Leverage and Margin in Forex

We summed up the useful information that will make your margin trading effective and prevent you from making mistakes that may cost a fortune.

Leverage: Should You Borrow From a Broker?

The term leverage is quite simple and usually doesn't raise questions in traders' minds. Simply stated, leverage is a loan that a broker provides to traders so that they can increase their position size. However, you should remember that the loan is not for a precise term. You don't own the borrowed money and cannot use it to purchase an asset.

Leverage is a loan that a broker provides to traders so that they can increase their position size. However, a trader doesn't own these funds.

Here, we should mention the term 'lot size'. The standard lot size is $100,000. This means that if you want to trade one lot, you need to have $100,000. But what percentage of people have such a vast amount of money? Even if you choose smaller lot sizes — a mini lot of $10,000 or a micro lot of $1,000 — odds are you won't be able to provide the entire amount.

The lot size affects the amount you can make in profit. A standard lot allows you to earn $10 per pip. If you trade a mini lot, you can make $1 per pip; a micro lot will let you earn $0.10 per pip. So, it's clear why traders care so much about the lot size.

However, not everyone has $1,000. That's why brokers provide investors with leverage, which can be thought of as a loan. For example, you have $100, but even a micro lot is $1,000. So, a broker offers you 1:10 leverage. As a result, you have access to $1,000 and can open a position.

Each broker chooses a unique amount of leverage. The smallest one is 1:5, which means that your own money will be multiplied by 5. The largest leverage amount is 1:1000, meaning your funds will be multiplied by 1,000.

Leverage Trading: How It Works

Put simply, leverage is the borrowed funds a broker provides to a trader. It looks like a bank loan but works differently. First, you don't have to pay the money back because you don't own it. Secondly, your risks rise significantly. This leads to the following questions: Why do brokers provide traders with money if they don't get it back or don't earn interest? Also, why do the traders' risks grow?

Leverage is accompanied by higher risks.

We're here to answer these questions. If we talk about a broker's profit, we should understand that every broker gets a commission for every trade you open. So, they benefit from you opening positions.

However, leverage is a two-way street. When it comes to risks, you should understand the following rule. Imagine you have $100,000, and you make $1,000 in profit. Here, your leverage equals 1:1, so your profit is 1%. If you have a 1:100 leverage, your profit will amount to 100%. Sounds good, doesn't it?

However, the situation is similar when it comes to losing positions. If you have 1:1 leverage, and you lose $1,000, your loss will be -1%. However, trading with leverage of 100 will lead to losing 100% of your funds. The prospect doesn't seem so attractive anymore. That's why some brokers limit the leverage they offer to their clients. For example, the maximum leverage Libertex offers (which it calls a 'multiplier') is 1:30 for retail clients and up to 1:600 for professional clients.

What AssetsCan Be Traded with Leverage?

Leverage is used not in the forex market and beyond, covering different assets. For example, derivative investors apply for leverage to open larger trades. You can also trade CFDs for oil, gold and stocks via a broker using leverage. Below is a list of the securities most commonly traded using leverage:

- Currencies are the most popular assets for leverage trading. Every reliable broker offers leverage for currency pairs.

- CFDs are famous among traders because they provide the option to trade such attractive assets as gold, oil and stocks that can provide a significant return when profitable.

- Derivatives are also popular among traders. Leverage allows them to operate large positions with small expenses and sometimes even without any expenses at all.

How to Choose Forex Leverage Wisely

We'd like to share simple rules to help you determine the perfect leverage that won't hurt your funds if you have a losing position.

- Step 1. Try different leverage ratios. The most effective way to minimise risks is to practice. It would be best if you remembered that higher risks accompany higher leverage. So, if you don't want to risk a lot, you should choose small ratios such as 1:5, 1:10. If you're confident in your knowledge and expertise, you can select higher levels.

- Step 2. Lower your risks. This is essential when it comes to trading. For this aim, you can use trailing and limit stops.

- Step 3. Determine the position size. The primary rule says a trader shouldn't risk more than 1-2% of each trading deposit.

Which Leverage Ratio Is Best for Forex Trading?

There is no perfect leverage ratio. Otherwise, there wouldn't be such a wide range of them. We'll give you an example of a significant leverage amount and a small one. By comparing the results, you'll be able to determine the right ratio for you.

- Small leverage. Imagine you have a small leverage ratio, let's say 1:5. So, if you have $10,000, with this leverage amount, you'll have $50,000 to trade with. A mini lot allows you to earn $1 per pip. In our case, that would be $5 per 5 lots. Imagine you suffered a loss of 50 pips. That would be $250 or 2.5% of the position.

- Big leverage. In this scenario, we also have $10,000, but we want to increase our potential profit. So, we choose 1:50 leverage. As a result, we have $500,000. Now, we can trade five standard lots. However, one pip will now cost $10. Because we bought five lots, one pip will cost $50. Let's assume we lost 50 pips. Our loss will amount to $2,500. or 25% of our $10,000.

Margin: How to Connect with Leverage

As you learn what leverage is, you should know about another term: margin. When we talked about leverage, we explored the question: "how can brokers provide such huge funds?"

It may seem risky to provide every trader with lots of money, but brokers know how to protect themselves using margin.

Margin is the minimum sum that should be in your account to open and maintain trades.

Margin is not a fee for a transaction; it's just a broker's insurance that you'll be able to operate open positions. The margin amount is held by the broker when you open a new position. A broker should have a guarantee that your balance won't fall below 0.

Imagine you have $100 and need 1:1000 leverage to open a one-lot position. Your $100 will be the margin, i.e., the minimum amount you need to open a trade and maintain it. Margin size depends on the number of lots and leverage you're using. The larger the leverage is, the smaller the margin you'll need to fill.

