The fate of one of the most influential social media platforms hangs in the balance as Twitter co-founder and CEO Jack Dorsey faces the fight of this life from an activist investor Elliott Management Corp. The opening salvoes of this struggle for supremacy has already shaken the social media site’s stock value, and traders should keep a close eye on the next clash.

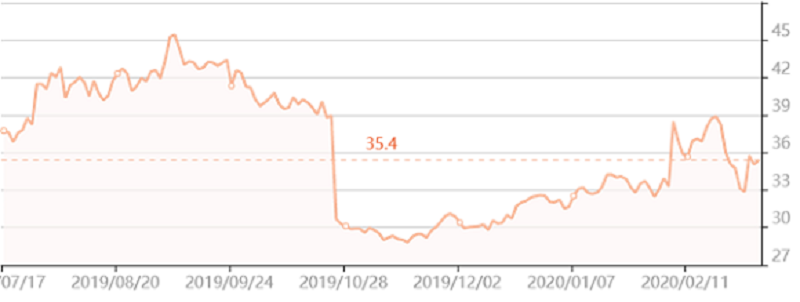

Twitter stock at the time of writing

Twitter stock rose by 7.7 percent following reports that an activist investor in the company, Elliott Management, was looking to flex its muscles and force changes at Twitter, including new leadership. The news comes at a crucial time in the build up to the US Presidential Election, and the disruptive investor is notable for their political agenda.

Who is Elliott Management?

Elliott Management is a hedge fund led by the billionaire Paul Singer, a Republican mega-donor dubbed “The World’s Most Feared Investor” and “aggressive, tenacious and litigious to a fault,” by Bloomberg. But Singer’s aggressive ventures have also consistently made money, with average annual returns of almost fourteen per cent, so it’s no surprise that stockholders seem eager to follow his lead.

Singer is also an open political actor, being one of the Republican Party’s top donors. Previously, the dreaded Elliott Management CEO opposed the current President Donald Trump during his initial campaign, but has since been converted to the Trump faithful.

Elliott Management has built up a stake of over $1 billion in Twitter (roughly 4%) over the years and is gearing up to flex its muscles. Singer has already nominated four new directors to Twitter’s board, which has entered ‘productive’ talks with the hedge fund. But Singer’s partisan allegiance could prove problematic for a platform upon which major political discourse is conducted.

Jack’s no dull boy

Dorsey cofounded Twitter and was its first CEO, but it’s not the first time that his commitment to the business has come into question. Jack was previously forced out as CEO for not spending enough time working on Twitter, only to return to the helm in 2015.

The controversial tech guru is famous for his varied interests, dabbling in yoga retreats, fad diets and unconventional hours. Most recently, Dorsey decided to spend 6 months in Africa, a move which dismayed Twitter shareholders.

Jack’s commitment to improving Twitter is once again cast into doubt, this time by Elliott Management. The embattled CEO is currently dividing his time between running Twitter and fintech company Square, Inc., with his recent plans for Africa related to the latter, another point of criticism for shareholders.

Twitter under Dorsey’s leadership has also dropped the ball when it comes to spotting new opportunities, notably when the company dropped support for Vine, leaving the territory open for TikTok to take over.

Supporters rally around Dorsey

With Singer’s hedge fund turning up the heat, Dorsey still enjoys support from within the company, as internal workplace discussions spilled out onto Twitter itself under the hashtag #WeBackJack. Tesla CEO Elon Musk also chimed in with his support for his fellow silicon valley celebrity, tweeting that Dorsey has “a good [heart emoji]’’.

Trade Twitter and top tech stocks with Libertex

As traders make their plans anticipating the next moves in Twitter’s drama, Libertex remains the most effective way to profit from the fortunes of the exciting social media sector. Our own hi-tech platform, available on your smartphone or the web, offers stocks in Twitter, Facebook, Apple, Alphabet, Tesla Motors, Tencent and other innovative tech companies. That’s in addition to 200 other financial instruments including fuel, precious metals, foreign currencies and cryptocurrencies.

Libertex clients trade with zero spreads and favorable leverage (up to 1:30 for Retail Clients and up to 1:600 for Professional Clients). Our award-winning platform is easy to use and offers trading guidance from our in-house finance experts, with regular news updates to keep up with the fast-paced financial market.

Ready to take your cut of the tech world? Then register with Libertex now!