The Difference Between CFD Trading and Investing

CFD Trading: Meaning and Application

CFD stands for a contract for difference; it's a derivative product that allows you to trade the asset's price movements without owning it. The CFD's price is the price of the security you trade.

If you're familiar with Forex trading, CFD trading is similar. Traders open positions based on their price predictions and either make a profit or incur losses. CFD trading is available for a wide range of financial securities, such as stocks, commodities, indices, futures and more.

How the CFD Market Works

The idea behind CFDs is that you can trade security without owning it. For instance, if you buy a commodity CFD for oil, you don't own barrels of crude oil. You can only potentially profit or lose funds from speculation on oil's price movement. So, you forecast a price direction based on fundamental and technical analysis and place a buy/sell order.

You buy or go long when you believe the asset's price will increase. You sell or go short if you're sure its price will decline.

When trading CFDs, it's worth knowing such vital terms as leverage, margin, spread and swap.

- Leverage. When investing, you need significant funds to purchase stocks, for instance. But when trading a stock CFD, you can start with $100 since CFDs are a leveraged instrument. As a reminder, leverage is the ratio of the amount you have to open a trade and the amount you use when opening a trade. Leverage raises the funds you can use to open a position. For instance, if the leverage is 1:100, you have $10,000 to open a trade vs $100 of your own funds.

- Margin. Another term you should be aware of is margin, which is the initial investment used to open a position.

You should remember about risks that are also applied to forex trading. Leverage and margin trading raises both the potential profit and the potential losses.

As with any similar financial endeavour, CFD trading includes expenses. Here are some terms that explain the expenses you bear when trading CFDs.

- Swap. When trading CFDs, you don't have to close your position within a day. Instead, you can keep it open as long as your funds allow you to. Still, you may have to pay an amount known as a swap to keep the position open.

- Spread. This is the commission you pay to a broker for executing your trade. The spread is the difference between the ask and bid prices.

CFD trading is done via brokers, so you can open a position either on MetaTrader or the broker's own trading platform.

Stock CFD Trading: Example

Although CFDs are available for various assets, we would like to focus on stock CFDs as shares are widely used both for trading and investing.

There are two options to trade stock CFDs: stocks and indices.

