Canopy Growth suffered from shrinkage on Thursday, after the Canadian weed producer announced that it would close two greenhouses and lay off 500 employees. The layoffs, combined with the change in leadership and the rise of a new rival in the marijuana space, is stirring up debate from analysts about the future of the industry and the best way to grow weed in the future. In the short term, other marijuana stocks are suffering through the uncertainty.

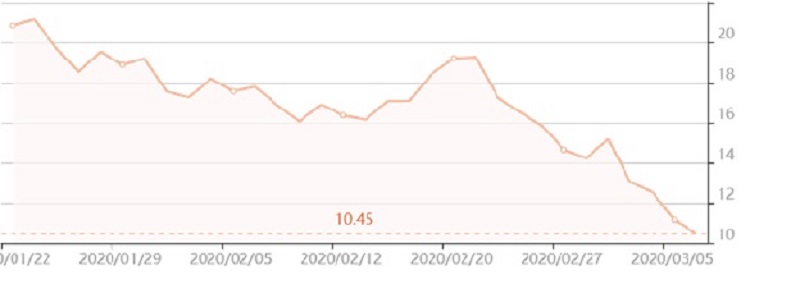

Canopy Growth stock performance at the time of writing

Canopy Growth stock performance at the time of writing

Wednesday brought the news that Canopy Growth (CGC) would be closing greenhouses in Aldergrove and Delta, British Columbia. The combined production space being let go is around 3 million square feet. The properties, Canaccord said, represented around 40% of its cultivation and production efforts in Canada. Planned expansion, with a third greenhouse in Niagara-on-the-Lake, Ontario, has been cancelled.

This didn’t exactly come as a surprise to analysts, who have noted a wider trend of shrinkage among Canada's big weed companies. The industry as a whole is scaling back, laying off staff, and replacing executives.

Demand too cool for current crop cultivation

Cannabis companies are often keen to showcase their large greenhouses in promotional photos, but in the end, overcultivation could be hurting the industry as supply overtakes demand. Canada just doesn’t seem to have enough retailers to actually sell the finished product. Too many consumers are saying no to drugs, and Canopy has noticed.

"These actions are part of the Company's effort to align supply and demand while improving production efficiencies over time," Canopy said in a statement, referring to the closures and apparent lack of demand. Canopy related the closures and "additional changes" to an ongoing cost-cutting push from its new leadership, as opposed to the old leadership, which focused on global expansion.

An effective mission statement for Canopy’s leaner and meaner regime under new CEO David Klein. Klein’s former company, Constellation Brands (STZ), invested $4 billion in Canopy in 2018. After a disappointing financial year for the marijuana grower in 2019, marked by steep losses and weaker-than-expected sales growth, the former Constellation Brands CFO has stepped in to implement a more profit-focused approach. The changes also include trying different agricultural techniques.

Are you in or out?

Canopy Growth statement on Wednesday noted that "federal regulations permitting outdoor cultivation were introduced after the Company made significant investments in greenhouse production." Canopy now operates an outdoor grow site "to allow for more cost-effective cultivation" to meet demand for some products that use cannabis extracts.

This has raised some concerns from analysts, considering that so far, results have been underwhelming for other companies who pivoted to outdoor growth last year. Canada’s cold climate isn't exactly ideal for outdoor growing. Outdoor grows may be cheaper than managing a climate-controlled indoor facility, but some enthusiasts still insist that they yield a lower-quality product.

Marijuana wilts as Canopy cuts costs

Canopy Growth stock declined 5.75% in the market today, hitting its lowest point since November. Other marijuana stocks also suffered: Aphria (APHA) dropped 6.7%. Aurora Cannabis (ACB), going through a similar restructuring to Canopy, slid down 5.1%.

Tilray stock performance at the time of writing

Tilray stock performance at the time of writing

Tilray, which has also laid off staff and failed to meet fourth-quarter expectations, saw stock fall 10.5%, down to a record low.

Ousted Canopy CEO rallies rival against former company

After being ejected from Canopy Growth, former co-founder and co-CEO Bruce Linton is assembling former colleagues to lead a new cannabis venture dubbed Collective Growth.

The new CG, which filed Monday with the SEC to eventually list on the Nasdaq and raise up to $150 million as a special purpose acquisition company, has its eye on US investment opportunities tied to hemp and CBD.

This is a logical follow-through on Linton’s actions during his tenure at Canopy Growth, when he directed hundreds of millions of dollars into hemp growing operations, including a New York cultivation facility that saw the Canadian company grow in the US for the first time.

Geoff Whaling, former advisor to Canopy and now Chairman of the National Hemp Association, has joined Linton as co-founder of Collective Growth. The pitch–to make the most out of hemp by using the entire plant, not just extracting CBD.

“Where we have a space right now is hemp shouldn’t just be viewed as CBD. Hemp has so many virtues that are under-realized,” Linton said, speaking to Yahoo Finance. “What we want to take is the whole plant and create a profit from every element of it.”

Canopy and Collective to compete?

The US could become a potential battleground between Linton’s new company and the one he was fired from. Hemp cultivation there has expanded since the 2018 farm bill made it legal for farmers to grow the plant. During his time as co-CEO of Canopy Growth, Linton also had a hand in its merger with US cannabis company Acreage Holdings, to be executed whenever the sale of marijuana becomes legal on a federal level.

US farmers are cultivating hemp in order to extract CBD, the non-psychoactive compound which is growing in popularity as a health supplement. Current estimates by analysts project that the total industry could be worth $23 billion by 2023.

But hemp has many advocates that have long held that the plant has much more to offer, as a textile, fuel or even plastic alternative. By looking at hemp in a more holistic light, Collective Growth is hoping for a better financial future than the CBD-focused Canopy Growth. Canopy’s former chief financial officer is among the alumni who have joined Collective.

“We can’t tell you what we’re going to do with the money cause we don’t know,” Linton said, when asked about potential acquisition targets, “but if you give it to us, we have a great management team and we think we can find some really great targets.”

Trade on marijuana stocks and more with Libertex

The weed industry is still finding its feet after being stigmatised for decades, but it remains an exciting sector for traders and investors in the long term. Libertex remains the most effective way to profit from marjuana, offering shares in Canopy Growth, Tilray, Aurora, Aphria and Cronosin. That’s in addition to 200 financial instruments including fuel, tech, precious metals, foreign currencies and cryptocurrencies.

Available on your smartphone or the web, Libertex offers trades with zero spreads and favorable leverage (up to 1:30 for Retail Clients and up to 1:600 for Professional Clients). Thanks to the easy to use design of our platform and guidance from our in-house trading experts, Libertex is the easiest way to manage all your trading needs.

Ready to snap up stocks on the marijuana market? Then register with Libertex now!