.

News Trading

The MIB Index is sensitive to interest rates and the ECB's policies. CFDs on the index can be used to trade when economic data is released or when speculation of a change in interest rates is high.

Trend Following

The MIB Index sometimes experiences short- to medium-term trends. Both rising and falling trends can be captured using CFDs.

Conclusion

The MIB is a key European stock market index and one of the best indices to trade for those who are active during the European trading session and follow the European economy.

You can trade CFDs on the index with Libertex. If you want to get started, you can open a risk-free demo account today to get used to the trading platform and learn more about trading the MIB Index with zero risk or costs.

Libertexis a broker and trading platform that offers CFDs instruments , free trading tutorials and state-of-the-art trading tools. But please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital.

Frequently Asked Questions

What is the MIB Index?

The MIB is an index of blue-chip stocks listed in Italy.

What moves the MIB?

The MIB responds to interest rates and other economic factors in Europe and Italy.

How can one invest in the MIB?

For long-term investors, MIB ETFs are a good option. However, the index is better suited to trading.

How can one trade the MIB Index?

The MIB is a great index for trading. Most traders use CFDs to trade the index.

How important is the MIB Index to traders?

The MIB is one of the major European indices and is sensitive to the European economy.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.