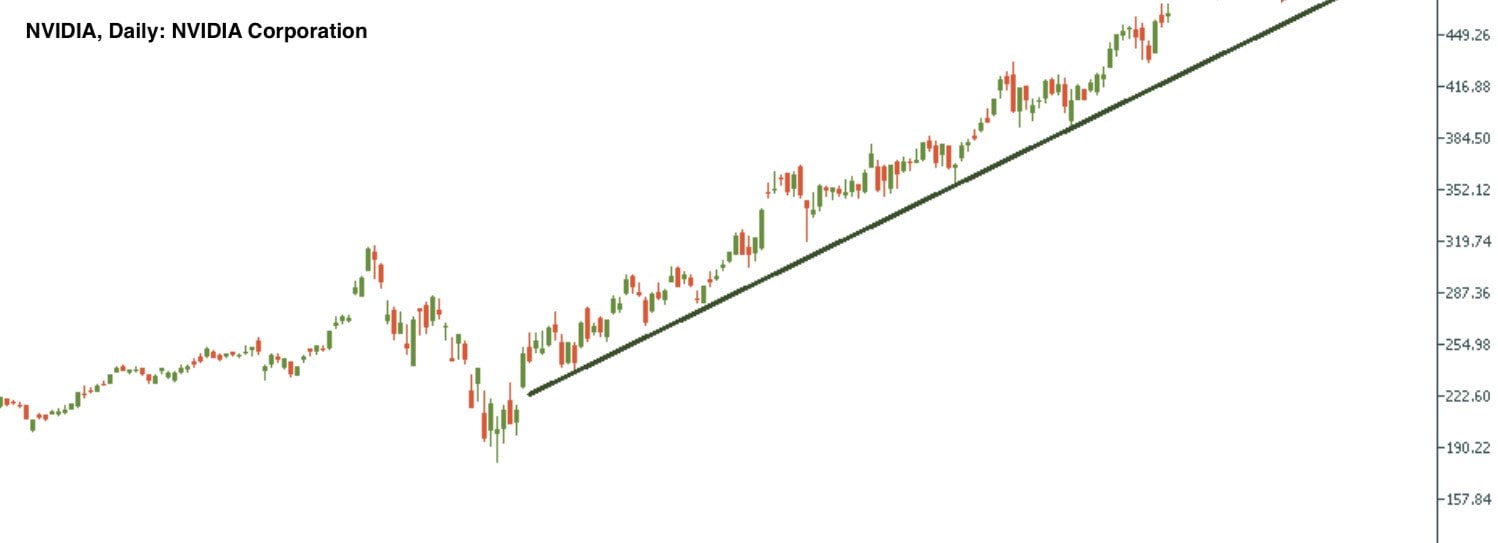

Company stocks. The first option is to trade a particular company's stock. Stocks offer a higher chance of moving in a certain direction and open a buy or sell trade (remember that when trading CFDs, you don't own the actual assets; you earn on price movements, so you can both buy and sell depending on market conditions).

The choice of stocks depends on many factors. You should apply fundamental analysis, which includes financial results, internal company news, industry news, etc. Also, remember to use technical analysis, which includes indicators, chart and candlestick patterns, price volatility, etc.