If leverage is expressed as a ratio, the margin is represented in terms of a percentage to the full position size. The margin size typically varies from 0.25% to as high as 2%.

Margin: How to Calculate

To calculate the amount of margin required, you need to determine a percentage (or so-called margin requirement) of the position size (or notional value).

The required margin is calculated in relation to the base currency of the pair you're trading. It's worth noting that if the base currency is different from your account's currency, the margin amount will be converted to the account denomination.

- If the base currency and account currency are the same, to get the amount of the required margin, you need to multiply notional value (position size) by the margin requirement.

- If the base currency and account currency are different, to get the required margin, you need to multiply the notional value by the margin requirement. The result should be multiplied by the exchange rate between the base currency and the account currency.

Types of Margin

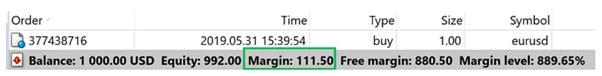

Margin is always seen in MetaTrader. However, if you look at the image below, you'll see that there are different types of margin terms. Let's clarify each one.

- Required margin. This is a basic term meaning the amount needed to maintain your open position. Each open trade has its own required margin that will be held ahead of time. Let's consider an example. Imagine you open a trade for the EUR/USD pair. You want to trade one standard lot of $100,000. A broker requires a 2% margin. So, your required margin will be $2,000.

- Used margin. This is the sum of all the required margin of the open trades. This amount is not accessible to open new trades. In MetaTrader, this term will be expressed by one word: margin.

- Free margin. This term is placed in the trade window in MetaTrader. The idea is clear: free margin is the amount still available to open new trades.

Relationship Between Margin and Leverage

Simply stated, a margin account allows a trader to use leverage. To calculate leverage, you need to divide one by the margin requirement. For instance, if the required margin is 2%, the leverage will equal 50.

Inversely, to count the margin requirement, you need to divide one by the leverage ratio. For example, if your leverage is 1:100, the margin requirement will equal 1% because 1/100 is 0.01 or 1%.

Margin: Trading Example in Forex Market

Let's consider an example of margin trading. Imagine you're trading two currency pairs: USD/CAD and USD/JPY. You have $1,000, but you used a 1:10 leverage, so you have $10,000.

The first trade is a mini lot (i.e., $10,000) of USD/CAD. The margin is 2%. The required margin will equal $200. The second trade is a mini lot of USD/JPY. The margin is 3%. So, the required margin is $300. In the end, we have a used margin of $500.

What Is a Margin Call?

A margin call is the level at which a broker sends a warning to a trader that their margin has reached a dangerous point (40% or lower). A broker warns a trader to either close a trade to limit losses or add funds to stay in the market. A broker can but doesn't have to close the trader's positions.

Here, we should mention one more term: stop-out. This follows a margin call if a trader doesn't heed the first warning. The stop-out is at 50% or lower, which signals the margin has reached the minimum allowed amount. This is the point at which a broker will close the trader's deals without any notification to prevent the balance from reaching negative figures.

Benefits and Limitations of Leverage and Margin

Both terms have their own advantages and disadvantages. Let's consider them to avoid mistakes.

|

Benefits |

Limitations |

|

|

|

|

How to Minimise Risks

The limitations of margin and leverage directly relate to the risks you may encounter. So, larger losses and the illusion of significant funds are the risks that may affect your trades' effectiveness. To minimise them, you have several options.

- A reliable broker. As we mentioned above, there is a wide variety of leverage ratios. It looks attractive that you can multiply your funds by 1,000. Still, you should remember that your risks will surge dramatically. Choose a reliable broker, such as Libertex, that will limit the leverage ratio to only safe ones.

- Stop-loss. Although a broker uses a margin call and stop-out, we recommend you avoid such situations. To do so, use stop-loss orders. Count the amount you can risk before you place a trade. But remember what we discussed about wide and loose stop-losses. The risk-reward ratio should not be less than 1:2.

- Take profit. This type of order can allow you to fix your potential profit before a trade turns against you.

- Strategy. Before you place an order, you should know how much money you can trade, so choose your position size wisely. Try different leverage ratios to define the perfect one that suits the amount of money you have and the assets you want to trade.

Forex Margin and Securities Margin

We previously talked about the forex margin. To make that concept clear, we need to discuss what a securities margin is.

A securities margin is borrowed money, which is used to buy stocks, ETFs, or bonds.

The amount usually equals up to 50% of the asset price. Here, we can use the term "buying on margin." For example, if you buy stocks, you take a loan from a broker. It's considered a down payment and allows you to own the security you purchase.

When we talk about the forex margin, it's not borrowed money. And you don't purchase currencies to own them.

Conclusion

To conclude, margin and leverage are basic terms of forex trading. They allow a trader to open positions no matter what amount of money they have. This option is attractive, but traders should remember the risks they may face.

To know how to use leverage and margin, you should practise. It's wise to do so with the small leverages that Libertex provides. The perfect place to practise new techniques risk-free is our demo account.

FAQ

How Does Leverage Affect Margin?

Leverage and margin have an inverse relationship. To calculate the required margin, you need to divide one by the leverage ratio.

How Do You Calculate Margin and Leverage?

To calculate leverage, you need to divide one by the margin requirement. Inversely, to count the margin requirement, you need to divide one by the leverage ratio.

What Is the Best Leverage for Beginners?

We would recommend using 1:5 leverage because it won't increase the risk of losses too significantly.

What Is 1:500 Leverage?

It means that the amount you have will be multiplied by 500. For instance, if you have $1000, you'll get $500,000. That will allow you to trade five standard lots.

What Is Leverage in Simple Words?

Leverage is a loan or borrowed money that a trader gets from a broker to open larger positions. Still, a trader doesn't own the funds.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.