One strategy for stock market chaos: Netflix and chill

As markets continue to thrash in the wake of the coronavirus panic, investors are looking for a safe haven to ride out the storm. And a clue to the best market hideout might be right in your living room.

It’s been a bloodbath worthy of a horror movie on Wall Street as economies around the world feel the bite of coronavirus. Reports of more confirmed infections continue to flood in, with businesses shutting down, companies pulling out of conferences, factories closing and crucial supply lines being cut. The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite are undergoing correction, with the Dow in particular taking the biggest single-day nosedive in history, falling over 1,100 points.

It’s no surprise then that investors are in full flight, searching for boltholes to stash their money. Gold is holding up well as a traditional safe haven, while unfortunately for crypto fans, bitcoin is only a haven in theory as cryptocurrency prices slump.

Stay-at-home-stocks could be a winner

With transport, tourism and manufacturing being the worst hit in as the global economy grinds to a halt, there is a silver lining for investors who can see the logical human response – people don’t want to move around in a pandemic.

A note from MKM partners identifies Netflix, Facebook, Amazon, Peloton, Slack and Zoom are among the companies that could rise despite the ongoing mass sell-off.

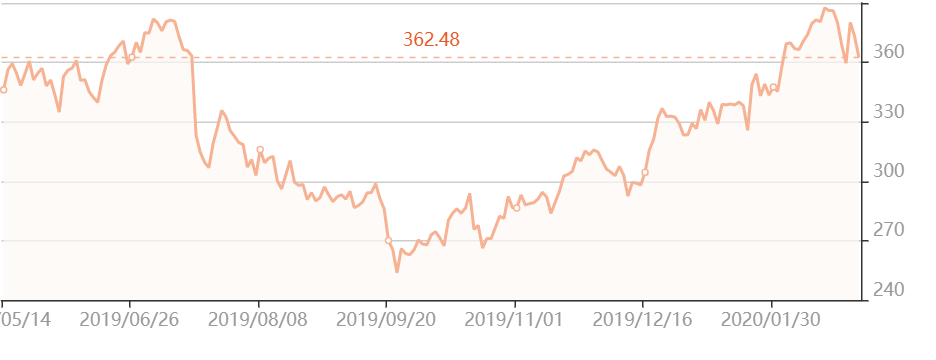

Netflix stocks at the time of writing

Netflix stocks at the time of writing

“We tried to identify what products/services/companies would potentially benefit in a world of quarantined individuals. What would people do if stuck inside all day?,” said JC O’Hara of MKM Partners.

Make money while you sit on the couch

Todd Gordon of Ascent Wealth Partners and John Petrides of Tocqueville Asset Management also shouted out to Netflix as a hideout tip on CNBC’s “Trading Nation.”

“I think a lot of people, coronavirus or not, are sitting at home watching Netflix,” Gordon, who is a managing director at his firm, said on Thursday. ”[It’s] amazing: In a down tape today, Netflix was actually strong and we’re actually working towards new highs.”

Trade top tech stock with Libertex

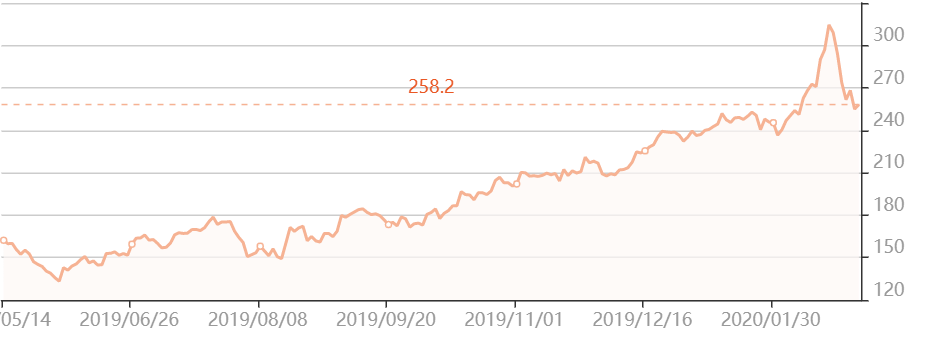

Netflix has been doing well so far this week, though is still wobbling at the time of writing. It remains to be seen whether it will hit a breakout around the $400 level, close to its 2018 all-time high of $418.97. Graphics firm nVidia is climbing, perhaps as gamers take advantage of the companies GeForce now service during their extra time at home. Meanwhile, traders should also watch Slack, as the workplace-centric messenger will see active use from professionals working the home office.

NVIDIA stocks at the time of writing

NVIDIA stocks at the time of writing

If you want to profit off the fortunes of today’s top tech companies, then Libertex is the best platform for you. Aside from the aforementioned entertainment and software companies, Libertex clients can go for gold and oil as their safe haven assets. As it’s a buyer’s market, it’s also a good time to think about diversifying your portfolio with currencies, crypto or any of the over 240 financial instruments offered by Libertex.

Available on the web or as a smartphone app, Libertex enables you to trade on the financial market 24/7. Our fast, user-friendly trading platform also provides live updates on market trends and trading signals based on the latest feeds, so that our clients have the up-to-date info they need to make the right call.

Want to take advantage of a moving market? Then register with Libertex and start trading now!