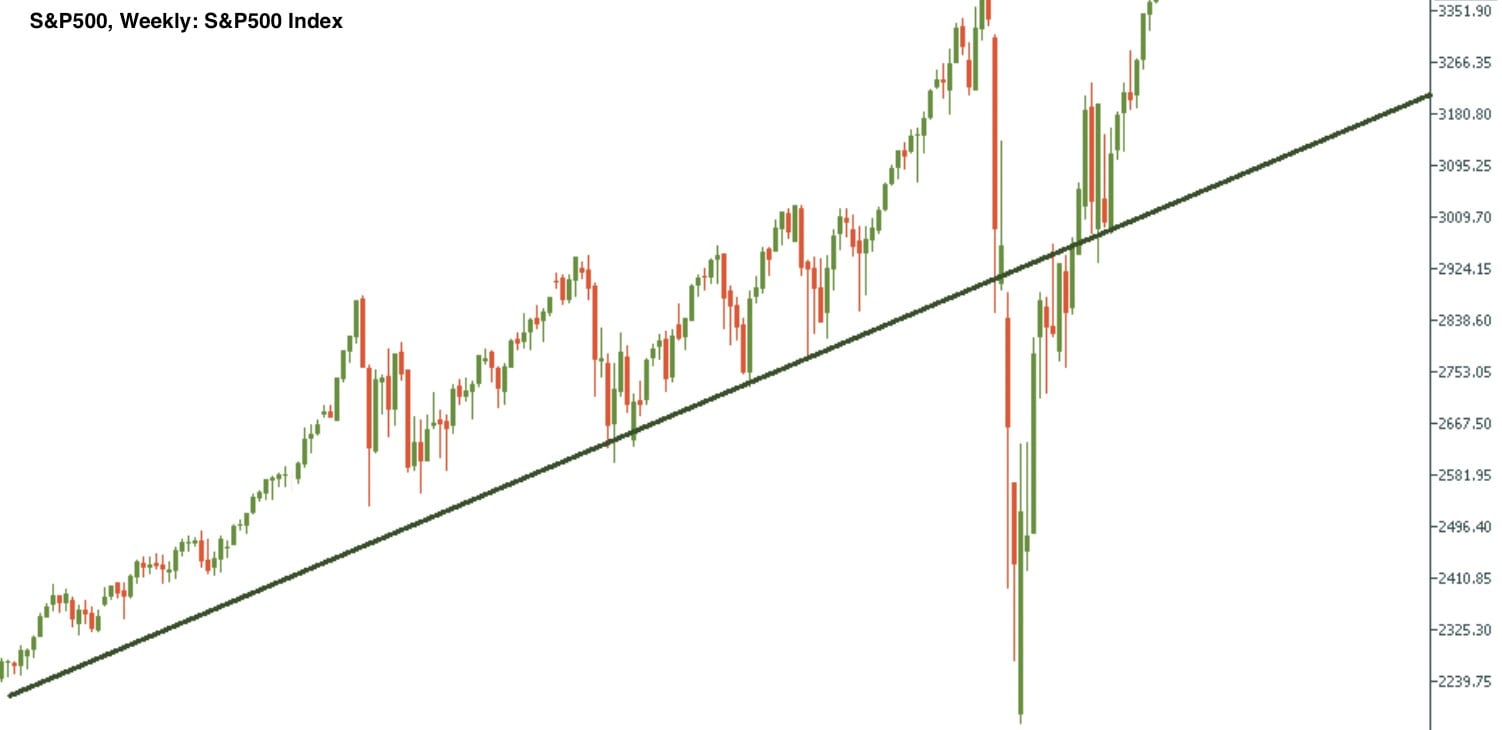

Indices. The second option is stock indices. An index is a benchmark that reflects the price performance of several of the largest stocks listed on a certain exchange. Here, you get a chance to lower risks as indices are a less volatile financial product. Their direction depends on the price of all stocks included in them. So, if one stock skyrockets, the rise will be limited by the price movements of other stocks.

When trading, there is no big difference between indices and real stocks. You may profit from both if you know how to predict a price direction.

Benefits and Limitations of CFD Trading

To understand this financial product better, it's worth considering its benefits and downsides.

|

Pros |

Cons |

|

Limited funding. When you trade a CFD, you can have limited funds and use leverage. |

Don't own the asset you trade. If you wish to be a shareholder, CFDs aren't for you because you're only trading the price difference in the underlying asset. |

|

Buy and sell. A great feature of CFD trading is that you can both buy and sell them, giving you more choice. |

Higher risks. Because CFD trading is similar to trading forex, high risks apply here, too. CFD trading involves speculation on price movements, and markets — especially stock markets — are subject to high volatility. |

|

Suitable for diversification. CFDs can be used to diversify your portfolio. |

|

|

Rapid rewards. Trading CFDs allows you to open short-term trades on one-minute timeframes. |

Investing: What It Is and How to Invest

An alternative to CFD trading is investing, which is the financial action of putting money in a financial product by acquiring it. There are many assets you can invest in, such as stocks, bonds, mutual funds, ETFs and more. The idea is to generate income from dividends or to sell it later when the price increases.

How to Invest

Because a wide range of securities is available for investing, it's impossible to highlight rules that apply to everything, but let's look at some examples.

A deposit in a bank account is one way to invest. You put your funds in an account and get monthly income through interest on your deposit. If you want to invest in bonds, you put your funds in them (at the time they're issued or on the secondary market via a broker) and get dividends for lending your funds to the company that issued the bonds.

In the next part, we'll consider ways of investing in stocks.

Investing in Stocks: Examples

There is also more than one option to invest in stocks.

Real stocks

The first way is purchasing real stocks. You buy one or several shares of a company's stock and get dividends for them. You can purchase stocks either through a stockbroker or directly from the company (if available). This option is available for you if you own enough money to afford stocks at their real price. Real stocks can be used to diversify your portfolio. However, this form of investment may be expensive as real stocks have high prices.

Mutual funds and ETFs

Another way to invest in stocks is to purchase parts of different shares by investing in a mutual fund. ETFs and index funds are like mutual funds in that they track an index. You can combine several funds to diversify your portfolio.

Investing: Advantages and Disadvantages

To compare CFD trading and investing, we should know the advantages and disadvantages of both concepts.

|

Pros |

Cons |

|

Passive income. If you don't have time to stay in front of a computer monitor, investing is the option for you. An investment can last for years. |

Lots of money. To invest, you need to have a lot of money. Leverage isn't available for investing. |

|

Lower risks. Investing involves lower risks relative to CFD trading. Price volatility doesn't play as big a role when you invest for a long period of time. |

Hard to diversify. Although you can diversify your portfolio with investments, doing so can be more expensive than using CFDs. |

|

Own an asset. When you buy an asset, you own it until it matures (bonds) or decide to sell it (stocks). |

Trading CFDs vs Investing in Stocks

To make it clearer, look at the table below that compares trading and investing. Although you can invest and trade many financial securities, we will compare stock CFD trading and stock investing. We'll highlight the similarities and differences.

|

CFD trading |

Investing |

|

|

Leverage |

Available. You can start trading with as little as $100. |

Not available. The required investment amount depends on the price of the product you invest in. |

|

Timeframe |

Any timeframe. You can trade CFDs even on a minute timeframe. |

Long term. Although it's possible to invest for several days, mostly investing is a longer-term activity used by passive investors. |

|

Platforms |

Platforms for forex brokers, MetaTrader and mobile apps. |

Web-based platform and mobile apps. |

|

Own physical shares |

No. If you choose CFD trading, you only speculate on price movements. |

Yes. When investing, you buy real stocks. |

|

Fees |

Yes. You have to pay a spread (a broker commission) to open a trade and a swap if you hold a position overnight. |

Yes. Possible broker fees for executing trades. |

|

Overnight cost |

Yes. If you hold a position overnight, odds are you will pay a swap. Still, the swap is not always an amount you pay; you can also receive it. |

No. You don't have to pay an overnight cost. |

|

Dividends |

No. Because you don't own stocks, you can't get dividend payments. |

Yes. Investors buy stocks to get dividends though you should be careful not all companies pay dividends. |

|

Markets available |

Over 15,000 markets that include commodities, indices, stocks, forex and more. |

Over 15,000 shares and ETFs. |

|

Trading/dealing hours |

CFD trading is similar to forex trading. 24-hour weekday trading on forex and major stock indices is available, as well as weekend trading on selected markets. |

Investors mostly buy shares of companies listed on the New York Stock Exchange (NYSE) and the Nasdaq Stock Market (Nasdaq), which are open from 9:30 am to 4:00 pm U.S. Eastern Standard time on weekdays (closed on stock market holidays). |

|

Cost to open positions |

Because you can use leverage, you can open a position for $100 or even less. |

You have to pay the full amount of the share or fund. |

|

Does hedging make sense? |

Yes. You can use CFD trades to hedge your investments. |

Yes. Still, stocks are not the most effective way to hedge. |

CFDs vs Investing: What Should You Choose?

There is no clear answer. You should choose the activity that matches your goals. If you have significant funds and are a passive investor, you can invest. If you're an active trader, CFD trading might be a good option, although it's riskier. Another feature of CFD trading is that you have more options to open trades because you can both buy and sell.

If you don't have experience in CFD trading, you can open a Libertex demo account. It resembles a real account but allows you to trade without losses and gain experience. Please remember that it's not a real account, so there are no losses or profits.

Let's summarise what we've covered.

FAQ

What Is the Difference Between CFDs and Stocks?

A CFD is a contract for difference that can be used for stock trading. When trading CFDs, the investor doesn't own the equity. On the other hand, a stock is a financial asset that can be both traded and owned by an investor.

Are CFDs Dangerous?

CFDs bear risks for traders as the core idea of CFD trading is price speculations. To succeed, you need to predict the price direction correctly. It's not an easy task, but if you practice, it is possible.

Do Day Traders Use CFDs?

Yes, day traders use CFDs as it's possible to trade CFD assets even on minute timeframes.

Is CFD Trading Easy?

Nothing is easy if you don't learn and practice. CFD trading has features you should be aware of before entering the market, so you may want to consider using a demo account that allows you to trade without losses (or earnings).

Is It Better to Use CFDs or Invest?

There is no best option. The best thing you can do is compare them and highlight what is most important to you. If you have significant funds and want to put your money into an asset to make it work for the long term, investing is for you. However, if you're interested in potentially fast profit with limited investments, you should consider CFD trading.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.